Barakah Offshore Petroleum Learns that Karma is a Dog, Not a Boomerang

Robert Waters

Publish date: Fri, 04 Aug 2023, 03:15 PM

There is a saying among cultured gentlemen that “karma is a boomerang.” It means that if you inflict pain and suffering on someone (or at least affect them in certain way), you will likely face the same fate in the future. Barakah is the latest example of this principle. Under the name of PBJV was once a successful oil and gas undertaking grossing RM 600+ million of revenues annually. Things looked good. Until the crisis came to petroleum industry in 2016. Many other players were able to emerge from it stronger, but barakah got seriously harmed. Seems like a karma type of event. Read this Chairman Statement from the Annual Report:

For the financial year the Group experienced a pre-tax loss … the losses were caused by significant increase in raw material costs, delay in projects completion and prolong dry-docking program of the vessel owned by the Company… In addition, these also hampered the Company’s ability to execute new projects due to the working capital constraint.

Meanwhile, during the financial year, the Company channelled its concerted effort, … in ensuring the Proposed Restructuring Plan which was submitted to Securities Commission … will bore a fruitful result.

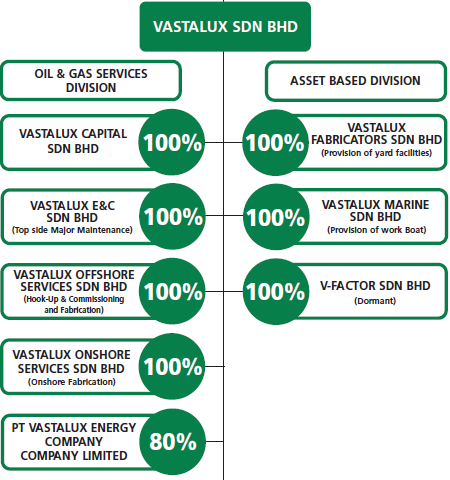

While the above accurately describes barakah’s recent situation, the statements were made by the Chairman of Vastalux Energy Berhad after his company triggering PN17 status of this company due to non-payment of loans. Vastalux was later absorbed by PBJV in a reverse takeover around 2012. Their subdivisions reflect reality at barakah nowadays.

It is a matter of judgement whether barakah acted as a white knight saving a company in distress or a ruthless player. But one cannot argue that this time around barakah is the party in distress (PN17) looking for angel investors and ways to avoid delisting my means of Regularisation Plan. The Management is now first and foremost involved in legal and financial dealings rather than providing good services to the Malaysian Energy Industry as once Vastalux did.

It is a perfect irony of the fate that barakah became what Vastalux was 10 years ago. And now barakah wishes that karma was just a boomerang, as you normally do not get harmed seriously by a flying stick. Non gentlemanly folks call karma a b*tch, or a dog. Karma can be a vicious dog biting you aggressively and long, causing serious damage. After pipelay barge loan default, Petronas suspension, revenue plunge one could say that karma is a relentless mad dog in this case.

x

More articles on Barakah Offshore Petroleum (PBJV) - High Seas Sinking in Slow Motion

Created by Robert Waters | Oct 04, 2023

Barakah offers 4 million shares to mysterious Mr. Zainal, forgets own shareholders who have legal right to receive such offer before others.

Created by Robert Waters | Sep 12, 2023

Barakah attacks investors, banks, clients, vendors and own management by litigation, default, unfair regularisation plan, passing losses on stakeholders. PN17 stop on road to delisting / bankruptcy

Created by Robert Waters | Sep 08, 2023

Barakah Offshore Petroleum pipelay barge loan default leads to PN17. Regularisation Plan. Litigation. Spreading misery to others. Clients became the defendants and legal cases are the new projects

Created by Robert Waters | Jul 09, 2023

Barakah Offshore Petroleum. Troubled company in PN17. No new contracts. Mounts of litigation. Debts. Regularisation Plan.

BARAKAH OFFSHORE PETROLEUM BHD

KLSE (MYR): BARAKAH (7251)

Created by Robert Waters | Jul 08, 2023

Regularisation Plan of Barakah Offshore Petroleum. PN17.

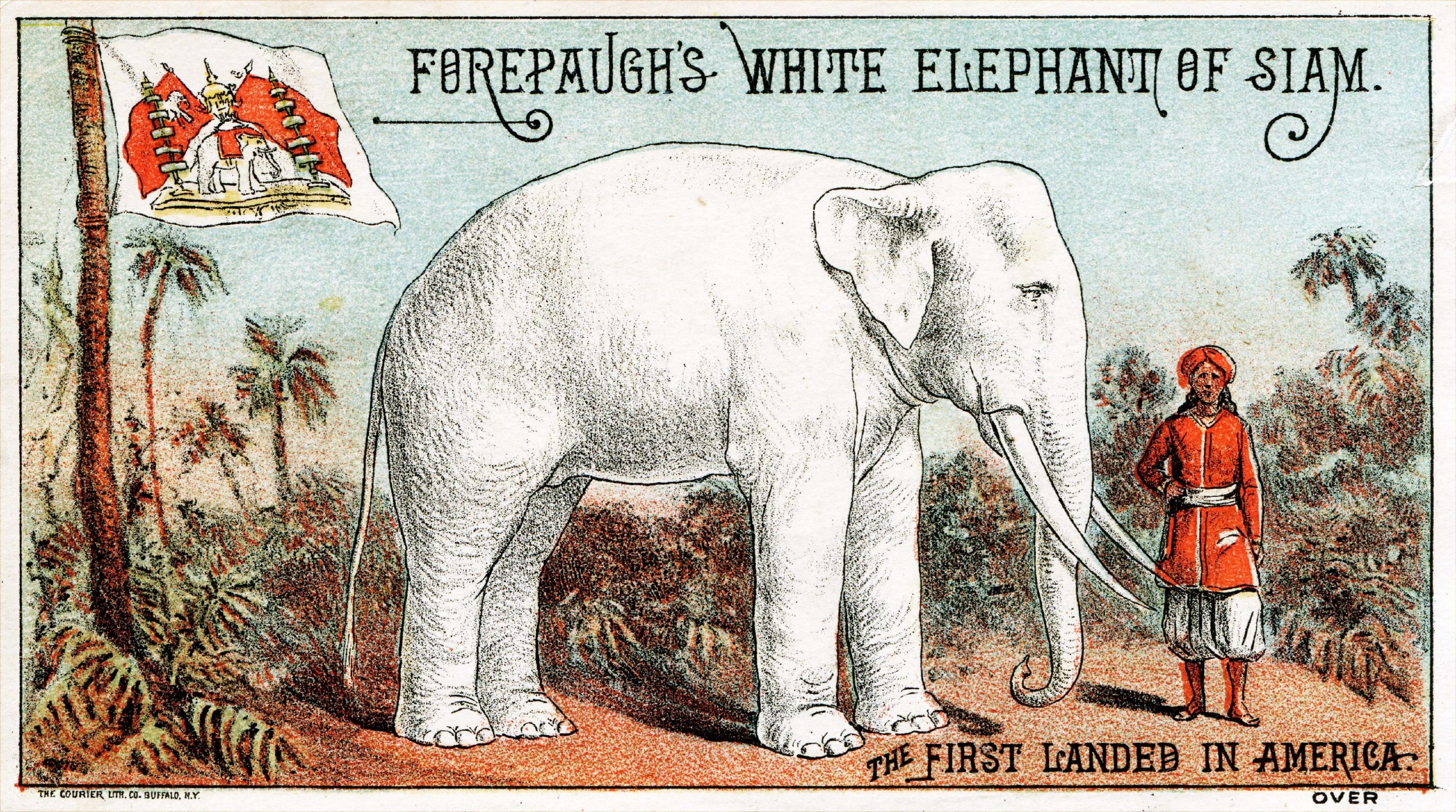

1. Barakah Acquires a White Elephant and Maintains it for 10+ Years

BARAKAH OFFSHORE PETROLEUM BHD

KLSE (MYR): BARAKAH (7251)