PWROOT - EVERYBODY CAN POWER UP AND FLY TOGETHER !!!

BURSAMASTER

Publish date: Sat, 13 Jul 2019, 11:42 AM

PWROOT - EVERYBODY CAN POWER UP AND FLY

TOGETHER !!!

(INVESTMENT GRADE - MY PERSONAL TP 2.50 Mid to

Long Term)

Recently I had spotted this mid cap company; which I believe has a bright future ahead -POWER ROOT BERHAD (Stock Code 7237, listed on MAIN BOARD, CONSUMER PRODUCTS & SERVICES - FOOD & BEVERAGES, market cap RM 729.11M as at writing)

In summary, PWROOT is leading company which develops and promotes herbal energy drinks fortified with two main rainforest herbs : Eurycoma Iongifolia Jack (Tongkat Ali) and Labisia Pumilia and Pathoina (Kacip Fatimah).

I noticed considerable interest starts to build in on 5th and 11th July 2019; which has triggered my Investment Radar; the volume registered a sizeable increase to 3.1 million & 2.4 million units respectively.

With this positive momentum & enthusiasm ahead, I believe, should spillover to next week. I foresee it trending to the next resistance of 2.00 before heading to my personal TP of 2.50 on the intermediate to long term.

LINKS TO READ :-

https://www.theedgemarkets.com/article/power-root-may-climb-higher-says-rhb-retail-research-0

Power Root may climb higher, says RHB Retail Research

https://www.theedgemarkets.com/article/selangor-sultans-exmilitary-aidedecamp-power-root-cochairman

Selangor Sultan's ex-military aide-de-camp is Power Root co-chairman

WHY I THINK THIS STOCK COULD HAVE GREAT POTENTIAL TO RISE FURTHER?

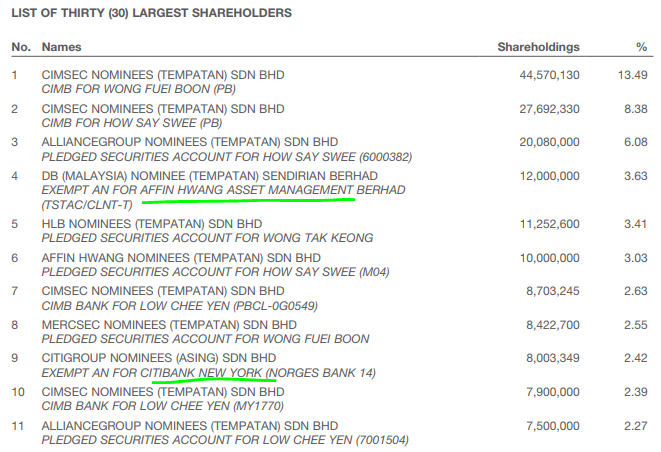

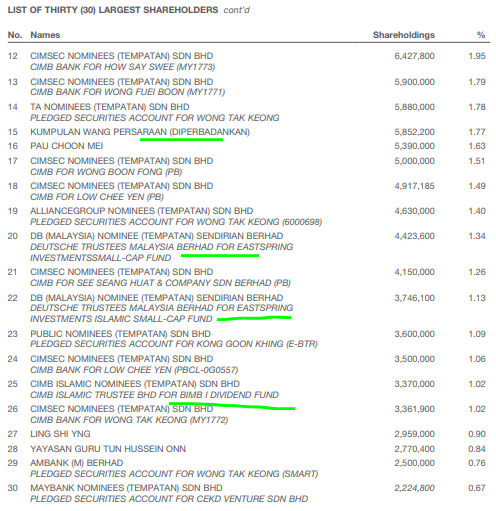

1. Notable Long Term Shareholders in the Top 30 List

Refer below latest shareholding report as of taken from latest Annual Report.

Among notable funds inside KWAP, EASTSPRING INVESTMENTS and Bank Islam Malaysia Bhd (BIMB). Long term funds inside a stock means that the effective float will be less as these funds will be holding on to the shares as long as the company keeps performing and paying them dividends.

2. Director Continuously Adding Interest in the Company

Refer below latest shareholding changes for the past few months (refer link for more details). It is noted that there has been a continuous accumulation by one of the PWROOT directors on both mother shares and warrants.

This signals strong confidence in the company future and potentially might have a big announcement coming soon.

https://www.malaysiastock.biz/Bursa-Announcement.aspx?code=7237&cat=5&page=1

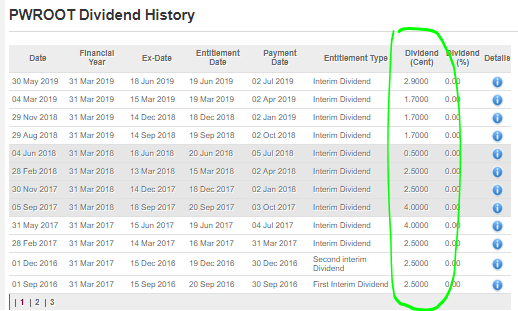

3. Consistently Paying Quarterly Dividends Since FY 2015

Refer below dividend history for the past 3 years. As we can see, the company has paid dividend to shareholders every quarter, without fail, as the company is in F&B business which is quite immune to economical fluctuations.

After all, every man needs his TONGKAT ALI & woman needs her KACIP FATIMAH despite how our financial status :P

From the below, this stock should be a no brainer for all those looking for quarterly consistent dividend payments, at the same time providing capital appreciation in the longer term.

4. Technical Analysis - ICHIMOKU CLOUD Breakout on Daily

Refer below WEEKLY chart of PWROOT. It has been on a downtrend since hitting its all time high of 2.88 on November 2015.

Recently, we saw that the stock had broken its downtrend and rebounded from its triple bottom (W Shape) formation. Judging from the bullish volume and bullish MACD cross, next week the price might trend up past the RM 1.88 resistance formed in July last year, and test its first psychological resistance at RM 2.00.

In longer term, I view the target of this stock around RM 2.50.

CONCLUSION

Considering all the above, my personal TP for PWROOT is set at RM 2.50 (Mid to Long Term). Funds & Investors should consider PWROOT to add to their portfolio

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Bursa Master

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022

Created by BURSAMASTER | Oct 23, 2021