6 NEW ARTICLES ! Barakah Squeezes Investors Like a Lemon - Dry and to the Last Drop. PN17 Regularisation Plan.

Robert Waters

Publish date: Sat, 08 Jul 2023, 11:46 PM

Read other 5 Barakah stories in this blog !

During 2019 Malaysia experienced turmoil of energy industry caused by low crude oil prices. Many highly indebted Oil and Gas companies found themselves in a precarious situation. An ordinary investor would think that the way out of the debt is as follows:

1. Reduce staff and salaries

2. Cut the management, director, office overhead

3. Sell unprofitable business

4. Secure new contracts by giving incentives to clients

5. Optimize the operation

Ordinary shareholders of Barakah Offshore Petroleum expected that their Company would tighten the belt and work harder. After all, the Company mismanaged the funds and let the share crash from RM 1.80 to 0.1 over time. However, this is NOT what happened. Barakah got used to share the pain, or even transferring the pain on others. They came up with the plan to squeeze their investors like a lemon for extra cash. And they sure squeeze them completely dry.

Barakah proposed in a REGULARISATION PLAN to consolidate existing shares 10:1, issue 4 new right shares at RM 0.2 for every outstanding share. Provide a warrant. Secure a new shareholder, a ‘Mr. Zainal.’ There is almost NOTHING in the plan about new projects, clients, growing business, etc. The company became a virtual business focused on monetizing others. And this time it is own investors being monetized.

This is a brilliant plan from the Management perspective. The Management will collect enough money to pay salaries and office expenses for a year or two. Also, they will pay fees of a few millions for issuing shares, warrants, etc. Bursa, law firm, underwriters and consultants, they all benefit greatly. This sure is a good plan as the management will have free money to use for 1-2 years, and to pay themselves bonuses. However, after 2 years the exercise will have to be repeated. I do not think that investors will reach out third time. New victims will be fund to be squeezed dry, like a lemon. Maybe a bank?

There is also a question ability of the investors to provide that extra funding. As barakah has few institutional investors, those are small shareholders holding the bag. They need to buy four times as much shares to retain their percentage of the company. Most do not have the funds available. They need to save on expenses to meet Company demand over time. They expected capital appreciation when they invested. Instead, they are asked to fork out extra cash.

My proposal to management would be to get a new contract using Petronas licence and get funding through work. In a few years, they can pay dividend to shareholders, rather than asking for extra funds. Isn't offshore servicing their business, rather than financial schemes, after all?

BARAKAH OFFSHORE PETROLEUM BHD

KLSE (MYR): BARAKAH (7251)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Barakah Offshore Petroleum (PBJV) - High Seas Sinking in Slow Motion

Created by Robert Waters | Oct 04, 2023

Barakah offers 4 million shares to mysterious Mr. Zainal, forgets own shareholders who have legal right to receive such offer before others.

Created by Robert Waters | Sep 12, 2023

Barakah attacks investors, banks, clients, vendors and own management by litigation, default, unfair regularisation plan, passing losses on stakeholders. PN17 stop on road to delisting / bankruptcy

Created by Robert Waters | Sep 08, 2023

Barakah Offshore Petroleum pipelay barge loan default leads to PN17. Regularisation Plan. Litigation. Spreading misery to others. Clients became the defendants and legal cases are the new projects

Created by Robert Waters | Aug 04, 2023

Barakah Story Chapters, PN17

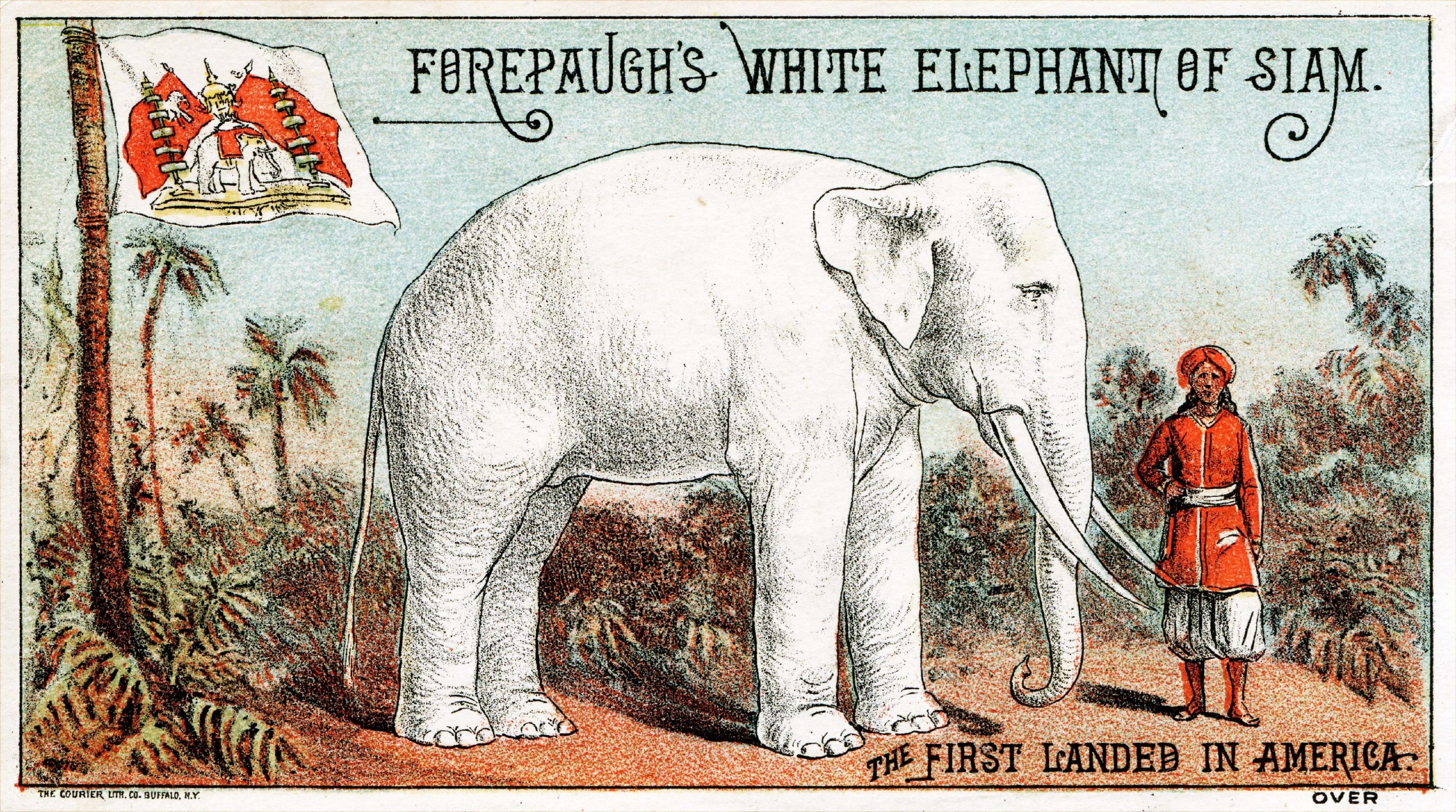

Barakah Offshore Petroleum Acquires a White Elephant and Maintains it for 10+ Years

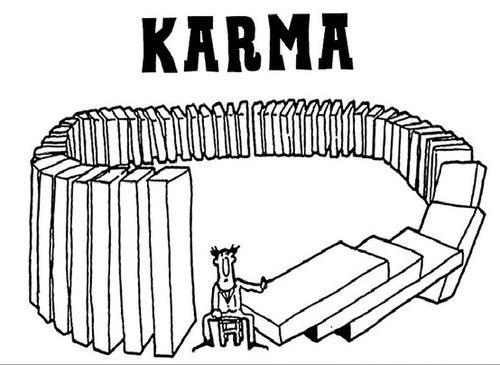

Barakah Offshore Petroleum Learns that Karma is a Dog, Not a Boomerang

Created by Robert Waters | Jul 09, 2023

Barakah Offshore Petroleum. Troubled company in PN17. No new contracts. Mounts of litigation. Debts. Regularisation Plan.

BARAKAH OFFSHORE PETROLEUM BHD

KLSE (MYR): BARAKAH (7251)