Trump Won!

DividendGuy67

Publish date: Thu, 07 Nov 2024, 02:16 AM

(.... and my portfolio made new all time high again today! Thank-you Mr Market! ...)

Background

I am a firm believer we must seek Bullish Markets, if we wants to have our portfolio to keep making new all time highs.

A few months ago, I felt the Bursa bull was getting tired. I blogged that I am cleaning up my MY portfolio, take some profits off the table, move some funds to the US to diversify and try to pursue greener pastures.

Fortunately, the Ringgit strengthened at the time. It was perfect timing, to start changing MYR to USD, even when everyone was bullish on MYR. I quietly did a series of DCI (Dual Currency Investment), and managed to convert a solid 5 digit USD at around 4.155.

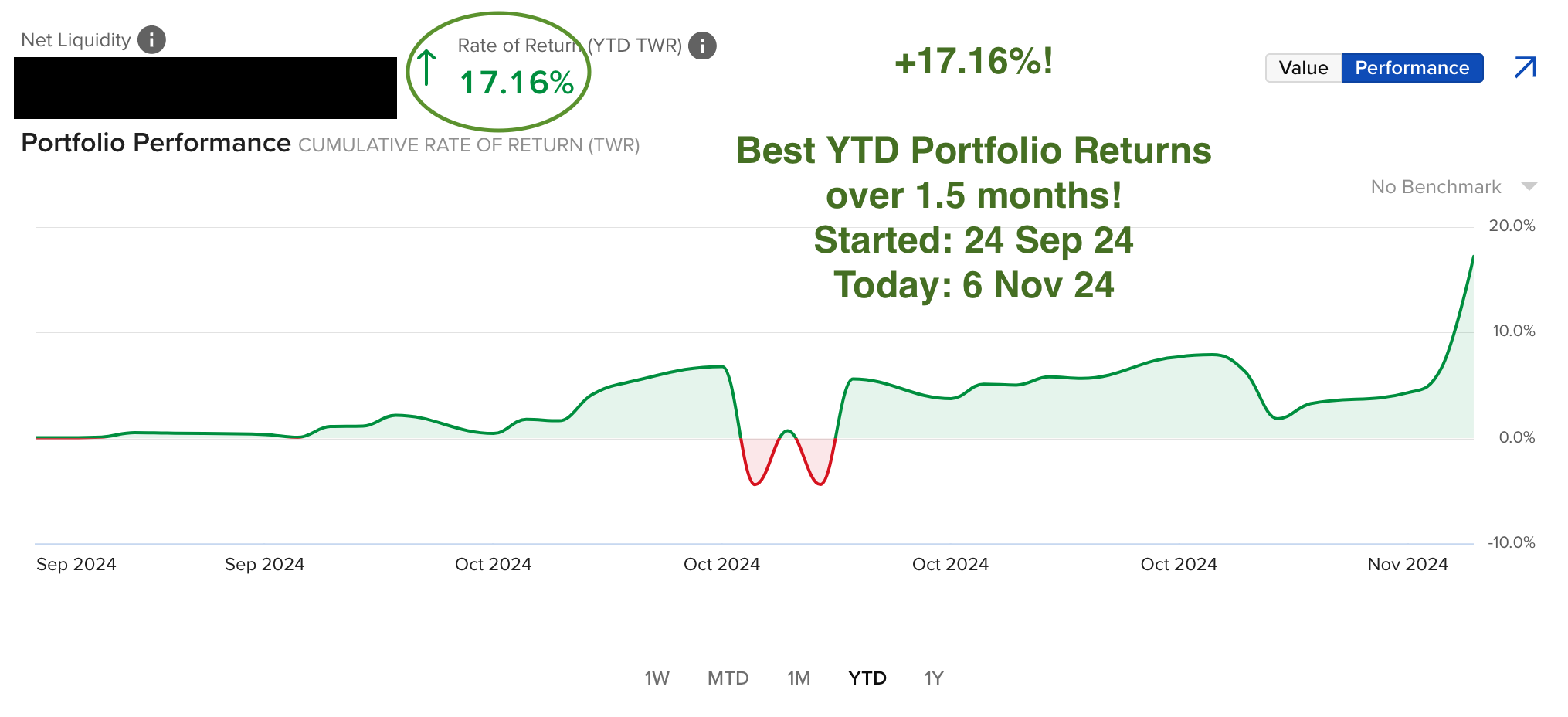

So, by 23 September 2024, my US Interactive Brokers account was finally opened. I had obtained all the necessary permissions to trade Options. I finally put on my first trade on 24 Sep 2024. Over the next 1.5 months, I funded the account 5 times.

My US Portfolio Objective: + 15% per annum

If you follow my articles, you'll know I am not a fan of chasing returns. My Bursa objective was only a modest 9% p.a., a bar low enough for me to beat without being overly aggressive.

However, as the US portfolio was new, I needed an objective. As I was planning to trade Options to supplement, the goal should be higher than 9% p.a. In the end, +15% p.a. looks like a realistic bar without having to chase, given my nearly 2 decade experience with Options (Disclaimer: Options are highly leveraged instrument which can cause permanent loss of capital).

The Trump Trade Setup and Result today

The timing was really fortuitious. After (1) Bursa lagging returns, followed by (2) strengthening Ringgit, followed by (3) the need to diversify to push me to take action to transfer funds, open new account, etc., then, we had (4) upcoming US elections!

Normally, I'm not interested with politics. However, in 2016, I had a great trade on US election day trading the /ES futures and made 5 digit USD in a single day - that was my record Day Trading.

So, it brings back good memories, but I was out of Futures trading action for 8 years, and I didn't follow enough.

And last week, I actually thought Harris could marginally edged out Trump. This is despite knowing the Sports betting outside the US favored Trump, plus many signs in currency markets, equity/stock markets in US, China, Malaysia, bond markets, crypto markets, certain stocks all pointing towards Trump winning.

Cut a long story short, a couple of days ago, I decided to positioned my US portfolio at various markets, assuming Trump would win short term. And this evening, delighted to see these outcomes:

- China ETF (YINN 3x). YINN fell > 7% and caused me a small loss after Trump won due to US China tariff fears.

- Crypto ETF (CONL 2x). CONL rose > 50% at the time of writing, after Trump won, as Trump is positive for Crypto market. Even though the position was smaller than YINN, the gain here more than offset the loss, with a net gain. I also had a smaller long Crypto position (MSTX 2x ETF MSTR) that also won today.

- US bond TMF ETF (TLT 2x). TMF fell as US long term interest rates rise, as Trump's tariffs are inflationary with knock-on effects to US yields at the longer duration, causing bond prices to fall.

- US stocks markets rallied hard. All my long positions in SPX (S&P500 index options), IWM/TNA (Small Caps ETF/3x ETF), TQQQ (Nasdaq 100 ETF 3x), as well as half a dozen stock positions rallied hard as well and easily offset the tiny loss in #3 above.

- USD strengthened against MYR, which was a great diversification impact.

- I had a small credit spreads (small bullish) positions on TSLA which went up, because Elon Musk and Trump are buddies. I didn't load up on TSLA because I was unsure if that link was a strong one if Trump did win.

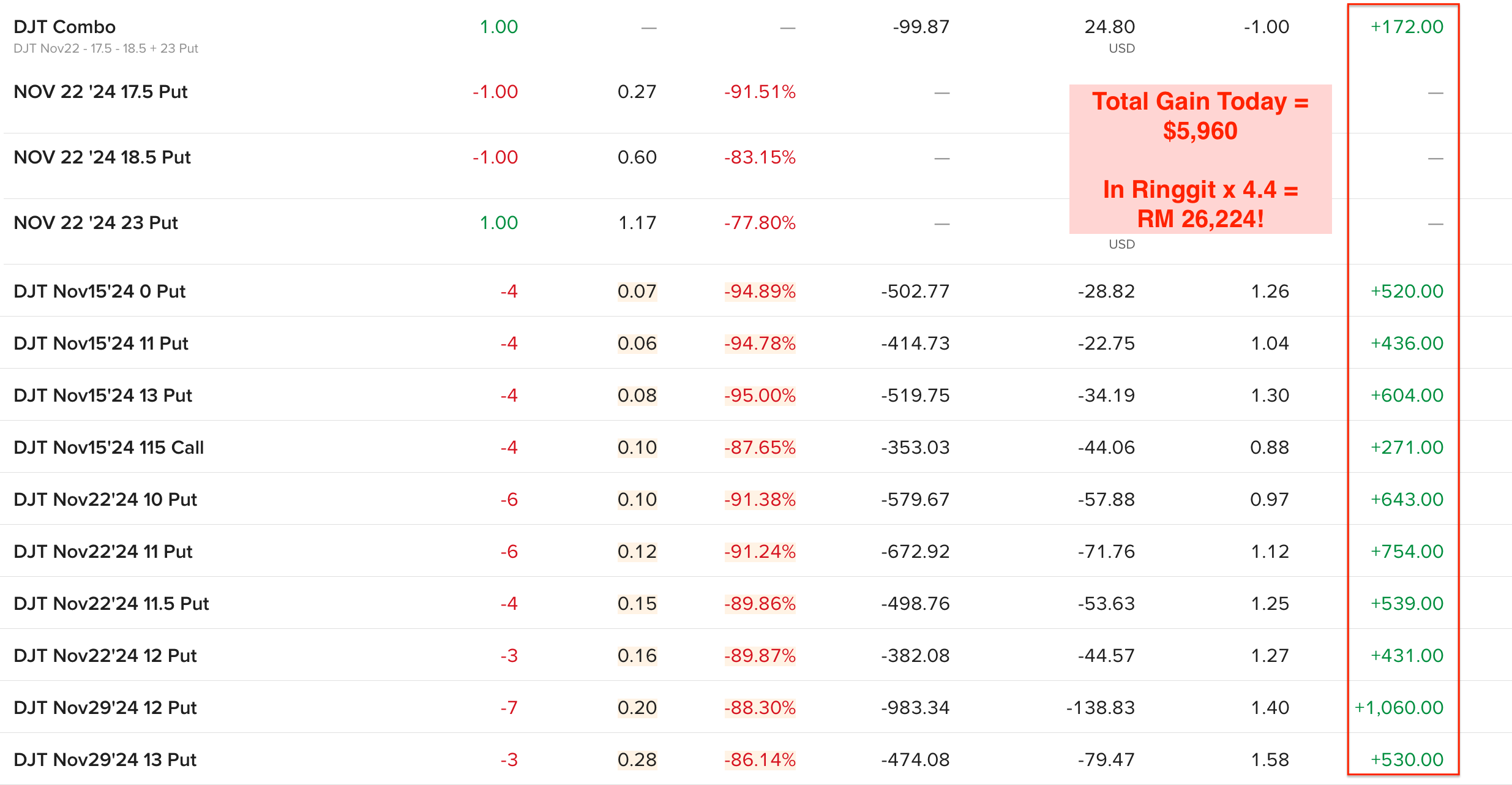

- And my key Trump Trade was probably DJT. The one day gain here is a nice.

What about DJT?

If you didn't know DJT, that's Trump's company called Trump Media & Technology Group Corp, that lost monies in the last quarterly filings. The stock was trading around $30 when I noticed it. What's interesting in the Options market for DJT is that the fear in the market was extremely high on both directions.

Simply put, even thought the stock traded between $30-$40 the past 2 days prior to elections, Mr Market thought there was still decent odds that DJT might fall to $10 (if Trump lost the election) or rise to $115 (if Trump won)!

This was crazy Option Pricing by Mr Market!

To illustrate, remember the election date is 6 Nov.

For 15 Nov option expiry (8 trading days), the implied volatility for the options was the highest I have ever seen in my entire life! The DJT IV exceeded 500% when normal stocks is considered high at 25% IV.

That meant, the Option premium for $10 strike exceeded $1, meaning you could sell a Cash Secured Put for $10 strike at 15 Nov expiry and collect $1 and if DJT crashed from $30 down to $10, you could be assigned 100 shares and still be at a profit position.

At the same time, you could also sell $115 strike Call at Nov 15 expiry for nearly $0.88. This meant if DJT did not rise from $30 to $115 in 8 trading days, you keep the entire $0.88 (i.e. $88 per lot). Yes, you read that right! To lose monies, you need DJT to rise above $115.88 in 8 trading days! This was super super crazy odds!

I liked both odds but unfortunately, the Call side required huge capital backing (to earn $88, you need cash of $11,500 to back this trade for cash secured trades). As I had limited funds, I decided to sell near 40 puts and 4 calls. So. I got greedy on the Put side.

I should mentioned by the time I discovered this trade, I had already used up my capital for all of the other trades mentioned earlier and more. So, this was one time where I threw caution to the wind as the odds are so compelling!

I sold as much as I could, received warning from IB on possible forced liquidation, so, had to deposit whatever USD I had since selling stocks in Bursa won't cut it due to T+2. After doing all that, it allowed me to sell 43 naked lots to collect well over US$7k premiums! I had never seen my Option Buying Power fell to zero before! It was crazy!!!

And then, today, when Trump won, the Option premiums collapsed hugely by 78 to 95%! All my shorts won fast in just 1 day. The short I did to collect $1.40 only had market values of $0.20 after US Options market opens. After adding up all my DJT profits, my profit for today was nearly $6k. That's a fast RM26.2k, after market knew Trump was going to win!

Summary and Conclusion

It turned out, my other positions also won more than I thought.

As a result, my portfolio grew +17% in just 1.5 months of trading. This includes recent monies deposited which diluted the % returns.

As a result of this gain, the total MY and US equity portfolio made new all time highs again today!

It has been an unbelievable short 1.5 months journey for me to trade the US markets.

Never in my wildest dream, before I made the decision a couple of months ago to diversify to US, that I was going to make +17.16% returns in just 1.5 months on my entire US portfolio!

This meant I have already met my 12 months trading objective in the US in just 1.5 months!

So unbelievable!

I feel incredibly blessed and feel incredibly thankful to markets!

Thank-you Mr Market!!!

Disclaimer: As usual, you are solely responsible for your own trading and investing decisions. Please be reminded that Options trading are extremely risky and can cause 100% loss in capital permanently.

More articles on https://dividendguy67.blogspot.com

Created by DividendGuy67 | Feb 02, 2025

Created by DividendGuy67 | Jan 25, 2025

Created by DividendGuy67 | Jan 24, 2025

DividendGuy67

PS. I just remembered that my IB account still have 15 min delayed quote. LOL. So, if you think you need the best and most up to date ticker updates to make +17% portfolio returns in 1.5 months, you really don't. 15 min delayed quotes doesn't matter if you are not doing Day Trading and your time-frames are longer than a few days.

2024-11-07 02:52