AGESON BERHAD – A Closer Step to be the Next Property Giant

KayElleGuy

Publish date: Sat, 01 Oct 2022, 10:14 AM

Dated 28th of October 2022, AGESON BERHAD or “AGES” had an announcement whereby a MOU was signed between Solidvest Properties Sdn Bhd or known as “Solidvest” and Koperasi Belia Nasional Berhad or known as “Kobena” for a sale of land.

Solidvest is an indirect 99% owned subsidiary for AGES.

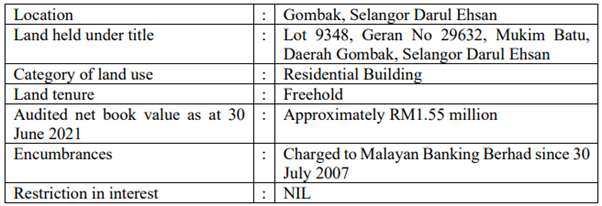

Particulars of the said land to be sold.

Under the MOU, AGES will sell a piece of land measuring 9.325 aces at the said location for a total purchase consideration of RM35.0 million. However, there are more terms under the MOU.

1.

Due to Solidvest’s solid track record in the field of property development, the GLC-Kobena has intended to appoint Solidvest as the developer to plan, develop, complete and procure potential purchasers for the said development.

2.

The development is expected to be parcelled into 56 units of semi- detached houses, 4 units of bungalows, 1 unit of pump house and suction tank and 1 unit of electrical substation.

3.

In fact, Solidvest had already acquired the planning permission plan from Majlis Perbandaran Selayang since 22nd of July 2019.

4.

The GDV of the development is expected to be RM95.2 million where the GDC is expected to be RM41.2 million, in which the costs will be financed by an established property developer from China, ShuangLing Holdings Ltd. According to a preliminary fact check, the registered capital of ShuangLing Holdings Ltd. is approximately USD50.0 million.

5.

The development is expected to be completed within two (2) years since the commencement of the development.

Details pertaining to ShuangLing Holdings Ltd: https://www.qixin.com/company/371c9377-4929-4b02-a68c-d80317dcc58e

It is important to highlight that AGES will be benefitting twice under the said proposal. For starter, the company will be able to convert the said asset into RM35.0 million in cash as a stash in their war chest. Next, under the MOU, AGES is entitled for profit under the development where the costs of development had already been financed by ShuangLing Holdings Ltd.

This will result in two (2) times in cash flow and profit generation for AGES as the net book value of the land bank is only RM1.55 million under their balance sheet.

Prior to the MOU, AGES is already enjoying healthy margins under their construction and property development arm despite having a minor hiccup in their Q1 results. With the support of GLC and the established China developer, the project is expected to kick off within 3 months which will be reflected in the upcoming financial year.

Certainly, AGES is once again one step closer to becoming the next major property developer in Malaysia.

More articles on KLSE Money Maker

Created by KayElleGuy | Oct 22, 2022

Created by KayElleGuy | Oct 17, 2022

A Safe Investment Haven Amidst The Chaos

Created by KayElleGuy | Oct 01, 2022

BLee

Answer to latest queries at:

https://www.klsescreener.com/v2/announcements/view/3617441

One new info from the queries and the answer:

"8. In addition to the profit guarantee of RM10 million, please clarify and state whether Kobena will be entitled to any profit sharing from the Proposed Development.

Ans: Kobena will not be entitled to any profit sharing from the Proposed Development apart from the profit guarantee of RM10 million."

2022-10-01 15:28