LBALUM - THIS STOCK STANDS TO GAIN FROM RESUMPTION OF CONSTRUCTION MEGA PROJECTS !!!

BURSAMASTER

Publish date: Sat, 16 May 2020, 02:21 PM

THIS STOCK STANDS TO GAIN FROM RESUMPTION OF CONSTRUCTION MEGA PROJECTS !!!

Hello to all readers out there. Government recently implemented the Conditional Movement Control Order (CMCO) which relaxes a lot of restrictions that were imposed during the Movement Control Order (MCO). A lot of businesses are allowed to open back again and this saw our index be propelled to above 1,400.

Having said the above, the stock which I'd like to talk about today is LB Aluminium Berhad (LBALUM - Stock Code 9326, Main Market, Industrial Products & Services - Metals)

BASIC INFORMATION ABOUT LBALUM

LBALUM has been delivering world-class products and services in the aluminium industry since 1985.

Their key expertise are manufacturing, marketing and trading of aluminium extrusion and ceiling metal tee products, designed and delivered to the customers' satisfaction.

Market Capital : RM 100.64 million

Shares Float : 248.49 million

WHY INVEST IN LBALUM ???

Currently, there are a few factors which make the investment at current price look attractive. I will explain below.

1. GOVERNMENT ALLOWING CONSTRUCTION MEGA PROJECTS TO RESUME, CAUSING HIGHER DEMAND IN ALUMINIUM

Government has recently allowed many construction projects to resume. To name some big ones are ECRL, MRT2, LRT3 and Tun Razak Exchange. Refer news link below for more info and details.

https://themalaysianreserve.com/2020/04/29/nod-for-developers-to-resume-mega-projects/

This resumption of mega projects, will cause sudden surge in industrial products which are used, to name a few link cement, steel, aluminium. Therefore, LBALUM will stand to gain in the near term onwards.

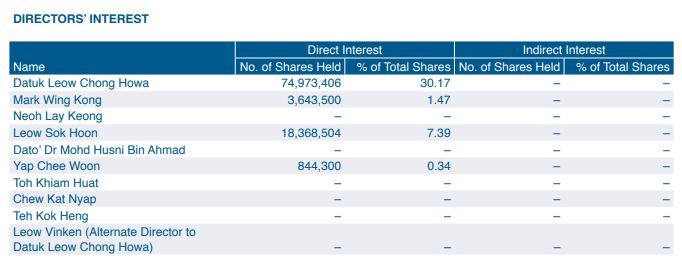

2. LOW SHARES FLOATING IN MARKET, DIRECTORS HOLDING 39.37% OF TOTAL SHARES

Refer below latest director shareholdings from 2019 Annual Report. It shows that directors are holding a total of 39.37% of the total floating shares.

This leaves an effective float of 60.63% in the market or 150.66 million shares. Based on this, any uptrend of price would be seeing less resistance as compared to a larger float in shares.

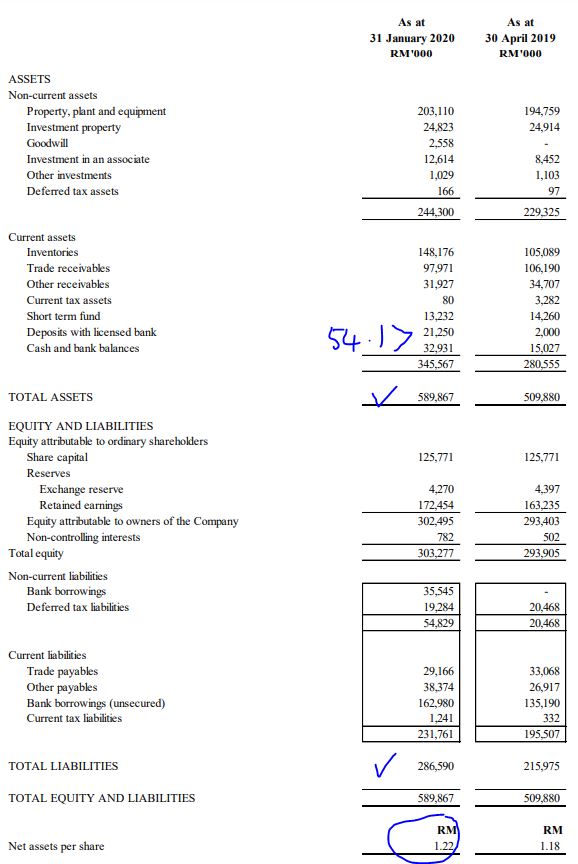

3. HEALTHY ASSET BASE VERSUS LIABILITY

Refer below latest asset & liability sheet as of March 2020 QR. A few points to note:

i. Total NTA stood at RM 1.22. Current trading price of 40.5c is a BIG DISCOUNT of about 81.5c (67% discount).

ii. Strong cash pile of RM 54.1 million (20.7c cash per share), which is slightly more than half of its market cap. Compared to last year same period, where the cash position was only RM 17 million.

iii. Total assets stood at RM 589 million versus liabilities of RM 286 million.

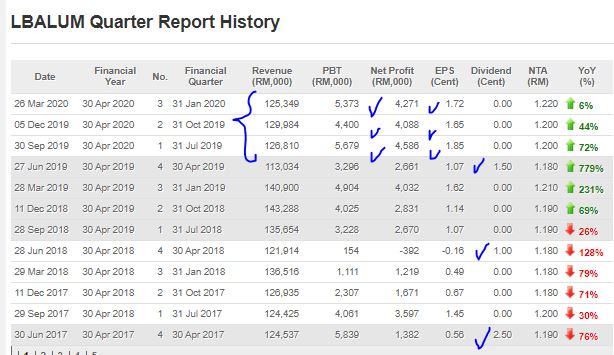

4. CONSISTENT REVENUE, PROFIT AFTER TAX, AND ANNUAL DIVIDEND PAYMENT

Refer below earnings summary for the last 3 years of LBALUM. A few observations below:

i. Revenue has been consistent above RM 120 million for the last 3 quarters

ii. Net profit has been improving compared to last Financial Year. Net profit maintained above RM 4 million for last 3 quarters

iii. 3Q EPS stood at 5.23c. Should the earning be consistent for coming quarter, this translate to full year EPS about 7c. Taking a 8-10X PE Ratio for full year EPS gives a fair value of 56-70c

iv. LBALUM also never failed to pay dividend at the 4th quarter of FY. Dividend paid for past 3 years was 1.5c, 1c and 2.5c respectively. We should expect another dividend payment coming announce in QR June 2020.

5. TECHNICAL ANALYSIS

Refer below the basic price and volume chart with key EMAs which I like to use to determine basic trend. A few observations:

i. Price was trading above 50c in January 2020 with peak of 61.5c. Refer to Circle 1, big volumes flowing in during this time. This makes the level between 55-60c, a major resistance in the long term for breakout

ii. Refer to Circle 4, whereby during the flash crash, volume of sellers remains low, indicating that only weak sellers are flushed out, and directors/major shareholders remain invested in this company for the long term

iii. Refer Circle 2, recent closing at 40.5c, indicates a strong close above EMA14 at 38.5c and EMA43 at 39c. This crossing reflects a bullish momentum ahead towards next EMA200 of 45c and EMA365 at 48c.

iv. Refer Circle 4, the volume flow is increasing, indicating improved interest in this stock

CONCLUSION

Considering all the above, I opine that current price for LBALUM is attractive due to below:

i) Economic reopening, and government allowing construction mega projects to resume, causing surge in aluminium and other related materials

ii) Low shares float in market as directors holding about 40% of total shares

iii) Trading way below its total NTA of RM 1.22

iv) Fair value between 56-70c based on forward earnings per share

v) TA shows crossing above EMA14 and EMA43, with healthy volume flow. This indicates a short term bullish momentum ahead

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Bursa Master

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022

Created by BURSAMASTER | Oct 23, 2021