Finding value in Banks

Ricky Yeo

Publish date: Sun, 27 Dec 2015, 06:21 AM

For more writeup, go to here

The banking sector has been one of the worst performing sector (right behind O&G) this year.

Apart from Hong Leong & Public Bank, most of the big banks' share price have been decimated. RHB -18%, Ambank -34%, CIMB -18%, Maybank -9%.

Valuing a bank or any financial company is always harder than valuing a manufacturing company for example. The problem lies in the loan. Banks take your money in the form of savings, fixed deposits, pays you a minimal interest, and lend them out as loan at a higher rates. Car, housing, commercial, personal or insurance etc.

How 'healthy' a bank is, as in with minimal exposure to bad debt/non-performing loan, is always hard to measure even if you read the annual report 10x.

But the good news is, banks are a resilient bunch. Will Maybank exist in 10 years time? I am very sure it will. Public bank? You bet. Maybe there are some mergers here and there, but chances of collapsing is low.

One easy (but crude) way you can value a bank is by looking at its Price to Book Value (P/BV) ratio and Return on Equity (ROE).

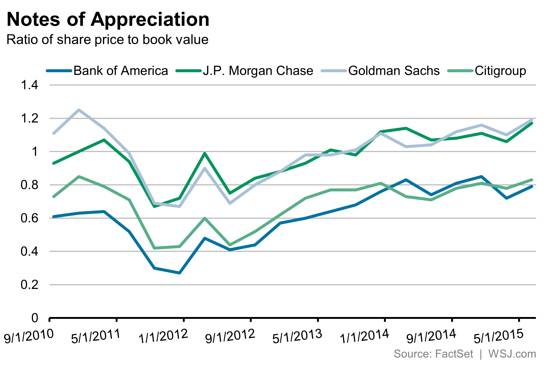

Back in 2009 GFC & 2012 Europe crisis, most US banks fell below the P/BV ratio of 1. For example, Bank of America fell all the way to just 0.2x of its book value (see chart). And subsequently all recovered. A few banks remain trading below book value at present.

Generally, P/BV is a good starting point. As a rule of thumb, P/BV of 1x is considered fair, below 1x is considered cheap and above 1x, expensive. But there is another thing you need to look at, which is the ROE level.

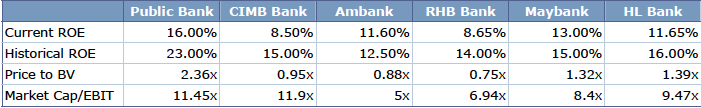

Public Bank's P/BV sits at 2.36x. That's expensive. But with an ROE of 16%-25%, you'll understand why it is expensive. Public bank is the king of banks in term of ROE.

The higher the ROE, the P/BV ratio will be higher, and vice versa.

Currently only CIMB, Ambank and RHB are trading below P/BV of 1x.

Another way to measure is using market cap to earnings before income tax (EBIT) multiples. Something like PE multiple. Public Bank has market cap of 71 billion, EBIT of 6.2 billion. Therefore investors are paying 11.45x (71/6.2) at current market price. Again, because PBB is a solid bank.

Public Bank

P/BV: 2.36

ROE: 16%

Market Cap/EBIT: 11.45x

PBB historical ROE is about 20-25%, down together with the industry but still one of the highest. Revenue & profit has continue to grow every year.

CIMB Bank

P/BV: 0.95x

ROE: 8-9%

Market Cap/EBIT: 11.9x

CIMB average historical ROE is around 15%, currently 8-9%. If ROE can recover to 15%, share price should follow. When? No one knows. Currently trading at slightly below book value. Their 11.9x is higher than PBB (11.45x) mainly because earnings has come down way faster than share price.

Ambank

P/BV: 0.88x

ROE: 11.6%

Market Cap/EBIT: 5x

Ambank average historical ROE is around 12-13%, currently at 11.6%, lower end of historical average. Lowest in P/BV after RHB. Market Cap/EBIT of 5x looks relatively cheap when compared to RHB & CIMB.

RHB Capital

P/BV: 0.75x

ROE: 8.65%

Market Cap/EBIT: 6.94x

RHB average historical ROE is around 14%, currently 8.65%. Has the lowest P/BV compare to other big banks. Market Cap to EBIT is relatively cheap too, right behind Ambank.

When ROE improve, P/BV ratio and EBIT multiple should increase as well. That applies to share price too. Of course price can rise too with a more positive sentiment even if ROE remain unchanged.

Conclusion

By measuring using P/BV, ROE level and EBIT multiples, you have some 'rulers' on hand and a sense of feel how the banks are fairing against one another. Should you buy? That's for you to answer. If you have other better stocks (higher upside lower downside) why bother with banks.

But right now, we are definitely seeing value starting to reappear in banking sector again.

braven

Appreciate your sharing. Thank you.

2016-01-16 21:58