NEXT TREND : SEMICONDUCTOR

Yusofff

Publish date: Sat, 13 Apr 2024, 01:17 PM

Everyone including the fund manager don't want you to get on board before them on the next trend and investors are still wondering what is the next trend. Right. Happy to say we are on the right track which is the semiconductors. Many investors are skeptical and predicting we will only recover in the semiconductor sector in Q3 or Q4 2024. Yes you are right. But then do we wait till company show good result or should we head in first. We let data speak for itself.

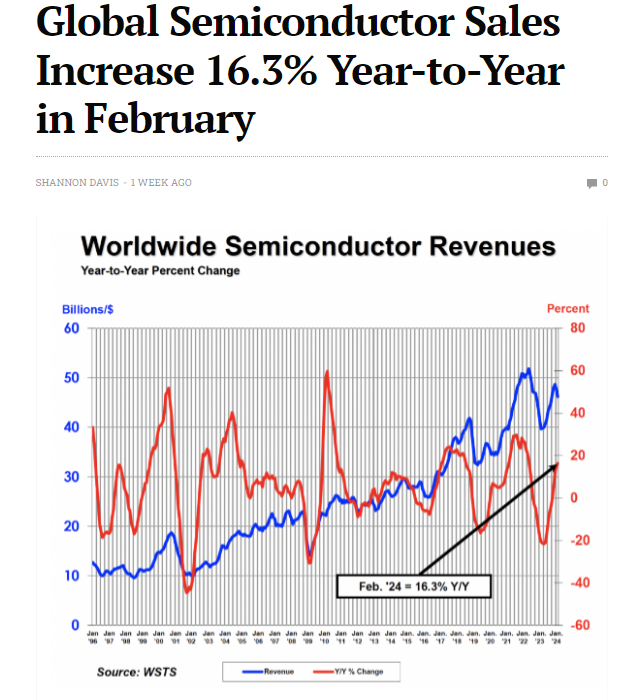

Chart 1

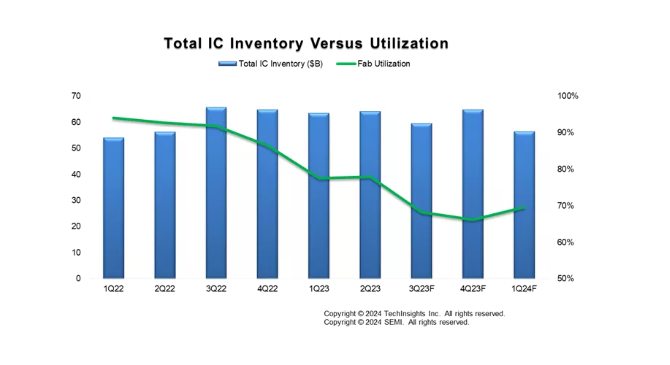

Chart 2 - Inventory has started to come down. We no longer facing oversupply situation.

There are many more data that shows semiconductor is just starting or have not even begin as not many investors are talking about it. Majority are more skeptical. In investing, to make money is to buy something when everyone is still skeptical.

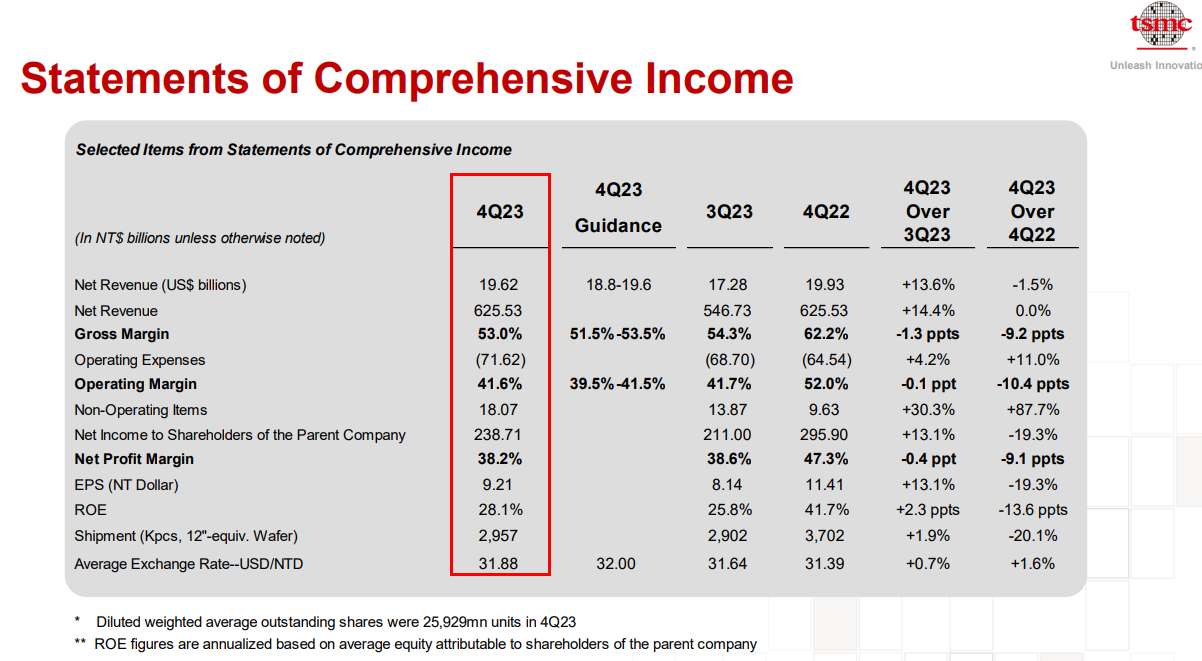

In most cases, the Design House and Foundry will be showing signs of recovery as we can see from TSMC results.

There is no doubt that Foundry is showing good sign of recovery. For malaysia it will follow suite by MI (material business), the fabrication companies such as Kobay and then OSAT (MI, Unisem).

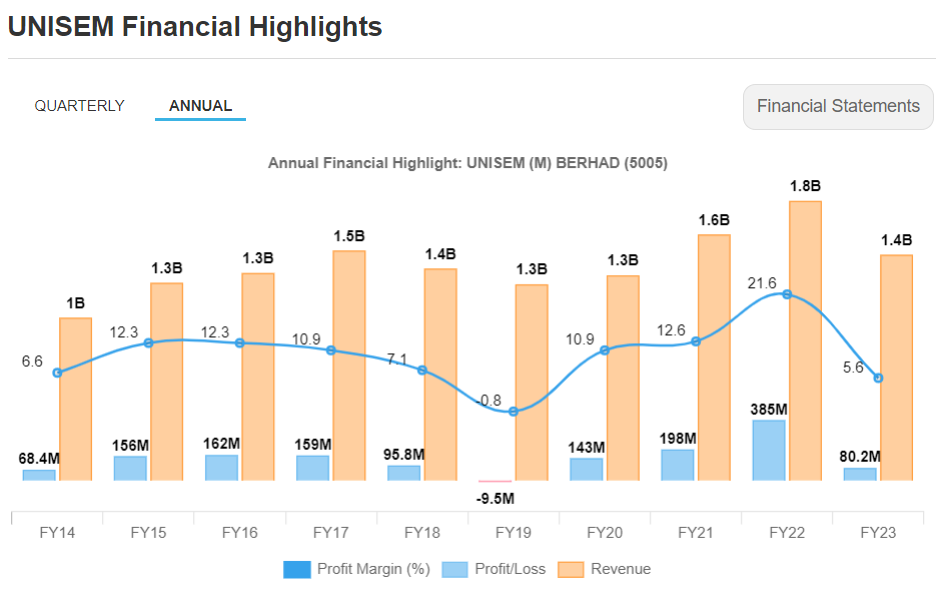

Hence, many are saying its expensive now. THink about it, what fund managers dont want you to know is the future profitability of the company. Unisem can be a multibagger. How? Take the annual profit of 385 millionn for instance, will it go back to the previous high? Answer is yes. They have expanded double their capacity last year and this does not take into account their doubling of capacity as well. Taking if semiconductor rebound, they head back to their previous high 385 million with 1.6 billion share cap, will give them a 0.24 cents EPS. Taking a conservative 25 to 30 PE, they should be trading at 6.50 to 7 bucks which is 70% increase from current price. Note, this is consider conservative without taking into account their expanded capacity. But however, many will still ask if they can go back to 385 million. The answer to this is simple, OSAT industry is under investment and 385 million is their max profit without taking into account the new capacity. So answer is why not.

Same goes to the rest of the semiconductor companies. Investors should start position some money into the semiconductor sector. Not at the ATE side. ATE side may take awhile.