JCY (5161) If BIG Brother Does Well, So Should Little Brother

NickelLee

Publish date: Fri, 07 Jun 2024, 01:07 AM

If the share prices of Western Digital (WDC) and Seagate Technology (STX) on Nasdaq is doing well, there is no reason to think that share prices of JCY International (JCY) should do any lesser. The logic, simply because JCY's business well-being is highly corelated to its customers WDC and STX since they co-exist within the same value chain.

JCY being the up stream component manufacturer & part assembler whilst WDC and STX being the brand owner and downstream seller of the finished product (HDD & SSD). As much as WDC and STX are both very important customer of JCY, likewise JCY is an important component supplier to its customers. No-one should discount this business link.

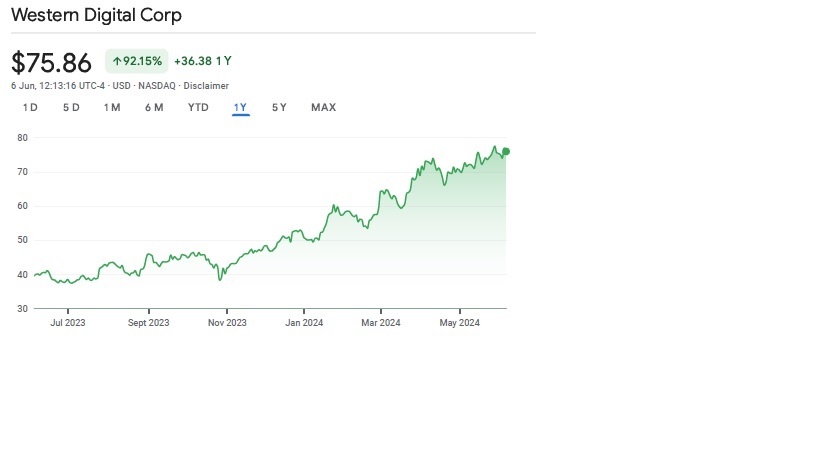

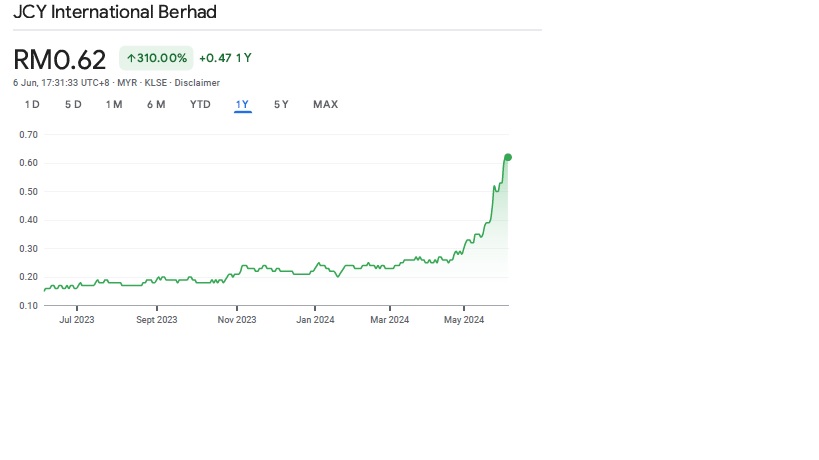

1-YEAR Share Price Performance

WDC.US (Western Digital) +91.45% - Lowest Price In The Last 10-Years Was ~USD30.00

STX.US (Seagate Technology) +62.08% - Share Price Never Really Collapsed. In The Last 10 Years, The Lowest Price was USD20.00 Never A Penny Stock

JCY.KL (JCY International) +310.0% (low base rock bottom effect). Isn't This The Beginning Of Recovery Or Share Price Too Aggressive In A Short Time?

JCY IPO Price was set at RM1.60 at a Market Cap of RM3.1bn when it was listed back in February 2010.

On a YTD basis, JCY has surged more than 3X from a low of RM0.15 (a year ago) on the back of big improvement in its last quarter results. Read Here:(https://tinyurl.com/3tkd2ep7). So the question is will JCY continue to outperform its customers and how?

My 2 Cents. Yes. JCY Will Continue to Outperform And This Is Only The Beginning .

How?

- Second half of 2024 results are expected to be better than First Half as confidently guided by management in their result review and commentary in May.

- Operational Leverage and Economies of Scale for JCY is Much Greater Than its Customers'. At slightly below 50% plant utilization rate, JCY is already clocked in RM5.34mn in net profit. Ask any production manager or factory owners that manufactures goods how important is it to get pass breakeven utilization rate. When utilization rate surpass breakeven level, profits can flow in exponentially with every improvement in utilization rate (also known as economies of scale).

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on JCY (5161) Another Multi-Bagger In The Data Center Theme

Created by NickelLee | May 23, 2024

[JCY 5161.KL] Another Multi-Bagger In The Data Center Theme

Discussions

Glove Superbull Vs DC (HDD & SSD) Superbull

glove bull was triggered by Coronavirus

lots of counter measure as this is bad

so Medical gloves

then sanitizer

then more gloves wanabees (bad as it leads to glut)

then China gloves (set up in just 6 months - no barrier to entry)

final straw - Vaccines

Vaccines like Atom bomb on Covid 19

So ended Glove bull

DC (HDD & SSD) Superbull now

Good for mankind and welcome by all

AI amplified Data Storage need

Take for example

A Tesla car (actually AI OPERATING AS A CAR)

TESLA CARS ARE SELF LEARNING ROBOTS

AS IT MOVES IT TAKES NOTES OF TRAFFIC, ROAD CONDITION, DISTANCE, LANDSCAPE CONTOURS, TIMING OF TRAFFIC LIGHT ETC ETC & ETC

THEN IT TRANSMITS DATA TO OTHER MILLIONS OF TESLA CARS ON THE ROAD CONCURRENTLY

AND MILLIONS OF ALL OTHER TESLA CARS ARE ALSO COLLECTING DATA INSTANTLY AND COMMUNICATE WITH OTHER AI (ARTIFICIAL INTELLIGENCE)

THIS EXPLOSIVE COLLECTION OF DATA BY THE TRILLIONS AND ZILLIONS MADE DELL CEO TO FORECAST THERE WILL BE A NEED FOR HDD BY 100X OR 10,000%

VERY GOOD FOR JCY, NOTION AND DUFU IN PARTICULAR

3 weeks ago

calvintaneng

hahaha so clever

now so many experts on Jcy

Clap!

Clap!!

Clap!!!

J - Jumping

C - Clapping

Y - Yelling

3 weeks ago