GENM - queue to buy at 2.50

DividendGuy67

Publish date: Wed, 12 Jun 2024, 02:39 AM

I think GENM is approaching accumulation zone, and I am queueing at 2.5 with a GTC Limit Buy order.

My investment goal is a modest one - target total returns equal 9% per annum, where:

- 6% comes from dividend yield (= 15 sen dividend / RM2.5 entry price)

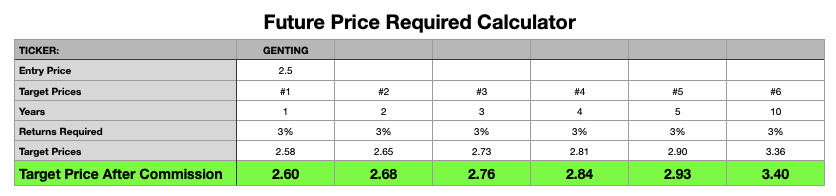

- 3% price gains coming from table below. For GENM to hit say 2.76 in 3 years time is not a high barrier and will deliver 3% per annum price gain. More likely to exceed.

Chart below is self-explanatory - don't know exactly when but some time during 2025-26, something may happen. As the stock has a long term uptrend, I am guessing the bias is on the upside, although no guarantees. My conviction is so-so i.e. average i.e. average position sizing. In a 40 dividend stock portfolio, neutral will be 2.5%, and can split into 2-3 parcels - no need to be greedy. Trend lines can sometimes be broken, hence, don't over-bet if you want to position your portfolio to make new all time highs.

I am content with 9% per annum total return target - no need to be greedy. 6% per annum income means if price goes down, because of small position size, we have many options such as do nothing (and collect dividends), or consider doing a 2nd buy trade when price fall has stabilized, as it is impossible to imagine GENM to go bust, being the only casino in the country.

Disclaimer: As always, you are solely responsible for your own investing and trading decisions.

PS. I already own GENM - when it rise to 2.9, I sold a significant size as I felt it was still in a consolidation zone. So, my buy back at 2.5 is to buy back what I previously sold partially.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on https://dividendguy67.blogspot.com

Discussions

It might go to 2.40 . Genm has Hugh borrowing. At the moment, interest charges are quite high. Wait for us to reduce interest

2024-06-12 20:39

@speakup, lol. I wish. Mr Market has proven me wrong so many times, I completely lost count, and I will continue to be wrong many, many more times in future.

For GENM, I also wish 15 sen dividend is guaranteed, but we both know this is never guaranteed too. I sincerely hope people diversify and not be greedy, so that if there's a dividend cut one day downstream, they won't be too disappointed, and if there is a dividend increase in the future they won't be too euphoric too.

Cheers!

2024-06-13 21:56

DividendGuy67

PS. Technical analysts who draw trend lines know that there is a common observation that differentiates the strength of trend lines. Basically, there's this simple rule of thumb that says that if the trend line is drawn over a longer period vs a shorter period, then, the longer period trend line is stronger.

So, the bottom trend line spans nearly 28 years. This one must respect.

The top trend line spans a much shorter period. All things equal, it is weaker.

This is why instinctively, I say that when it comes to 2025-26, the bias is tilted towards upside, say 80/20 chance.

Now that I think about it, it's because the trend line patterns that I draw is a common one that I've seen before many times in the past.

Anyway, nobody knows the future, so, don't bet the farm. Just sharing some common TA observations.

2024-06-12 03:11