Stocks That Analysts Recommend Most for 2025

edgeinvest

Publish date: Fri, 03 Jan 2025, 10:00 AM

KUALA LUMPUR (Jan 3): Going into 2025, the US president-elect Donald Trump’s penchant for unpredictability set the stage for a potentially unpredictable time ahead. Being a major export destination for many countries, the US’ international trade policy will have a bearing on global economic growth.

Nevertheless, analysts expect lower global interest rates in 2025 compared with 2024, arising from a slower global inflation will encourage flow of investment money into emerging markets, including Malaysia.

Analysts, in general, foresee earnings growth momentum to continue in 2025, anticipating an average 8% growth for the FBM KLCI component stocks. The higher earnings will be driven by a stronger domestic economy enabled by the ongoing multi-year infrastructure projects and a favourable policy environment, as well as a broad-based export recovery on the global economy.

Analysts also contemplate that a strong market liquidity supported by a strengthening ringgit could potentially give rise to expansion in price-earnings valuation of the market.

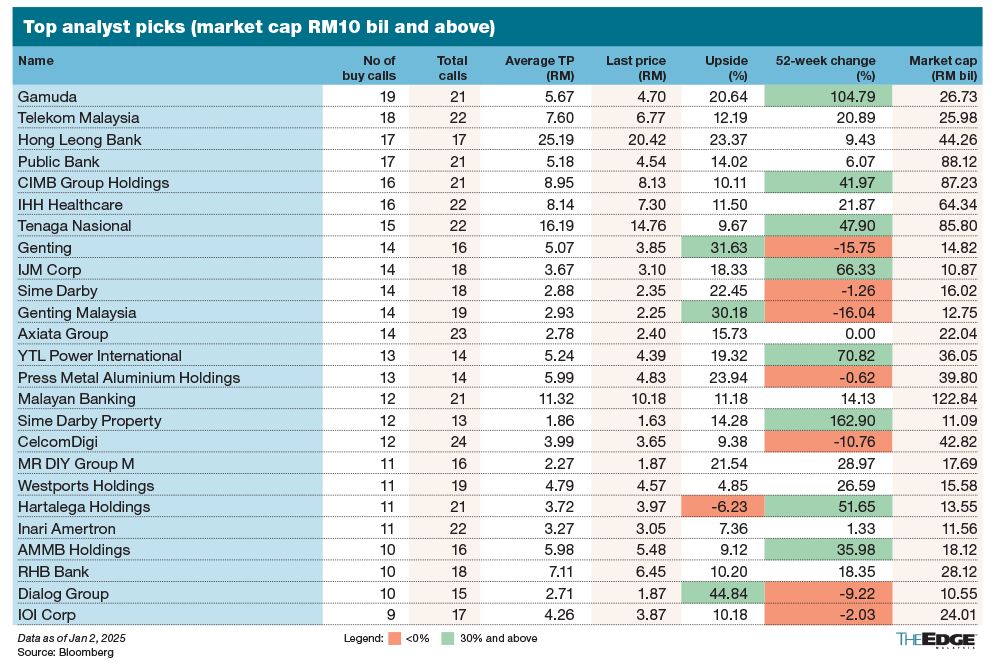

Looking at the top stock picks of 2025 by analysts, The Edge compiled a list of companies with the most "buy" calls relative to total analyst coverage, as well as the potential upside relative to the consensus target price on Bloomberg.

Hong Leong Bank, YTL Power, Press Metal, SimeProp, Gamuda are screaming buys for super large caps

Among companies with a market capitalisation (cap) above RM10 billion, Hong Leong Bank Bhd (KL:HLBANK) is the most recommended by analysts considering the banking group is trading at roughly 1.15 times of its book value of RM18.19 per share. Additionally, the banking group’s high asset quality and dissipating concerns on its China associate whose operations had been solid have made it attractive.

All 17 analysts tracking Hong Leong Bank are recommending the banking stock to their clients with consensus target price of RM25.19, representing a 23.4% upside against Thursday’s closing of RM20.42. The stock has merely gained 9.4% in 2024.

Other big cap companies that have the highest percentage of "buy" calls, include YTL Power International Bhd (KL:YTLPOWR) where 13 out of the 14 analysts covering the stock have “buy” recommendation, as they believe the stock was largely oversold after declining more than 30% from its high of RM5.38 in May. Analysts anticipate YTL Power’s earnings to reach record highs in the financial year ending June 30, 2026 (FY2026) and FY2027 as its AI-powered data centre (DC) business starts to ramp up and contribute materially. The consensus TP of YTL Power is at RM5.24, representing a 19.3% upside against its closing price of RM4.39 on Jan 2. Despite the volatile swings in share price, the stock rallied 70.8% in 2024.

Press Metal Aluminium Holdings Bhd (KL:PMETAL) also has 13 "buy" calls out of 14. Analysts cite the integrated aluminium smelter is well-positioned to capitalise on the potential spillover effects of a heightened US-China trade dispute. One imminent development is China’s removal of the 13% tax rebate on aluminium exports which could potentially boost demand from non-China manufacturers. There is a 23.9% potential upside based on the consensus target price of RM5.99 compared with the closing price of RM4.83 on Jan 2, valuing Asean’s biggest aluminium smelter at price-earnings (P/E) ratio of 24.3 times currently.

Interestingly, the two big gainers — Sime Darby Properties Bhd (KL:SIMEPROP) and Gamuda Bhd (KL:GAMUDA) whose share price more than doubled in 2024 — remain on analysts’ recommendation list.

Analysts’ optimistic view on SimeProp hinges on the expectation of a big leap on its earnings starting the financial year ending Dec 31, 2027 onwards driven by two 20-year lease agreements under the data centre projects.

Analysts believe that the listing of a REIT could be in the pipeline. There are 12 "buy" calls out of 13. The consensus target price is at RM1.86, a 14.3% potential upside against Thursday’s closing of RM1.63.

After rising 105% in 2024, Gamuda Bhd (KL:GAMUDA) still has a high number of "buy" calls with 19 "buy" calls out of 21. The consensus target price of RM5.67 represents 20.6% upside against the stock's Jan 2 close of RM4.70. Analysts cite superior order book prospects and the stock’s imminent inclusion into the KLCI to boost market visibility especially among foreign investors as reasons.

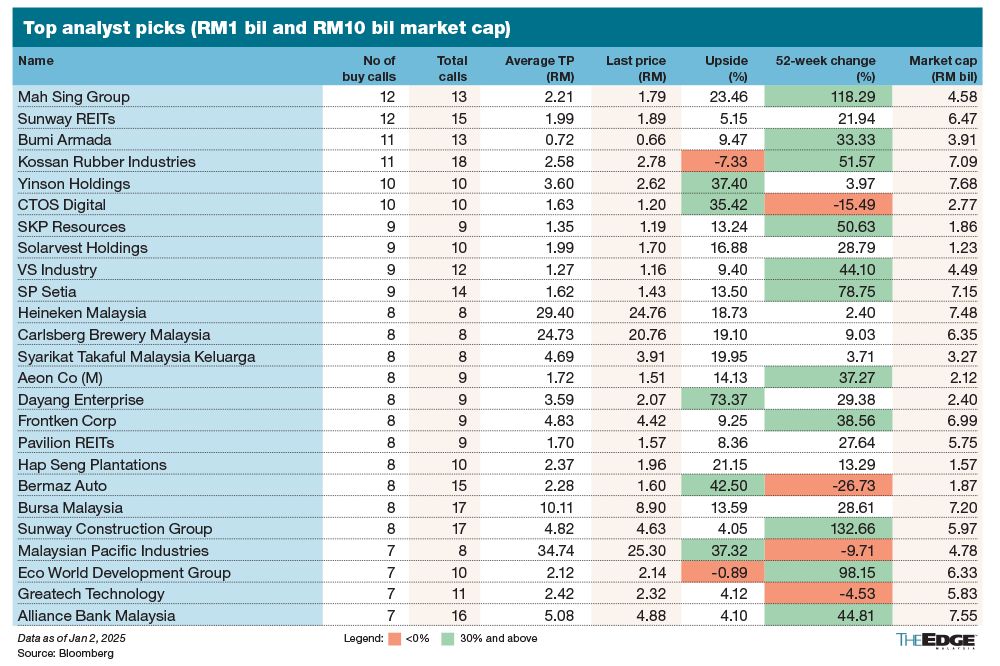

Notable top picks for big-cap picks

Among companies with a market capitalisation between RM1 billion and RM10 billion, top picks based on the percentage of "buy" calls are Yinson Holdings Bhd (KL:YINSON) with 37.4% upside potential against consensus target price of RM3.60, amid expectation of significant earnings growth prospect given its pipeline of jobs in floating production storage offloading vessels’ (FPSO).

Another most liked big-cap stocks is CTOS Digital Bhd (KL:CTOS), as analysts project its earnings to grow 16.7% in 2025 riding on the high growth potential of credit reporting solutions in the Asean market. Analysts have ascribed a higher P/E multiple of 29 times to arrive at the consensus price of RM1.63 and represents 35.4% upside against Thursday’s closing of RM1.20 with a P/E of 21.4 times.

Mah Sing Group Bhd (KL:MAHSING) has 12 "buy" calls out of 13. The consensus target price of RM2.21 represents 23.5% upside against the stock's Jan 2 close of RM1.79. Analysts forecast its earnings to grow 22.7% in 2025 because of strong property sales and recurring income contribution from its DC venture.

Solarvest Holdings Bhd (KL:SLVEST) was also well-liked by analysts who have projected the integrated solar provider’s earnings to grow 30% in 2025 riding on favourable operating cost tailwinds and secular industry growth. The consensus price of RM1.99 represents 16.9% upside against its close of RM1.70 on Jan 2.

Other notable "buy" include Syarikat Takaful Malaysia Keluarga Bhd (KL:TAKAFUL) (with 20% upside) where analysts projected its earnings to grow 6.5% in 2025 supported by sustained demand from its Bancatakaful segment despite having to face rising expenses.

Both Heineken Malaysia Bhd (KL:HEIM) (with 18.7% upside) and Carlsberg Brewery Malaysia Bhd (KL:CARLSBG) (with 19.1% upside) are on recommendation lists because of resilient demand and sustainable decent margins; and SKP Resources Bhd (KL:SKPRES) (with 13.2% upside) on inventory replenishment from its major customer Dyson, after the completion of destocking activities that lasted five consecutive quarters. Dyson contributed about 75% of total sales to SKP Resources.

Mid-to-small cap: O&G top, construction and consumer healthcare hold highest potential upside

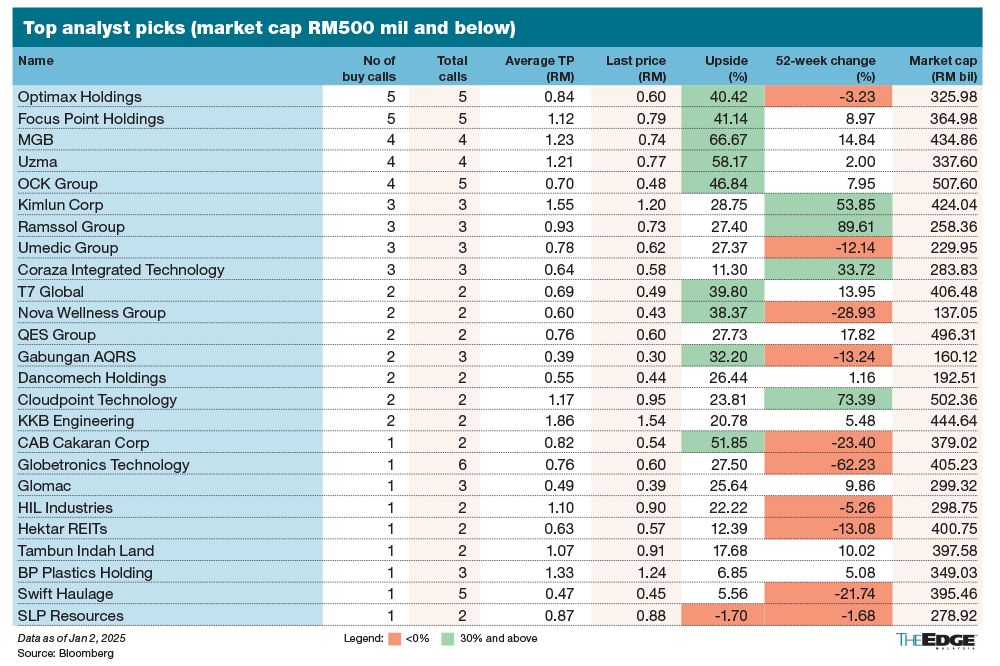

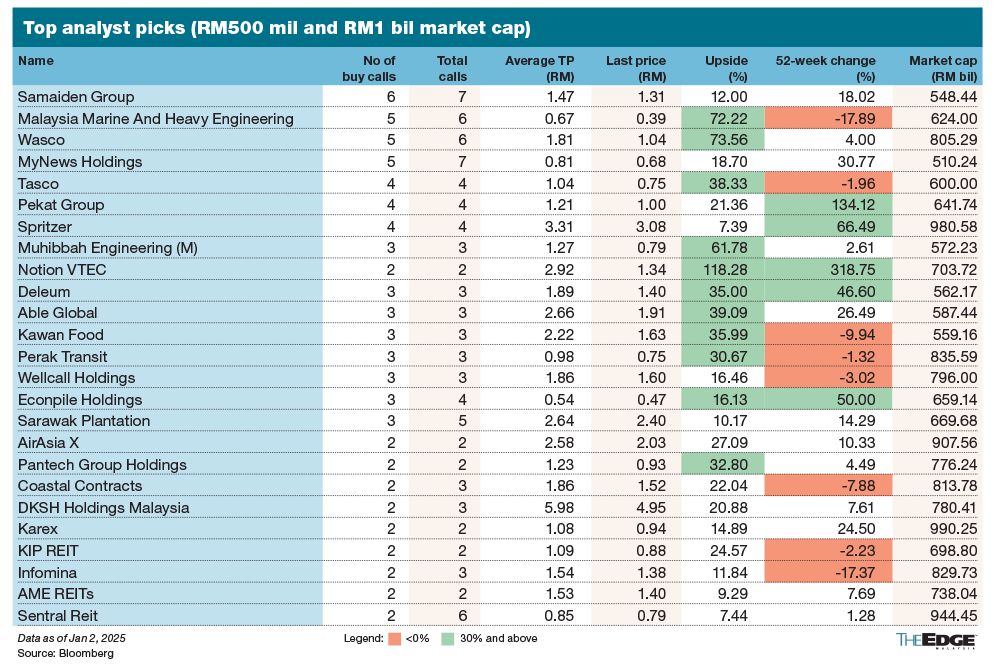

As for the companies with a market capitalisation below the RM1 billion — typically known as the mid-to-small cap space, based on the list of stocks with the most potential upside, the oil & gas (O&G), construction and consumer healthcare sectors are identified as the most noteworthy sectors.

Analysts cite increasing work orders on the back of strong order book visibility as a primary reason to be bullish on both the O&G and construction stocks.

Specifically, the O&G stocks with the most upside potential are Wasco Bhd (KL:WASCO) with 73.6%, followed by Malaysia Marine and Heavy Engineering Bhd (KL:MHB) that has 72.2% upside, Uzma Bhd (KL:UZMA) with 58.2%, T7 Global Bhd (KL:T7GLOBAL) with 39.8%. and Deleum Bhd (KL:DELEUM) with 35%.

Meanwhile, the construction stocks that have the highest upside potential are MGB Bhd (KL:MGB) with 66.7%, followed by Muhibbah Engineering (M) Bhd (KL:MUHIBAH) with 61.8% and Kimlun Corporation Bhd (KL:KIMLUN) with 28.8%.

In the consumer healthcare space, Focus Point Holdings Bhd (KL:FOCUSP) that has 41.1% upside, and Optimax Holdings Bhd (KL:OPTIMAX) with 40.4% upside, are picked as proxies to increasing eyecare demand, while Nova Wellness Group Bhd (KL:NOVA) with 38.4% upside, is picked on new own brand products introduction and sustained consumer demand.

Source: TheEdge - 3 Jan 2025

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-02-05

GAMUDA2025-02-05

GAMUDA2025-02-05

OPTIMAX2025-02-05

YINSON2025-02-05

YTLPOWR2025-02-05

YTLPOWR2025-02-04

FOCUSP2025-02-04

GAMUDA2025-02-04

GAMUDA2025-02-04

GAMUDA2025-02-04

GAMUDA2025-02-04

GAMUDA2025-02-04

GAMUDA2025-02-04

HLBANK2025-02-04

MUHIBAH2025-02-04

PMETAL2025-02-04

PMETAL2025-02-04

SIME2025-02-04

SIMEPROP2025-02-04

SIMEPROP2025-02-04

SIMEPROP2025-02-04

TAKAFUL2025-02-04

TAKAFUL2025-02-04

YINSON2025-02-04

YINSON2025-02-04

YINSON2025-02-04

YTLPOWR2025-02-03

FOCUSP2025-02-03

FOCUSP2025-02-03

FOCUSP2025-02-03

GAMUDA2025-02-03

GAMUDA2025-02-03

GAMUDA2025-02-03

GAMUDA2025-02-03

GAMUDA2025-02-03

GAMUDA2025-02-03

GAMUDA2025-02-03

HLBANK2025-02-03

HLBANK2025-02-03

HLBANK2025-02-03

MGB2025-02-03

MGB2025-02-03

MGB2025-02-03

MGB2025-02-03

MGB2025-02-03

MGB2025-02-03

PMETAL2025-02-03

SIME2025-02-03

SIME2025-02-03

SIME2025-02-03

SIME2025-02-03

SIME2025-02-03

SIME2025-02-03

SIME2025-02-03

SIME2025-02-03

SIME2025-02-03

SIMEPROP2025-02-03

SIMEPROP2025-02-03

SKPRES2025-02-03

WASCO2025-02-03

YINSON2025-02-03

YINSON2025-02-03

YINSON2025-02-03

YTLPOWR2025-01-31

CARLSBG2025-01-31

GAMUDA2025-01-31

GAMUDA2025-01-31

GAMUDA2025-01-31

GAMUDA2025-01-31

GAMUDA2025-01-31

GAMUDA2025-01-31

GAMUDA2025-01-31

HLBANK2025-01-31

MAHSING2025-01-31

MAHSING2025-01-31

MGB2025-01-31

MGB2025-01-31

MGB2025-01-31

MGB2025-01-31

MGB2025-01-31

MGB2025-01-31

SIMEPROP2025-01-31

SIMEPROP2025-01-31

SIMEPROP2025-01-31

SIMEPROP2025-01-31

TAKAFUL2025-01-31

TAKAFUL2025-01-31

TAKAFUL2025-01-31

YINSON2025-01-31

YINSON2025-01-31

YINSON2025-01-31

YINSON2025-01-31

YINSON2025-01-31

YINSON2025-01-31

YTLPOWR2025-01-31

YTLPOWR2025-01-29

GAMUDA2025-01-29

MAHSING2025-01-29

SIMEPROP2025-01-29

YTLPOWR2025-01-28

GAMUDA2025-01-28

GAMUDA2025-01-28

HLBANK2025-01-28

MAHSING2025-01-28

MGB2025-01-28

MGB2025-01-28

MGB2025-01-28

MGB2025-01-28

MGB2025-01-28

MGB2025-01-28

SIME2025-01-28

SIMEPROP2025-01-28

SIMEPROP2025-01-28

SIMEPROP2025-01-28

SIMEPROP2025-01-28

SIMEPROP2025-01-28

SLVEST2025-01-28

SLVEST2025-01-28

SLVEST2025-01-28

SLVEST2025-01-28

SLVEST2025-01-28

WASCO2025-01-28

YINSON2025-01-28

YINSON2025-01-28

YTLPOWR2025-01-28

YTLPOWR2025-01-28

YTLPOWR2025-01-27

FOCUSP2025-01-27

GAMUDA2025-01-27

GAMUDA2025-01-27

GAMUDA2025-01-27

GAMUDA2025-01-27

GAMUDA2025-01-27

GAMUDA2025-01-27

GAMUDA2025-01-27

HLBANK2025-01-27

HLBANK2025-01-27

MGB2025-01-27

MGB2025-01-27

MGB2025-01-27

MGB2025-01-27

MGB2025-01-27

MGB2025-01-27

PMETAL2025-01-27

SIMEPROP2025-01-27

SIMEPROP2025-01-27

SIMEPROP2025-01-27

SIMEPROP2025-01-27

SIMEPROP2025-01-27

SIMEPROP2025-01-27

TAKAFUL2025-01-27

WASCO2025-01-27

YINSON2025-01-27

YINSON2025-01-27

YINSON2025-01-27

YINSON2025-01-27

YINSON2025-01-27

YTLPOWR2025-01-27

YTLPOWR2025-01-27

YTLPOWR2025-01-27

YTLPOWR2025-01-27

YTLPOWRMore articles on CEO Morning Brief

Created by edgeinvest | Feb 05, 2025

Created by edgeinvest | Feb 05, 2025

Created by edgeinvest | Feb 05, 2025

Created by edgeinvest | Feb 05, 2025