AHB 年度财务审计报告 (转载) 其股价曾从IPO RM3.90 冲至 RM20,现在股价才RM0.19?

InvestFA

Publish date: Sat, 08 Aug 2015, 04:48 PM

从中得知到至2015年3月31日,该公司应收账款RM3,806,735迟迟未收回,但该公司管理层却认为该款项是可以收回的。然而,该会计师事务所指出该款项是否能收回纯粹取决于公司管理层的努力在于债务追讨与债务人谈判。

在 Statements of Financial Positions 中,可发现到 Fixed deposit with a licensed bank 显示出有RM1,017,100,按照 Note 12,银行利息为3.10%,一年利息收入为RM31,530.10。Cash and bank balances 从 RM961,795 增长至 RM1,460,714。(+51.87%)目前该公司现金流大增主要归功于之前配股及其盈利增长。

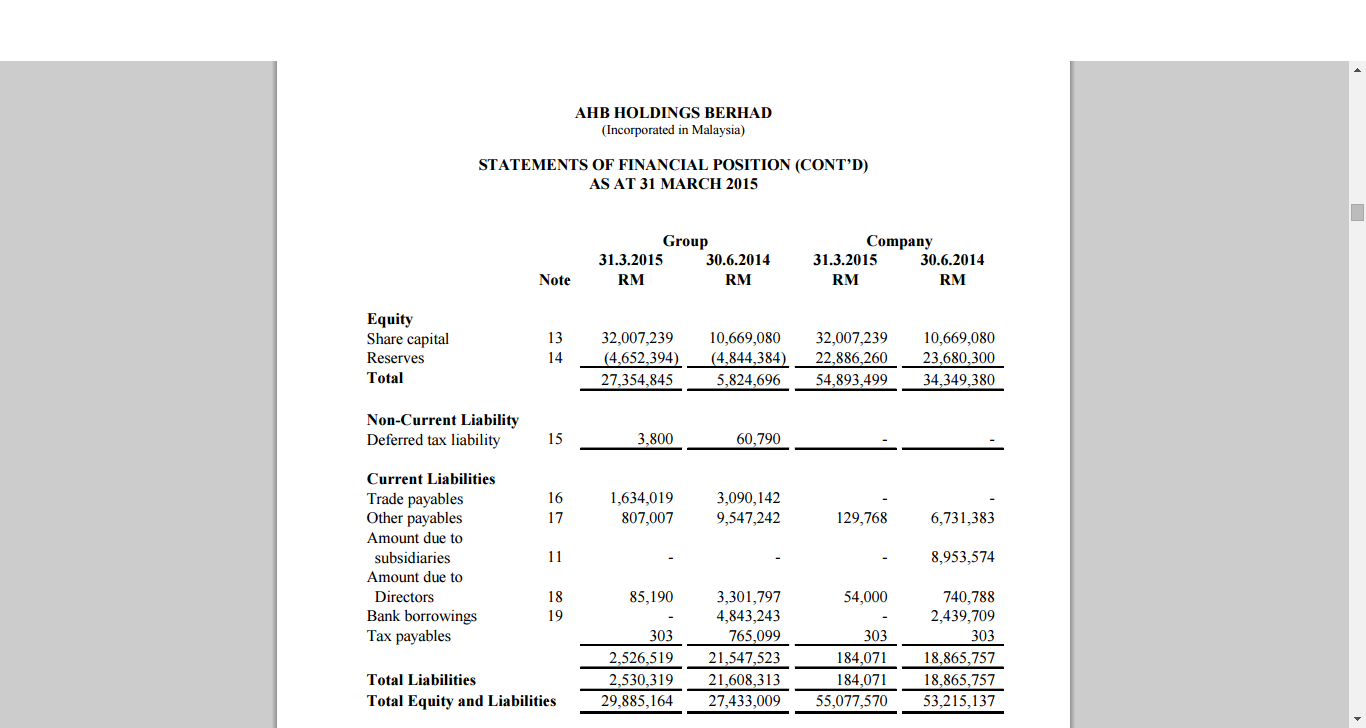

Total Liabilities 从2014年6月30日的RM 21,547,523 下降至RM 2,526,519。(-88.28%)自上次所发生的事件后,该公司管理层严管账目上的支出,保持着良好的现金流动性。(该事件个人曾在212楼提过。)

Profit for the financial period 从 RM 729,561 增至 RM 964,657。(+32.22%)

*2014年(整整12个月 Profit = RM 729,561)

*2015 年(整整9个月 Profit = RM 964,657)

试想如果再把剩下的三个月营收及净利算在内的话,Profit 将会是多少呢?

Finance Costs 也从去年的 RM 422,372下降至RM 58,579。(-86.13%) 主要原因是因为该公司已经还清银行贷款,直接间减少 Interest expense on: Term loans。

Revenue (1.7.2013 to 30.6.2014) = RM 13,468,296

Revenue (1.7.2014 to 31.3.2015) = RM 11,528,701 *(Nine months only)

Average revenue per month

(Last Year) RM 1,112,358 V.s (This Year) RM 1,280,967 Growth (+14.13%)

该公司进军外国上游市场,首个设定的目标为印度。该公司将在印度设立其办公室及陈列室,因AHB在当地已拥有相当稳定的业务及固定的国际客户群。接着,该公司将推出一系列新产品。之后,通过当地多名经销商合作,借此增加该公司的竞争力。

主要客户营收来自2个(2014: 2)客户总结为RM 9,391,312 (2014: RM 7,930,021) 贡献超过81%(2014: 59%)整个公司的营收。

Trade Receivables, Cash and bank balances denominated in USD,SGD。

*The Group has not entered into any derivative instruments for hedging or trading

purposes. However, the exposure to foreign currency risk is monitored from time to

time by management of the company.

Effect to profit or loss before taxiation

USD/RM Gain/(Loss)

-Strengthened 5% $353,854

-Weakened 5% ($353,854)

SGD/RM Gain/(Loss)

-Strengthened 5% $2,236

-Weakened 5% ($2,236)

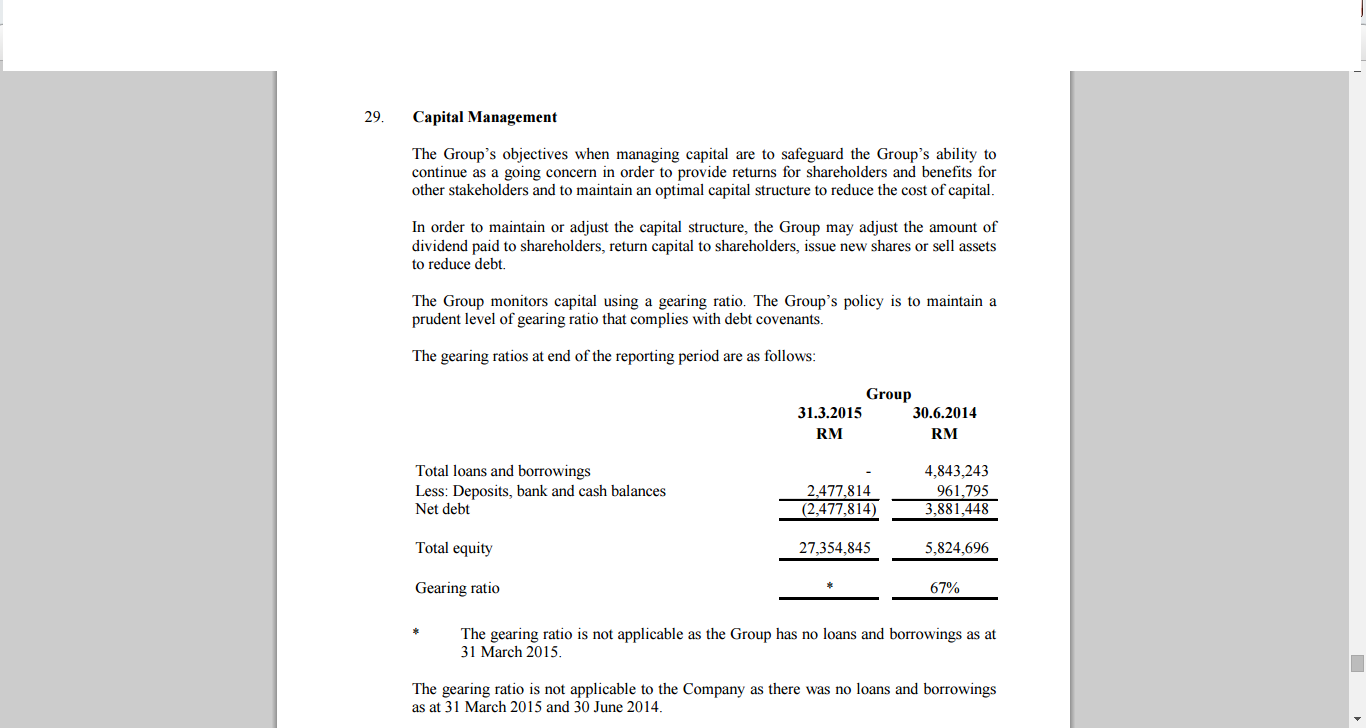

*Gearing ratio is not applicable to the Company as the Group has no loans and

borrowings as at 31 March 2015.

1 Jan 2015 USD/MYR 3.495 V.s 7 Aug 2015 USD/MYR 3.931 Profit Growth = ?%

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Share Investment Articles

Created by InvestFA | Mar 19, 2016