MHB (5186.KL) Unloved By Many But Deep Deep Value Fast Rising

NickelLee

Publish date: Wed, 05 Jun 2024, 02:12 PM

RM1.5bn Contract Win; Second Win(d) and More To Come.

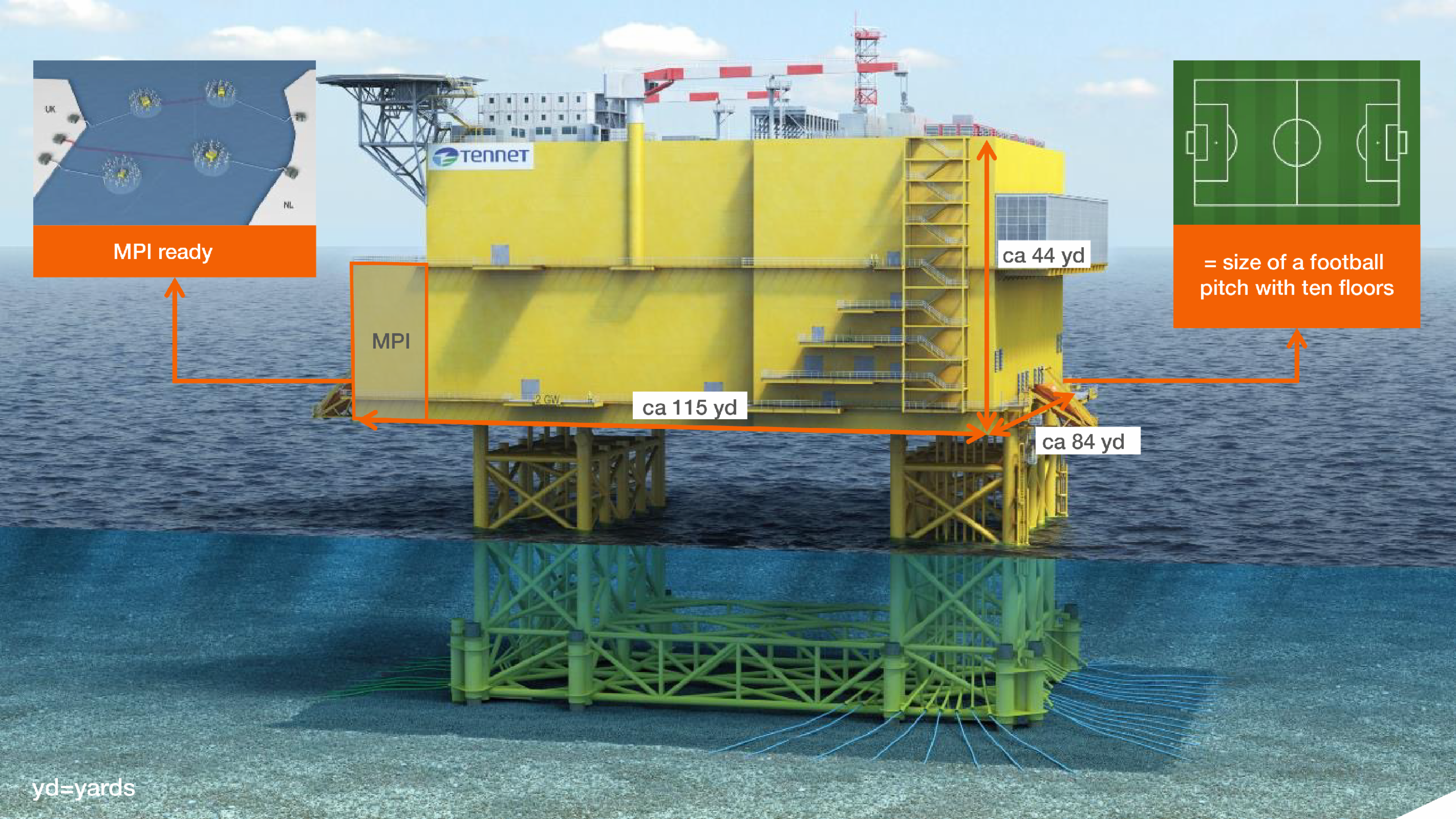

MMHE announced yesterday that it has secured a subcontract worth RM1.5bn to build an offshore substation at a wind farm in the Netherlands. The fabrication works of the substation platform — which receives power produced from the wind farm and stepped up before being transmitted onshore — will begin in 2025 for 36 months.

With this award, MMHE’s order book stands at RM6.9bn, giving it a Price to Order Book Ratio of 0.1X only. Simply putting it, with annual revenue recognition of RM2.0bn, the current order book could last through 3.5 years if no contracts were further tendered.

For MMHE, this is their second offshore wind contract after they secured the first one in November 2023 for the manufacturing of the OSS HVDC platform for the IJmuiden Ver Alpha project in the Netherlands.

In addition, MHB and Petrofac said they will collaborate towards the possibility of another OSS of similar size.

So What is This TenneT 2-GigaWatt Project In Europe:

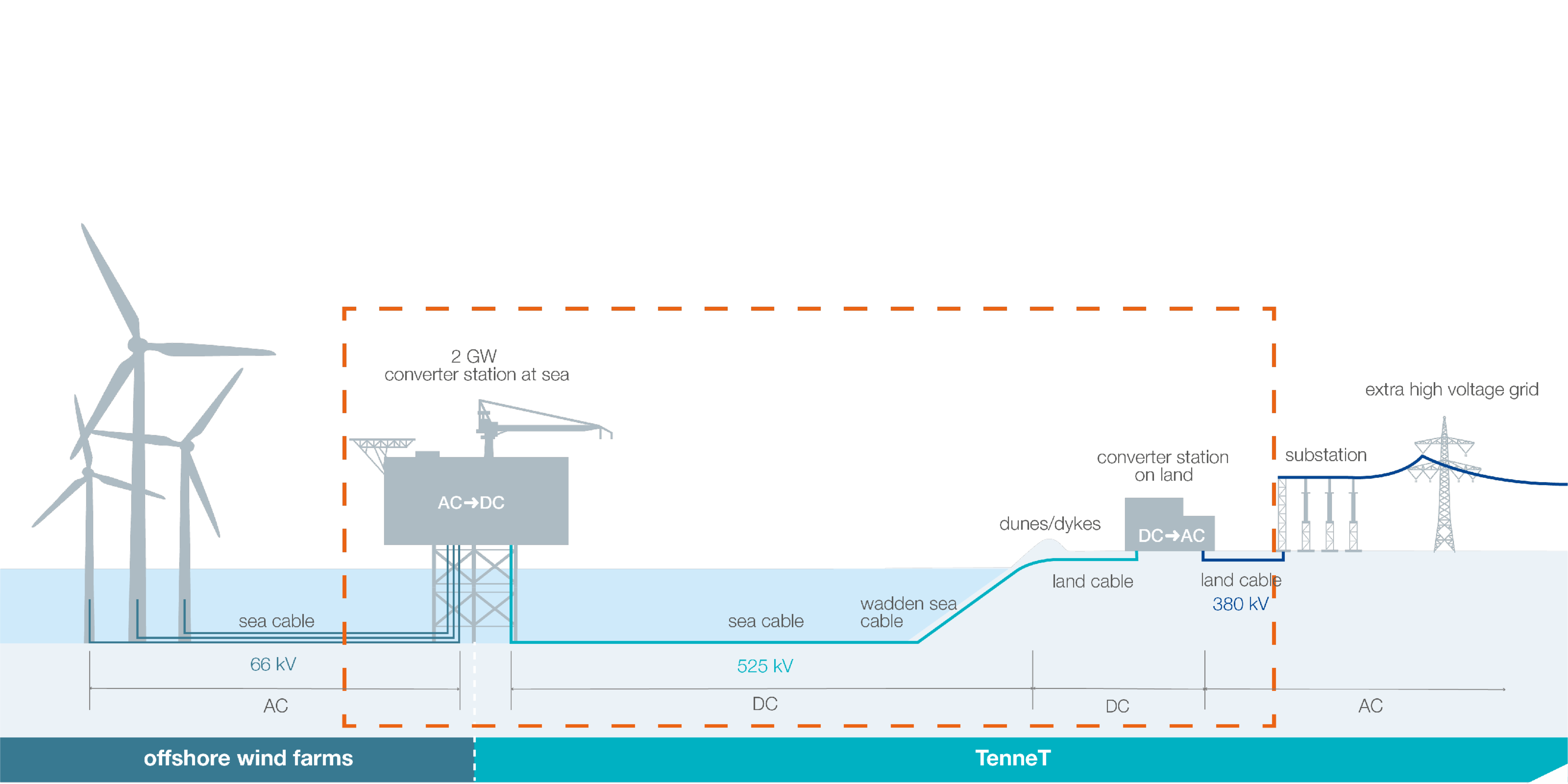

As part of the European energy transition and making the continent to be climate neutral by 2050. The European Union planned for at least 60GigaWatt (Gw) of energy to be derived by wind and 300Gw by 2050. TenneT’s grand plan is for 40Gw of new offshore grid connections, accounting for 2/3 of the 65Gw offshore wind energy target by 2030 agreed by Germany, the Netherlands, Denmark, and Belgium in the Esbjerg Declaration signed in May 2022. TenneT BV is the national electricity transmission system operator of the Netherlands, headquartered in Arnhem. Controlled and owned by the Dutch government, it is responsible for overseeing the operation of the 380 and 220 kV high-voltage grid throughout the Netherlands and its interconnections with neighbouring countries.

The Tennet 2Gw Project is to deliver the much-needed green energy to land. TenneT will build at least 14 high-voltage direct current (HVDC) offshore grid connection systems with a transmission capacity of 2 gigawatt (GW) each in the Dutch and German North Sea by 2031.

MMHB’s subcontractor belongs to the USD14bn Nederwiek 1 multi-year framework agreement awarded to Hitachi Energy and Petrofac back in December 2023. Under the terms of the agreement, Petrofac will perform the engineering, procurement, construction, and installation (EPCI) of offshore platforms and elements of the onshore converter stations. On the other hand, Hitachi Energy, as global technology partner, will supply its high-voltage direct current (HVDC) converter stations, which convert AC to DC power offshore and DC to AC onshore.

Privatisation Candidate:

If its a name to be speculated for a privatization exercise, MMHE definitely fits the bill. The national oil & gas behemoth PETRONAS, indirectly owns MMHE via its stake in MISC Bhd. Whilst MISC’s 66.5% stake stayed motionless over the years, there has been speculation in the past to take MMHE private. It's net cash position then and low price to book valuation together with tightly held shareholding structure made it an attractive case.

Analyst Call: Let’s see what the forecasters say,

TA (TP: RM0.55 upgraded from RM0.51) HOLD

RHB (TP: RM0.60 upgraded from RM0.57) BUY

BIMB (TP: RM0.94 maintained) BUY

2 BUYs 1 Hold, both active coverage (from TA and RHB) raised their TP after 1Q24 result released. The upgrade in their target price is due to operational improvement on the Heavy Engineering biz and brighter outlook on order book and expected job awards from tenders. 1Q24 order book stood at RM5.4bn whist tenderbook for this year is valued at RM6-7bn with a 50:50 split on local and international jobs. Dry dock utilisation is 70%

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|