DividendGuy67

Publish date: Sun, 01 Dec 2024, 06:19 PM

Introduction

As the 2nd largest economy in the world, China deserves watching especially with Trump assuming the Presidency next month, his strong views about China and tariffs, the potential conflict with the largest economy in the world. In Bursa, you can get exposure to China stocks in a variety of ways.

As I currently trade US options, my "go to" instrument to express a single view on China is FXI. It is highly simplified of course, as FXI is an ETF holding the largest 50 Chinese stocks that is listed in the HKSE, and so is not complete but it is "good enough" normally for me. FXI is the unleveraged version. The leveraged 3X version is YINN but being 3X, it is subject to volatility decay.

Background of FXI

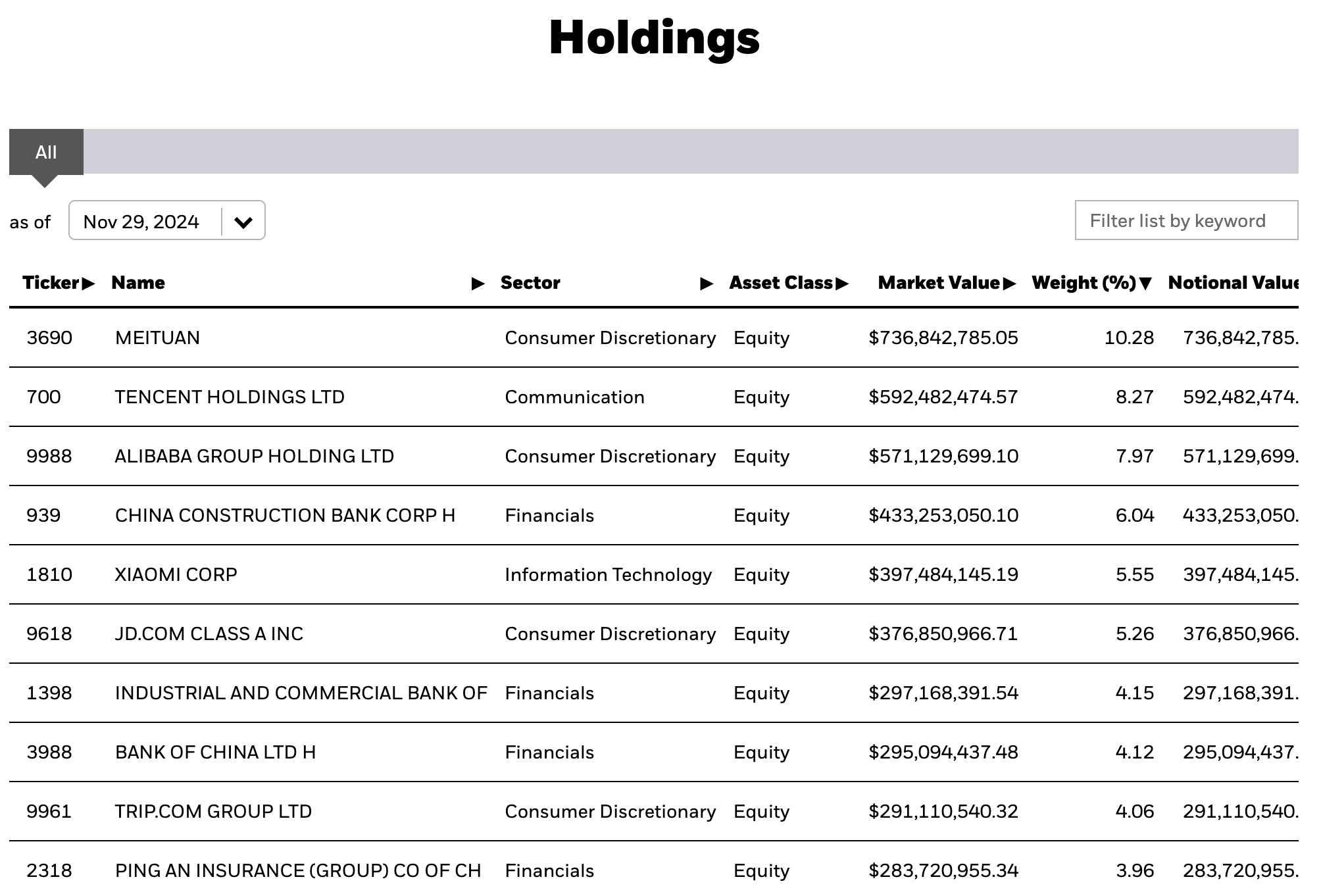

Top holdings are famous names like Meituan, Tencent, Alibaba, CCB, Xiaomi, JD.com, ICBC, BOC, Trip, Ping An ... if you own FXI, you are owning very decent companies in the world.

Charts

Starting with Monthly charts, we see that during 2004 to 2007, FXI went through a massive bull run with super gains, but after that peak in 2007, it went through a 17 years of massive sideways consolidation, that can be roughly split into 2 halves - say between $20-$30 and between $30-$50. What I am excited about is that since Mar 2022 up to recently it spend 2.5 years at the bottom half and just recently broke above into the top half ...

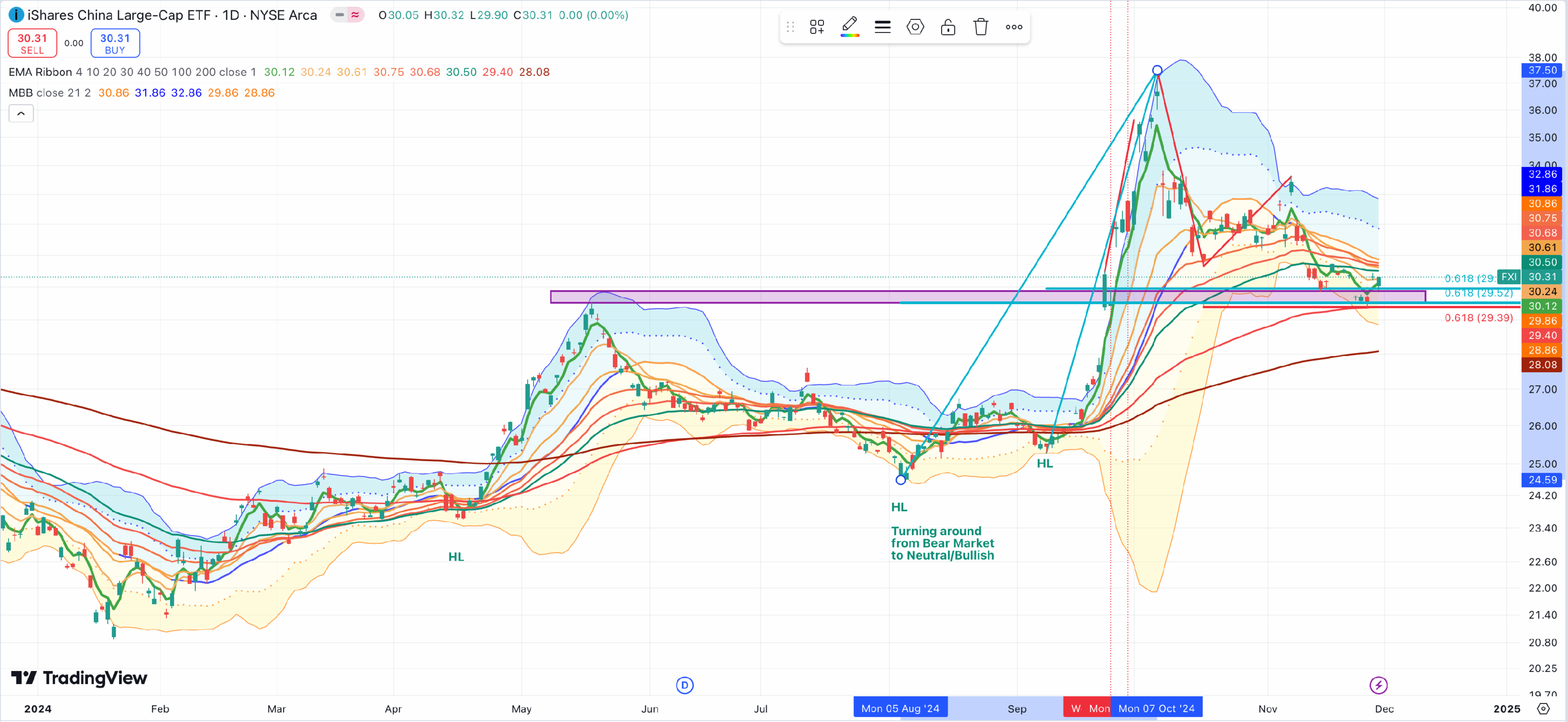

Using Daily Candles:

Key observations:

- Based on Price action alone, I first drew the purple box.

- Later, I overlay with 3 Fibonacci levels - the 61.8% retracement off the first turquoise line, the 61.8% retracement off the 2nd turquoise line and the 61.8% Fibonacci extension off the red lines. These 3 Fibonacci levels are important levels because the 61.8% is like the Golden Parameter amongst Fibonacci traders. It coincided very well with the Purple box price action.

- The key thing for me is that the past 2 days, it has broken above the Purple box. Additionally, it spent only 3 days inside the purple box. It's almost like a "mini" inverted Head and Shoulders, traditionally a potential bullish signal. The only problem with this signal is that it is rather short period, weakening its signal. In the context of longer term trades, this few days signals are potential "noises", but all big trends starts with noises.

Where the long thesis might go wrong

As traders, we also visit reasons why our long thesis might go wrong. I see many reasons:

- Divergent news. Recently, Trump announced a rather "good" news that he only planned to impose China tariffs of just 10%, instead of 60% threatened. By right, markets should rally but the rally is rather muted. Perhaps market remain distrustful of Trump until he assumed Presidency. Additionally, Xi has not responded.

- Trump is really unpredictable - it is a coin toss, whether he will actually do what he says.

- China's domestic situation is serious - it won't go away instantly.

- The Chinese government initiatives are generally perceived as "not enough". But Xi is unlikely to commit until Trump shows his hands clearer perhaps next year - so, any moves might not be so soon.

- US markets are over-valued ... yes, my base case is for this over-valuation to continue to be even more over-valued with S&P500 already breaking out above 6,000 as I had expected months ago and I won't be surprised if mid 2025 turns out to be another record breaking first half. In my book, any dips in January and February 2025 is buyable. However, beyond H1/25, it is hazy and the longer it takes for the Chinese economy to improve, theoretically the greater the odds of US stock market peaking ... unlikely yet, but anything is possible in markets.

- CNBC is another of my "go to" news for China news and it's been rather quiet ...

- And all the other possible reasons ...

Notwitstanding, it doesn't completely negate the thesis, but just brings it down a notch - which is why for me, the grading is average (see below).

My Trading Plans

Besides the above considerations, my personal trade grade system is a bit uncommon and non-intuitive in the sense that I need more price action to confirm. For now, I feel this is just a Grade C long idea. However, if the trade confirms, depending on what it does, it can turn into Grade B idea at higher prices.

To novices, this is counter-intuitive but traders often prefers to see the right kind of price actions to commit further capital. One example of such price action is the usual one where if after rising, it then dips to a "higher low" at logical places, with the right volume and price action, the trade grade can turn from C to B, even though C was at a lower price than B.

As I think it is C-grade today (and acknowledging it can turn into B-grade later), it passes the long trade, and deserves say 0.5%-1% of my capital. So, when US market opens tomorrow, I plan to take a position in FXI. Likely it's going to be a "safe" trade with small chance of losing significantly and higher chances of winning over the next 2-3 months depending ... and then maybe longer period.

Note - if it breaks below and closed convincingly below the 23.39 red line, the long idea is invalidated and it is not impossible for FXI to go lower when lower price might not necessarily mean "buy more" until it hits a logical support level. Usually, below this key support level of 23.39, the best thing to do for stock traders is either do nothing, or get smaller, until it hits the next logical support level below when it may then be time to add back what was reduced .... It is not advisable to average down blindly when an instrument is downtrending, because you will just dig a bigger hole unnecessarily.

Summary and Conclusion

After 17 years of sideways consolidation, and the breakout to the upper half recently, I am excited.

I plan to risk 0.5%-1% of capital in this trade, as my US portfolio is currently "fully invested" (according to my complex "risk limits") however, as this is China, I am willing to make a small exception here.

Documenting the charts and comments for future reference.

Disclaimer: As usual, you are fully responsible for your own trading and investing decisions.

Disclaimer 2: As I am an Options trader seeking leverage, Options are highly dangerous instruments where the possibility of losing the entire risk capital is real and not small. Therefore it is not recommended and the first disclaimer applies.

hotsauce1924

nice, 8% of my portfolio is invested in chinese stocks via 2 HKEX Etfs, tracker fund of hk (2800) and ishares china A50 (2823). the former is for "offshore chinese stock exposure" like tencent baidu alibaba etc, while the latter is for "onshore" mainland only china bluechips. Did not sell at all during the september runup, which I think was a mistake as I lost a chance to take a 30% profit, but am long for a time horizon that is years out.

6 hours ago