Malaysia Stock Analysis – Yinson (7293)

LouisYap

Publish date: Wed, 16 Oct 2019, 02:34 PM

Malaysia Stock Analysis – Yinson (7293)

Yinson is the 6th largest Floating, Production, Storage and Offloading (FPSO & FSO) service provider in the world.

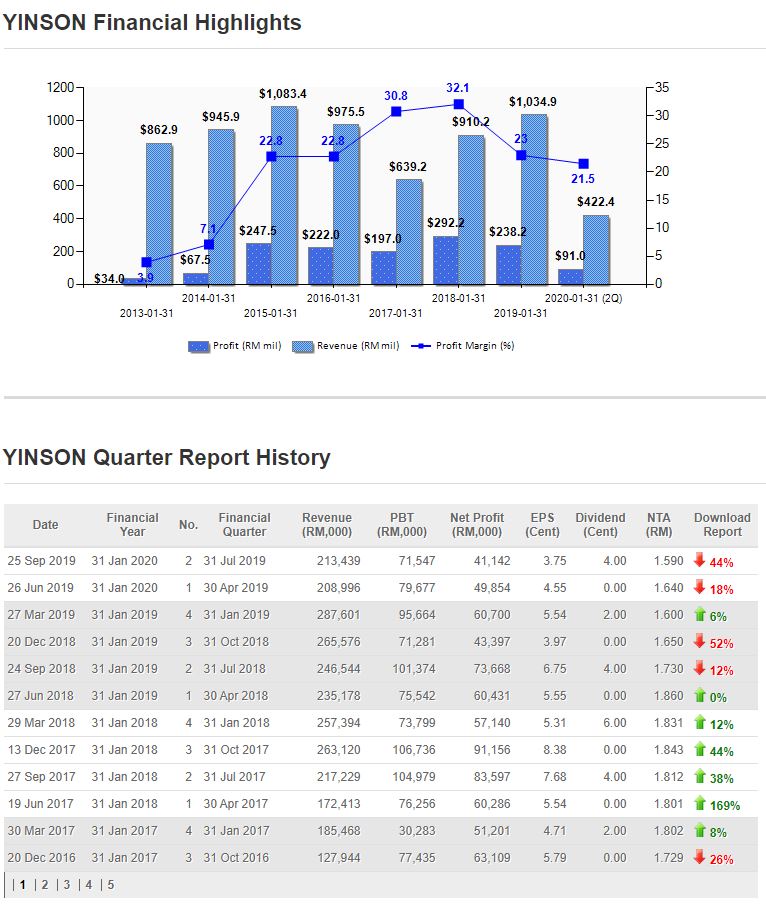

The company's adjusted turnover in fiscal year 2019 increased by 10.1%. The company's adjusted EBITDA (interest, tax, loss and profit before depreciation) increased by 9.1% in FY 2019.

The adjusted after-tax profit of the company's fiscal year 2019 fell by 14.4%, mainly due to the decline in the Utilisation rate of Vietnamese joint venture assets and the increase in the cost of the entire year.

The increase in costs is due to the company's perceived improvement in the oil and gas market, the company's increased resources (manpower and systems) to meet the market, and the company's borrowing more funds to prepare, so interest costs have also increased.

The company's adjusted EBITDA margin is 75.1%, asset-liability ratio 0.5 times, leverage 2.1 times and solvency 4.5 times. Yinson do not have problem in repaying interest.

The dividends paid by the company have decreased, because the company needs funds to prepare for future business opportunity.

Although the company is the sixth largest FPSO contractor in the world, the company's ambition is not to be the world's largest FPSO contractor, but the world's most profitable FPSO contractor, which they have achieved. The company's FPSO usage rate is close to 100%.

In February 2019, the company signed an agreement with Sumitomo Corporation to form a joint venture to provide FPSO services to Brazil (Yinsonji successfully participated in the bidding contract).

The company also received a $151.70 FPSO engineering contract from FIRST E&P. With this contract, Yinson's FPSO work will not be interrupted.

In June 2019, Addaz (Yinson's client) extended the FPSO's engineering contract for four years (starting on October 17, 2019). In the same month, PTSC extended the lease of FPSO for one month to July 31, 2019.

The company's engineering contract value is approximately $4.94 bil. The longest contract period is June 2032 (there is an opportunity to extend for another 5 years), and the remaining average contract period is 2025, with an opportunity to extend for 10 years.

In addition, Yinson's engineering contract have little impact from oil price fluctuations. Assuming the oil price falls, Yinson's contract will receive the minimum compensation, which is enough to cover the operating cost and the price of the contract to rent tanker.

Customers bear the risk of oil price falling. On the contrary, assuming the oil price starts, the company's contract still have room to rise.

Q&A During AGM:

1) Q: The company will enter the Brazilian market and focus on bidding for three large projects. In addition, the company also spent a lot of effort to bid for Aker Energy’s Pecan project in Ghana. What is the company's outlook for the Brazilian and Ghana markets?

1) A: Brazil is the largest country in the FPSO market, with 30-35% of the existing FPSOs there. If you see that we spend money on expansion in Brazil, we know that there are not many companies eligible to participate in these large-scale bidding. The latest news announces that there are no more than three remaining bidders. Brazil has the pipeline needed for FPSO work, and Petrobras is already a stable customer of this business, so we put the goal here.

As for Ghana, we are only involved in a bid. We already have an FPSO (ENI) over there, we will bid because we are already familiar with it, and if there is one FPSO in Ghana, it will bring synergy in operation. Ghana is in the heart of Africa and is our core area.

2) Q: With the existing engineering contract value of 4.9 bil USD, does the company expect future turnover and profitability to increase?

2) A: Our turnover will increase in the four quarters of the 2020 fiscal year, and the profit will increase, but the profit rate should be maintained.

3) Q: Many other Malaysian oil and gas companies have also obtained many engineering contracts, but their profitability has declined. Do you expect Yinson's profitability to decline?

3) A: Different oil and gas companies have different business models, and we are doing very well in this regard. Six years ago, there were about six FPSO contractors, but now there are no more than three. We get the majority of our customers, not because the demand has increased, but because the supply has decreased. And now banks are very cautious about lending to oil and gas companies. They only give companies that have good execution capabilities and have engineering contracts in hand. We have a very strong position in the FPSO.

Louis Yap

Facebook:

https://www.facebook.com/louisinvestment/

Web Site:

https://www.wealtharchitect2u.com/

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

YINSON2024-11-22

YINSON2024-11-22

YINSON2024-11-22

YINSON2024-11-21

YINSON2024-11-21

YINSON2024-11-21

YINSON2024-11-20

YINSON2024-11-20

YINSON2024-11-20

YINSON2024-11-20

YINSON2024-11-19

YINSON2024-11-19

YINSON2024-11-19

YINSON2024-11-18

YINSON2024-11-18

YINSON2024-11-18

YINSON2024-11-18

YINSON2024-11-18

YINSON2024-11-15

YINSON2024-11-15

YINSON2024-11-15

YINSON2024-11-15

YINSON2024-11-14

YINSON2024-11-14

YINSON2024-11-14

YINSON2024-11-13

YINSON2024-11-13

YINSON2024-11-12

YINSON2024-11-12

YINSON

teoct

Thanks.

2019-10-16 14:42