Stock Idea - HSS Engineers

AmInvest

Publish date: Tue, 12 Sep 2023, 09:34 AM

Company Background. HSS Engineers (HSS) is principally involved in the provision of engineering and project management services including engineering, design, construction supervision, project management, environmental services and building information modeling services. The group’s position as one of the leading listed engineering consultancy group in Malaysia.

Prospects. (i) HSS has completed over 800 projects in Malaysia involving highway, road, rail and water sectors over the years. The group will continue to leverage on its depth of expertise to participate in the upcoming nation-building infrastructure projects, (ii) HSS is expanding into digital and technology sectors, particularly in areas such as data centers and 5G telecommunications due to the transferability of its expertise, and (iii) HSS is actively pursuing its regional expansion and set to engage in strategic partnerships with leading Japanese consultants for participation in JICA-funded projects across Indonesia, Philippines and India.

Financial Performance. In 1HFY23, HSS posted a higher revenue of RM94.7mil (+27.5% YoY) with a PAT of RM9.5mil (+48% YoY). This was mainly due to contributions from project management consultancy and engineering services segments. As at 30 June 2023, the group’s order book stood at RM1.4bil (7.4x annualised 1HFY23 revenue), in which 75% stemmed from project management.

Valuation. HSS is currently trading at an attractive FY23F P/E of 11.9x, which is lower than its 5-year forward average of 22.4x and Bursa Construction Index’s 15.2x currently. As a comparison, Kinergy Advancement, involved in electrical & mechanical engineering services and sustainable energy solutions, trades at a much higher 83x trailing P/E.

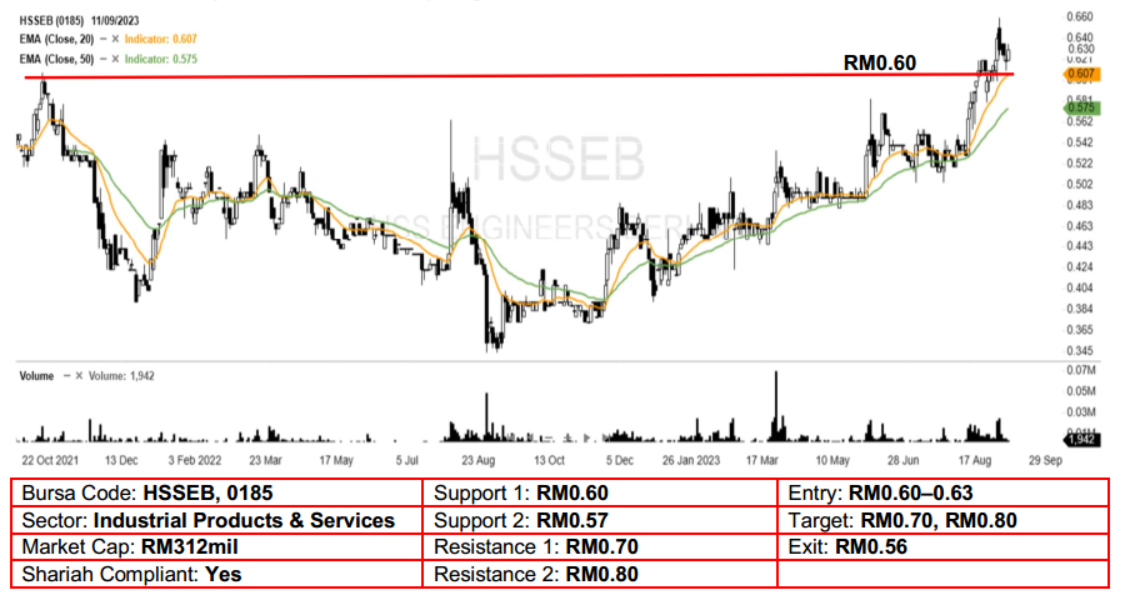

Technical Analysis. HSS may trend higher after it surged to a new 52-week high and closed above the RM0.60 resistance a week ago. In view that the 20-day and 50-day EMAs are starting to turn upwards, a positive outlook can be expected here. A bullish bias may emerge above the RM0.60 level, with stop-loss set at RM0.56, below the 50-day EMA. Towards the upside, near-term resistance level is seen at RM0.70, followed by RM0.80.

Source: AmInvest Research - 12 Sept 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024