CARLSBG - When will the Consolidation End?

DividendGuy67

Publish date: Wed, 04 Sep 2024, 01:09 PM

Background

I am a late entrant to CARLSBG. I first took a trading position in Nov 22, sold all in Jan 23 for a profit, and reentered again in 2023, except this time, to slowly build an investing position. My last blog article on CARLSBG as an investing position here.

My investing thesis then (and still is now) is that the second consolidation that started in 2/2020 will soon end. As usual, Mr Market decides on the precise timing (I don't know when). Fundamentally, I am hoping the price will resolve itself to the upside in next 6-12 months.

Fundamentals

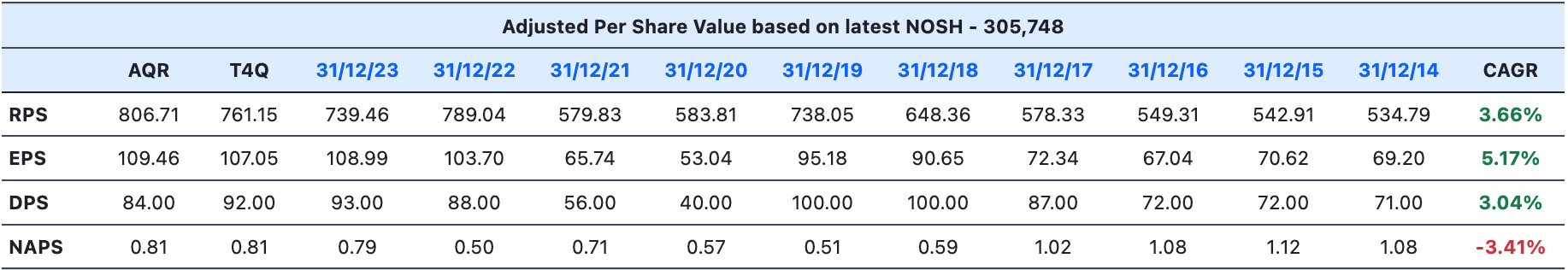

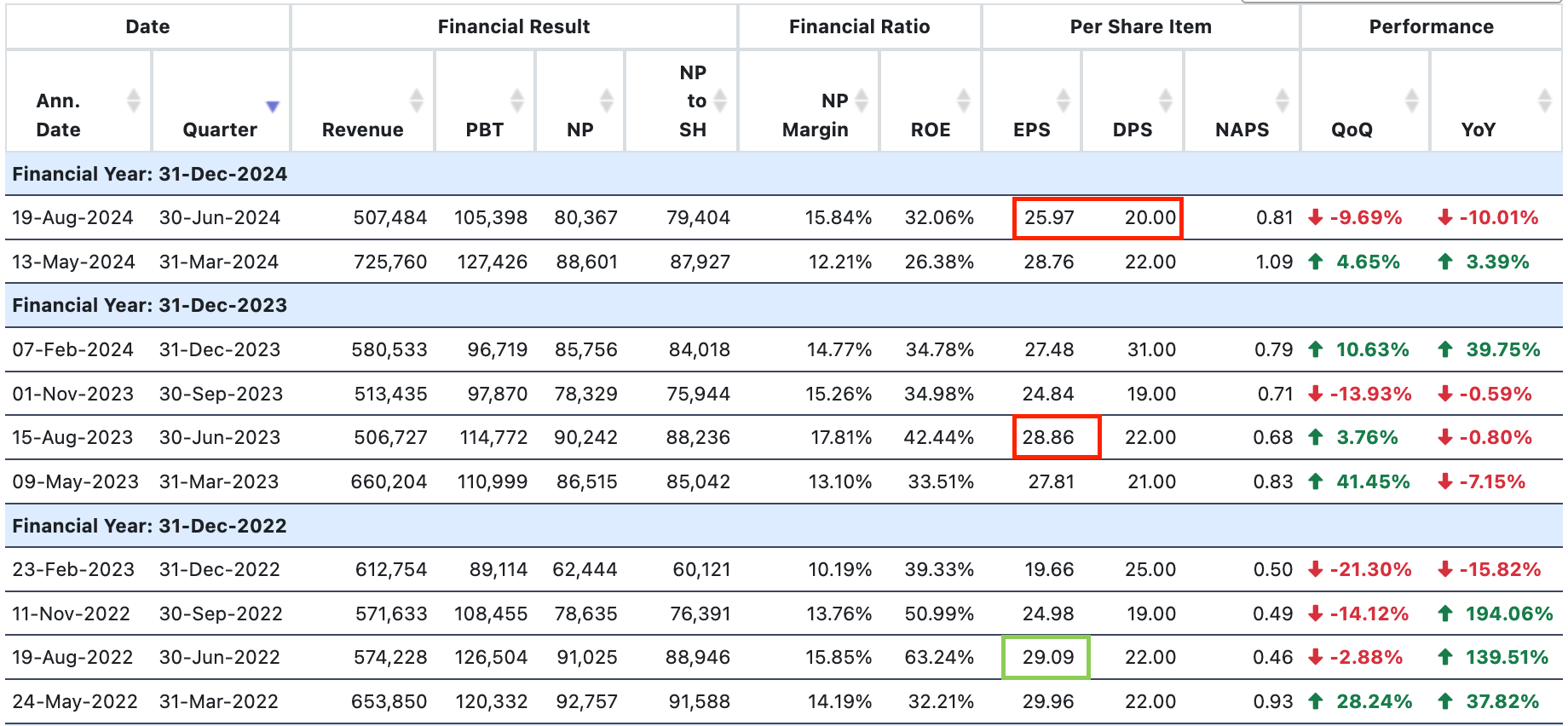

Past 10 year annual results are solid (EPS grows 5% CAGR). Past 3 year quarterly results are consolidating (last quarter EPS and DPS dips slightly YoY).

Long Term Chart

Key observations:

- The 2 key bull markets are obvious and shaded in green.

- The first bull lasted 4 years and returned 427%, coming from a low base. The early investors has benefited tremendously.

- The second bull lasted longer (5.3 years) and returned less but still a strong +278% over this period. It was still not too late for the 2nd batch of investors and they benefited too.

- The 2 previous consolidation period are also obvious.

- First is 5/13-5/16 lasting 3 years and tested the patience of the first batch of investors.

- Those who were patient were amply rewarded with the 2nd bull lasting 5+ years with +278% returns.

- Today, it's quite clear that investors are feeling quite frustrated with CARLSBG after over 4 years of consolidation.

- This is now longer than the previous consolidation period.

- The quantum fall is also bigger.

- Comparing the first bull and first consolidation, the second bull and second consolidation are weaker with overall less returns. Still fantastic, but not as good as the first batch of investors in 2009-10 say.

- However, there are these few TA rules that gives me hope.

- The longer the consolidation period, when it breaks out, the greater the effects.

- Principle of alternation - if the second bull is weaker, consolidation takes longer, if CARLSBG has used the consolidation period wisely and invests in its business well, then, the 3rd bull can be stronger. This is an area that deserves further analysis to see if CARLSBG has used the past 4+ years of consolidation wisely or not.

- If you drill down from Monthly to Weekly chart, the resistance channel is quite clear.

- 5 years is a long time, it won't be easy to break out.

- It is not unusual to extend the consolidation period if the breakout attempts are not successful.

- Chart patterns don't usually play themselves out as clear as what you are seeing.

- Hence, the current situation is testing the patience of many investors. For a chartist, I am now holding this position for over 1.5 years, which is longer than many of my other investing positions where my timing are much, much better.

Other thoughts, Summary and Conclusion

Why invests in CARLSBG.

- Besides the long term chart setups.

- As a dividend investor, both EPS and DPS has been growing decently, around 5% and 3% per annum CAGR respectively. I don't mind the DPS growth lagged the EPS growth the past 10 years, because in the long term, I expect the DPS growth to catch up with EPS and for dividend investors, this is a nice position to position yourself there.

- DY ~ 93 sen / 19.22 average cost = 4.8% Dividend yield which is not bad considering this DPS is expected to grow around 3%-5% per annum long term. This sure beats FD and approaches EPF. This excluded Price gains.

- If the chart setup comes true and the next 5-10 years returns half of the 2nd bull run returns of say 140%, the price gain will be fantastic for the patient investor.

I take heart that market doesn't make it easy for investors to earn the full bull market returns. The fact that it's not easy is a wonderful thing for the true investors. We don't know for sure if we'll win over the next 10 years but in a well diversified portfolio of high quality dividend stocks, we have done our job when we positioned ourselves well. My position size today is around 2.1% of today's market value, I haven't sold a single shares since accumulating the past 1.5 years, and it's about right.

It's still not too late to wait for the dip again and then accumulate - I expect the current test vs the downtrend line channel to fail, and hence no need to chase. I also own the stronger HEIM in a slightly larger size (2.6% today's capital) and so will continue to monitor both positions.

Disclaimer: As usual, you are solely responsible for your own trading and investing position.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on https://dividendguy67.blogspot.com

Created by DividendGuy67 | Jan 22, 2025