Gadang (9261) – Undervalue of Construction Stock

issic622

Publish date: Mon, 20 Aug 2018, 12:29 PM

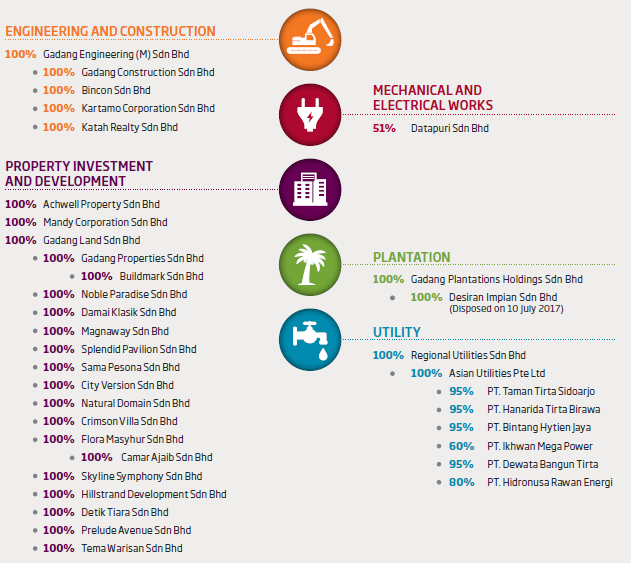

Business summary: BRIEF; Gadang Holdings Berhad is engaged in the businesses of investment holding and the provision of management services to the subsidiaries. The Company's segments include Construction division, Property division and Utility division. The Company's Construction division is engaged in civil engineering works, including earthworks, infrastructure works, hospital and mechanical and electrical (M&E) works. The Property division is engaged in the development of residential and commercial properties. The Utility division is engaged in the construction, maintenance and management of water and power supply facilities. The Investment holding segment is engaged in investment activities and provision of management services. The Company operates in Malaysia, Indonesia and Singapore. Its subsidiaries are also engaged in earthwork contractor services.

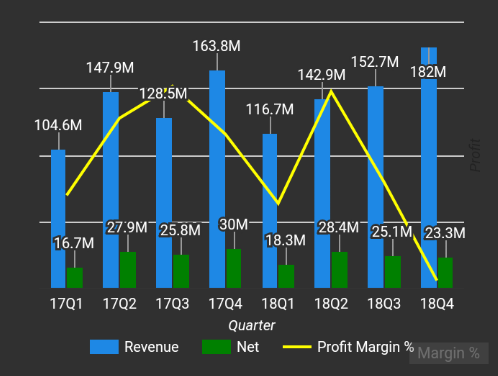

Financial Summary: BRIEF; For the fiscal year ended 31 May 2018, Gadang Holdings Berhad revenues increased 7% to RM594.3M. Net income before extraordinary items decreased 8% to RM95.3M. Revenues reflect an increase in demand for the Company's products and services due to favorable market conditions. Net income was offset by Other Expenses increase from RM3.1M to RM18.2M (expense), Administrative expenses increase of 27% to RM31.8M (expense). Increasing of admin expenses mainly due to one time off expenses like ESOS.

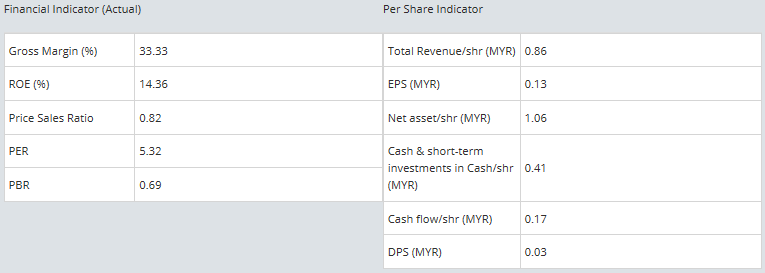

Recently due to uncertainty in construction market, caused the share price drop from previous high 1.30 to current level 0.74++, the main impact is after the 509 election, most of the major construction is pull back by new government. I believed is a good time to collect, and build up Gadang share stage by stage with current PE 5.3 plus healthy balance sheet. On hand book order is enough to cover for next 2-3 financial year performance.

Financial indicator as references.

Currently the share price is trade at low range, risk is much lower than previous. For those who are looking for long term invest may consider Gadang into your poftfolio. Remember this is not a buy call statement.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on MoneY is KinG

Created by issic622 | Nov 10, 2017

Created by issic622 | Oct 05, 2017

Created by issic622 | Jun 14, 2017