M+ Online Technical Focus - 13 Jul 2015

MalaccaSecurities

Publish date: Mon, 13 Jul 2015, 10:34 AM

Follow-through buying support has noted above the 1,700 psychological level. The MACD Histogram has turned green – suggesting that the momentum could be picking up. The RSI, however is staying below 50. Resistance will be envisaged around the 1,740 level. Support will be set around 1,680.

Follow-through buying support has noted above the 1,700 psychological level. The MACD Histogram has turned green – suggesting that the momentum could be picking up. The RSI, however is staying below 50. Resistance will be envisaged around the 1,740 level. Support will be set around 1,680.

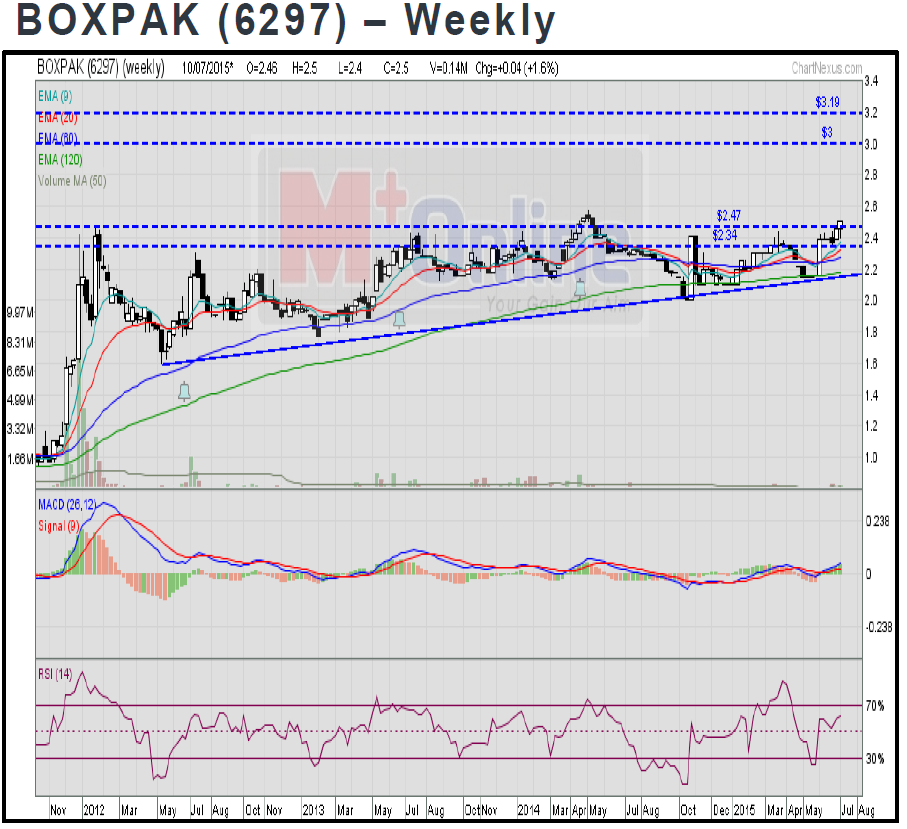

BOXPAK has formed an ascending triangle formation breakout above the RM2.47 level with mild volumes. The weekly MACD Indicator has expanded positively above zero, while the weekly RSI is hovering above 50. Price target will be pegged around the RM3.00-RM3.19 levels. Support will be located around the RM2.34 level.

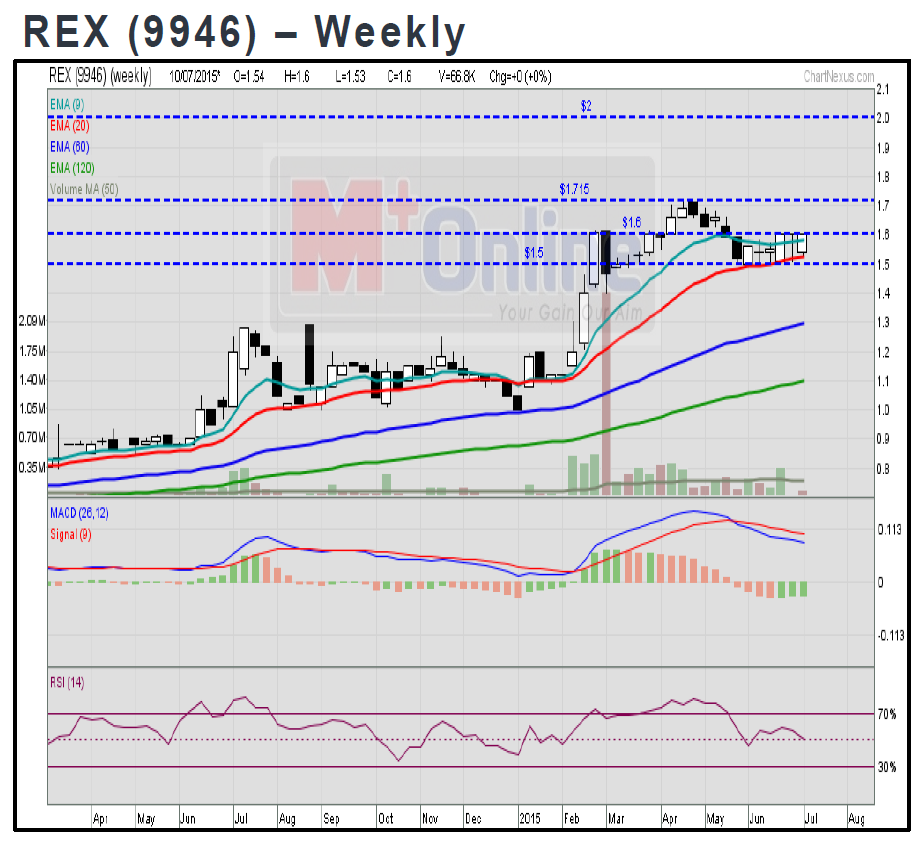

REX trended sideways between the RM1.50-RM1.60 levels over the past two months. The weekly MACD Histogram has extended another green bar. The weekly RSI stood at 50. Monitor for a breakout above the RM1.60 level, targeting the RM1.71 and RM2.00 levels. Support will be anchored around the RM1.50 level.

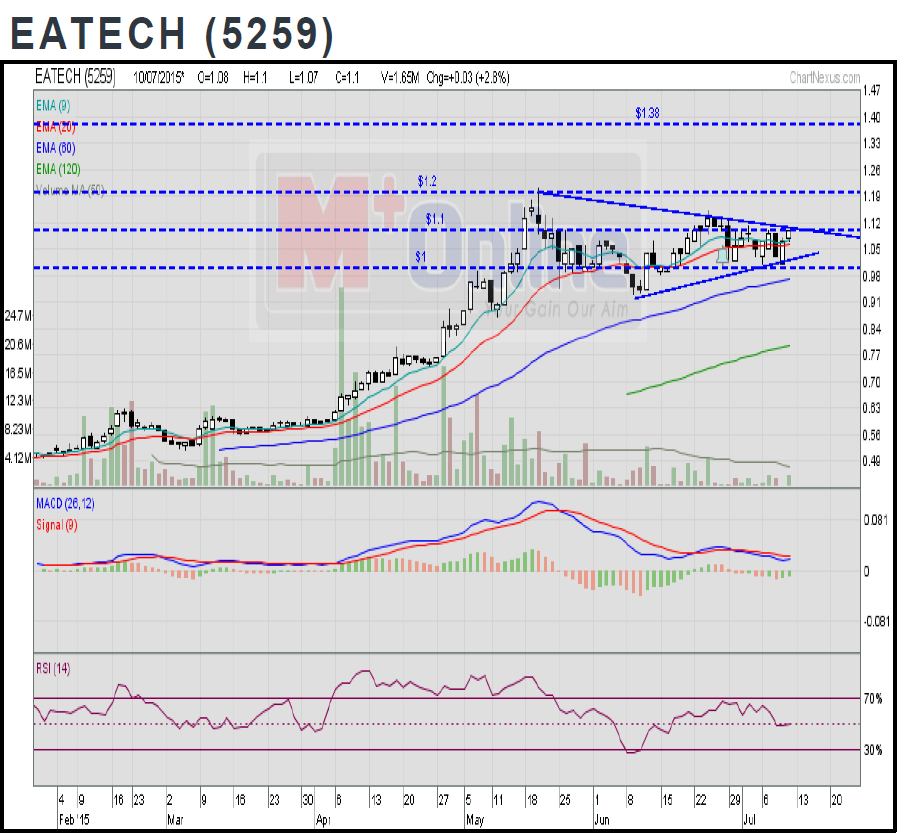

EATECH has trended within a symmetrical triangle formation over the past two months. The MACD Histogram has turned green. The RSI, however, is below 50. Monitor for a breakout above the RM1.10 level, targeting the RM1.20 and RM1.38 levels. Support will be located around the RM1.00 level.

Source: M+ Online Research - 13 Jul 2015

More articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024