Stock on The Move - Redtone Digital

AmInvest

Publish date: Tue, 06 Jun 2023, 09:15 AM

Company Background. REDtone Digital (REDtone) is a leading integrated telecommunications and digital infrastructure services provider. The group offers an extensive range of services under 3 main categories: Telecommunications Services, Managed Telecommunications Network Services (MTNS) and Industry Digital Services. On 24 May 2023, REDtone transferred to the Main Board of Bursa Malaysia.

Investment Highlights. (i) The MTNS segment is expected to remain as the main contributor for the group amidst ongoing largescale telecommunication infrastructure projects such as JENDELA and 5G rollout. (ii) Pursue growth in the booming telecommunications segment with escalating demand for reliable connectivity, intelligent IP (Internet Protocol) telephony and collaboration tools in line with an increasingly digitalised economy. (iii) Developing new services and revenue streams by exploring new technology-driven solutions such as Smart Farming.

Financial Performance. In 9MFY23, REDtone posted a higher revenue of RM147mil (+27% YoY) with a PAT of RM49.3mil (+57.5% YoY). This was mainly attributable to higher revenue contributed by telecommunication services and MTNS segments as well as fair value gain on short-term investment.

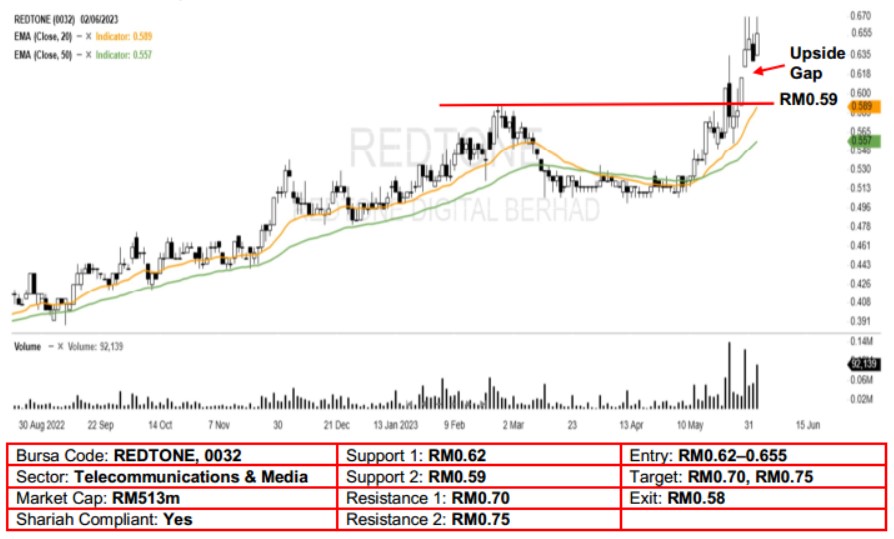

Technical Analysis. REDtone may trend higher after it surged to a new 52-week high and closed above the RM0.60 psychological mark a few sessions ago. In view of the uncovered upside gap formed on 30 May and together with rising EMAs, the upward momentum is likely to pick up further. A bullish bias may emerge above the RM0.62 level, with stop-loss set at RM0.58, below the 20-day EMA. Towards the upside, near-term resistance level is seen at RM0.70, followed by RM0.75.

Source: AmInvest Research - 6 Jun 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on AmInvest Research Reports

Created by AmInvest | Dec 20, 2024