M+ Online Technical Focus - 17 May 2017

MalaccaSecurities

Publish date: Fri, 19 May 2017, 09:55 AM

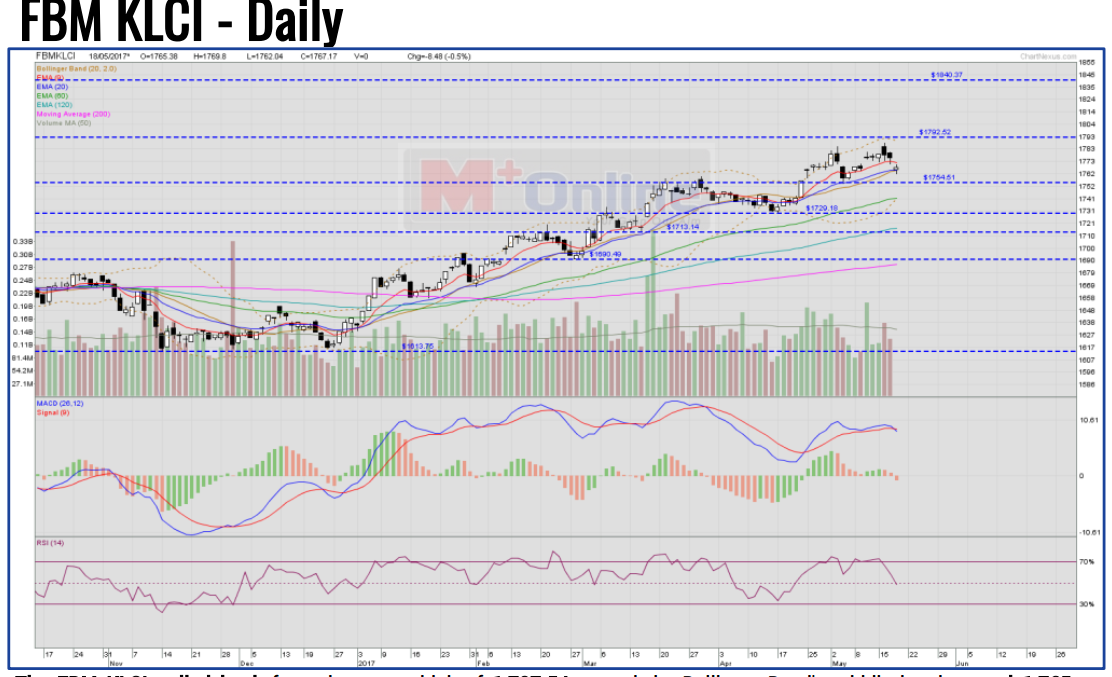

The FBM KLCI pulled back from the recent high of 1,787.54 toward the Bollinger Band's middle band around 1,765 to yesterday's intraday as low of 1,762.04 before finally closing at 1,767.17 (-8.48, -0.5%). The MACD histogram extended another red bar below the zero level and the MACD line crossed down below signal line. This indicates the first significant bearish divergence formation since 1Q2017 as the RSI is crossing down below 50 level. The next immediate resistant levels are observed near 1,792 and 1,800, while the immediate support levels are monitored near 1,754 and more critically near the 1,729 level.

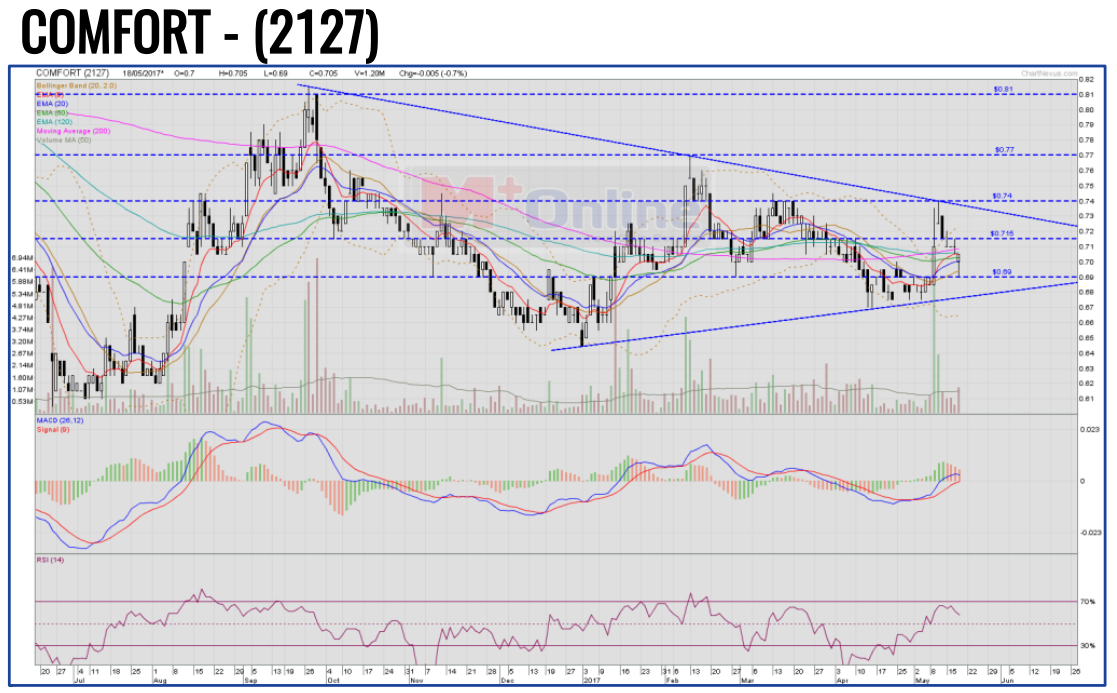

COMFORT's price is consolidating toward the end of the triangle's apex and rebounded above the Bollinger Band's middle band. The MACD is staying above the zero level for more than six days, while the RSI is still hovering around 55. Monitor for the price to breakout above RM0.715 to the next upside targets around RM0.740, RM0.770, and RM0.810. Trailing stop with daily BB20MB or new entry stop loss below RM0.690.

GLBHD's stock price is consolidating toward the end of teh triangle's apex and rebounded above the Bollinger Band's middle band. The MACD histogram turned from red to a green bar. and the RSI is rising above the 50 level. Monitor for the price to break up and stay above RM0.660 to envisage a move toward RM0.700, RM0.750, RM0.800, and RM0.850. Trailing stop with daily EMA9 or new entry stop loss below RM0.630.

POHUAT rebounded above EMA9 and the Bollinger Band's middle band. The MACD signal line stays above the zero level for three consecutive days, while the RSI is hovering slightly below the 70 level. Monitor for the price to breakout above RM1.86 toward the next upside targets around RM1.90, RM1.93, RM2.00 and RM2.04. Trailing stop loss with the daily EMA9 line or new entry stop loss below RM1.82.

Source: Mplus Research - 19 May 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024