M+ Online Technical Focus - 7 Jun 2017

MalaccaSecurities

Publish date: Wed, 07 Jun 2017, 09:54 AM

The FBM KLCI managed to buck the negative performance on global stockmarkets overnight to record its third straight day of winning streak, closing at 1,791.01 pts. The MACD Indicator has issued a BUY signal, while the RSI continues to trend above 50. Resistance will be pegged around the 1,800-1,820 levels. Support will be set around the 1,760 level.

LUXCHEM has experienced a breakout-pullback-continuation pattern above the RM1.65 level with improved volumes The MACD Histogram has extended another green bar, while the RSI is approaching 50. Price target will be envisaged around the RM1.87 and RM1.94 levels. Support will be set around the RM1.65 level.

SEB has formed a bullish engulfing candle and subsequently broke-out above the RM0.66 short-term consolidation level with slightly improved volumes. The MACD Histogram has turned green, while the RSI is approaching 50. Price may rally towards the RM0.75-RM0.835 levels. Support will be anchored around the RM0.605 level.

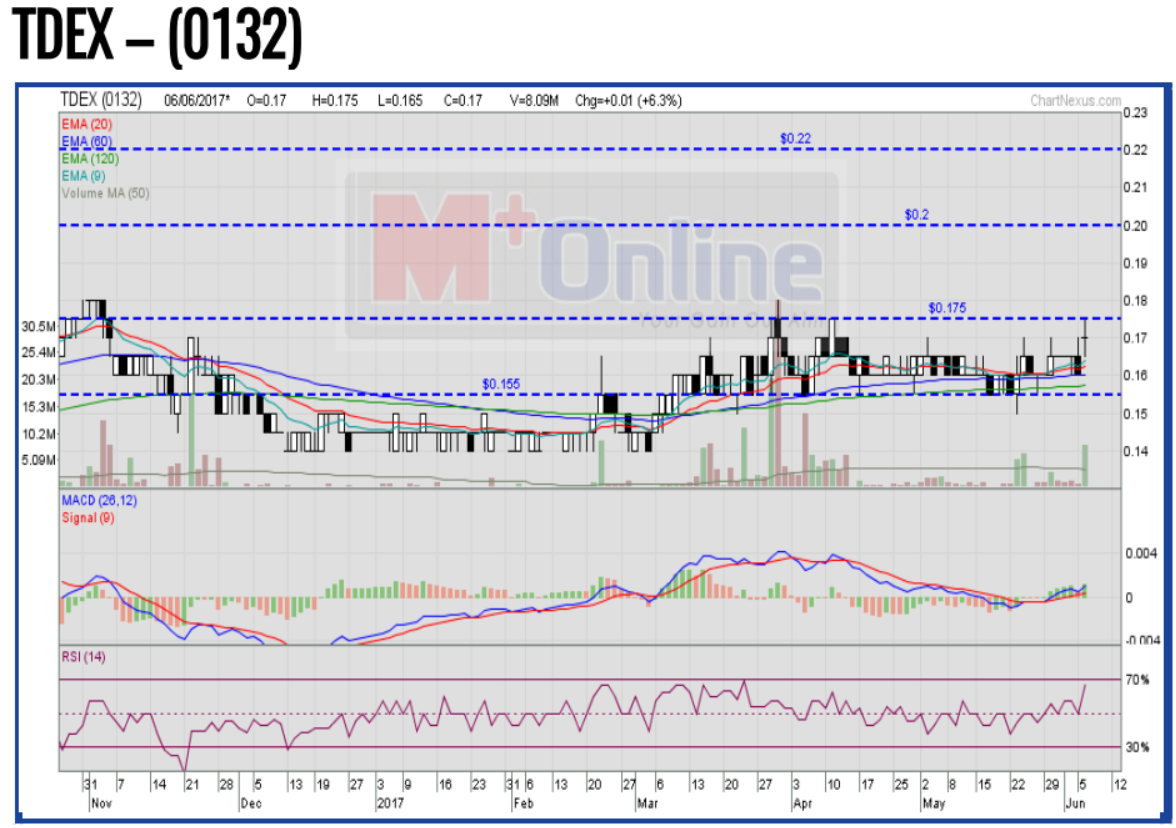

TDEX has gapped-up and re-testing the RM0.175 resistance level with improved volumes. The MACD Histogram has turned green, while the RSI is above 50. Monitor for a breakout above the RM0.175 level, targeting the RM0.20-RM0.22 levels. Support will be pegged around the RM0.155 level.

Source: Mplus Research - 7 Jun 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024