WMG - PROPERTY SECTOR RESUMES UPTREND ! THIS PROPERTY STOCK IS TRADING AT 80% DISCOUNT TO ITS RTO PRICE !!!

BURSAMASTER

Publish date: Sat, 04 Jul 2020, 03:41 PM

PROPERTY SECTOR CONTINUING UPTREND ! THIS PROPERTY STOCK IS

TRADING AT 80% DISCOUNT TO ITS RTO PRICE !!!

Hello to all readers out there. Our index made a good rebound this week to close at 1552.65 which is above the 1500 level.

I noticed that PROPERTY index had started to rebound this past week, forming a cup and handle pattern. Refer Circle 1, where property index had hit a higher low recemtly, and after the retracement completed, started to gain back momentum upwards.

Having said the above, the stock which I'd like to talk about today is WMG HOLDINGS BERHAD (WMG - Stock Code 6378, Main Market, Property)

BASIC INFORMATION ABOUT WMG

WMG was founderd in 1996 with core businesses in a few fields:

i) Property Development

ii) Building Materials

Market Capitalization : RM 44.75 million

Shares Float : 426.17 million

Website : http://www.tekala.com.my/

1. RTO PRICE WAS 50 CENTS PER SHARE IN 2017, NOW TRADING AT 10.5 CENTS

ONLY !!!

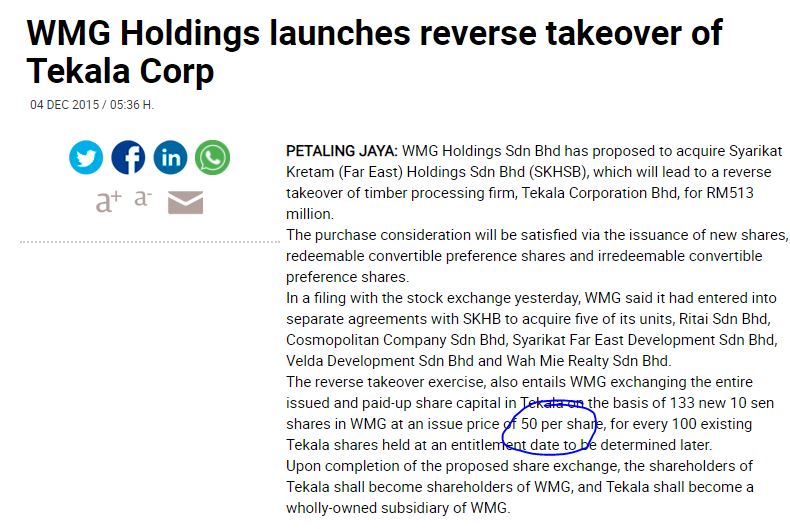

Refer below old news regarding this company. Before the Reverse Take Over (RTO), WMG was known as TEKALA.

In December 2015, WMG Holdings Sdn Bhd launched RTO for Tekala at 50c per share. In August 2017, the RTO process was completed, and Tekala name was changed to WMG.

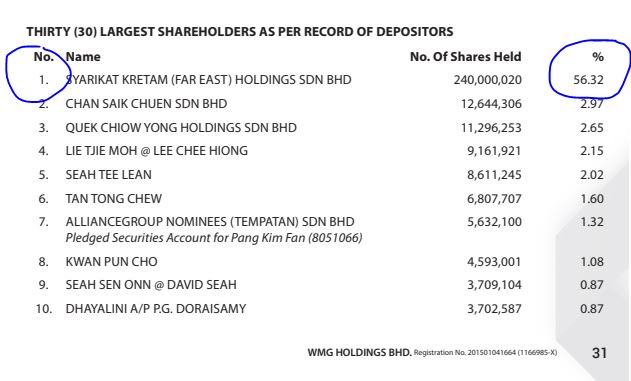

Syarikat Kretam (Far East) Holdings Sdn Bhd is now a majority shareholder in WMG at 56% shareholdings, which they had acquired via the RTO at 50c.

Since completion of the RTO, and hitting a high of 70c in June 2017, this stock had been on a downtrend. However, it is noted that there had been no selling whatsoever from the major shareholders who took over the company.

Therefore, I foresee that this company real and instrinsic value shall be noticed by investors very soon, as the latest closing price at 10.5c is way below the RTO price.

2. EXCITING FUTURE AHEAD, WITH HUGE 633 ACRES LAND BANK IN SABAH &

TOTAL UNBILLED SALES OF RM 51.56 MILLION

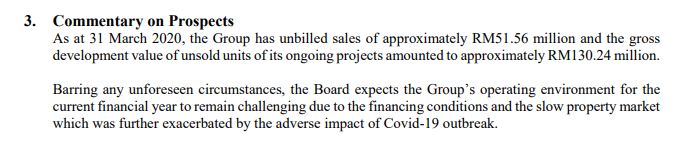

Refer below latest information on WMG assets in quarter report.

We note the following facts:

i. WMG has total land bank of approximately 633 acres, with 435 acres in Sandakan and 198 acres in Kota Kinabalu

ii. WMG has 3 ongoing projects:

-Sejati Corporate Garden at RM 11.25 million (94% completion)

-Sri Indah Kondominium at RM 30.16 million (63% completion)

-Parklane 1 Terrace at RM 6.56 million (27% completion)

iii. A few projects to be launched in near time worth RM 23.14 million

Based on latest commentary of the prospects, total unbilled sales stood at RM 51.56 million and GDV of unsold units totalling RM 130.24 million.

3. TRADING AT 75% BELOW NTA, NET ASSET VERSUS LIABILITY OF RM 180

MILLION

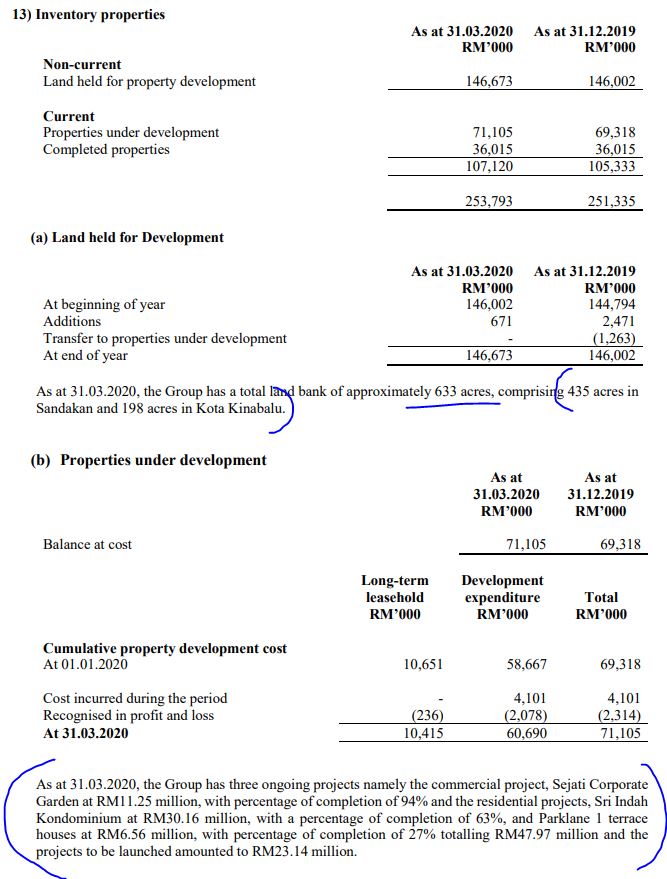

Refer below assets versus liability sheet for WMG as of latest QR.

Total assets stood at RM 433.4 million versus liabilities of RM 253.4. This means a healthy asset surplus of RM 180 million.

Total NTA is 42c, which means that latest closing price of 10.5c, is a 75% discount to its NTA.

4. TECHNICAL ANALYSIS - ROUNDING BOTTOM FORMING, AND MOVING

AVERAGES STARTING TO CONVERGE, HIGH UPSIDE & LOW DOWNSIDE

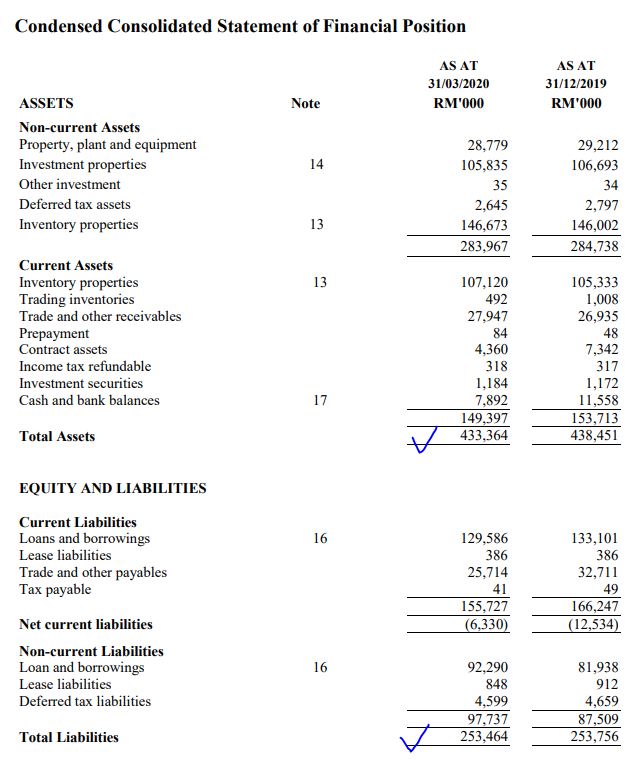

Refer below the basic price and volume chart with key EMAs for WMG daily chart :

A few observations on the daily chart chart:

i. WMG hit a peak of 70c in June 2017 on the back of RTO news. However since then had been downtrending

ii. Exciting prospects, with 633 acres land bank in Sabah and unbilled sales of RM 51.56 million

iii. Trading at 75% below NTA, net asset versus liability of RM 180 million

iv. Refer Circle 2, it seems that the Moving Averages for WMG has started to converge, indicating that the big trend in the stock might be changing from downtrend to uptrend very soon

v. Looking at the longer term view of this stock, there is very much potential upside compared to the downside at this moment

CONCLUSION

Considering all the above, I opine that current price for WMG is attractive due to below:

i) Latest closing price of 10.5c is way below its RTO price of 50c in 2017

ii) Exciting prospects, with 633 acres land bank in Sabah and total unbilled sales of RM 51.56 million

ii) Healthy asset surplus compared to liabilities, and trading at 50% to its NTA of 12.5c

iii) Chart showing a rounding bottom forming, with volumes of trading improving. Also, Moving Averages and converging upwards, indicating a big change in trend is possible very soon

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Bursa Master

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022

Created by BURSAMASTER | Oct 23, 2021

supersaiyan3

Aduh.....

2020-07-05 11:15