FINTEC GLOBAL BERHAD (formerly known as ASIA BIOENERGY TECHNOLOGIES BERHAD) [0150 - Part 2]

ChloeTai

Publish date: Tue, 19 Dec 2017, 06:40 AM

DESCRIPTION

Fintec Global Berhad, formerly known as Asia Bioenergy Technologies Berhad, is a technology incubation and investment holding company. The Company's major business activities are categorized into four segments, namely Technology incubation, Portfolio investment, Biotechnology products and Oil & gas services. Its Technology incubation segment provides management and strategic advisory services, research-related activities and sale of machineries to commercialize technologies in bio-energy and biotechnology sectors. Its Portfolio investment segment is engaged in portfolio investment in quoted and unquoted shares. Its Biotechnology products segment is engaged in the engineering, procurement and technology provision for biomass power plants, as well as the production and sale of microbial-related products. Its Oil & gas services segment partakes in providing engineering and maintenance services for the oil and gas sector.

FINTEC GLOBAL BERHAD INCUBATEES

The Group’s current investment focus is on six key industries: Renewable Energy (VSolar Group Berhad), Engineering (AT Systematization Berhad), Food and Beverage (Focus Dynamics Group Berhad), Financial and Application Technology (NetX Holdings Berhad), Oil and Gas (AsiaBio Petrolelum Sdn Bhd) and Halal Food Production (AsiaBio Capital Sdn Bhd).

(A) VSolar Group Berhad

VSolar Group Bhd has had to change its strategy after its solar project hits a snag. In August 2017, VSolar entered a partnership with KRU Asia Pte Ltd, Rangkaian Iltizam Sdn Bhd and Kenneth Lee ai Tong to jointly develop a 10MW biomass/biogas plant.

Instead of empty fruit bunches (EFB), which have physical inconsistencies that affect burn efficiency, the joint venture will use sorghum (sejenis bijirin) as its feedstock.

By planting, harvesting and processing sorghum, it provides an end-to-end solution. This helps to control the consistency of the feedstock. Sorghum is easy to plant and harvest and the material is consistent. The whole plant is utilized. It is stored like hay, in bundles. If it gets wet, that is not an issue, unlike EFB. It does not need an additional warehouse for storage.

The company currently has 2000 hectares of sorghum plantation in Pahang and it is expecting to see the results of its past few harvests in March 2018.

The joint venture is also the perfect opportunity to test microbe technologies developed by AsiaBio which are meant to shorten the plant-to-harvest period.

Because of the inconsistencies in EFB biofuel production, the take-up under SEDA (Sustainable Energy Development Authority) feed-in tariff has been low, which the company sees as an opportunity to earn better rates.

As a summary, VSolar has swapped their effort and resources from a Solar player into plantations feedstock Biomass/Biogas green energy player. The main reasons is that they have planted sorghum for their Green Biomass Energy feedstock because it has a very high rate of oil production during the biomass process than any other feedstock and it does not affect the production level even if it is harvested in wet condition.

(B) AT Systematization Berhad

AT Systematization Berhad is engaged in investment holding and provision of management services to its subsidiaries. Through its subsidiaries, the Company is engaged in the design, manufacture and fabrication of industrial automation systems, machinery, industrial and engineering parts. It has developed standard products which cover automated test handling systems, automated laser marking and vision inspection systems, fully automated assembly system, automated production line integration system and clean room class 1 intelligent conveyor transport system. The Company operates in Malaysia, the People's Republic of China, Thailand and the Philippines. Its subsidiaries include AT Engineering Sdn. Bhd., Miako-Tech Engineering Sdn. Bhd., AT Engineering Solution Sdn. Bhd., AT Precision Tooling Sdn. Bhd., AT Machinery (Suzhou) Co. Ltd. and Automation Technology Systematization Industries Ltd.

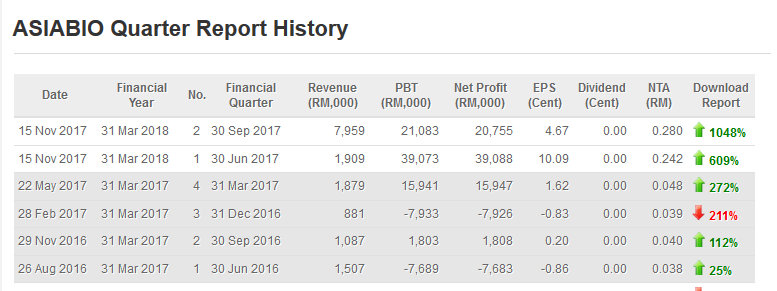

(C) Focus Dynamics Group Berhad

The Group has redirected its strategic direction towards its F&B segment and Property Investment segment. The Group will:

(i) continue its diversification initiative to develop a mixed commercial development (The Arch) which will feature retail / F&B lots, event hall, a Chinese restaurant, a seafood restaurant, a karaoke centre and car parks in a 5-storey building with a basement level to be erected on a piece of land next to TREC KL and the Tun Razak Exchange.

The Company has budgeted a funding requirement of RM60 million for the construction of The Arch, which will begin early next year. They are bringing in international brands. It will be more focused on specialty brands, bespoke restaurants, lounges, concept clubs, artisan coffee spots and a convention area.

AND

(ii) leverage on its existing F&B outlets, namely “Chaze”, “LAVO” and “Maze” to further expand its F&B business including amongst others, opening of additional outlets or launching new F&B brands.

Obviously, Focus Dynamics Group Bhd has provided Fintec Global Bhd with the highest ROI (Return Of Investment). Fintec has set aside RM8.99mil to invest in the ICPS of Focus Dynamics Group Bhd, planned to be processed this month.

(D) NetX Holdings Berhad

NetX Holdings Berhad is a Malaysia-based company engaged in the research and development of software, system design, integration and installation and provision of information technology services. The Company provides a complete range of information technology (IT) solution, which includes network solutions, security solutions, performance management, network management and 24-hour support and maintenance services. Its core services are integrated channel bonding, which enable bonding of lines regardless of the network line performance; network performance enhancement, which include the provision of fully converged enterprise network, network security, which include the provision of active-integrated security solution and maintenance and service. Operations are carried out in Malaysia, Hong Kong and People's Republic of China.

NetX on the other hand have seen positive growth in its payment solutions operations and expects further improvements once its collaborative efforts with Hello Digital (Cambodia), XOX Berhad and M3 Tech Berhad bears fruit.

Fintec --> (NetX - payment solution) and possibly followed by Bitcoin in the future.

(E) AsiaBio Petrolelum Sdn Bhd

The company is involved in oil and gas engineering and maintainance.

On 21 October 2017, AsiaBio Petroleum Sdn Bhd (ABP) announced that the Company has entered into a Collaboration Agreement with ACME Industrial Services Sdn Bhd (ACME) to set up an integrated facility to provide blasting and painting (B&P), as well as steel fabrication services.

On 8 June 2017, AsiaBio Petroleum Sdn Bhd (ABP) announced that the Company has clinched a subcontract worth an estimated RM220mil to provide ancillary services related to the proposed Refinery and Petrochemical Integrated Development (Rapid) complex in Pengerang, Johor. The company has received a letter of award (LOA) from Tenisha Construction Sdn Bhd that involved the design, maintenance and dismantling of scaffolding systems for the utilities, interconnecting, officesite. (UIO) facilities.

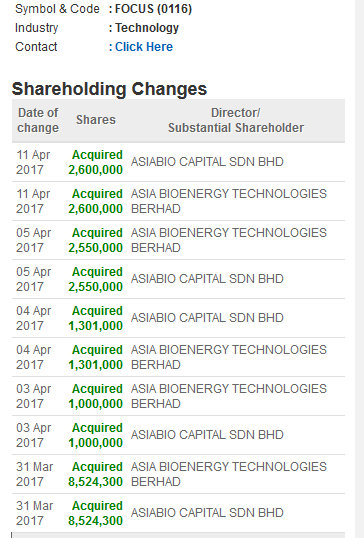

(F) AsiaBio Capital Sdn Bhd

AsiaBio Capital Sdn Bhd has inked a memorandum of Understanding (MOU) with Hong Kong YRZC International Group Co Ltd., Shan Xi Hong Hui Food Limited Liability Co and Shan Dong Wang Jia Yuan Zi Halal Food Brewing Co to export halal food products to China. The parties are expected to enter into a partnership by year-end. They will go into a 50:50 partnership and set up three outlets. Demand for halal products will only grow along with the growing Chinese population. The market for halal food is larger than in Malaysia. The non-Muslim market is also buying halal products because the quality assurance is there.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Chloe Tai Blog

Created by ChloeTai | Jul 18, 2024

NATGATE is a multi-bagger AI technology gem.

Created by ChloeTai | Jul 16, 2024

IJM new Target Price is RM4.40 forecasted by CGSI.

Created by ChloeTai | Jul 14, 2024

GAMUDA is the king of construction throughout the world (not only in Malaysia).

Created by ChloeTai | Jul 12, 2024

SUNCON TP of RM5.46.

Created by ChloeTai | Jul 12, 2024

Gamuda TP of RM9.50.

Created by ChloeTai | May 30, 2024

Created by ChloeTai | May 22, 2024

Mah Sing export their plastic products to

More Than 50 Countries

around the world.

Created by ChloeTai | Apr 29, 2024

RHB Research - Going All Out; Keep BUY. New Target Price RM1.61.

VenFx

Good morning Chloe Tai

Lets cheer for this New Born

From the FINTEC GALAXY.

2017-12-19 08:39