Investment Bloggers Day 2019 - RECAP

MQ Trader

Publish date: Wed, 06 Mar 2019, 06:18 PM

The Investment Bloggers Day 2019 was held at The Boulevard Hotel, Midvalley KL on 2nd March, 2019. It was a first-ever event co-organized by ShareInvestor Malaysia and I3Investor Malaysia to bring retail investors and traders the opportunity to meet their investment bloggers and hear their sharing on investment ideas for the year 2019.

Tickets for the event were sold online and also available for redemption as part of the promotional offer from MQ Trader. Due to overwhelming response, all of the event tickets were sold out before the event, and the organizers had to close the registration early as the venue could not take in anymore participants.

We were impressed by the great responses shown by the participants on that day. Some of attendants even travelled from far to Kuala Lumpur in order to meet the speakers / bloggers in person. After the event ended, we received many emails with positive feedback. Some of them requested us to share the contents and photos of the Investment Bloggers Day 2019.

Thank you

We would like extend our appreciation to those who took time and effort to attend this event. We would also like to thank the Event Organizers, Sponsors, and Speakers / Bloggers, who have put in great efforts to prepare the contents and provided wonderful presentations on the day.

Investment Bloggers Day 2019 - Photos Gallery

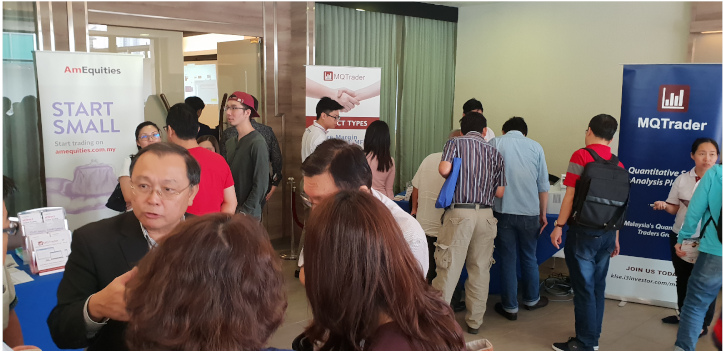

Here are some photos captured on the day of the event.

Full House audience during Investment Bloggers Day 2019.

People queing to take photos with the famed blogger - Mr Koon.

Some booths outside the event hall - MQ Trader

Some booths outside the event hall - Share Investor

Some booths outside the event hall - ATFX

Some booths outside the event hall - Bole Resources

Keynote speakers

1. Koon Yew Yin

Mr Koon shared his golden rules for share selection that he practiced in his trading strategy.

To know more about his presentation, you can visit My Presentation on Investment Bloggers Day 2019 – Koon Yew Yin.

2. CS Tan (Bull Trader)

Mr Tan presented the topic Learn How to Trade Confidently in the Stock Market. To know more about Bull Trader, please visit bulltraders.com.my

3.Phua Lee Kerk

Mr Phua shared his investment knowledge by covering broad topics such as Global Macro Economics and impacts from Trade War and Brexit.

Other Speakers

4. Eason Chong (Bole Resources)

5. Leong Kah Meng (Macquarie)

Attendees received an introduction to structured warrants, including reasons to trade them and useful terms to know. They learned about how to select a warrant through 4 simple steps, and also found out more about the Live Matrix, which allows investors to find out where Macquarie warrant's bids and offers will be.

6. Foo Yong Jui (ShareInvestor)

Mr Foo explained how to filter potential stocks with fundamental and technical analysis by using the market screener in ShareInvestor Station. A good investment decision should cover both FA and TA. Using the market screener in ShareInvestor Station, Mr Foo has shared which stock should the trader target to. The next step is to calculate the intrinsic value and all the assumption can be found in ShareInvestor Station again. The last step is to read the fund flows or big players' movement by the volume distribution chart.

7. Choivo Capital

Choivo Capital shared his great concepts on how to identify a wonderful company through his presentation. To find out more, please visit (CHOIVO CAPITAL) My Speech on 2 March 2019: My experience and Identifying a wonderful company.

8. Kar Yong (ATFX)

Kar Yong discussed on the practical steps that he took to profit consistently from the market.

9. Lew Ying Hui (MQ Trader)

Ying Hui walked through MQ Trader stock analysis system’s key features and MQ Trader Investment Methodology. To know more about MQ Trader system, please visit MQ Trader Education Series.

10. SSLee

Mr Lee shared the methods used to calculate the intrinsic value of INSAS. To know more about his presentation, please visit Investment Bloggers day: I3

Lucky Draw Session

Congratulations to one of the participant who won the special prize - RM 1,000 worth of cash sponsored by MQ Traders Group!

Here are the other lucky draw winners:

Contact Us

Please do not hesitate to contact us if you have any feedback on Investment Bloggers Day 2019.

More articles on MQ Trader Announcement!

Created by MQ Trader | Jul 15, 2024

Created by MQ Trader | Jan 17, 2024

Created by MQ Trader | Jan 11, 2024

Created by MQ Trader | Jan 05, 2024

Discussions

Insas down 1 sen from last Friday. Already said waste money hear SS Lee talk true.

2019-03-06 22:18

Drop 1 sen panic meh ??

Like that so pondan... u better don invest in stocmkt....u better jump into the river & put ur monies in FD mah...!!

Posted by besos > Mar 6, 2019 10:15 PM | Report Abuse

Down 1 sen from last Friday. Already said waste money hear SS Lee talk true.

2019-03-06 22:19

So many people attend talk why Insas nobody interested? Take Dayang for example. Why Dayang(KYY talk) can up 20 sen?

2019-03-06 22:22

Slow & steady mah....it is a marathon long term run loh....!!

This is what investment all about mah....!!

Posted by besos > Mar 6, 2019 10:22 PM | Report Abuse

So many people attend talk why Insas nobody interested? Take Dayang for example. Why Dayang(KYY talk) can up 20 sen?

2019-03-06 22:29

Insas is an undervalue stock since many years.. Undervalue doesnt mean will go up.. Follow Kyy Dayang better

2019-03-07 07:29

Sslee shld talk abt myeg lah, hibiscus lah, aturmaju lah. Safer. Insas is like bjcprp, will be sleeping 10yrs,then e suddenly give you 200% return. So u wanna wait not. Thts a question to ask yourself.

2019-03-07 08:00

So many i3 people went to Investment Blogger Day...

O so many speakers.

i3 investors Will get confused who to follow. Hihihi

2019-03-07 08:15

All talk about Insas, Myeg or Hibiscus. I weighing humbled Orion the most in my portfolio.

2019-03-07 08:49

Dear all,

Just for your information: I told attendees that I keep 1/3 of my portfolio for dividend stocks, 1/3 deep value stocks (Benjamin Graham) and 1/3 for trading (Koon Bee stocks). Recently I learn from Philip Fisher to invest on growth stocks Pchem (more than 10% return now).

I welcome attendees by saying in life there are losers and winners and by spending RM 10 ringgit and take action to attend today Investment bloggers day, they are already the winners since they are open minded and eager to learn from all (Not like quack, quack, quack rather spend his RM10 in backline of Bukit Bintang for a blow job)

At the end I advice them currently O&G is the theme play, go trade some KoonBee’s and Calvintaneng’s O&G stocks but no “Sailang” or margin finance and must know when to front run Mr. Koon (Sell before Mr. Koon)

Curry Mee” is the starter appetizer (Koon already sold). Main course “Dayang”(Still goreng) by the next quarter result “Hibiscus” (next quarter should be better) will most likely the delicious dessert and then if you have some spare money invest some in INSAS before FEB 2020. (Warrant expired date and if Dato’ Sri Thong convert his warrant will trigger conditional MGO)

Thank you

2019-03-07 16:04

Dear SSLEE, todate have you figured out why HengYuan performed performed so inconsistent against your in depth analysis and study ??

2019-03-08 09:45

one third in KYY stocks, one third in Philips stocks ok......put one third in lousy stocks is only for idiots ( and beginners).....

one more thing.....1 stock in each category is called S=Qr...........put 10 stocks in each category is for mutual funds.

2019-03-08 09:55

Dear Connie555,

Thank you for your overwhelming enthusiastic support. By the way where are the 500 tins of seaweed keropok? Don’t tell me Jonny English eat all by himself. No wonder, everyone tell me he looks like just putting on another 10 kg. Hahaha.

Thank you

P/S: Pity the PLP king miss the boat on Currymee and Dayang, no worry he can try his luck on Hibiscus or Naim.

2019-03-08 18:00

Dear SALAM,

On Hengyuan disadvantage:

1. Loans refinance execute on 5 Feb 2018. The loan is a combined long term/short term facility for USD 430 million. Interest rate at LIBOR +1.6 %. Exchange rate at 5th FEB 2018 is 1 USD 3.902 MYR. Hence need for exchange fair value loss if MYR weaken.

2. Do not own petrol retail outlet thus does not enjoy government price control fixed retail profit.

http://www.theborneopost.com/2019/01/08/margin-revision-to-benefit-pet...

In a statement by Finance Minister Lim Guan Eng last Friday, the government has agreed that the margin for petrol station operators be revised to 15 sen per litre for RON95 and RON97 petrol products and 10 sen per litre for diesel products.

“This is an additional 2.81 sen per litre for petrol and three sen per litre for diesel, compared to the current rate of 12.19 sen per litre for petrol and seven sen per litre for diesel,” the statement also read.

3. Timing of crude oil purchased, seem like they are buying crude oil at wrong timing (each purchase range between 300,000 to 1 million barrels. Comparable more expensive then PetronM purchase price Brent Crude Oil. Will ask BOD to plot the date and price of Brent Crude oil purchase against the international Brent Crude Oil price chart.

4. The Capex for the latest Hydrogen generation plant look suspicions. http://www.bursamalaysia.com/market/listed-companies/company-announcements/6037181. Full Fund Release of USD66.40 million for the H2GEN Project. The H2GEN Project is undertaken to supply the refinery with 30 tonnes/day of hydrogen for hydro desulfurization unit#2 and the extractive desulfurization hydro-treating process to meet the 10ppmw sulphur specification. The refinery will be short of hydrogen upon Euro5 gasoil specification implementation in September 2020. https://www.bangkokpost.com/business/news/1551686/big-allots-b500m-for-hydrogen-plant-due-to-operate-next-year A 12,000 tonnes of hydrogen a year, by Thailand's largest industrial gas maker, is setting aside 500 million baht.

5. http://www.bursamalaysia.com/market/listed-companies/company-announcements/5964569. Separately, the Board of Directors approved an increase in funding of USD76 million for the Euro4M Mogas project (“Project”), bringing the total investment to USD211 million +/- 10%. Question for what purpose the addition funding of USD 76 million?

6. http://www.bursamalaysia.com/market/listed-companies/company-announcements/5906633 The Total Investment Cost for the CAR Project is estimated at USD48 million. Question is CAR project thro’ competitive quotation/open tender?

I really loss confidence on China man major shareholder run company, anyhow I will attend the next AGM and ask the hard/tough/fact finding questions. After that I do not feel confident to invest in any China man run company anymore.

Thank you.

2019-03-08 18:04

Posted by Sslee > Mar 8, 2019 06:00 PM | Report Abuse

P/S: Pity the PLP king miss the boat on Currymee and Dayang, no worry he can try his luck on Hibiscus or Naim.

===========

u are my broker meh? U know what I buy and sell meh?

2019-03-08 18:06

facts and figures....not SSlee imaginations.....

SS Lee got lots of imagination....too bad loves lousy stocks.....

2019-03-08 18:48

Unless the boss is willing to strip the company naked and sell off all its asset, INSAS is NOT undervalued. As a minority shareholder, the NTA is almost meaningless. You can get better NTA value from HUAYANG, MYCRON, LIONIND, ULICORP...the list goes on. Low P/B normally means 1 thing, its lousy.

2019-03-10 10:10

sslee no shame one ah, with you and your Insas, hard sell like that.....

hard selling Insas tells me more about SSlee than about Insas......

2019-03-10 15:02

It is good hearing KYY sharing his successes in furniture stocks and VS, the stocks he picked in 2015. He made a killing. These stocks each gained a few hundred percents.

It might be of interest too to hear him elaborate a bit more on Jaks and Sendai. It appears to us on the outside that his one wrong call in Jaks wiped out all his prior successes. He had to sell his prized lands subsequently.

2019-03-11 07:57

why u want to know about Jaks?.............jaks was a mistake last year for kyy.....but a great share for me this year.......................

2019-03-11 12:38

similar to Jaks.........the best shares these few months have been recovery stocks............

In fact today it is very narrow with only a few shares performing, Jaks, Dayang, Success....and that is the theme .

2019-03-11 12:42

Useless talk...old conman(or market) will pick an average of 10k from the pockets of those who follow him!

2019-03-11 18:21

ramada

Insas? Oh my god.

2019-03-06 22:09