Malaysia Stock Analysis Report – Pharma (7081)

LouisYap

Publish date: Mon, 11 Nov 2019, 04:05 PM

Malaysia Stock Analysis Report – Pharma (7081)

Pharma - Malaysia's largest listed integrated pharmaceutical group

The Government has agreed to provide a 25-month interim period for procurement of drugs to Pharmaniaga Bhd after its concession ends on Nov 30, and it allow the Health Ministry to make the necessary preparations to undertake the services which were done previously by Pharmaniaga, whose concession was said to be a monopoly.

Main business:

Research, develop and manufacture medicines,

Logistics and distribution of pharmaceuticals and medical equipment,

Community pharmacy.

Non-primary business:

Medical equipment in the hospital.

Hospital design and planning.

Company milestones:

1994 - Government medical store was privatized and Remedi Pharmaceutical Sdn Bhd was established

1995 - Remedi Pharmaceutical Sdn Bhd becomes a subsidiary of Pharmaniaga Berhad.

Pharmaniaga becomes the first integrated healthcare company

1999 - Pharmaniaga Berhad debuts on Bursa's second board

2003 - Pharmaniaga Berhad moved from the second board of directors to Bursa's main board.

2004 - Purchased a 55% stake in PT Millennium Pharmacon International Tbk (MPI), an Indonesian healthcare distribution company.

2010 - Boustead Group acquired Pharmaniaga Berhad from UEM Group for RM534 mil.

Main business model

Logistics and distribution

It is the company's main source of income and profit.

It consists of supply chain management, order management, and warehousing, supplying hospitals, other agencies, and the private sector of the Ministry of Health. The 8 warehouses are located in Selangor, Penang, Sabah and Sarawak, with an advantageous location.

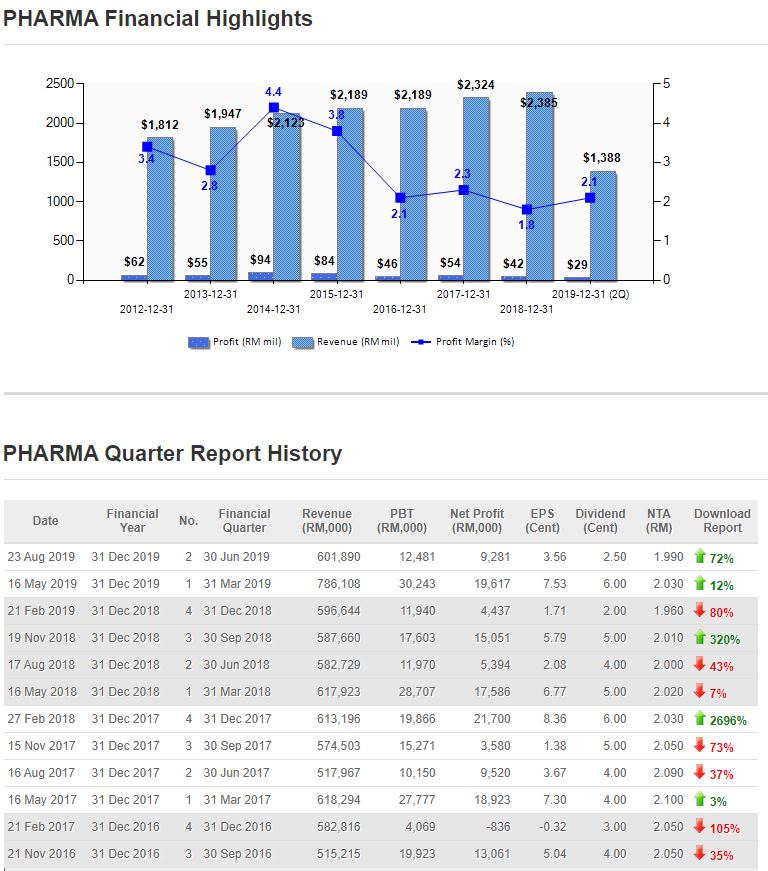

2018 financial year performance:

Overall, in the fiscal year of 2018, the company's turnover increased slightly by 2.6% compared to the 2017 fiscal year. However, after-tax earnings fell by 21.5% compared to the 2017 fiscal year.

Turnover:

The logistics and distribution business remain the company's main source of revenue, accounting for 70.6% of the company's total turnover. Overseas operations (mostly in Indonesia) are the second largest source of income, accounting for 29%. The turnover of the manufacturing business is the least.

With the increase of 29 mil in government budgets 2019 in health care, Pharmaniaga also expects better sales in the coming year, and plans to invest an additional RM174million for expansion, mainly logistics networks. Warehouse expansion and improved manufacturing capabilities.

The company's goal is to acquire another 45 products containing a Halal certificate and develop more products by 2024.

The company's new drug division is progressing well in oncology and vaccine development. Nearly 10 tumor and vaccine products are nearing completion and production is expected to begin in 2019.

For the Indonesian business, the company will launch more products under the Citrex series.

For the European Union, the company is taking steps to introduce hospital-specific injections, which will provide a better foothold for company penetration.

With the company's expertise in logistics, Pharmaniaga hopes to provide distribution services to local or international companies through its logistics network.

Louis Yap

Facebook:

https://www.facebook.com/louisinvestment/

Web Site: