DBHD - SHORT TERM BULLISH ENTRY SIGNAL APPEARED !!!

BURSAMASTER

Publish date: Tue, 11 Jun 2019, 06:49 PM

DBHD - SHORT TERM BULLISH ENTRY SIGNAL APPEARED !!!

(PERSONAL TRADING TP 0.57, LONG TERM TP 0.70)

(DBHD WA TRADING TP 0.12, LONG TERM TP 0.20)

It made a resistance breakout at 0.45 on increased volume of of 2.75 mil shares. Subsequent resistances at 0.490 and 0.57 which is it 52-week high.

NOSH is only 318 mil shares.

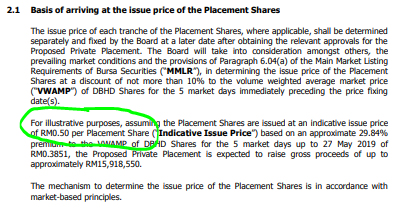

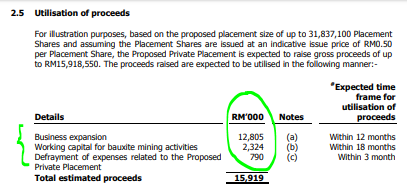

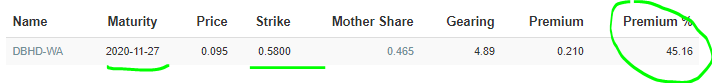

Refer below DBHD WA profile captured from KLSE SCREENER website for those looking at alternate cheaper entry, to consider the warrant due to below:

a. Considerably long life to go - 15 months to go to expiry at 27 November 2020

b. Strike price of warrant is 58 cents, currently mother share trading at 46.5 cents. The gap between current price and strike price is not big, and once mother share crosses 58 cents the warrant movement will be faster

c. Reasonable premium of 45% for a warrant with 1.5 years life

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is not a BUY CALL but only sharing my observations.

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Bursa Master

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022

Created by BURSAMASTER | Oct 23, 2021