Cypark Resources Berhad (KLSE: 5184): The Second Serba Dinamik?

Meatbone

Publish date: Fri, 06 Jan 2023, 06:19 PM

I’m Nigel Tan, and I’m a former shareholder of Cypark Resources Berhad and a long-time small businessman.

I recently found my copy of this article from back then, and this was the reason i sold most of my shares back then.

As today share price go up, i would like to encourage us small time cypark investors to exit and sell everything to Jakel or whoever supporting the share price.

I put a copy of the article here.

THE MYSTERY OF CYPARK ARTICLE. (CLICK THIS LINK TO DOWNLOAD)

And spent some time extracting the article and putting it here, as i think important

What has happened since the article come out,

- LSS2 project is supposed to be in Empangan Kelinchi and Terip in Negeri Sembilan, but in this article, it says that its moved to Danau Tok Iban, Kelantan. There is no update to investors or sukuk holders about this with no request for approvals. Such a big change so late will surely have a huge impact on construction cost, potential power generation, require a new contract signed with TNB etc.

- Mr Ng Zhu Wei and Bakertiliy Monteiro Heng have resigned as auditors over fees, but till now they have not hired any new auditor when annual report need to submit in just 3 months.

- They placed out 30% of the company to Jakel Group. If the Concession Agreement is so good, how come cannot borrow money from bank?

- PROJECT STILL NOT DONE. WTE STILL NOT YET COMPLETE

=================================================================================================================================================

We think that the management of Cypark Resources Berhad (“CRB”) should enlighten their public investors regarding their mysterious Waste-To-Energy plant, among many other questions as detailed below.

Executive Summary

Waste-to-Energy (“WTE”) Project at Ladang Tanah Merah, Negeri Sembilan

The project started on September 2013 and was supposed to be completed by 2017 at a total cost of RM300 million.

Currently, as of 1 June 2022, the project stands uncompleted, and the company has spent (and capitalized interest cost related to the project) RM713.5 million on the project (more than double the initial RM300 million estimate), and further recognized an additional RM188.4 million in “Profits from construction of public service infrastructure”. It is currently recognized as an intangible asset worth RM901.9 million (as per 2021 Annual Report).

Accounting for the more than 5-year delay, costing 3 times over the original budget, as well as having lost 5 years of its concession life for nothing (as of 2021 only 20 years of concession life is left), using managements assumptions, it implies Project IRR of a mere 1.2%, while its debts amounting to RM712 million carrying an average interest rate of 6%, making this asset effectively worthless.

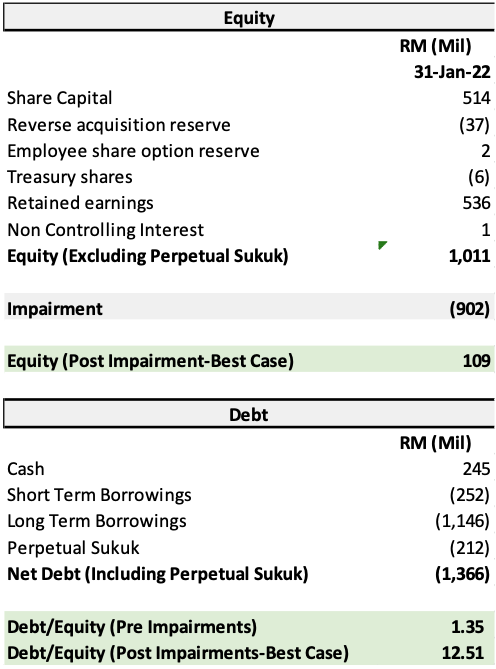

If this asset is impaired to its fair value, CRB will be insolvent with a net debt of RM1.36bn and equity of merely RM0.1bn and persistent negative cash flow.

The Hidden Subsidiaries of Cypark and Missing Interest Expense

CRB have shown a history of using current/past employees /associates as nominal shareholders, in their 2013 LSS and 2019 LSS2 projects. Despite not owning any ordinary shares, CRB is effectively funding and operating the entire project, with all risk and rewards borne by CRB.

This structure enables them to (i) capitalize interest cost that should otherwise be recognized as an expense and (ii) potentially hide related party transactions and recognize fictitious construction profit. Upon “Acquisition” of these assets from the related parties, they are not disclosed to Bursa despite meeting all the disclosable transaction requirements which needs shareholders’ approval.

If the RM51.4m missing interest cost is properly accounted for, CRB PBT for FY2021 would be reduced by more than 50%. If we further adjust for earnings from construction jobs from supposedly its own subsidiary, its 2021 PBT would go down by nearly 80%.

Contract Asset

As at 31st Jan 2022, CRB recorded RM845m of contract asset on its balance sheet, this is entirely attributable to the LSS2 construction jobs that it carries out for its hidden subsidiary according to the 2019 Sukuk document. The Sukuk document also shows that the total EPC contract works awarded be no more than RM600m. The contract asset for the long overdue LSS2 jobs is now way above the EPC amount. We found that it is inflated due to interest cost being hidden under this contract asset line as well as recognition of construction profit earned from its hidden subsidiary.

Cashflows/IRR of 2019 LSS 2 Projects and LSS 3 Projects

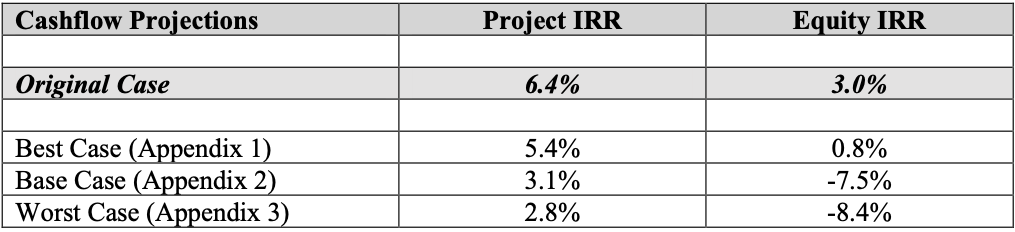

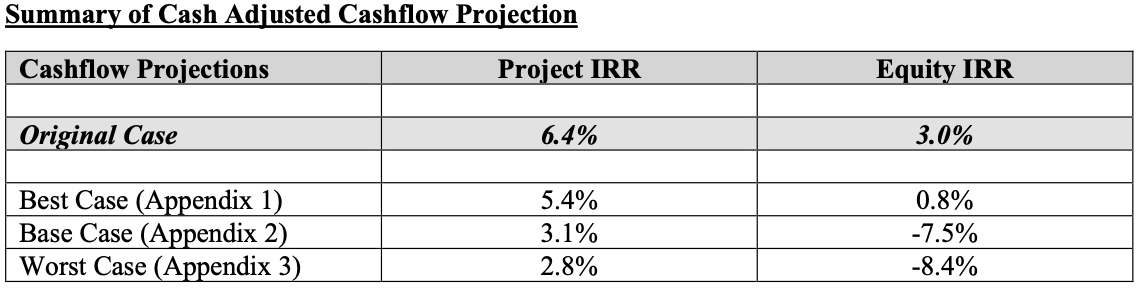

Non withstanding the corporate governance and company structure problems, using the managements own estimate within the Sukuk Documents. The project IRR of the LSS2 Project is a mere 6.4% compared to the effective interest cost of 7.3%.

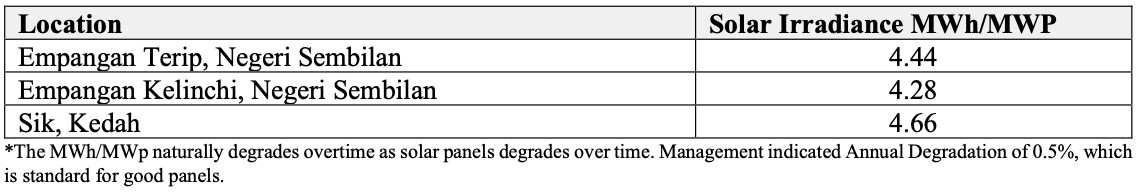

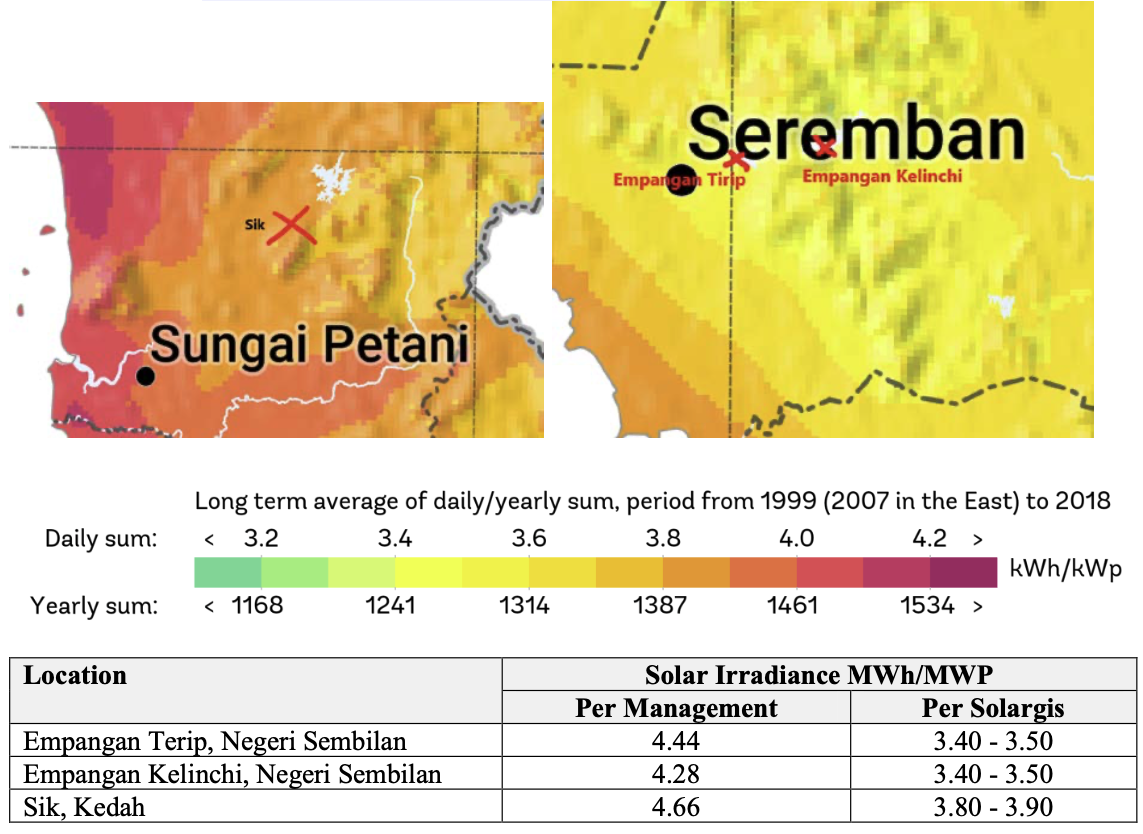

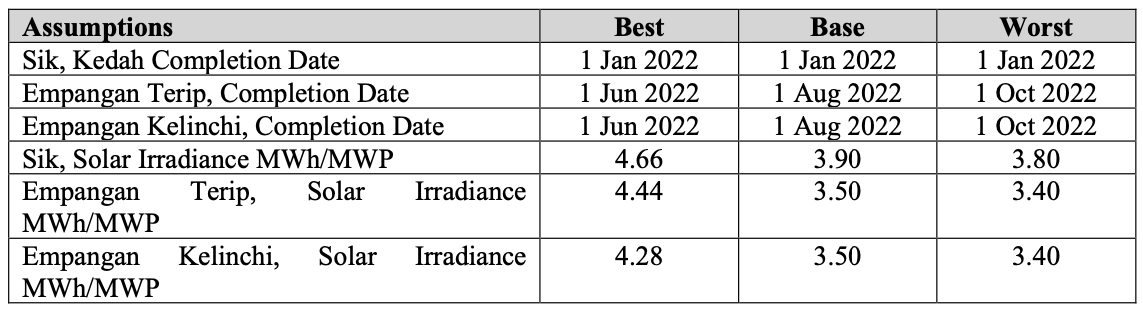

In addition, we have reason to believe that management’s assumptions on the solar irradiance levels of the relevant location (directly correlated to the amount of energy that can generated), is overstated by 15-30% compared to publicly available data.

In addition, the project is also currently behind schedule, after normalizing the irradiance levels and accounting for the project delays, a summary of the IRR’s for LSS 2 is as follows.

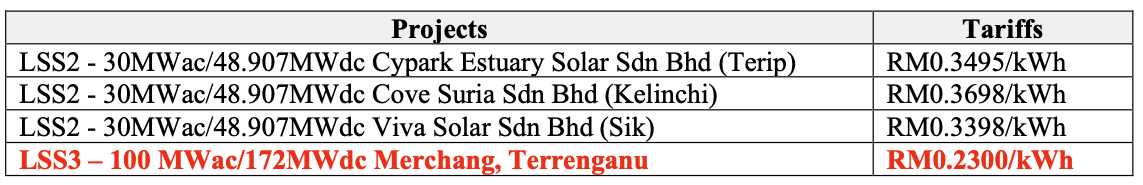

Given the above, the Merchang, Terrenganu LSS3 project that CRB have won has tariff rates of almost 32% lower at RM0.2300, than the LSS2 project.

Given the current inflationary pressures, and the laws of physics, it’s impossible for the LSS3 project to not be loss making.

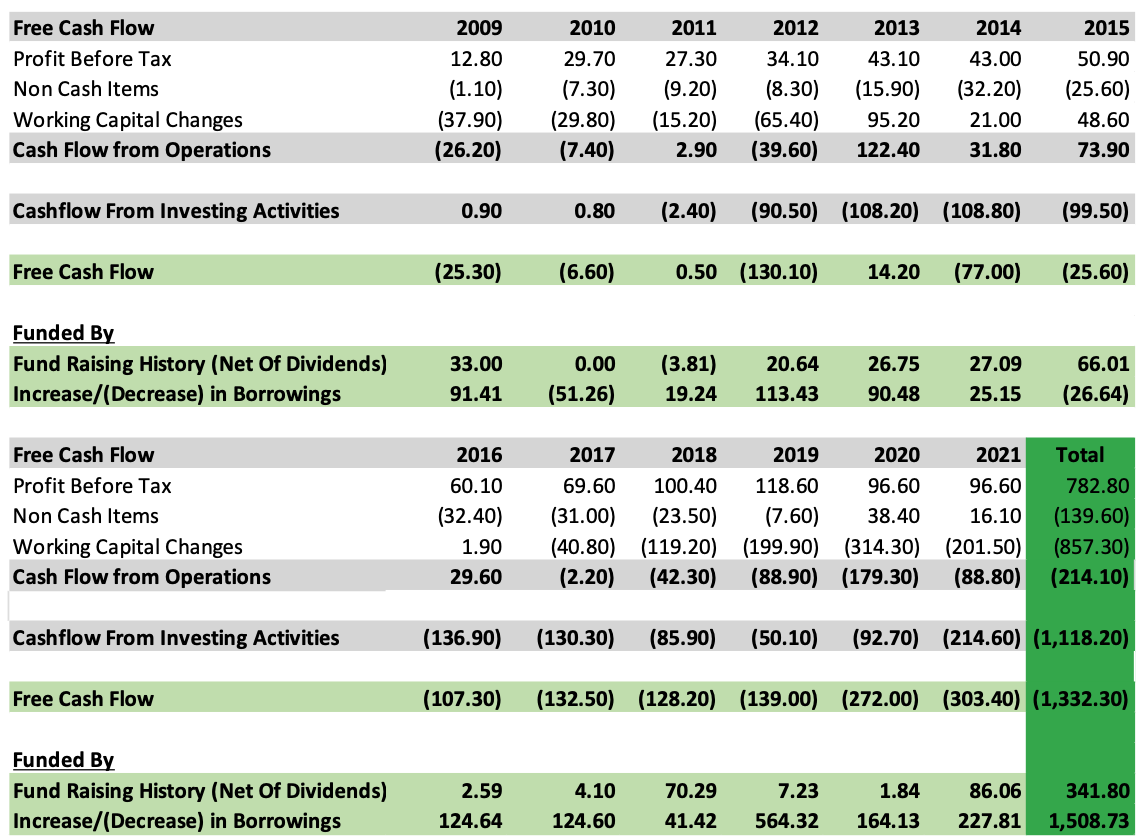

The Non-Existence of Free Cashflow and the Fundraising of CRB

Since its listing in 2010, CRB have only twice recorded a positive Free Cashflow. Overall, it has recorded a total of negative RM1.332 billion in free cashflow.

Since 2010, this deficit has been funded by both an increase in borrowings, and equity fund raising by Cypark, with the most recent fund raising in 2021. We expect this trend to continue, given their legacy and current loss-making contracts whose losses have not been recognized yet. However, if the music were to stop, there won’t be enough cash flow to repay the bondholders and the bank loans. (Maybank, OCBC and RHB are cited as their principal bankers in the annual report.)

Conclusion & Question to the Auditor

As auditors of the financial statements, Mr Ng Zu Wei from Baker Tilly Monteiro Heng PLT is responsible for ensuring that the financial statements are true and fair. In which case we would like to ask a few questions.

During an audit, one of the Key Audit Matters for companies with large Intangible Assets, is the Impairment Assessment for Intangible Assets. We would like to know, how the WTE Project, which is 5-years behind schedule, and costing 3 times over the original budget, and having lost 5 years of its concession life for nothing (as of 2021 only 20 years of concession life is left) have no impairments to its intangible assets?

While IFRIC 12 (Service Concession Asset) allows the concessionaire to book the fair value of the intangible asset and corresponding construction revenue and profit during construction period, it is the auditor responsibility to question if there is truly any profit to be booked once cost overrun is obvious and project is massively delayed (by 5 years).

Did the auditors properly question the management’s assumptions on their projections? A simple financial projection will show that the project is destined to bleed from day one.

CRB’s Waste-to-Energy (“WTE”) Project at Ladang Tanah Merah, Negeri Sembilan.

In 2013, CRB announced the WTE Project at Ladang Tanah Merah, Negeri Sembilan. This project is a concession asset, as per a Concession Agreement (“CA”) with the Solid Waste and Public Cleansing Management Corporation and the Government of Malaysia, which was represented by the Ministry of Housing and Local Government.

Under the CA, the Government shall deliver the municipal waste from designated scheme areas for treatment and disposal at the WTE System. The Company is entitled to be paid an agreed fee as defined in the CA known as tipping fees. The company shall also be generating revenue from sales of electricity for converting the waste to clean renewable energy under the Sustainable Energy Development Authority Malaysia (“SEDA”) Act. This concession starts from 2017 – 2041.

The project started on September 2013 and was supposed to completed in 2017 at a total cost of RM300 million.

Currently, as of 1 June 2022, the project stands uncompleted, and the company has spent (and capitalized interest cost related to the project) RM713.5 million on the project (more than double the initial RM300 million estimate), and further recognized an additional RM188.4 million in “Profits from construction of public service infrastructure”.

Currently, this WTE Concession Asset which originally cost RM300 million is recognized as an asset worth RM901.9 million (as per 2021 Annual Report) despite being more than 5 years late (and still non-operational), costing more than an additional 2.3 times over the original budget and having lost 5 years of its concession life for nothing (as of 2021 only 20 years of concession life is left).

In terms of Accounting Standards, when it comes to Concession Asset, the owner of the asset can proportionally recognize “Profits from construction of public service infrastructure”, if the Present Value of all future cashflows from the concession asset is higher than the cost of building it.

This “Profit” plus the “Cost of Construction” is then recognized as an “Intangible Asset” before being amortized over the utility or useful life of the concession asset.

In the case of Cypark’s WTE, which is more than more than 5 years late (and still non-operational), cost more than an additional 2 to 3 times over the original budget, and having lost 5 years of its concession life for nothing (as of 2021 only 20 years of concession life is left), it’s more likely that an impairment to its current fair value based on the adjusted cashflow projections needs to be made.

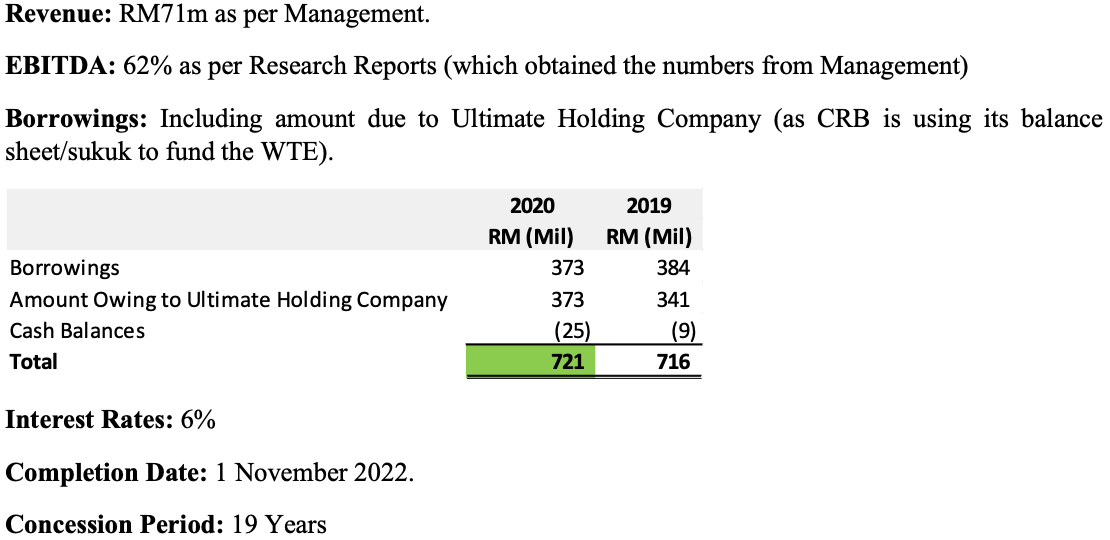

Using a simplified cashflow with the following assumptions,

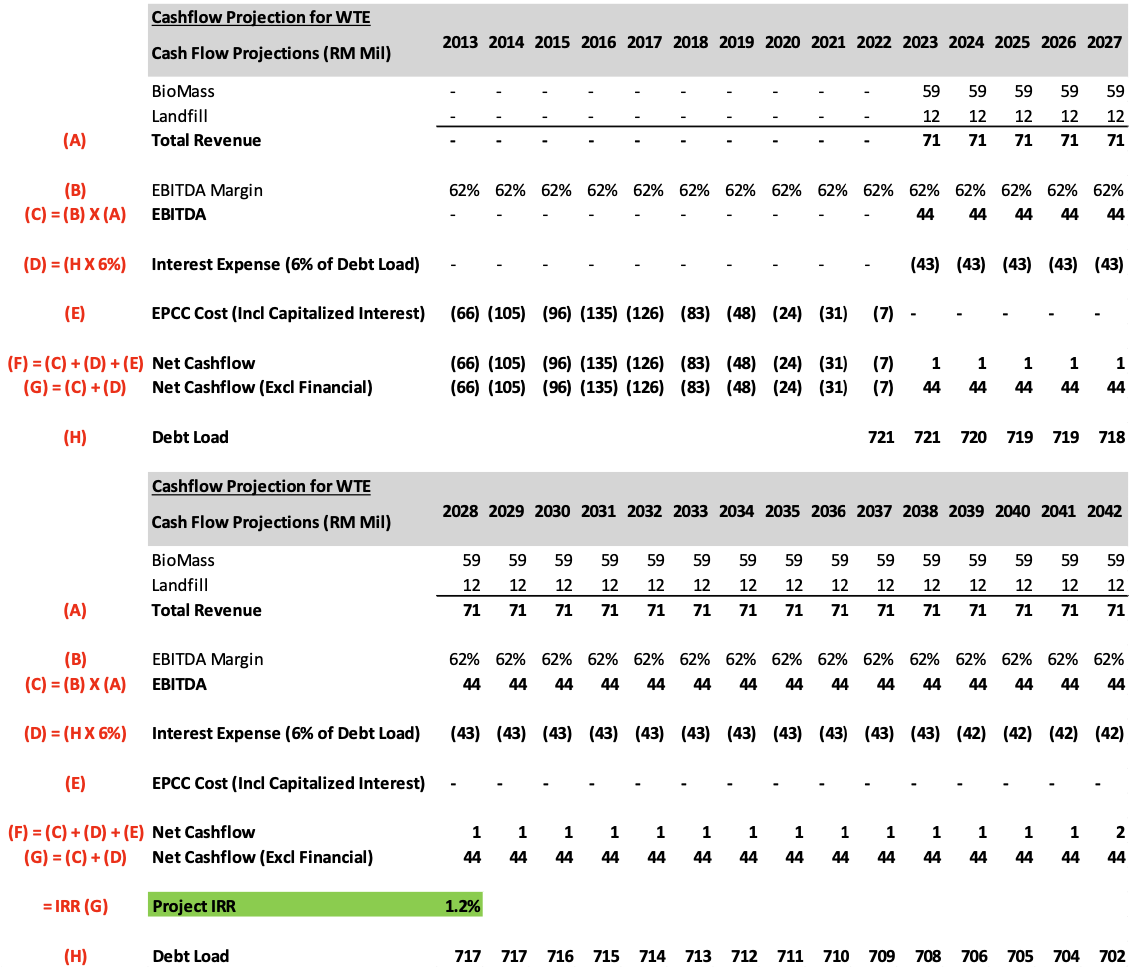

We will obtain the following Projected Cashflows.

As we can see, based on the current performance of the asset, adjusted Project IRR is 1.2% (ie, this project is only profitable if your cost of capital is less than 1.2%).

As this project is basically entirely funded by borrowings, whose interest rates are around 6%, it’s almost impossible for it to be profitable.

In fact, by the end of the concession period, when the asset is transferred to the government, CRB would likely still be liable for borrowings of around RM702m.

In short, the Intangible Assets of RM901.9m relating to the WTE needs to be impaired in full.

IF (it is big IF), the WTE plant eventually went into operation by end of this year, it would then begin to recognize the RM71m annual revenue, RM43m interest cost p.a. and additional deprecation of RM47m p.a. Assuming an EBITDA margin of 62%, the project will immediately lose RM46m each year.

Based on the latest quarterly reports, this will result in Equity (Excluding Perpetual Sukuk), to fall from RM1.01 billion to RM109 million.

And push their Debt/Equity Ratio from 1.35 to 12.51

To put simply, if the actual estimated impairments were taken up, CRB would likely be borderline insolvent, especially if the Sukuk and Perpetual Sukuk Covenants is considered.

If the above is not scary enough, do note the projection is made based on management numbers, we have not even started asking questions about the assumptions.

WTE Projects is very difficult in general, and especially so in Malaysia, for a few reasons.

Firstly, the most profitable portion of the WTE Project is the landfill and the collection of tipping fees, but the government cannot guarantee a certain amount of rubbish. The trucks will bring the rubbish to you, but the volume is up to God.

Secondly, rubbish in Malaysia is much wetter compared to those in other countries, therefore, it’s quite likely that you would need use heat to dry the rubbish up before you can burn it to generate power. This additional process could result in the BioMass segment consuming a lot expensive energy and hence lower its margin.

The Hidden Subsidiaries of Cypark

2013 “Acquisition” of Kenari Pasifik, Tiara Insight and Semangat Sarjana

On 30 April 2013,

- Kenari Pasifik Sdn Bhd together with its wholly owned subsidiary, Gaya Dunia Sdn. Bhd. (“KPSB”) which held the Bukit Palong Integrated Renewable Energy Park (3MW Solar, 0.5MW+0.5MW Biogas), built on 25 Acres of Safely Closed Non Sanitary Landfills.

- Tiara Insight Sdn Bhd together with its wholly owned subsidiary, Rentak Raya Sdn. Bhd. (“TISB”) which held the Rimba Terjun Renewable Energy Park (2MW Solar), built on 14 Acres of Safely Closed Non Sanitary Landfills

- Semangat Sarjana Sdn .Bhd. together with its wholly owned subsidiary, Ambang Fiesta Sdn. Bhd. (“SSSB”) which held the Kuala Perlis Renewable Energy Park (5MW+1MW Solar), built on 20 Acres of Safely Closed Non Sanitary Landfills

were consolidated into the accounts of Cypark Resources Berhad.

This resulted in an additional RM141 million worth of Property Plant and Equipment being recognized in CRB’s book, with a corresponding decrease in Trade Receivables, and increase in Borrowings.

The management explains that this is due to Cypark Renewable Energy Sdn. Bhd (“CRESB”) (a wholly owned subsidiary of Cypark Resources Berhad). entering into three management service agreements with three group of companies.

The company does not hold any ownership in these three groups of companies.

However, based on the agreements entered, the company has control over the financial and operating policies of these entities and receives substantially all the benefits related to their operations and net assets. Consequently, the Company consolidates these six companies as subsidiaries.

All 3 companies have the following shareholder structure

the financing and construction of the following assets worth RM141 million was done by CRESB, with the Ordinary Shareholders and Preferred Shareholders contributing a mere RM1,002.

Needless to say, this is a very odd shareholder/financing structure.

- Why were the companies only consolidated in 2013, instead of from 2011, as the nature of the project seem to indicate that CRB was the controlling party from the start?

- When this company was consolidated, why was there no announcement to Bursa Malaysia as per Listing Requirement - Part D (10.04, 10.05, 10.06) and why was there no shareholders’ approval being seek? The transactions resulted in more than 25% change in the Percentage Ratios as defined in Listing Requirement – Part B - 10.02 (h).

- Why was this shareholding structure even used when its far simpler to just have CRESB hold the Ordinary and Preferred Shares from the beginning?

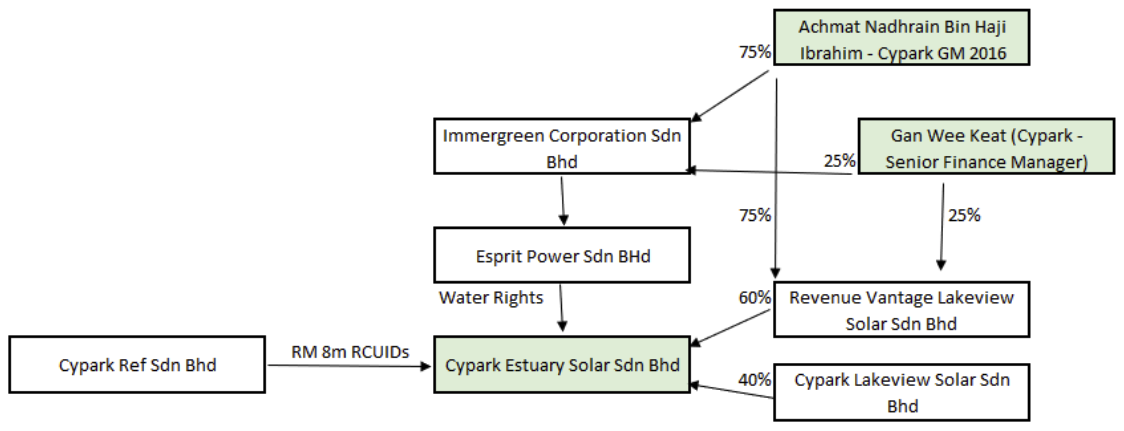

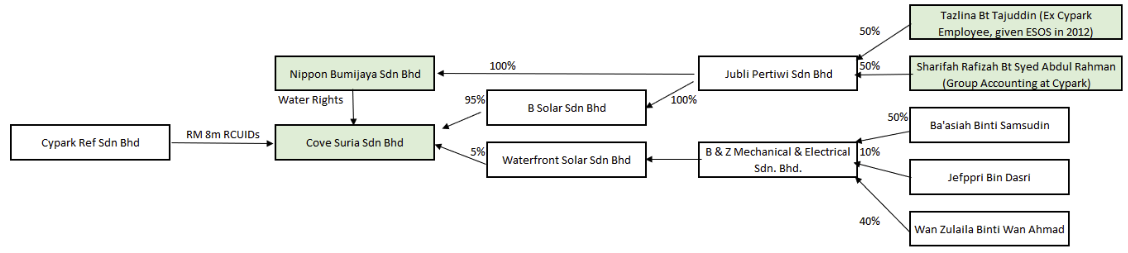

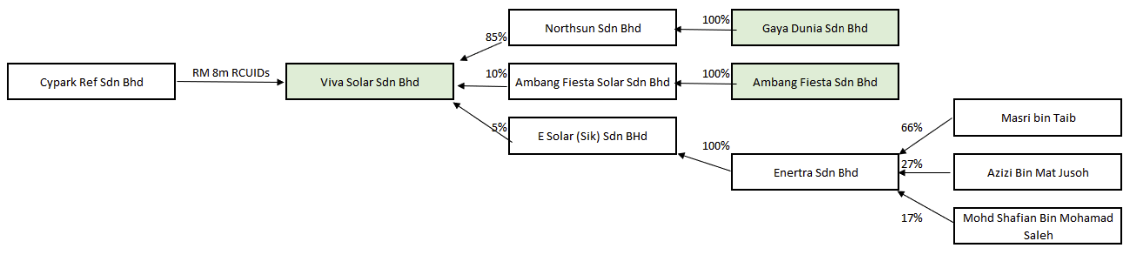

2019 Project Companies Cypark Estuary Solar, Cover Suria and Viva Solar.

We see these details of a similar structure in the 2019 RM550 milllion Sukuk Prospectus, where Cypark Ref Sdn Bhd (“CRSB”) (a wholly owned Subsidiary of CRESB and CRB) is responsible to raise the financing for the following project companies and projects,

- Cypark Estuary Solar Sdn Bhd (“CESSB”) – 30MWac floating powerplant in Empangan Sungai Terip, Negeri Sembilan

- Cover Suria Sdn Bhd (“CSSB”) - 30MWac floating powerplant in Empangan Kelinchi, Negeri Sembilan

- Viva Solar Sdn Bhd (“VSSB”) - 30MWac ground-mounted Power Plant, Sik, Kedah

CRSB does not hold any ordinary shares in these companies, but is to purchase RM8,000,000 in Redeemable Unsecured Islamic Debt Securities (RCUIDS) from all 3 for a total of RM24m.

On the fifth anniversary, RM1,000,000 from the RCUIDS of each company can be converted to ICPS for a total of RM3,000,000, the ICPS is entitled to 95% of the profit from each company.

On the fifth anniversary of the ICPS, they can be converted to ordinary shares up to a cap of 95% of the enlarged share capital of the company.

In addition, looking at the organization charts, there also appear to have serious conflict of interest.

For the case of CESSB, the major shareholders Achmat Nadhrain Bin Haji Ibrahim and Gan Wee Keat are both employees of CRB.

And for the case of CSSB, the major shareholders Tazlina Bt Tajuddin and Siti Rafizah Bt Syed Abdul Rahman are both employees or ex-employees of CRB.

In the case of VSSB, if Gaya Dunia Sdn Bhd and Ambang Fiesta Sdn Bhd are both controlled and consolidated by CRB, why is VSSB which is 95% owned by those two not consolidated into CRB?

The management needs to answer a few questions being:

- Why are current/ex-employees of CRB holding the water rights for their projects, as well as shares in the companies?

- Is there another management service agreements with these three project companies, giving CRB control over the financial and operating policies of these entities and receives substantially all the benefits related to their operations and net assets? If that is the case, shouldn’t it be consolidated now?

- Why are these structures chosen in the first place, versus directly holding shares in the respective companies?

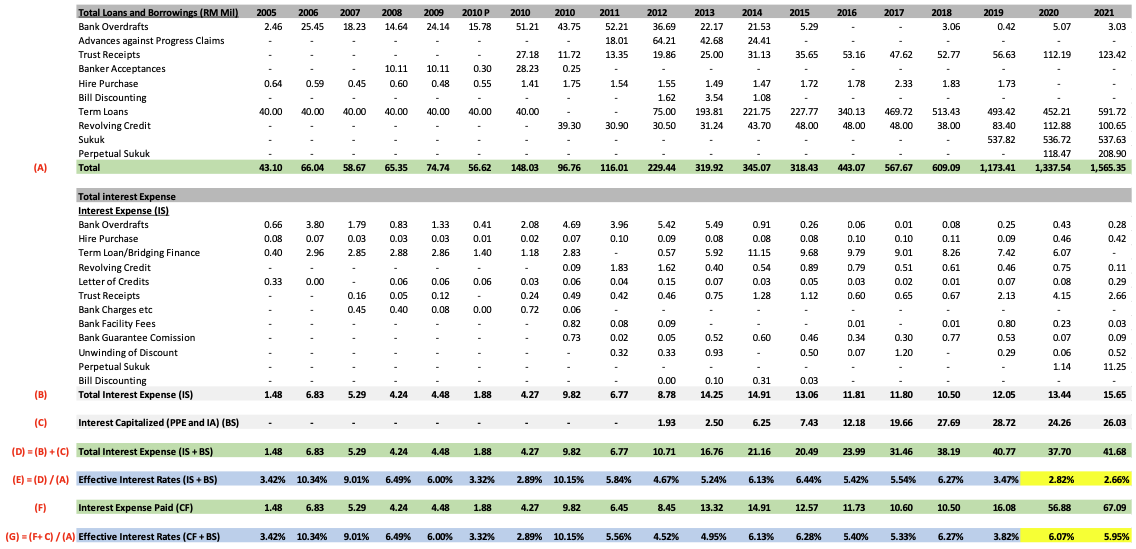

Hide and Seek with Interest Expenses

Directly correlated to these the 2019 Hidden Subsidiaries, are Interest Expenses that mysteriously disappeared from the Income Statement, and was not capitalized in Property Plant and Equipment or Intangible Assets.

As we can see from here, from 2020, there is sudden drop in Interest Expense (P/L) (with the capitalized interest is included) from an average of interest rate of 6% to 2.7%. We consider 2019 an outlier, since a large sum was raised towards the end of the year via the Sukuk, distorting the numbers.

However, from the perspective of the Interest Paid (C/F) (with the capitalized interest is included), it has stayed even at 6%.

Performing a reconciliation, we noted that the following interest was missing from the Profit/Loss

In 2019, 2020 and 2021, additional interest expense (when compared to the Cashflow) amounting to RM4.03m, RM43.43m and RM51.4m is missing.

Well, since 2019, the only change in the company was from the 2019 Sukuk Issuance as well as the existence of the 3 unconsolidated LSS2 Project Companies (where CRB holds 99.999% of the injected capital), and its related Contract Assets.

It appears that since 2019, CRB have been capitalizing the interest related to the construction of assets in the 3 unconsolidated Project Companies, in the “Contract Asset” item of the Balance Sheet.

Here are a few interesting questions,

- If CRB does not own the 3 project companies (despite owning 99.999% of the injected capital), and therefore does not consolidate them. Why is the Interest Cost capitalized? Have you ever seen a construction company capitalize their interest cost when doing construction work for clients?

- If CRB is capitalizing the interest cost, as they see it as constructing their own asset via the 3 hidden subsidiaries (by virtue of owning 99.999% of the injected capital), why are the companies not consolidated?

- If the RM51.4m missing interest cost is properly accounted for, CRB PBT for FY2021 would be reduced by more than 50%.

Cashflows/IRR of 2019 LSS 2 Projects

In 2019, CRB raised a RM550 milllion Sukuk for their won LSS2 projects. Cypark Ref Sdn Bhd (“CRSB”) (a wholly owned Subsidiary of CRESB and CRB) is responsible to raise the financing for the following project companies and projects,

- Cypark Estuary Solar Sdn Bhd (“CESSB”) – 30MWac floating powerplant in Empangan Sungai Terip, Negeri Sembilan

- Cover Suria Sdn Bhd (“CSSB”) - 30MWac floating powerplant in Empangan Kelinchi, Negeri Sembilan

- Viva Solar Sdn Bhd (“VSSB”) - 30MWac ground-mounted Power Plant, Sik, Kedah

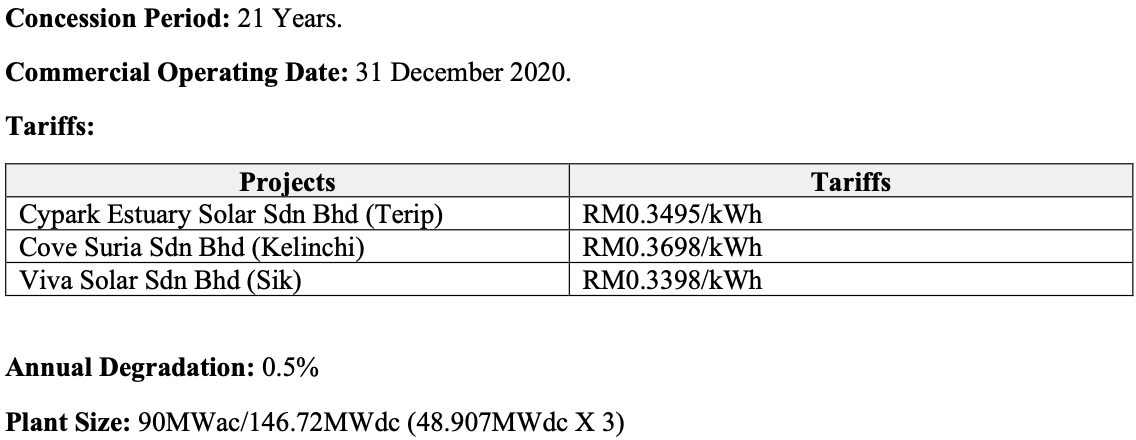

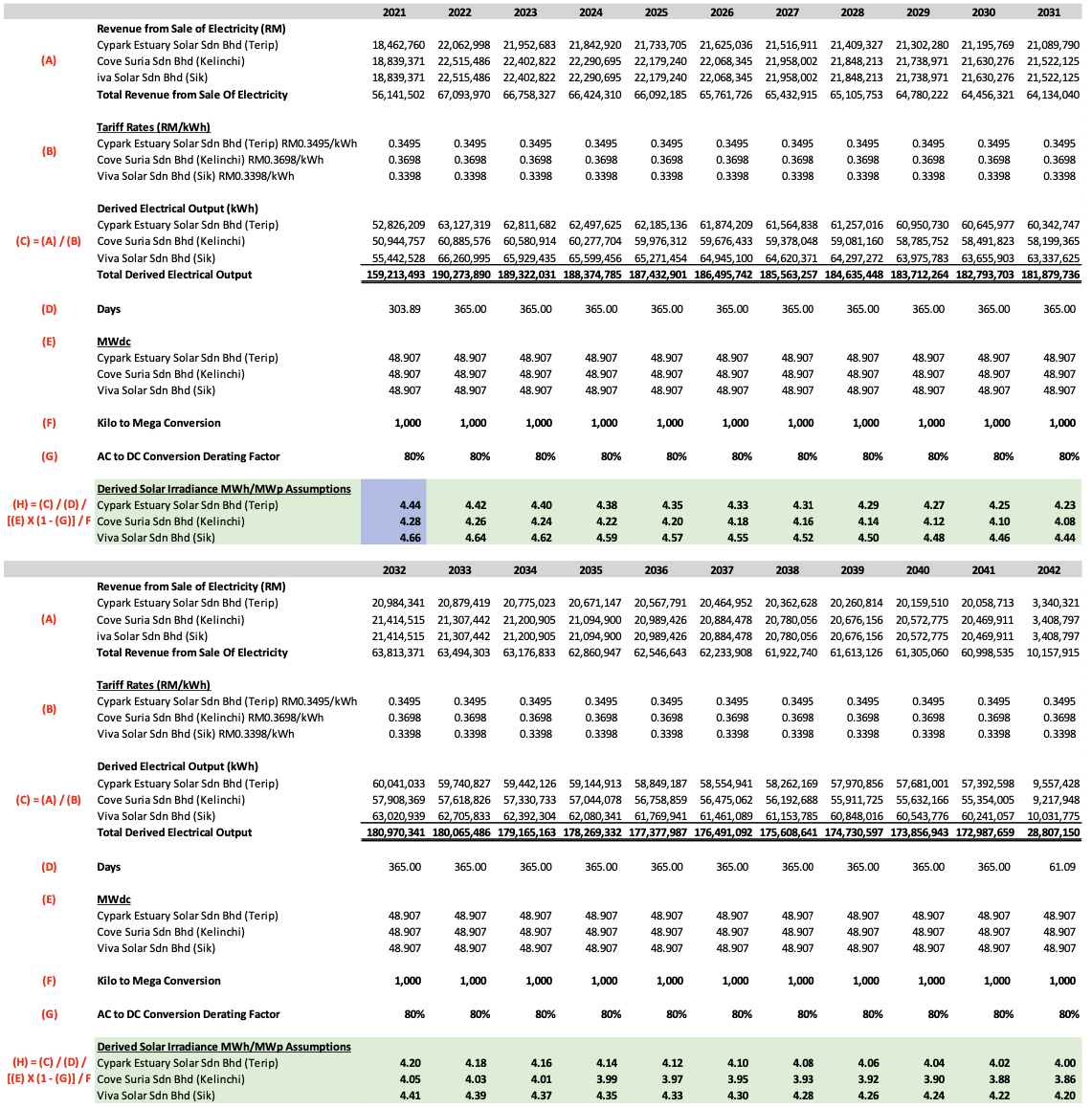

In the Sukuk Prospectus, they provided a copy of their Cashflow Projections, as well as the tariff rates, concession period & etc.

A summary of the key details are as follows.

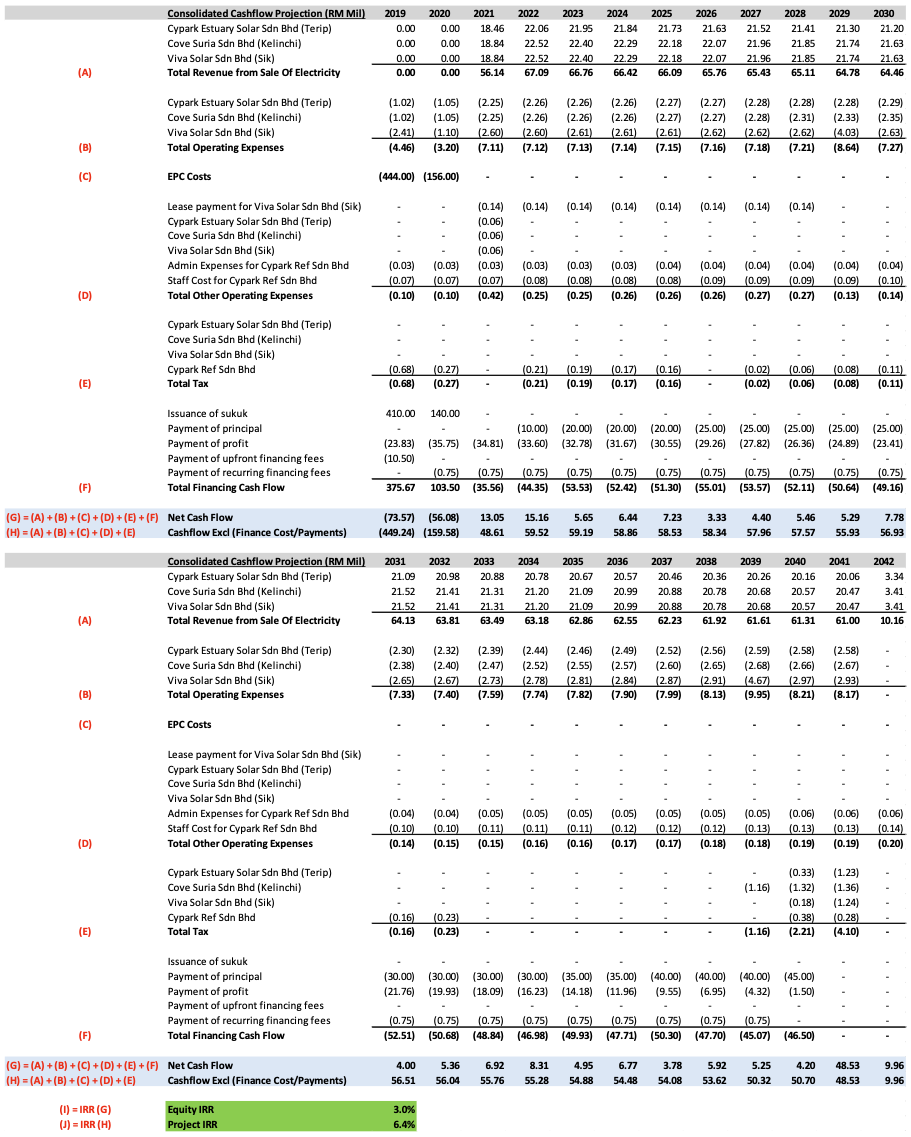

Extracting the relevant numbers and line items, we’ve created a Consolidated Cashflow Projection for all 3 LSS 2 Projects.

When doing calculating the IRR of a Project’s Cashflow Projection, Equity IRR will almost never be less than Project IRR.

When Equity IRR is less than Project IRR, there is only one reason, and that is when your Interest Cost is higher than the Project IRR

How can this be?

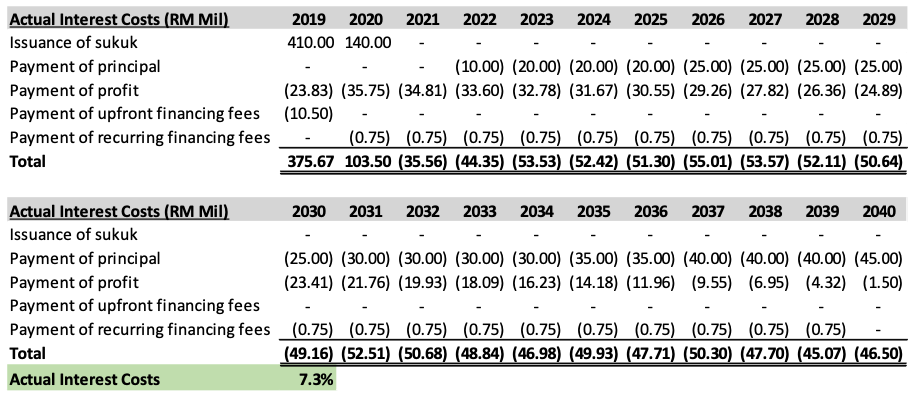

As the interest rate of the Sukuk’s is indicated to be 4.6% to 5.99% per annum, which is below the 6.4% Project IRR.

Well, Sukuk’s bring their own compliance and timing cost.

Including all these, actual interest cost is more like 7.3%. This results in the return for the equity injected being a mere 3%. And this is the best-case scenario.

Excluding the potential O&M Contract post transfer to government in 2040, (not likely to be worth much, its current RM1.2m per year for each solar plant), the management would have literally obtained better returns by putting the money into fixed deposits.

However, this is the best case/management scenario. Are all the currently used assumptions reasonable?

Well, in terms of management cost etc, it’s quite reasonable, the interesting and questionable assumption is the Projected Power Generation Output.

Understanding Solar Power Generation

Using CRB’s LSS2 projects, we will try to provide a summary on how solar power generation is projected.

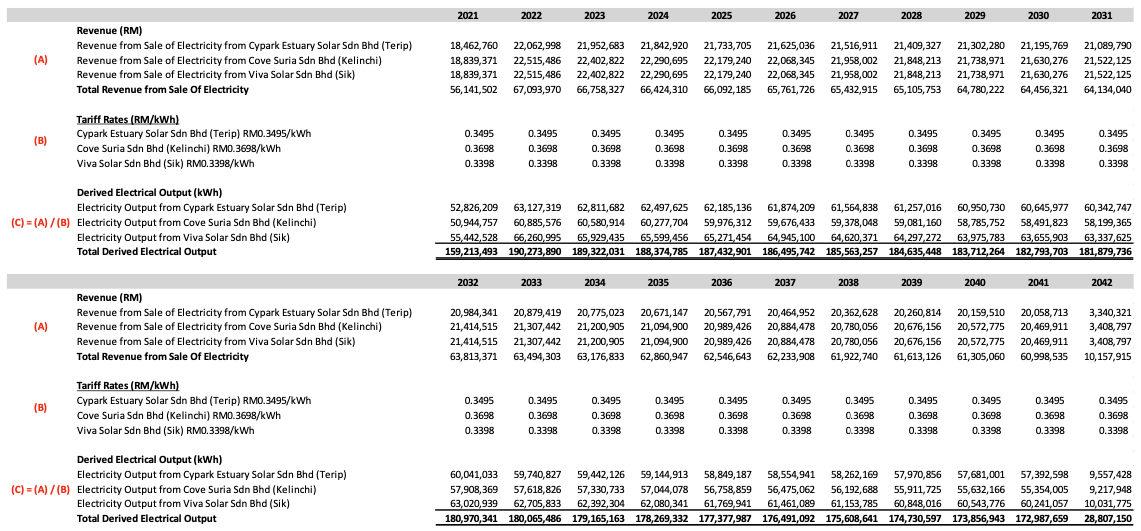

Now based on the projected revenue and the tariff given for each solar plant, we can derive the amount of power management expects to generate each year.

Now, the formula for Electrical Output for Solar Plants is,

Yearly Electrical Output KwH= (“Plant Capacity in MWac”) X (“KW to MW Conversion”) X (“AC to DC Conversion Derating Factor”) X (“KWh/KWp or Solar Irradiance Hours Per Day”) X (“Number of Days in a Year”)

- Plant Capacity in MWac: As per prospectus, 90MWac (30MWac X 3) OR 146.72MWdc (48.907MWdc X 3)

- KW to MW Conversion: 1000KW = 1MW

- DC to AC Conversion Derating Factor: = This DC to AC conversion process usually results in a loss of around 20%。However, as you can see here, given a 20% loss, 146.72MWdc of power generated should equal 117.376MWac, however, the amount of energy sold is only 90MWac. This is likely because the management is providing a buffer, as the contract would likely include a clause stating that TNB could buy somewhere around an additional 6-7% of output.

- Number of Days in Year: It’s a 21-year contract, for the first year Commercial Operational Date (“COD”) is expected to be 31 December 2020. As the year end is October 2021, there will only be 10 months in the First Year. And on Year 22, there will be 2 months, resulting in the total of 21 years.

- “KWh/KWp or Solar Irradiance Hours Per Day”: Out of all the assumptions, this is the one which is most subject to management judgement. Now what is this?

On average, the radiation we get from the sun right before it enters our atmosphere is 1367 W/m2 with a range of ±3% more or less. We receive around 1000 W/m2 every hour on the surface of the earth, based on standard testing conditions (STC), which is defined as 25 Celcius, at noon 12pm, on a cloudless day, with Air Mass of 1.5m.

Now, when you install a solar panel of say 1 kWp, that panel will be able to provide 1 kWp (Watt Peak) per hour if the sun is shining at its maximum intensity or under STC. Obviously, STC does not exist every hour of the day in every site location. Conditions are different depending on site location and the meteorological data.

Therefore, management will refer to the site location and meteorological data, and say that, based on the above information, using these panels, i can generate 5kWh per day on average. Or 5 kWh/kWp. This means, in a 24-hour daily cycle, they can obtain energy equivalent to 5 hours of Peak Energy.

Inputting the above, we obtain the following.

As we can see from here, management assumed an initial MWh/MWp of

Is this reasonable?

Well, referring to Solargis Photovoltaic Electricity Potential Map,

Let’s just say they are likely being more optimistic than they should.

In addition, due to the Covid Pandemic, COD have been deferred from 30 December 2020 to an unknown date. TNB may have been very kind to not charge the Liquidated Delay Damages of RM15,000 per day, but the interest on the Sukuk marches on. (Interest never sleep)

Thankfully, the solar plant located in Sik, Kedah have been completed on 1 Jan 2022, as announced on 3 Jan 2022.

Therefore, the Cashflow Projections need to be further adjusted for both the delay and a normalized Solar Irradiance. We’ve used the following assumptions for the “Base” “Best” “Worst” case.

As we can see, adjusting for the delays and the overly optimistic estimate of Solar Irradiance, its linked directly to revenue, this has affected the Cashflow Projections the most.

The adjustments have turned LSS 2 from what looks like a bad investment to a disastrous one. Furthermore, the other 2 floating solar farm remains uncompleted as at 1 June 2022. (Don’t forget interest never sleeps.)

2020 LSS3 Projects

If you thought the LSS2 Projects were bad, here is a taste of their “Winning” bid of the LSS3 project

Like the LSS2 Project, it too has been delayed. It was supposed to be completed by end 2021, however today, there is no news regarding completion, other than FY2022.

Compared to the LSS2 project, whose Project IRR is below the Actual Interest Cost, the Merchang, Terrenganu LSS3 project has tariff rates of almost 32% lower at RM0.2300.

What will the Project IRR be? Can it even reach 3%?

And LSS3 solar plant is going to be built in a period of rampant inflation when material/construction cost for solar plants is up by a minimum of 20% to 30%.

The Non-Existence of Free Cashflow and the Fundraising of CRB

Since its listing in 2010, in the subsequent 13 years, CRB have only twice recorded a positive Free Cashflow.

Overall, it has recorded a total of negative RM1.332 billion in free cashflow.

Since 2010, this deficit has been funded by both an increase in borrowings, and Fund Raising by Cypark, with the most recent fund raising in 2021.

We expect this trend to continue, given their legacy and current loss-making contracts (except the losses are not yet recognized)

Conclusion & Question to the Auditors

As auditors of the financial statements, Mr Ng Zu Wei from Baker Tilly Monteiro Heng PLT is responsible for ensuring that the financial statements are true and fair. In which case we would like to ask a few questions.

- During an audit, one of the Key Audit Matters for companies with large Intangible Assets, is the Impairment Assessment for Intangible Assets.

We would like to know, how the WTE Project, which is 5-years behind schedule, and costing 3 times over the original budget, and having lost 5 years of its concession life for nothing (as of 2021 only 20 years of concession life is left) have no impairments to its intangible assets?

While IFRIC 12 (Service Concession Asset) allows the concessionaire to book the fair value of the intangible asset and corresponding construction revenue and profit during construction period, it is the auditor responsibility to question if there is truly any profit to be booked once cost overrun is obvious and project is massively delayed (by 5 years).

Did the auditors properly question the management’s assumptions on their projections? - When constructing assets for a third party, interest cost is always expensed out by the construction company.

If CESSB, CSSB and VSSB the holders of the LSS2 Projects being constructed by CRB are third parties, why is the interest expense being capitalized in Contract Assets? - If CRB is investing more than RM24,000,000 into the 3 project companies, with other “Third Parties” (Who primarily consist of current and former CRB employees) shareholders contributing less than RM165 in total, who is in essence the actual owner and operator of the project?

Is CRB constructing their own LSS2 assets or a third party’s LSS2 assets? - According to management, the RM 844.68m worth of contract assets primarily consist of the 3 LSS2 projects, which was budgeted at RM550m.

How much has the actual cost of LSS2 exceed its budget? Is there any impairment necessary? A simple cash flow projection based on data from the sukuk document will show that the project return is unlikely to cover its cost of debt.

Or does the management plan to impair the assets in the 3 Project Companies, before signing management service agreements with these companies, giving control over the financial and operating policies of these entities and receives substantially all the benefits related to their operations and net assets.

Therefore, conveniently consolidating these companies at Net Book Value, masking hiding the impairments within an increase in Property Plant and Equipment, with a corresponding decrease in Trade Receivables, and increase in Borrowings?

In summary, we found that Cypark behaves like a financial scheme which allows its management to treat both the debt and equity markets like an ATM over the years. All its major projects experience significant delayed and excessive cost overrun. Even if it manages to complete these projects based on the recently announced timeline (again), it is unlikely to generate sufficient cash flow to service its massive debt obligations (RM1.5bn) and borrowing cost.

It is akin to a ticking time bomb as eventually, the cost of servicing its debt interest and principals will no longer be able to be funded through new debt or equity fund raising.

Sadly, if the auditor had stood up to it when the project delay and cost overrun became obvious years ago, this snowball wouldn’t get to this large and the eventual damage to the capital market could be more manageable.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Cypark Questions

Created by Meatbone | Jul 26, 2022

Discussions

sslee wants to be activist...then can also do investigative reporting like this piece.

2023-01-07 10:35

sslee, forget HY...........nothing in HY................. u lose money in hy is your own mistake, nothing to do with the company.

2023-01-07 10:36

this are a lot of stuffs in this article.

in Malaysia, a lot of companies are listed and share prices are supported by left hand right hand profits from epcc work on their own projects/ fixed assets ...................... who to blame? surely the authorities is part of the problem.

2023-01-07 10:42

the authorities have not been doing their job, the minority shareholders watch dog ngo have not been doing their job, the media have not bee doing their job. Its a gray area and nobody wants to touch it

2023-01-07 10:45

all these epcc profits on own assets is fertile ground for share price manipulation.

causing a lot of problems to minority share holders and members of the public ....so when will the authorities look into it?

2023-01-07 10:50

this practise started way back many years ago with the North South Highway project. ...and Plus wanted/ needed to show profits from the word go.

2023-01-07 10:52

the analysts, the reporters, the main stream media are part of the problem because nobody wants to spoil the dinner.

2023-01-07 10:54

and this problem is not just with cypark................................................its widely practised in malaysia

2023-01-07 10:56

personally, I don't see a solution.............the authorities , the issuing house, the KlSE, the SC , the auditors are all invested into the scam already .

2023-01-07 11:01

if the unity government is serious about protecting investors, protecting minority share holders, protecting the small people.......................................... then the authorities need to offer better guidelines to this practise ...and this is a wide spread practise in Malaysia not just limited to cypark.

2023-01-07 11:13

when there are loopholes in the guidelines/ laws, people will exploit it, and what better way to generate profits than left hand right hand profits ? there is no willing buyer willing sellers basis .......the buyer and seller is the same party and just want to show big profits from the word Go. ................................................ it is fertile ground for cheating, for frauds, for profits manipulation and share market manipulations.

2023-01-07 11:23

SEE Research recommended kgb wb to Eagle Group

Yesterday one Eagle Group cutloss kgb wb and suffered a loss of 50%

Fortunately his good dividends from bplant, hs plant, Tsh, Taann, Fgv, jtiasa cushioned his losses from following SEE Research buy the rubbish overvalued kgb wb

SEE Research was banned by Eagle group admin Ms Wendy for misbehavior

Last week 2 directors of Revenue were banned for wrong doings

They brought 4 thugs and barged in to steal 30 boxes of documents by criminal force

This SEE Research acts like cyber thug bull doze his way everywhere and cry father cry mother after being banned for wrong doings

2023-01-07 11:27

SEE Research recommended kgb wb to Eagle Group

Yesterday one Eagle Group cutloss kgb wb and suffered a loss of 50%

Fortunately his good dividends from bplant, hs plant, Tsh, Taann, Fgv, jtiasa cushioned his losses from following SEE Research buy the rubbish overvalued kgb wb

SEE Research was banned by Eagle group admin Ms Wendy for misbehavior

Last week 2 directors of Revenue were banned for wrong doings

They brought 4 thugs and barged in to steal 30 boxes of documents by criminal force

This SEE Research acts like cyber thug bull doze his way everywhere and cry father cry mother after being banned for wrong doings

2023-01-07 11:27

SEE Research recommended kgb wb to Eagle Group

Yesterday one Eagle Group cutloss kgb wb and suffered a loss of 50%

Fortunately his good dividends from bplant, hs plant, Tsh, Taann, Fgv, jtiasa cushioned his losses from following SEE Research buy the rubbish overvalued kgb wb

SEE Research was banned by Eagle group admin Ms Wendy for misbehavior

Last week 2 directors of Revenue were banned for wrong doings

They brought 4 thugs and barged in to steal 30 boxes of documents by criminal force

This SEE Research acts like cyber thug bull doze his way everywhere and cry father cry mother after being banned for wrong doings

2023-01-07 11:27

whether it is building a house, a road or an IPP, the proper way to prepare the accounts is to show profits only when there is real third party transactions in rental income , sales, tolls, electricity tariffs.......................... but in stock market in malaysia, profits can be generated from the word Go and while the asset is still being build. .............. and this is the guidelines/ laws of Malaysia now.

2023-01-07 11:36

calvin tan................I am a trader.................good ,bad ugly also I can trade............................I trade to make money not for any other purpose.

2023-01-07 11:40

as for cypark................I got cypark at 53 sen, sold yesterday at 65..............I am a trader, what to expect?

2023-01-07 11:44

calvin..................................................this i3 is a very funny place.........everyone here is a trader.................why look down on traders? u think your plantations did well meh? u think buy and hold plantations in 2022 did well meh?

2023-01-07 11:51

my basis of buying cypark is very simple. jakel is a very big name in Malaysia.

my basis of selling is equally simple.................. I expect there will be a draw back

2023-01-07 11:55

"brightsmart

my basis of buying cypark is very simple. jakel is a very big name in Malaysia."

=============================

ROFLMAO!!

Really? JAKEL just got burned down in Shah Alam.

Definitely, "got prawn behind a stone" :-D

2023-01-07 12:16

Went to take a brief look at Cypark balance sheet

it shows a huge debt of Rm1.4 billions and cash only Rm180 mil

profit is dismal and no wonder Cypark did not pay any dividend for last 3 years

new entrant could just joined to do a fast goreng as textile business now bad due to recession in spending on consumer discretionary

better don't chase

2023-01-07 12:20

Dicky...u not good enough to profit from cypark means u are not a good trader or u don't know how big is jakel in Malaysia

2023-01-07 12:38

Calvin.... didn't cut loss on your plantations means u are a lousy trader/investor......that is all that is needed to know

2023-01-07 12:43

Hahaha

I bought Bplant at 57 sen ahd it gave 16% dividend for last 2 years plus price has gone up to 65 sen

No need to sell like your sendai at Rm1.60 gave no dividend plus price also. Collapsed

2023-01-07 12:46

This piece which took many hours to write is about epcc profits and associated risks.....not about Calvin and not about plantations.

2023-01-07 14:50

Sslee...whoever wrote this is good work and love.....u want to be activist then do investigative research like this la.

2023-01-07 14:52

Activism does not mean go and get laymen to listen to CEO bull.shit / sweet talk about their companies.

2023-01-07 14:56

AGM is design specifically for CEO to bull.shit / sweet talk about his company...want to attend AGM, better for laymen to attend AGM of good quality companies not AGM of doubtful quality companies.

2023-01-07 15:00

SEE Research ?

This one banned by Eagle Group Admin Ms Wendy Low after 5'eagle group members complained about his misbehavior

Just like 2 Directors of Revenue were sacked and they came back with 4' thugs to force take 30 boxes of company documents in criminal trespassing

After being banned for wrong doings he howling and cry father cry mother and still want to bull doze his way

Fyi

Eagle group has 282 member strong now and out of harm from SEE Research

All sane people please stay safe

2023-01-07 19:46

Talk is no use

Our friend Vijay in Eagle Group also led astray by SEE Research to buy KGB Wb at very high price

SEE Research promoted that KGB Wb will go above Rm2.00 but sly like a fox sold without telling others

Yesterday Vijay cutloss in KGB Wb by a huge loss of 50% all due to SEE Research recommenfation

This is the truth

All from Eagle group can view

And Eagle group now got 282 members

At first some Eagle Group members followed SEE Research

But the truth finally prevails and their eyes opened to see the vicdictive spirit of this man of horror - totally no self control

2023-01-07 22:20

People spend long time write article at least give praise and comment on article la

2023-01-08 11:39

Sadly, if the auditor had stood up to it when the project delay and cost overrun became obvious years ago, this snowball wouldn’t get to this large and the eventual damage to the capital market could be more manageable

------

Auditor, especially those outside the big 4 not doing their job

2023-01-08 12:03

But it is not just auditor at fault....this practise is very common in Malaysia because the money and hence incentive to cheat is too large in an environment that is conducive to cheating

2023-01-08 12:08

brightsmart

sslee wants to be activist.......................then sslee should take up this case.

2023-01-07 10:34