Daythree Digital's Evolution in GBS and the Potential for Investors

Coleman77

Publish date: Fri, 26 Jan 2024, 12:08 PM

Daythree Digital Berhad (DAY3, 0281), which was listed in the Bursa ACE Market on July 26 2023, made a noteworthy debut with an opening share price of RM0.65, reflecting a substantial 116.0% premium above its Initial Public Offering (IPO) price of RM0.30 per share. However, the company experienced a downtrend in its share price attributed to negative market sentiment and other influencing factors.

Delving into the company's background, Daythree Digital holds a prominent position among Global Business Services (GBS) solution providers, specializing primarily in customer experience and lifecycle management services.

Ever wonder what customer experience and lifecycle management services do? Basically, these services intricately focus on orchestrating and optimizing the entire customer journey, spanning from initial awareness and acquisition to retention and advocacy. The overarching goal is to elevate customer satisfaction, foster loyalty, and enhance the overall brand experience at each touchpoint. The customer experience lifecycle encompasses pivotal stages, including awareness, consideration, purchase, onboarding, support, and advocacy.

Daythree Digital offers a comprehensive suite of services, including customer care support, helpdesk and technical support, content moderation, customer retention management, revenue generation, receivables management, as well as back office and transactional processing. In addition to these services, the company has developed proprietary digital tools, namely Faith, Daisy, and Saige. These platforms are incorporating cutting-edge technologies like generative artificial intelligence and cloud computing.

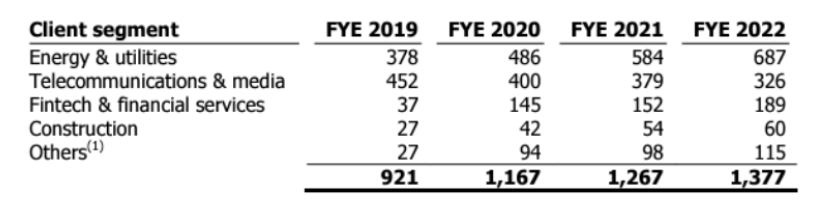

Catering to a diverse clientele across sectors such as Energy & Utilities, Telecommunication & Media, Fintech & Financial Services, Construction, E-commerce & Retail, Healthcare, and Travel & Hospitality, Daythree Digital has established a strong presence in Malaysia.

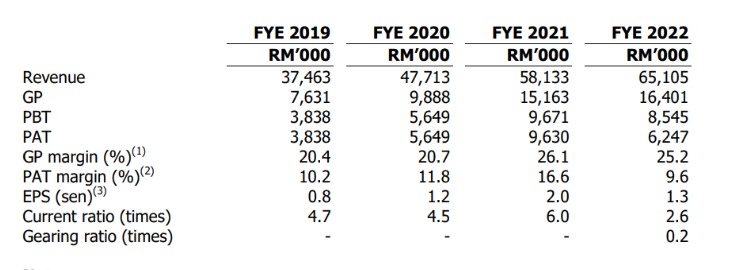

In terms of financial performance, the company has demonstrated consistent growth, with revenue escalating from RM 37.46 million (FYE 2019) to RM 65.10 million (FYE 2022), indicating a robust expansion of market share. Notably, Daythree Digital has maintained a gross profit margin exceeding 20.0% over the past four years, underscoring the high value-added nature of its services in the market.

For the latest financial period ending 30 September 2023, Daythree Digital achieved cumulative revenue of approximately RM66.3 million and a net profit of around RM5.24 million, reflecting a significant improvement compared to FY2022.

Research conducted by Protégé Associates projects continued growth in the Malaysian GBS industry, anticipating an increase from RM24.8 billion in 2023 to RM31.7 billion in 2027, representing a compound annual growth rate (CAGR) of 6.3% during this period.

Considering the current Price-to-Earnings (P/E) ratio of around 22.12 times and the share price trading at RM0.33, it appears that Daythree Digital is undervalued, presenting a potential opportunity for investors.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|