A special case study – Industrial Property Sector

HawardHo

Publish date: Mon, 29 Aug 2022, 05:53 PM

Under the latest Knight Frank – a leading independent global property consultancy firm’s Rest Estate Highlights (REH) report, the world-renowned consultancy firm had confirmed that the logistics sector is continuing to grow, with 3PL and e-commerce as key players expanding their operations, leading to a higher demand for logistics and warehousing space.

I quote Knight Frank Malaysia’s senior executive director Judy Ong:

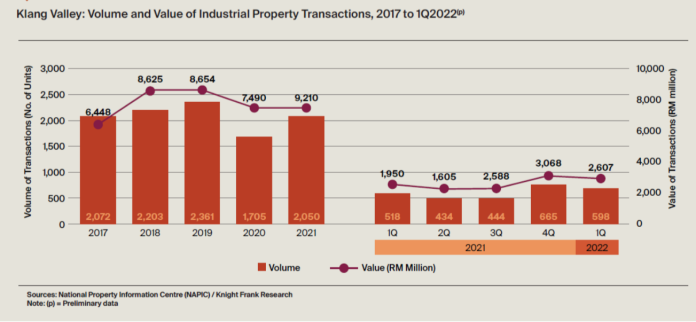

“The industrial property sector in the Klang Valley saw a rebound in market activity with 2,050 industrial properties worth RM9.21 billion changing hands in 2021, reflecting annual increments of 20.2% and 23.0% in transacted volume and value respectively.”

To add on, the executive director of land and industrial solutions Allan Sim had also mentioned:

“The main concerns among manufacturers and logistics players are rising transportation costs, shortage of labour and disruption in supply chain.

“With more multinational companies setting up new businesses and facilities within the ASEAN region, Malaysia is expected to benefit from this diversification and reshaping of global supply chain strategies.”

More evidence were shown as the numbers of industrial properties investment were made by REITs such as KIP REIT, AXIS REIT in collaboration with XIN HWA, SWIFT LOGISTICS massive logistics hub investment, as well as Capitaland Malaysia Trust first ever industrial purchase of 5.11-hectare freehold industrial warehouse for RM80.0 million in Batu Kawan.

If you can’t beat them, join them. This is clearly the case for industrial property demand in Malaysia.

Some of the well-known developers such as Titijaya Land Berhad is investing RM200.0 million for a logistic commercial complex for DHL in Penang, IJM partnering up with CHEC China for their first ever industrial and logistic development in Kuantan.

To add on, Knight Frank Johor associate director Tan Lih Ru had also mentioned that the logistics sector is thriving with Port of Tanjung Pelepas (PTP) recording commendable year-on-year growth despite the global supply chain disruption.

Also, Batu Kawan Industrial Park will not shy away as PDC had reported to develop between 100 to 150 acres of industrial land annually in addition to the new industrial park in Kepala Batas.

Here comes the million dollar question – who will be the hotspot in town for the next industrial and logistics development?

Introducing – OCR GROUP BERHAD. While many new investors may not be aware of the developments of the company, the group had actually performed relatively well after an asset clean-off since the pandemic. Notably, they are also involved in multiple affordable housing projects in Malaysia.

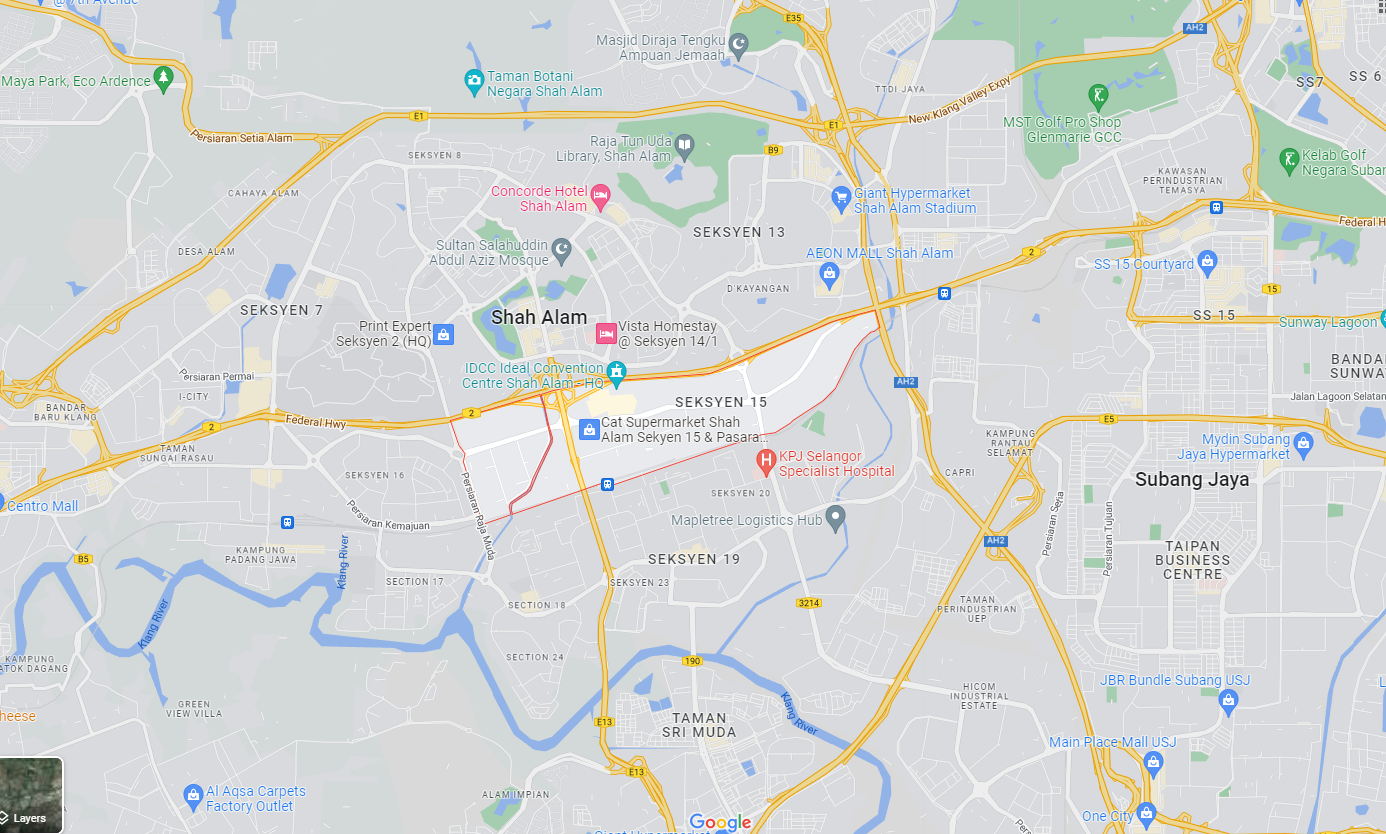

That being said, the recent Joint Venture Agreement (JVA) between OCR and Magna Ecocity is something that will change the investment landscape of the company forever. Under the JVA, OCR will fund and undertake the development of a parcel of 99 years leasehold land known as HSD 16667, PT 12, Seksyen 15, Bandar Shah Alam.

The strategic plot of land was surrounded by at least 3 easily accessible highway, which makes the development of land into industrial property highly viable for the group.

What’s more – since the land was last valued under PPC International Sdn Bhd on 3rd October 2019, it is very likely for the land to appreciate in value beyond the RM160.0 million valuation.

As at today, OCR is trading at an extremely low valuation of RM88.0 million despite having the development right of an undervalued prime land in Shah Alam, where most of the new industrial and logistics development were located. Assuming the land-costs to GDV is 30%, which is abnormally high just for the sake of margin of safety, the GDV could amount to RM533.3 million, and a mere 10% profit margin will result in RM53.3 million on top of what the company is earning.

The share price of OCR is also depressed currently due to lack of sentiment in the construction industry. This might be the investment opportunity that investors had been looking for in 2022!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|