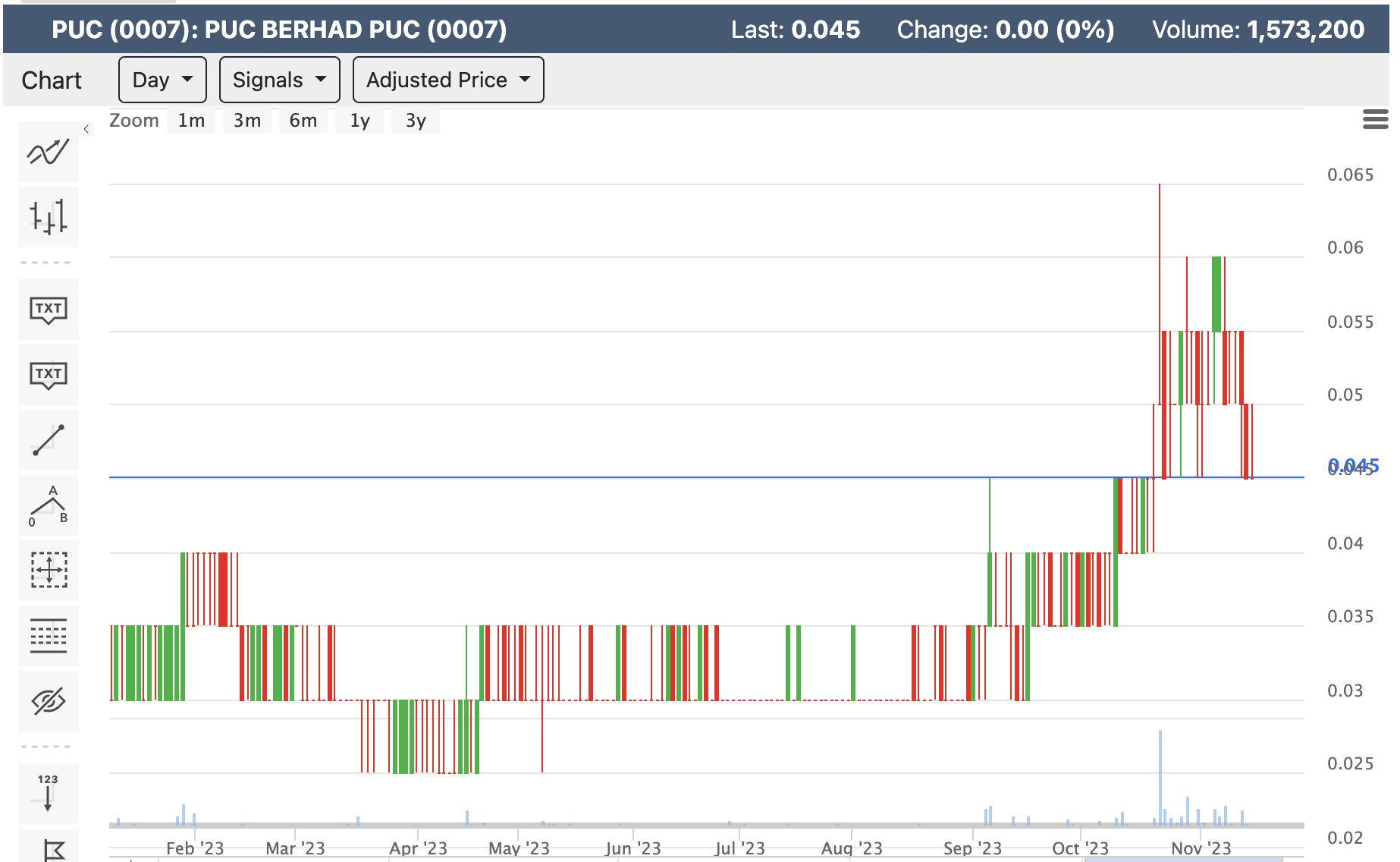

PUC Berhad's Technical Analysis: A Potential Turnaround?

AnthonyAng666

Publish date: Wed, 15 Nov 2023, 08:50 PM

Summary of Indicators.

The overall analysis leans towards bearishness with 19 sell, 2 buy, and 1 neutral signal.

Technical Indicators. A mix of signals is observed, including 7 sell, 2 buy, and 1 neutral signal. Key indicators include RSI (44.885, sell), Stochastics (66.667, buy), MACD (-0.002, sell), and ADX (22.508, buy), painting a diverse picture.

Moving Averages. All moving averages (MA5, MA10, MA20, MA50, MA100, MA200) are indicating sell signals, suggesting a bearish trend in the short, medium, and long term.

Pivot Points: Across various methods (Classic, Fibonacci, Camarilla, Woodie's, DeMark's), the pivot point levels are consistent at 0.05. This may serve as both a support and resistance level, indicating potential turning points for the stock.

The current technical analysis reflects a bearish sentiment. However, PUC Berhad's recent partnership with a leading e-wallet operator could be a significant factor in reevaluating this outlook. Such collaborations can drive positive market sentiment and potentially lead to a bullish turnaround, especially in a digitally evolving economy. Investors might view this partnership as a catalyst for growth, possibly changing the technical outlook in the near future.

More articles on ECOMMERCE

Created by AnthonyAng666 | Dec 04, 2023