An Analysis on Oka Corp

Ricky Yeo

Publish date: Fri, 11 Mar 2016, 05:30 PM

Introduction

OKA Corp came to my attention late last year when RHB release their top picks for 2016. I tend to ignore all these pick of the year stuff but a quick glance through its historical results piqued my interest about the company. Thus I decided to take a deeper look at the company and industry.

Background

OKA Corp started out as a company making sewage related precast concrete products such as precast concrete pipe, jacking pipe etc but has since expanded into other concrete products used for drainage, water and buildings related infrastructure works. Some of them are niche market such as precast jetties, staircase etc. Except for their ready-mixed concrete business, everything in their business involve precast concrete products catering to different subsectors within the infrastructure/construction industry.

Their main business or majority of their products caters to drainage and sewage related works, both which falls under infrastructure where clients can be a mixture of government and private. But mainly private as government tend to award infrastructure projects to contracters/construction companies.

OKA does publish a list of projects that they have taken over the years and a quick glance through over 60-70% projects are related to highways and townships with the remaining from projects like airport, light rails, ports. So I am fairly confident the bulk of their business remains in drainage and sewage with remaining from building construction and others.

They have factories located at Batu Gajah (Perak), Senai (Johor), Nilai (NS), Gambang (Pahang) and Sungai Petani at Kedah.

Precast concrete

Precast concrete is just a process of putting cement into a mold and turn it into the shape you want before delivering it to the site. Which is opposite to pouring concrete on site. Precast concrete isn't something new and this manufacturing process has many benefits from cost savings, environmental friendly, better/consistent quality to quicker installation, durability etc.

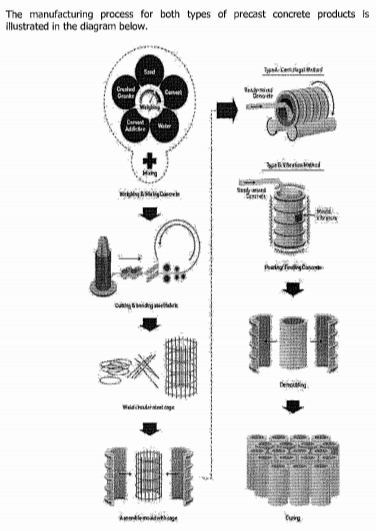

Courtesy of Chin Hin IPO Prospectus

Basically the process involve cement weighting and mixing sand, aggregrates into the mixer together with water; reinforcement cage steel bar fitted into mould; pour concrete in; some are done in a spinning machine; curing process begins; demoulding; concrete is cured for 7 days; mould is cleaned, oiled and ready for next casting.

Industry

It is a very boring industry. We will start with precast concrete industry in general before talking more about precast concrete in sewage/drainage sector as this is where they mostly compete in.

In general the whole precast concrete industry is very fragmented. You have hundreds of these companies littered all over Malaysia. Most of them private, family-owned while a few larger ones are listed in Bursa such as Hume Industries, which belongs to Hong Leong Group. There are no brand awareness. People don't say "I only want OKA manhole'. The industry mostly compete on cost. When you check out OKA's income statement, cost of goods sold take up 80-90% of the revenue.

Normally the raw materials that goes into making precast concrete are things like steel, sands, cement, cement additives and aggregrates etc. So raw material, energy (electricity) and manpower pretty much make up almost all of the cost. Any increase on raw material cost will have a significant impact on profit margin.

All precast concrete products, be it for general building construction or for drainage/sewage have to meet certain requirements and qualification from engineering and quality (ISO) point of view to ensure durability and reliability. For example, cement additives, a type of coating are commonly added to concrete pipe used for sewage to prevent corrosion. As we consume more meat and beers, our discharge becomes more and more acidic. As with all kind of infrastructure products, longevity is the key, longevity = low maintenance = lower cost, not how beautiful it looks.

One interesting characteristic about this industry lies in the product itself. Take precast concrete pipe, the main product for OKA used in drain or sewage. The smallest pipe starts at 33cm in diameter, roughly the size of a tyre, that's 280kg each. The biggest one reaches 182cm in diameter, the height of a man, and that easily weight 8150kg each = 6 Toyota Camry.

Precast concrete is similar to cement in that they have a low value to weight ratio. They are so heavy yet low in value. In contrast, diamond has a high value to weight ratio. Precast concrete is extremely heavy and cheap that it is uneconomical to transport it over a long distance. So you will never see someone ship concrete overseas.

So when you look at the industry in Malaysia, it is not one market; but many mini-markets. Unlike gloves where you can produce it in JB and ship it everywhere around the world, a concrete pipe manufactured in Seberang Prai can only cater to the mini market within that area of about 100km radius because the cost of transporting is too high.

A precast concrete company with factory in Seremban does not compete with another company that has their factory located at Ipoh. When you subdivide the whole Malaysia into many mini markets of 100km radius each, that is how precast concrete manufacturers compete. So it doesn't make sense for a precast concrete manufacturer to centralized their manufacturing in one location, unless there are demand in that area to meet it. Now you'll understand why OKA has 5 factories spreading all over the peninsula. It is part-nature of the product and part-decentralization strategy for the company.

And it makes sense for construction companies too. If you are a contracter building a highway in klang valley, you will prefer to have a supplier that can deliver on short notice and on time to the construction site. That reduce delay and in construction, every hour counts. Even if you are able to find a factory 300km away that offer you a cheaper price after factoring in all the transportation cost, it is still uneconomical for the project as a whole.

In Malaysia, anything related to water is governed by SPAN, aka Suruhanjaya Perkhidmatan Air Negara or National Water Services Commission. That include drainage and sewage.

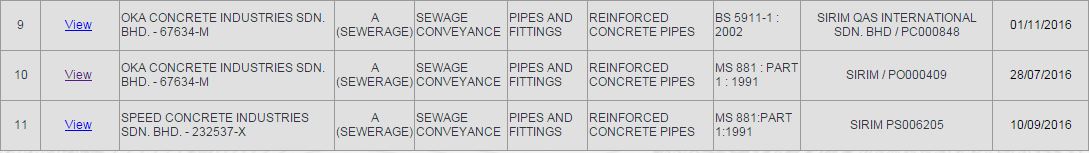

As mentioned when it comes to sewerage products the quality control is more stringent because you are dealing with all kinds of chemical discharge from household, commercial to industrial that has a higher potential of corroding the pipes. In SPAN website, there are only 7 companies that are listed as Category A sewerage suppliers under Reinforced Concrete Pipes.

Amongst them Hume Industries is the largest. As some may aware Hume Industries was previously called Narra Industries but has since changed their name after acquiring Hume, which made all precast concrete products. Aliansa Sdn Bhd is a company located at Johor, don't have much info about it, privately owned. Alliance Precast Industries is also privately owned, factories located at Rawang, Johor, Terrengannu and Ulu Yam (Kelantan); E-Rete a private company from Ipoh; G-Cast is the subsidiary of Chin Hin which was listed on Bursa recently, a relatively young subsidiary in precast concrete. And lastly, Speed Concrete Industries with their factories around Selangor, Kuantan and Kluang.

I am not sure how hard it is to become a Category A sewerage supplier but 7 companies supplying sewarage products all over Malaysia does seems a bit little. But of course keep in mind that there are a lot other suppliers that supply sewerage pipe in other type of materials from steel, clay, PVC to cast iron. But basically these 6 companies are the main competitors of OKA in concrete pipes category. Let's have a look at the war map below.

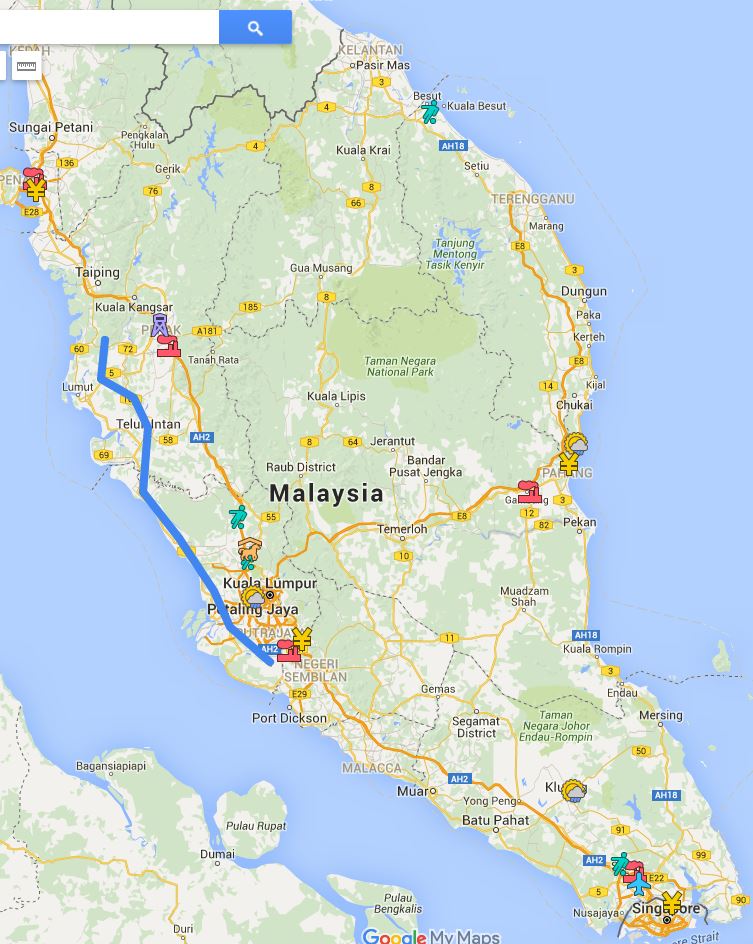

Red Factory - Oka Corp | Japanese Yen - Hume Industries | Purple Rig - E-Rete | Soccer Player - Alliance Precast | Airplane - Aliansa Sdn Bhd | Sunny Rainy - Speed Concrete | Gold Horse - G-Cast

Most of the factories are situated around Selangor and Johor area as that's where most of the demands are. Most factories are typically locate on the outskirt of a city as the cost of land is cheaper. Factories require a huge piece of lands mainly for production and inventory these huge concrete products, which takes up a massive space. When you compare all of them, basically it is only OKA and Hume Industries that have factories to take advantage of infrastructure projects across the whole peninsula.

West Coast Expressway WCE

The blue line is the 223km West Coast Expressway (WCE). Not the precise route but it starts at Banting Selangor and runs all the way up to Taiping Perak. It is also the main investment thesis for RHB Research when they pick Oka as the main beneficiary for this project. And it is not hard to see why. There are quite a few suppliers to cater for the lower half of the expressway covering Selangor territory but as for the upper Perak section, it is only OKA and E-Rete that have factories located there. With the expressway spanning just over 200km from one end to another, you have virtually 2 mini markets there.

Based on WCE website, the current progress of the project is about 14.62% as of Dec 2015 with completion date set at 2018. I have no doubt OKA will benefit from this project but how big will the contribution be to the bottom line, that is something hard to find out.

And then again, WCE is just one of the big project. We'll still need to examine the long term competitiveness of OKA.

Supplier forces

Suppliers for the industry are mainly companies manufacturing cement, steel, aggregrates, additives and machineries. As these materials are commodities and abundance, I don't see there's any pricing control from any supplier. However since raw materials comprise a large chunk of the operating cost, company like OKA is very sensitive to any changes to the prices of these materials.

Buyers forces

Buyers are mainly construction companies, property developers or building contractors. This can be a main concern. While most property developers have a profit margin from mid to high teens, most construction companies' margin tend to be razor thin, typically 10% or below. And in an industry selling commodities like concrete to large buyers, there will be a constant pressure to keep the cost low because selling price is pretty much dictated by market forces.

This could also be part of the reason why OKA has been pushing into other niche products that carries higher margin such as precast jetties and trying to be more innovative by coming up with new products. Below their margin has improved remarkably from low single digit to above 10%.

Substitutes

This is a tricky one. I wanted to say based on the industry standard, concrete seems to be the default. But nonetheless there are substitutes. During my research I came across many western countries using vitrified clay pipe for sewage citing it can last longer (up to 100 years) than concrete but unsure why Malaysia use concrete instead of VC. Anyway the chance of substitute is low as it is governed by SPAN.

Barrier of entry

The only few potential barriers that can slow down new entrant in the short/medium term is high capital investment (Land + factory), establishing reputation (supplier-client relationship) and getting certified by SPAN. In the long term, there's none. You can just simply acquire an existing manufacturer that has all 3 of the above to gain a foothold in this industry.

In saying that, OKA does invest in R&D and some of their products are patented as well, such as 'Box-Pile' retaining wall system but how big the edge is I am not too sure. And again, at the end of the day, it all comes down to cost advantage. If OKA has a unique manufacturing process that can lower their cost in the long term, they probably have a clear edge compare to new entrants or other competitors. But that is something I won't know unless I visit the plant. And from the numbers comparison with Hume, it is more or less on par with Hume.

Intensity of rivalry

OKA has mentioned a few times over the years in their annual reports that they always face aggressive pricing pressure from competitors and considered that cost advantage pretty much determine the survival of these companies, it is reasonable to assume competition is high.

That is another reason they are focusing a lot to lower cost and invest in new and innovative products that can differentiate themselves and carries a higher margin.

Whether they can continue to improve profitability in the face of aggressive competition remains uncertain. The positive sign is they are investing in R&D to add more value for their customers.

Financial Statements

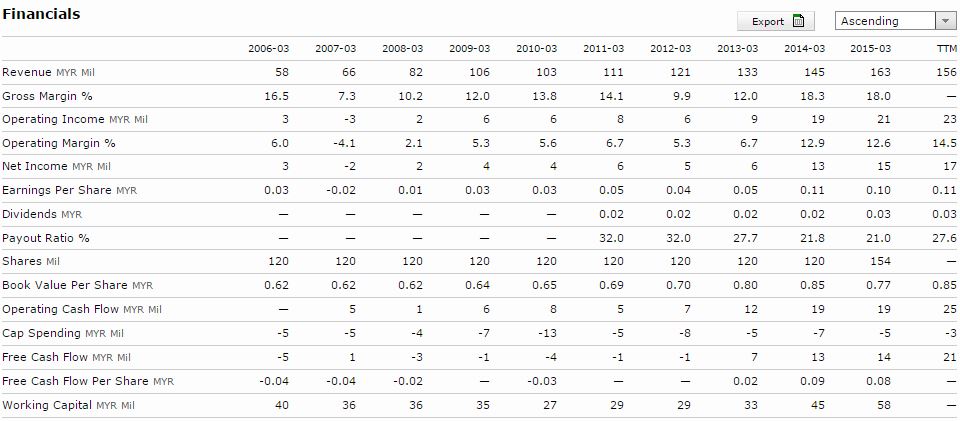

When you look at the key ratios, OKA has grown their sales from 56 mil 10 years ago to 163 mil last year, quite a good record. Gross margin has largely remain the same at around 16-18%. So what has contributed to the net margin improvement from 5% to 9% is not really because of top line margin improvement but because of non-operating expenses aka SG&A has gone down from 10% to 6%.

As you know financial leverage x asset turnover x profit margin = ROE. The increase in asset turnover (0.66x to 1.09x) and profit margin (5.23% to 9.16%) both contributed to push ROE from 4.1% to 12.93%. My take is that from here onwards ROE expansion will be slow unless gross margin improves (SG&A can't go down forever). As for asset turnover, it is hard to tell where is the limit but growth in revenue will ultimately hit a ceiling if assets doesnt grow.

Another key observation is on the capital spending or capex. OKA has been consistently spending 5-7 mil a year over the past 10 years. When you compare that to operating cash flow, they are spending heavily from 2006 - 2012 period with negative FCF almost every year, and from 2013 onwards they started to slow down on growth capex and at the same time their prior investments begin to bear fruit, causing operating cash flow and FCF to balloon.

Borrowings paint a similar picture too. Financial leverage went from 1.19x to 1.5x during 06-12 period to fund capex & operations but now with cash flushing in they are sitting on net cash of 17 mil.

Valuation

There are several ways to value OKA and we will use a number of them hopefully we can get a feel how much the whole company is worth.

Peer comparison & Multiples

Hume Ind

P/B: 3.18x

P/E: 20.65x

EV/EBIT: 20.61x

OKA

P/B: 1.12x

P/E: 8.64x

EV/EBIT: 6.45x

EV/FCF: 10x

Hume Ind is the perfect candidate to match and also the only competitor to list on bursa. I don't think we can get much information from the multiples above other than Hume Ind is trading at an extremely rich valuation compare to OKA.

Hume's ROE is higher than OKA at 17% TTM but that's mainly because of financial leverage of over 3x.

OKA's current EV/EBIT is very likely to fall to around 5x and EV/FCF to 6x once the 4th quarter results come in.

DCF

Over the past 10 years, OKA invested a total of 64 mil in capex. Compare that to operating cash flow of 82 mil, that is 82% reinvestment. Which is extremely high when on average most manufacturing companies only allocate 20-30% of operating cash flow onto capex annually.

And I think there is reasons to believe that going forward capex is likely to stay at depreciation level of around 6 mil or less while operating cash flow can continue to grow due to heavy capex in earlier years. OKA's latest 3rd quarter report showed only 1.8 mil invested for capex so far with operating cash flow coming in at 17 mil. FCF is likely to hit 20 mil on the final quarter.

And looking at the working capital growth and asset turnover, OKA does not look like a very capital intensive business, so a 25% reinvestment should be adequate to grow the business. If OKA can maintain ROE 12%, with a dividend payout ratio of 20%, expected growth rate will be 9.6%.

Bull case scenario

This scenario assume OKA manage to increase market share & sales volume while maintain margin. But on the other side increase in volume also results in an increase on capex.

Revenue growth = 12% (Year 1-5), 8% (Year 6-10), 3% (Terminal)

Operating margin: 12%

Capex: 35% of operating cash flow

Cost of Capital: 10%

Estimated value/share: $1.48

Status quo scenario

This scenario assume everything would remain the same aka extrapolate.

Revenue growth = 9.5% (Year 1-5), 5% (Year 6-10), 3% (Terminal)

Operating margin: 12%

Capex: 25% of Operating cash flow

Cost of Capital: 10%

Estimated value/share: $1.34

Bear case scenario

In this scenario OKA's attempt to push for market share & sales volume causes capex to increase but failed to grow revenue, at the same time margin falls.

Revenue growth = 8% (Year 1-5), 3% (Year 6-10), 1% (Terminal)

Operating margin: 9%

Capex: 35% of Operating cash flow

Cost of Capital: 10%

Estimated value/share: $0.85

Using the 3 scenarios above, multiples, book value as anchor and qualitative informaion like their business model and industry dynamic, we can sort of establish a value range from $0.85 - $1.60 with $1.20 being the mid point. If you have a scale of 0-10 with 0 being overly undervalued, 5 fairly valued and 10 as way overvalued, I think you can put OKA at around 3.5-4. Not ridiculously undervalued but definitely looks cheap at present.

Conclusion

From the business point of view, it is relatively hard to find a moat for OKA. As the nature of the business where cost rules, OKA can only increase profitability mostly through lowering cost and increasing sales volume but not sales price. There's no doubt the management has done a great job in running the operation efficiently and focus a lot on cost control. And that has contribute to the success of margin expansion and asset turnover growth.

In 2015 annual report, the management has emphasized that their intention to increase sales volume from taking a bigger market share, which will definitely require them to price their products more aggressively. Will that come at a cost of lower profit margin or will more cost control support current margin? Maybe better product mix that boost top line growth? These are things we have to think about.

In the short term, there are several tailwinds for OKA. Multiple infrastructure/construction projects such as WCE will definitely improve their business over the next few years. Free cash flow should started to grow robustly as they slow down on capex. Of course this is on the assumption that margin doesn't fall.

In the long term, the focus will be on ROE, capex and FCF. OKA's share price has risen substantially due to the growth in ROE and I believe going forward it will remain the key ratio for PE expansion and the catalyst for price as well. Given the current price of $0.95, I think the downside risk is capped while the upside potential looks promising but nothing exponential. You won't see any leap.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Intelligent Investing

Discussions

Good writing n good analysis.thank so much n you should conduct a class.

2016-03-11 20:20

Hi JT Yeo, I apology for calling you something bad & now have deleted my previous comments related to you.

2016-03-11 22:34

A very detail presentation...something that you can rarely find people coming up with. Keep up the good - hard work JT Yeo..

Not gone through in detail...but I am quite curious on the initial growth rate of 8% basis...need to check & compare with my own derivations when I have time..

(small comment:..for laymans like me...the current PE together with the clearly visible near future expected EPS changes...always makes the message simple , strong and easier to grasp!... :))

2016-03-11 22:38

Where can compare homeriz with oka? Both is totally differences industry. Homeriz is a furniture company. Dont misslead people again. Please compare using a same industry.

2016-03-13 16:41

One more thing, when u start to speculative about shares? Management say wan to increase then increase? Any plan? Any fixed assets bought? Any project added? What is the order book? Currently world economy is not good. Wan to incresse then increased?

2016-03-13 16:44

Excellent analysis and well written report.

Just a small question,

"OKA's current EV/EBIT is very likely to fall to around 5x and EV/FCF to 6x once the 4th quarter results come in"

That FCF here mentioned above, is it FCFE or FCFF?

2016-03-13 21:17

wchong JT Yeo, may i know how you get the table of the financial and key ratio?

15/03/2016 13:15

I believe its from Morningstar.

2016-03-15 16:51

Dayummmmm, what a well researched report. I need to learn from you

pingdan, are you confusing homeriz with hume?

2016-03-15 17:48

hi Ricky Yeo, based on The Edge magazine publish article title 'CMS the big winner in Pan Borneo Highway Project' on Jan 18, 2016 stated that about 50% of the highway cost could be for material cost.

http://paultan.org/2016/01/27/banting-taiping-west-coast-expressway-5-complete/ WCE construction cost about RM5B. Assume 50% for material cost, RM2.5B and assume 5% net profit margin, it will be RM125M.

How much net profit for precast concrete player? i have no idea

2016-06-28 11:02

piggybank

Well written!

2016-03-11 17:49