Mikro MSC: Valuation and financials and insider selling

Goodstockbadstock

Publish date: Mon, 31 Jul 2017, 10:08 PM

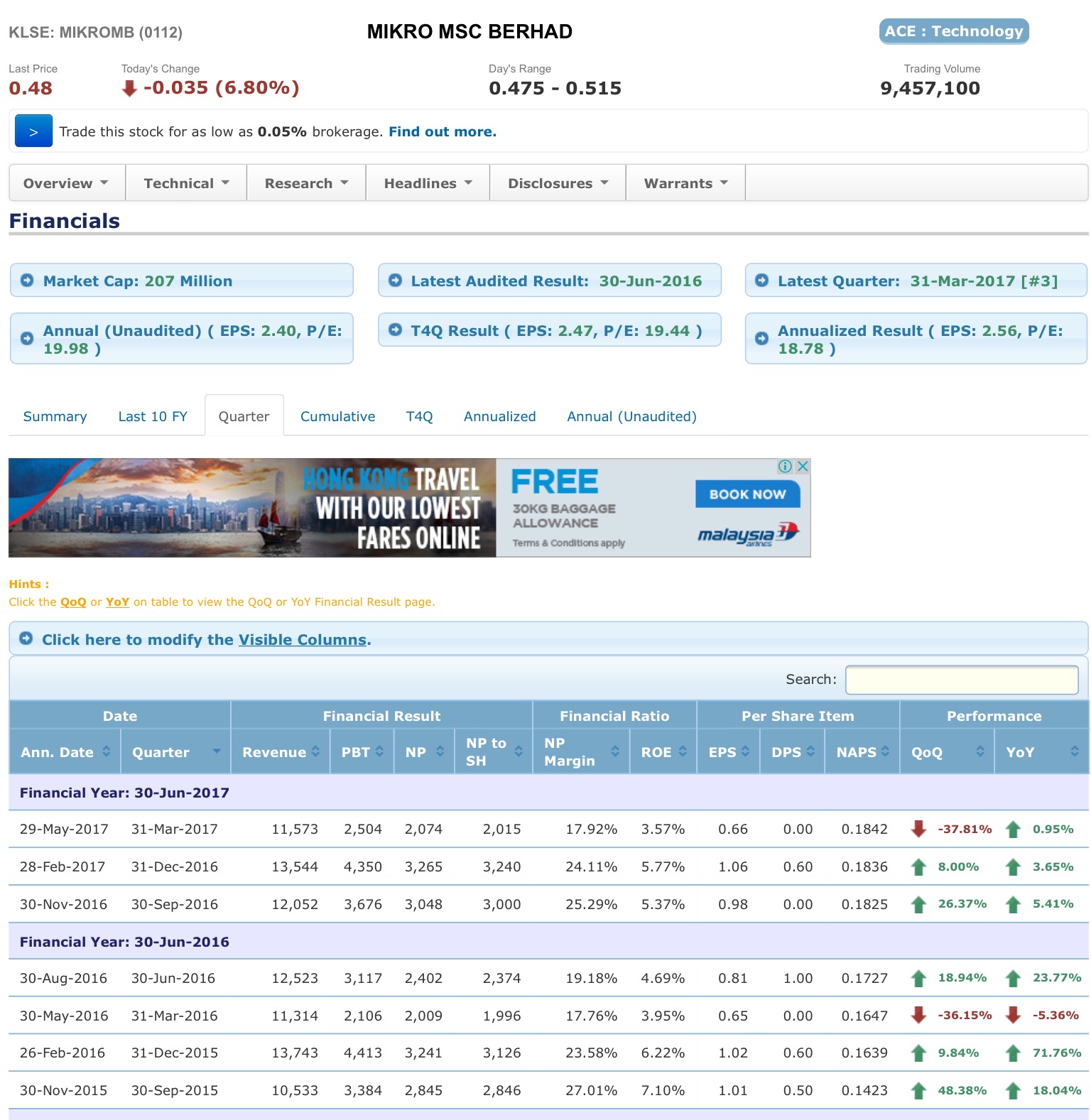

T4Q P/E = 19.44

T4Q EPS GROWTH = 7%

PEG RATIO = 2.44 (>1 = OVERVALUED)

PEG RATIO = 1 (FAIR VALUE = 18 sen)

P/NAV = 2.61

**main concerns**

1) Lower Revenue growth: 4.44% in first 9 month FYE 30 June 2017.

2) Other factors like fluctuation in material costs & currency might affect Mikro MSC profitability

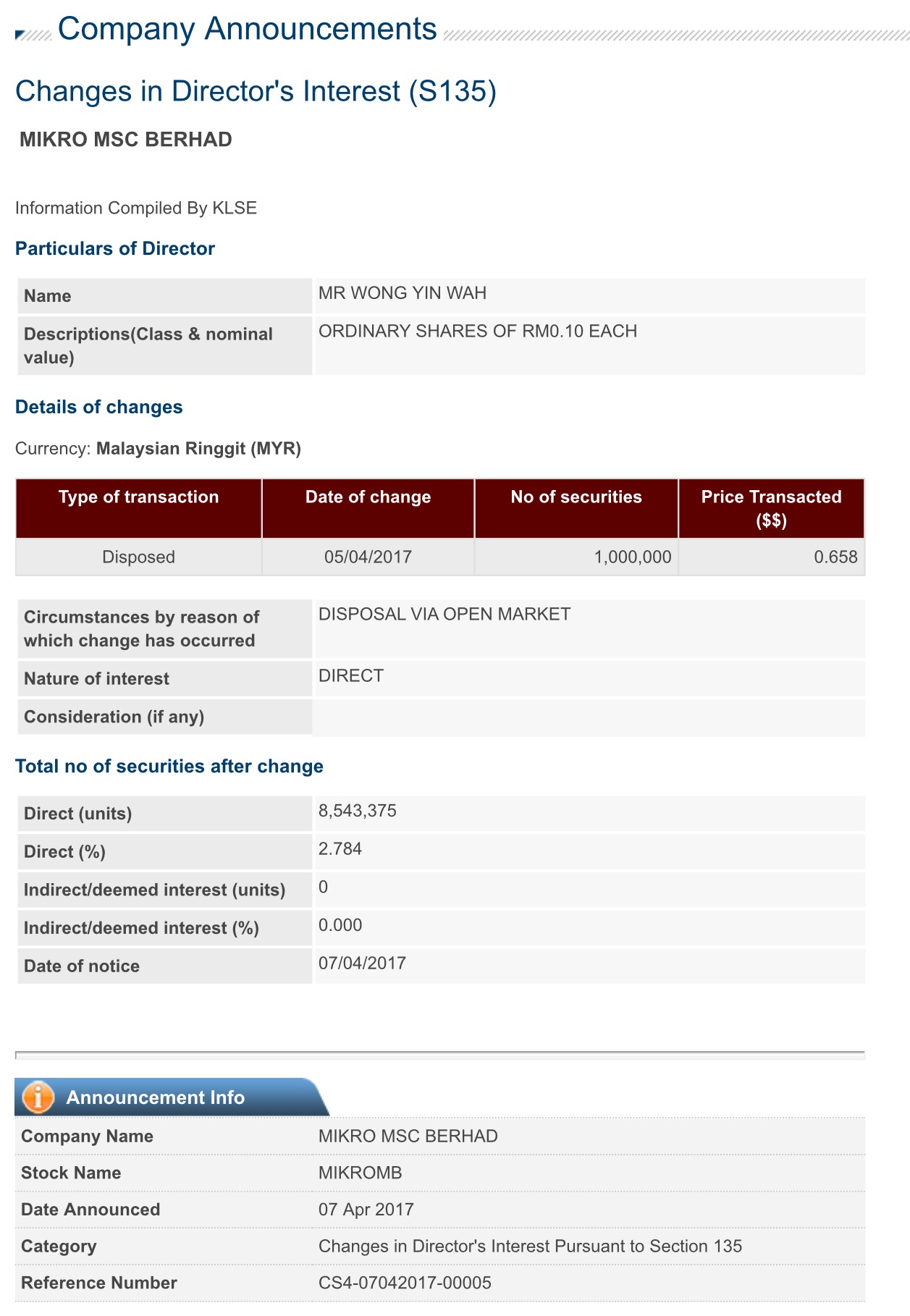

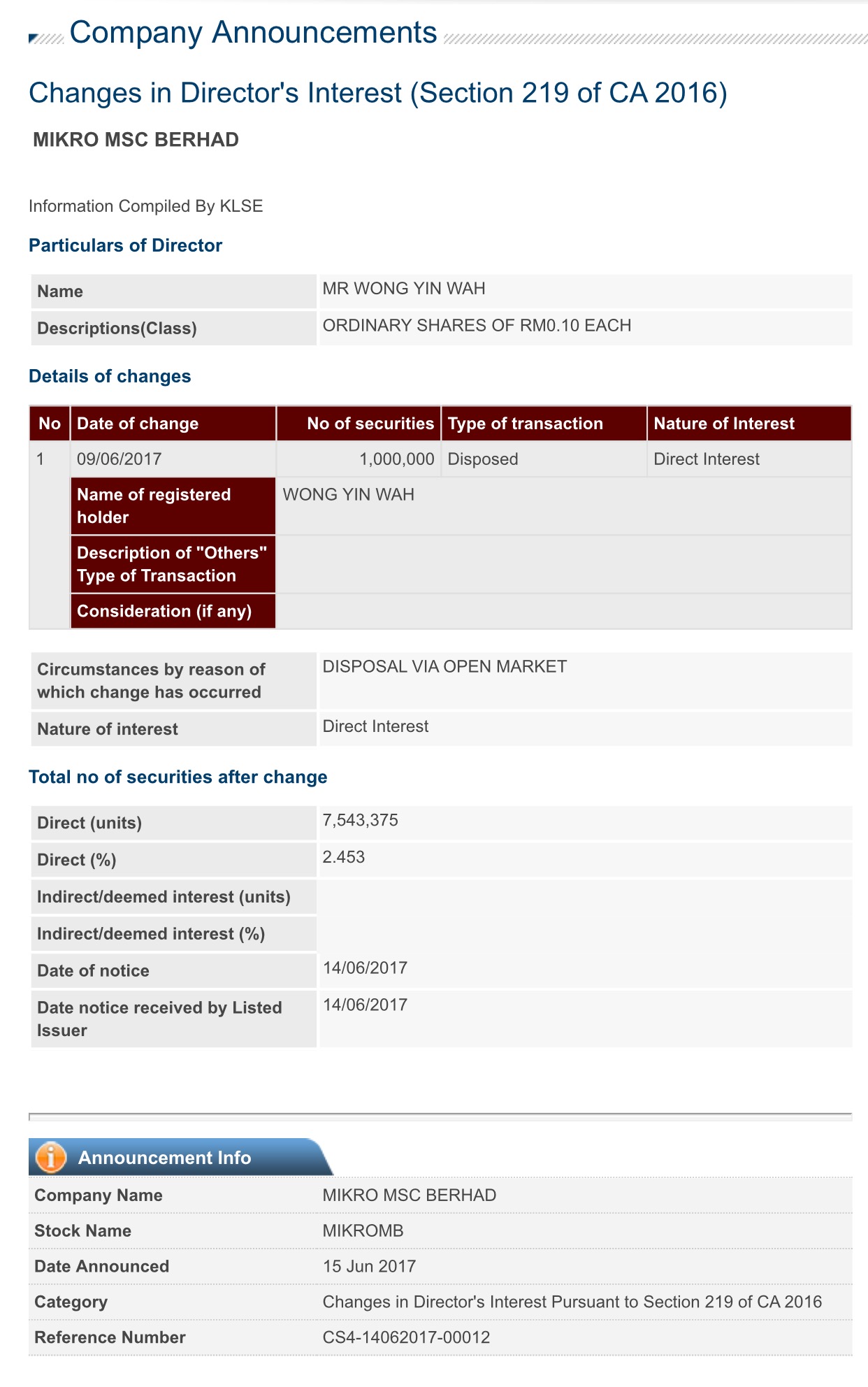

3) Insider selling by Director (1 million shares at $0.658 - price after bonus issue is 47 sen)

Disclaimer:

Please be informed that the information above is solely for the sharing purposes and does not constitute a buy or sell call.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

Brother please do you analysis deeper and more comprehensive la. Let me answer to your main concern:

1. Lower Revenue growth: 4.44% in first 9 month FYE 30 June 2017.

Do you know that they are almost at 100% of their capacity waiting for new

plant to be in place, which has a capacity of 2-5 times current?

2. Other factors like fluctuation in material costs & currency might affect Mikro MSC profitability

Go check whats is their gross profit margin, last i check it was 50%. If

material and currency going to affect them, 90% of Malaysian listed company can

close shop.

3. Insider selling by Director (1 million shares at $0.658 - price after bonus issue is 47 sen)

What are you talking about? He sold before bonus issue announcement.

Last would appreciate you do your analysis more diligently, all the answer above i can get it in under 5 minutes time. Good luck to you.

2017-08-04 14:35

optimusprimeXV

evil :)

2017-08-01 10:07