M+ Online Technical Focus - 5 May 2017

MalaccaSecurities

Publish date: Fri, 05 May 2017, 06:03 PM

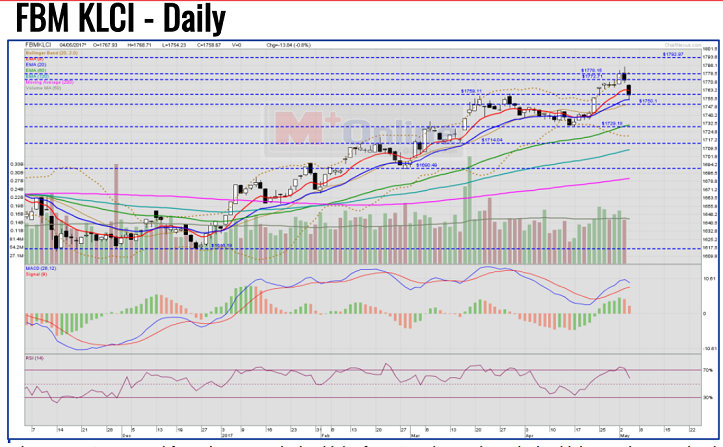

The FBM KLCI retreated from the recent closing high of 1,778 to the previous closing high near the 1,754 level and closed at 1758.67 (-13.84, -0.78%) yesterday. The daily MACD histogram's rounding top extended two red bars and the RSI crossed down below the 70 level. The immediate support level is observed at 1750 level; near to the daily Bollinger Band's middle band and next supports are seen at 1,729 and 1,714 respectively, followed by the critical support at the 1,690 level. If the daily MACD crosses down below the signal line, that would confirm a short-term bearish divergence took place and implies a negative trend on the FBMKLCI.

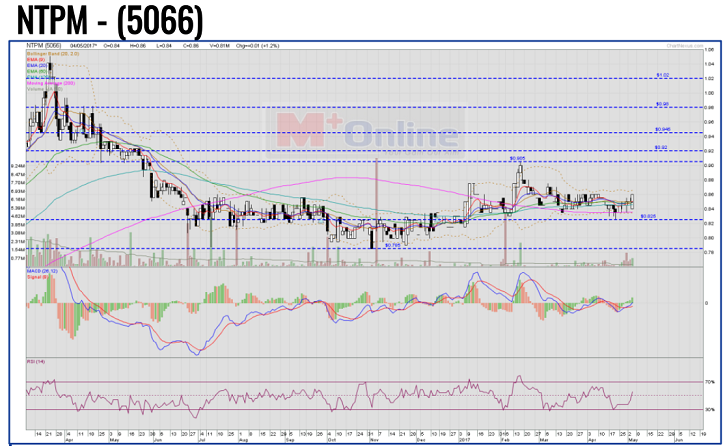

NTPM rebounded above the Bollinger Band's middle band and closed at RM0.86. The MACD histogram is extending an additional green bar above the zero level, while the RSI is staying above the 50 level. Next upside targets to envisage are around RM0.905-RM0.920, RM0.945, RM0.980, and RM1.02. Trailing stop with daily EMA9 or new entry stop loss below RM0.84.

IBHD brokeout above RM0.65 with an expansion of the Bollinger Band and an increase in volume. The MACD histogram extended another green bar and the RSI stays above the 70 level. Upon breakout, the next price targets to envisage are around RM0.70, RM0.745, RM0.76, and RM0.775. Trailing stop with daily EMA9 or new entry stop loss below RM0.62.

TAS brokeout above RM0.38 with an expansion of the Bollinger Band and higher volumes. The MACD crossed up the signal line above the zero level and its histogram extended more green bars. The RSI is rising near to the 70 level. Upon the breakout, the next potential targets to envisage are around RM0.41-RM0.43, and RM0.46- RM0.48. Trailing stop loss with the daily EMA9 line or new entry stop loss below RM0.36.

Source: Mplus Research - 5 May 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-18

IBHD2024-11-18

IBHD2024-11-12

IBHD2024-11-12

IBHD2024-11-12

IBHD2024-11-12

IBHD2024-11-12

IBHD2024-11-12

IBHD2024-11-12

IBHD2024-11-12

IBHD2024-11-08

IBHD2024-11-08

IBHD2024-11-08

IBHD2024-11-08

IBHD2024-11-08

IBHD2024-11-08

IBHD2024-11-08

IBHD2024-11-08

IBHD2024-11-06

IBHD2024-11-06

IBHD2024-11-06

IBHD2024-11-06

IBHD2024-11-06

IBHD2024-11-06

IBHD2024-11-06

IBHDMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024