Louis Yap

Facebook:

https://www.facebook.com/louisinvestment/

Web Site:

Malaysia Stock Analysis Report – TGUAN (7034)

Founded in 1942, TGUAN initially traded tea and coffee in small town of Kedah, Sungai Lalang and expanded the tea business and distribute beverages and consumer products to grocery and coffee shops, food outlets and general traders with registered trademark of 880.

In the 1960s, TGUAN has entered Plastic Packaging industry and listed on the KLSE in 1997. As of now, it is now one of the largest plastic packaging manufacturers in Malaysia.

TGUAN has 2 main business divisions:

(1) Plastic Division and

(2) F&B.

And, Plastic Division contributed 90% revenue in turnover, and plastic products can be divided into four major categories, namely Stretch films, Garbage bags, Industrial bags and PVC food wraps.

The F&B department is a tea and coffee product, and these two major products contribute 7% of the turnover. In addition, the F&B department also produces organic noodles Organic Noodles Products, but revenue contribution is not significant.

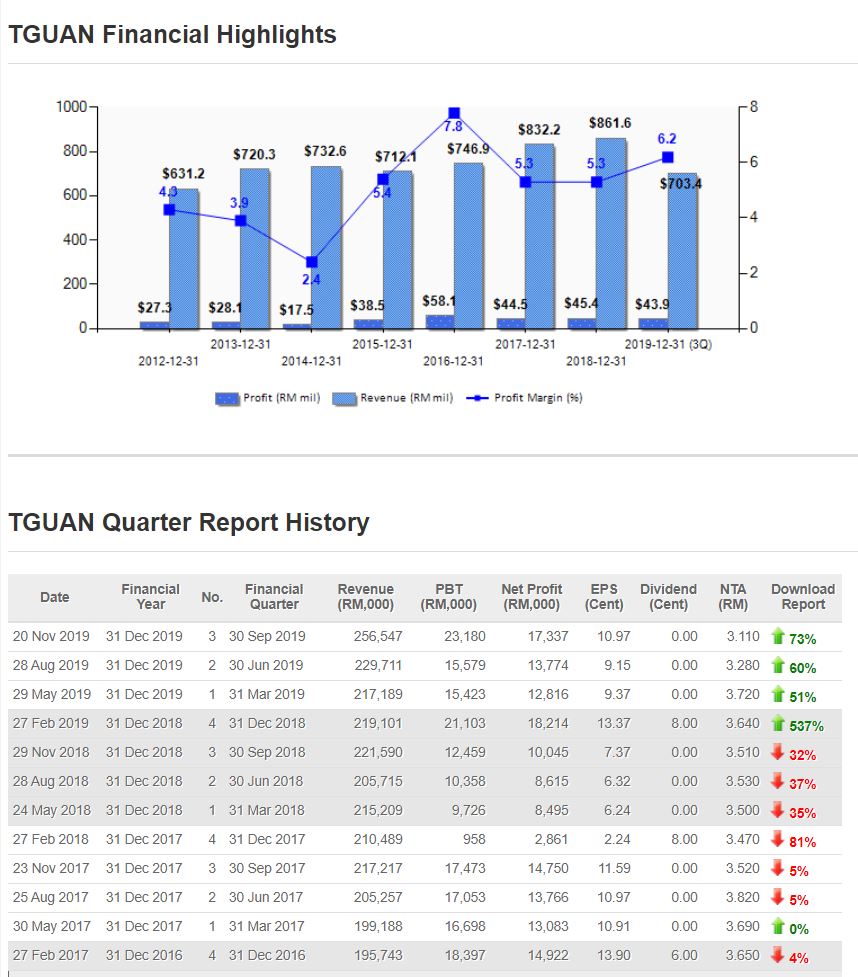

September 2019 Performance

Turnover: RM 256.5mil, YoY rose 9.5%, QoQ rose 15.8%

Net profit: RM 23.2mil, YoY rose 66.5%, QoQ fell 86.1%

TGUAN's business has grown steadily over the years, with great proven track record.

The main reason is the increase in sales volume of its stretch film, garbage bags and courier bags. In addition, the F&B department has turned a profit after closing the restaurant business and increasing the sales of tea and coffee products.

And the higher profit was mainly due to the increase in export on stretch films and courier bags. The strengthened US dollar against MYR and the decrease in the prices of its major raw materials also strengtened the PBT.

In addition, the company's cash flow is stable, despite the increase in debt, but still maintain a state of net cash. Although the company did not have a dividend policy, but stable, with a dividend of 8 cents last year, and expected with dividend payout at 4Q according to historical record