PPB - Entering accumulation zone but should you accumulate?

DividendGuy67

Publish date: Sat, 25 May 2024, 10:26 PM

PPB is a quality business, and a clear large cap stock. Kuok Brothers own majority shares (51%). However, over the past 5 years, pessimism on this stock has grown, as price trades below 2019 price peak just shy of RM20 round number resistance.

- To recap, its performance was superb during 2000-2010, returning 10 baggers or more to its investors then.

- Subsequently, from 2010-2019, growth slowed down but still decent up to around 2019.

- However, the past 5 years, it appears to have entered into a new pessimistic phase. After a great 2022 year, in 2023, EPS had a big drop, revenues dropped, pessimism rose, which is why the stock enters a possible accumulation zone (RM14-15).

The question is should we buy? Let's review its business quality, fundamentals and technicals again.

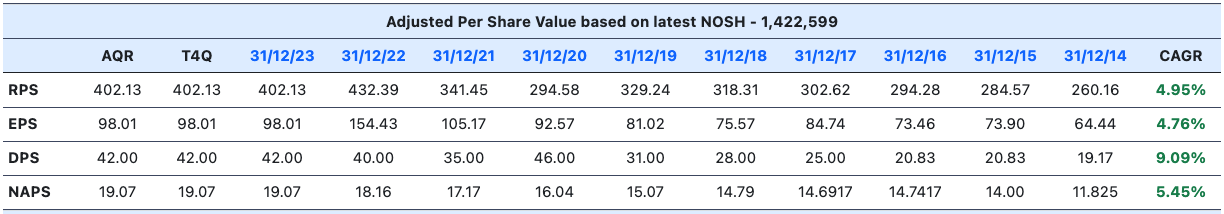

Past 10 Years Performance Metrics - B

- RPS - steady growth from 2014-2019, dipped in 2020, explosive growth in 2022, fell back in 2023.

- EPS - Big earnings drop from 2022 peak.

- DPS - fast growth, however, is also due to higher dividend payout ratio. Still minority payout, but management is signalling that this company may be leaving behind it's rapid growth phase, to return more to shareholders.

- NAPS growth has slowed down a lot since 2015. Easy to say its huge growth days are "over" and easy to be pessimistic. Management has not done a bad job.

Business Quality (B-/C+)

- (B-) Grains and agribusiness, consumer products - these 2 segments I like. The former is the key profitability engine and I like both over the long term.

- (C-) Film exhibition and distribution - GSC dominant in Malaysia and smaller in Vietnam. Unfortunately, 2023 is still loss making (it was profitable in 2019 pre-Covid). I am lukewarm because the trend has changed post-pandemic, where some of its share has been taken away permanently by online-streaming - online streaming is now here to stay and grow.

- (C+) Property - small.

Price Chart since 2010

Key chart observations:

- Still uptrend channel despite slower growth since 2010.

- Strong downtrend line resistance since 2019 in line with slower performance.

- Likely to stay inside the triangle (formed from blue downtrend line and rising channel line), maybe over next 1-3 years (?).

What is the play? / Why buy?

5 possible reasons:

- This is not a quick win, but a slow and steady approach that is more suitable for wealth accumulation than speculative wins.

- Additional diversification to my highly diversified portfolio - the big question though is - is this (14.88) the right time to enter yet?

- Dividends - current dividend yield is 2.8% (42 sen / 14.88 price) which is below FD rate for now, but if it maintains say 6-8% DPS growth, the dividend yield on cost could double to 5.6% in 9-12 years and double again thereafter. Not bad, but not ultra compelling yet. I think I need at least RM14 for first entry to get 3% dividend yield.

- Price gains - this appeals a bit more - if price goes a bit lower (to improve dividend yield) and if we get closer to the cross over point (which could be 2025-27), there is a good chance for explosive move to the upside past RM21 over the following 5 years or so.

- Growing dividends - this is the most interesting part for me. I want to own more of this type of stocks, to provide us with a rising annuity income that is inflation linked, to provide regular, automatically growing, passive income for our future retirement.

Yes, with its grains, agribusiness, consumer products, this is another potential Warren Buffett stock where we can consider Buy and Hold where the favorite holding period is "forever" (unless it exceeded the top of that rising channel).

Target Position Size?

A good quality business like this is unlikely to go down as low as RM10, but if it did, I would load up a full 5% capital.

I like its management. I can visualize its grains, agribusiness, consumer products earnings to be larger than now in 5, 10, 20 years time for sure.

I'm now waiting for an attractive price.

At this juncture, I'm still mulling at which price point to load up to 3% capital. I have no position yet, but stalking.

It's no big deal if miss, but it's in my wish list.

I will be persuaded by the attractiveness of the entry price.

Disclaimer: As usual, you are fully responsible for your own trading and investment decisions.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|