SERN KOU – A Defensive Play Amidst Inflationary Market

ddm1312

Publish date: Wed, 02 Mar 2022, 01:52 AM

As the Russia-Ukraine ceasefire talks fail, global oil markets had jumped more than 10% and it is expected to exacerbate the already-tightened global supply chain. However, one company raise above all due to their defensive business nature and relatively strong earnings, as well as share price movement.

As you may have seen it in the title, this company is SERN KOU.

To recap, SERN KOU is principally involved in the midstream timber industry, while aided with their downstream furniture business.

As for the furniture business, we know that the backlog orders are commonly between 3 to 6 months in the Muar region and positioned as both a furniture player and a supplier for furniture market, SERN KOU is poised to benefit from the rallied demand of processed wood.

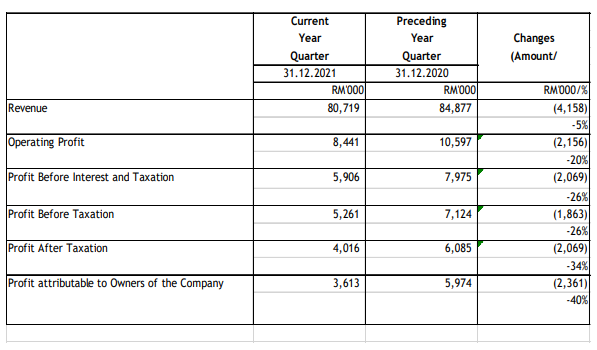

Albeit a great recovery from the previous quarter, which was badly impacted by the Movement Control Order, we see a slight Year-on-Year decrease in revenue and profit after tax for the company.

According to the commentary of the company, this was mainly due to reduced demand for tropical wood.

Bear in mind that the tropical wood is not necessarily processed wood. There is a shift from full logs of furniture, which is likely to be tropical wood to processed wood as the ready-to-assemble model for furniture is more widely accepted in the market.

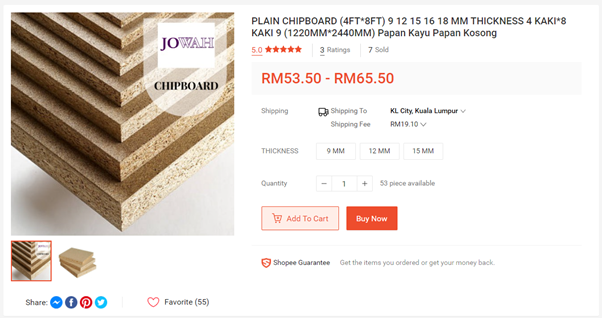

I’ve taken a smaller trader in the market as example to demonstrate the increase in price for chipboard, a.k.a. processed wood. A few months ago, the price for a 9MM thickness plain chipboard is around RM35 ~ RM40, but the price had increased by over 30% to date.

I also wanted to remind investors that for the 2QFY22 of SERN KOU, it merely reflects up to 31st December 2021 with the maiden turnaround profit from the furniture segment, as well as picking up demand from processed wood to hedge against the lowered demand for tropical wood.

Currently, the USD-MYR chart is seemingly going through a consolidation phase. However, as oil price increase, rate hike in US is inevitable and this would in turn benefit the furniture players in Malaysia, which are export orientated.

Once again, SERN KOU’s position as both a mid and downstream player is likely to be benefited from the rally of USD strength.

To date, SERN KOU is still generating relatively stable cashflow. I believe as the company continue to grow its bottom line in the upcoming quarters – in which I do not see how they wouldn’t, it is likely for SERNKOU to challenge the RM0.80 and RM1.00 price level.

If you are looking to hedge your portfolio admist a high inflationary environment, then this is the company.