Irrational Selling of INARI - by a Long Term Shareholder and Industry Players

AtristeBane

Publish date: Thu, 19 Dec 2019, 08:20 PM

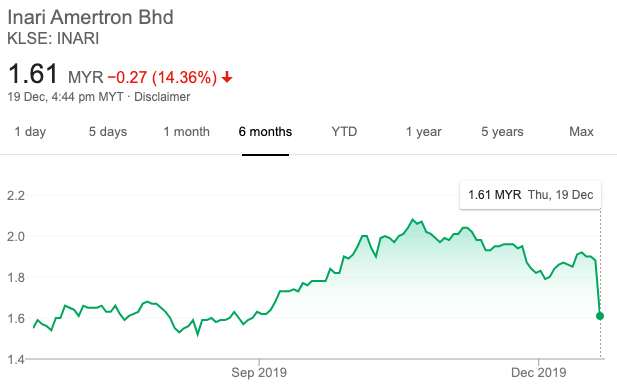

Today, Inari Ametron Berhad ("INARI")'s share price has fallen by 14.36% today, one of the heaviest selldowns in its history. After reading comments and opnions shared by the retail investors and bloggers, I realise most of them do not have in-depth knowledge and experience, in both: the Company, INARI itself and the industry. Information provided by them can be somehow misleading.

The objective for me to write this article is to share my personal views about the Company, INARI and the basis for the heavy selldown today. I, myself have bought INARI shares since 2013, during that time the company was known as Inari Berhad, before the completion of acquisition of Amertron INC Limited. Now, it is know as Inari Amertron Berhad.

I have been holding most of my shares from 2013 till now in 2019, despite the heavy selldown in 2018. It was and still is one of my substantial holdings. The objective of this article is NOT to recommend you to buy or to sell the shares, but to share my humble views about the Company wtih you. Since 2013, I have been keep in touch with some industry players and experts in the respective industry, that has broaden my knowledge about the Company and the industry landscape.

The Cause of Today Sell Down

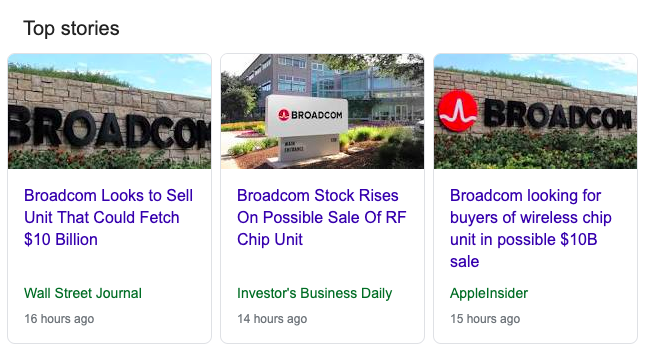

Several press releases have stated Broadcom on a possible sale of Radio Frequency ("RF") Chip Unit. Broadcom is one of the major customers of INARI. What would be the implications?

1. Broadcom Looks to Sell RF Chip Unit. It is a Possibility, Not a Confirmation.

Broadcom looks to sell the unit at $10 Billion. Broadcom is currently working with Credit Suisse Group AG to find a buyer for its RF unit. First, there is NO ready buyer. Second, a corporate exercise that involves M&A with value of more than $10B, it will take a long period of time, at least 6 months to 1 year for the legal and financial due diligence. And after all, the success rate of M&As is usually low.

Should there be NO DEAL for the sale on the RF Chip Unit by Broadcom, there is NO financial impact to INARI's business.

2. IF Broadcom has sold out its RF Chip Unit successfully, INARI might lose its Radio Frequency business as a Supplier?

First, INARI has proven its capabilities in RF throughout the years based on merit where INARI was awarded as Best Supplier (Best Contract Manufacturers) for 2010, 2015 and 2017.

Second, the Radio Frequency components are in an extremely high demand market, due to faster 5G adoption and potential high volume of 5G phone sales.

Third, there are limited OSAT service providers specialising in Radio Frequency with huge production capabilities. INARI's new plant ("P34") in Batu Kawan with a total floor space of 680,000 square feet was completed in May 2019. P34 is the biggest plant for INARI, in Block B - to cater for spillover RF testers in preparation for future 5G business.

Fourth, switching of OSAT supplier, especailly a Supplier (INARI) who was awarded as Best Supplier for a number of years is not a cost-effective decision, where it would cause a huge disruption to the supply chain.

3. Potential of More Orders to INARI, either from Existing or New Strategic Owner?

In 2020, we are expecting a faster 5G adoption and huge volume of 5G phones will be rolled out. Qualcomm Inc expects global smartphone makers to ship 450 million 5G handsets in 2021 and another 750 million in 2020, the world's largest supplier of mobile phone chips said.

Hope my sharing (combined with industry experts' views) would allow you to understand more about INARI and the industry landscape. Last but not least, while technology and semiconductor players such as Apple, Broadcom, Qualcomm and etc., their share prices are at all-time highs, I'm very optimistic with INARI's business prospects.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

T4Q Result ( EPS: 5.60, P/E: 30.37 )

Annualized Result ( EPS: 5.96, P/E: 28.52 )

this type of P/E is vulnerable!

2019-12-20 01:27

Fulfill 5G theme and investor is interpret with a wrong mindset, prepare to buy aggressively tomorrow. Broadcom is planning to sell off the RF chip unit is a high switching cost for the supplier. Indirectly, this will benefit Inari as their margin will turn higher.

2019-12-20 01:39

Huge risk : single customer. Some LT shareholders prob thought it was another pentamaster intraday rebound and prob bought for the rebound. Doesn't look good till 1.45 : Prob a punt at 1.45-1.50

2019-12-20 01:50

RETAILERS dont have so many lots to cause a sell down

on tis large cap stock. its the fund mgrs.

so u think u know better than them, wow

2019-12-20 05:45

Inari fully depend on Broadcom, without Broadcom Inari will be floating without direction. If you notice, all Inari new products also depend on broadcom to award to them. There are many hidden stuffs in most deal. New owner may not need Inari in long term.

2019-12-20 05:54

Inari is just a testing and packaging company that cater most of their services to Broadcom who owns the IP technology for the RF modules. In terms of market share, Broadcom is slightly a head of Qorvo. The fact that Inari is only concentrated on Broadcom instead of producing for other is most likely due to commercial conflict of interest protection imposed by Broadcom. In addition to that, Qorvo has no reason to sub their production modules out since they have their own production line. The only RF competitor to Broadcom that sub their production works to OSATs is Skyworks. But their market share is tiny relative to Qorvo and Broadcom.

If Qorvo buys Broadcom's RF business over, Qorvo will be the single largest marketshare. The likelihood US Antitrust will block that deal would be pretty high too since it reduces competition ( A good example is Broadcom take-over deal of Qualcomm). Plus Qorvo has no reason to buy over since Qorvo already have a strong footing in BAW filters.

Therefore my guess, the potential buyers will be down to either Skyworks or Apple.

If Skyworks buys over, Skyworks existing OSATs doesnt have the necessary capacity to absorb all Broadcom's order. And why would they disrupt and shift everything to them in the first place? Inari has the proven track record and cost effectiveness. Skyworks would be shooting themselves on the foot if they ever do that for causing disruptions. Instead, i think this could also be a blessing for Inari, as they can now even compete with Skywork's existing OSATs for their orders (= more orders).

If Apple buys over, i dont see why Apple need to boot Inari out, since Apple is a software based company, they will still need OSATs to produce for them. Apple has been working with Inari indirectly via Broadcom since the first Iphone. The longterm relationship and trust they build throughout this year all pens down to their capability and cost efficiencies. Assuming Apple is the new boss for the Broadcom's RF business, Inari will still be Apple's Preferred OSATs (another one will be ASE).

With 5G theme coming in play next year, i dont see why Inari should be shaken.

2019-12-20 13:04

@T4Q Result ( EPS: 5.60, P/E: 30.37 )

Annualized Result ( EPS: 5.96, P/E: 28.52 )

this type of P/E is vulnerable!

Many have actually done well...with this PE

Yes, I do believe in PE, However, a lot of people may even get conned if blindly buy based on PE... remember those China shoe company... MSPORTS, very low PE.. RIP.. XINQUAN.. very low PE... also RIP... so many people were trapped..

I am not saying low PE no good, Low PE company are normally very efficient company, very high profit margin from their revenue. However.. most of they time they already reach the limit of their efficiency... can't grow much already. The most they can do is to give you dividend. Every year will more or less report the same amount of profit and give you the same amount of dividend.

But high PE company, depends on why the PE is high. If high PE with shrinking revenue and asset, yes those are bad. BUT... high PE with high revenue growth and high asset growth, these are growth company with plenty of room to grow.

So basically it comes back to two things, dividend and capital appreciation. Usually the later is more tangible.

Of course I have many expensive shares with high PE in my collection like SERBA DINAMIK, Sime Darby Plantation, Sarawak Plantation, TaaNN, TM, Axiata, DiGi, MyeG, Greatec, CIMB, BIMB, KLCCP etc etc

Bottom line you need to be patience and focus on the end game. Inari does fits into the Government and Global master plan for Digital Economy. She is our potential 5G contributors.

Cheers!

2019-12-20 23:25

BEIJING (Reuters) - China will offer extra financial support to manufacturers next year, the banking and insurance regulator said on Friday, after a run of bond defaults by private firms in the sector.

blackchicken Cheap loans underpin China’s semiconductor sector: OECD

2019-12-21 11:45

since nothing concrete on RF sales yet,inari will still need to carry on to supply the demand and order

2019-12-21 17:52

Any political pressure for Broadcom to sell to ensure supply is cut off to Huawei?

2019-12-21 19:43

.png)

lizi

long term weakness of inari depending on single customer exposed now.

2019-12-19 21:02