Thematic Hidden Champion for 2022

ddm1312

Publish date: Sun, 09 Jan 2022, 11:08 AM

Thematic Hidden Champion for 2022

While investors in Malaysia are sceptical on the sustainability of price movement for commodities, Goldman Sachs is “extremely bullish” on commodities and mentioned that there may be a commodities supercycle that may last over a decade. While the potential for commodities bull run to run over a decade is debatable, we still cannot deny the fact that prices of items will remain high for the upcoming 2 – 3 years due to the broken global supply chain and increasing demand.

You may read more about the comments about commodities by Jeff Currie.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------

This article had inspired me to look out for underserved commodities players in the market, or companies that are in the value chain. I understood that investors are head over heels on semiconductor stocks, but the said sector will experience moderate growth of circa 8% to 9% growth in 2022, hence it was not worth the value after pricing in the full 2022 calendar year earnings.

However, one sector that investors missed out is the furniture industry. Due to the last MCO imposed by the government and added with difficulties of shipping the products to their end customers, Muar – the country’s beloved furniture heaven is experiencing unprecedented backlog orders. Top industry players such as LII HEN INDUSTRIES, POH HUAT RESOURCES, and even the new bloods, ready-to-assemble furniture makers like ECOMATE, MOBILIA HOLDINGS had booming orderbook as well as backlog orders.

Does this mean we should invest into these companies? In my humble opinion – no. One should look deeper into the value chain as these companies, as furniture makers usually have issues with transferring costs increment to their clients.

That being said, there is one company that the market had not really identified yet.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------

This company is unlike other pureplay furniture maker, where they had a very interesting segment could be greatly benefited from the current bull run and shortage of commodities, which is the processing and trading of wood. You may not believe me, but if you were to ask around construction companies, it is very likely for them to suffer from wood products shortage like plywood or particle wood, whereas the traditional furniture industry uses more of the full logs of trees.

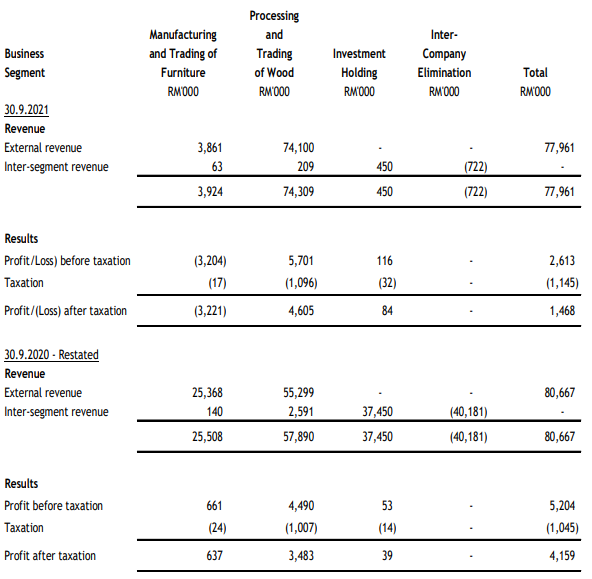

And back on the results note, you may have noticed that they had really good earnings in their processing and trading and wood business. From an industry study, this company had received a lot of orders from their peers in Muar as well as clients from the middle east region. In terms of market size, this company is one of the largest in the market.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------

And this company is SERNKOU, as some of you may have already guessed it correctly.

Based on the current market outlook and demand, it is very likely for SERNKOU to continue experiencing a strong order flow into their wood products, which was mainly consumed for the furniture industry. The current valuation of 49 times PER may seem stretched, but this was mainly due to the downturn of the last 2 quarters, which were impacted by their furniture segment.

Moving forward, I believe this company could hit a new high in earnings in 2022 with the sustained commodities prices and strong demand order flow for the company. We expect a RM32 to RM37 million net profit for 2022 for this company. And given that the market have not talk about this company yet, this shows a huge rerating opportunity for the company.

My personal TP for this company would be at least RM1.00 by the end of 2022.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|