M+ Online Technical Focus - 23 Jun 2017

MalaccaSecurities

Publish date: Fri, 23 Jun 2017, 09:57 AM

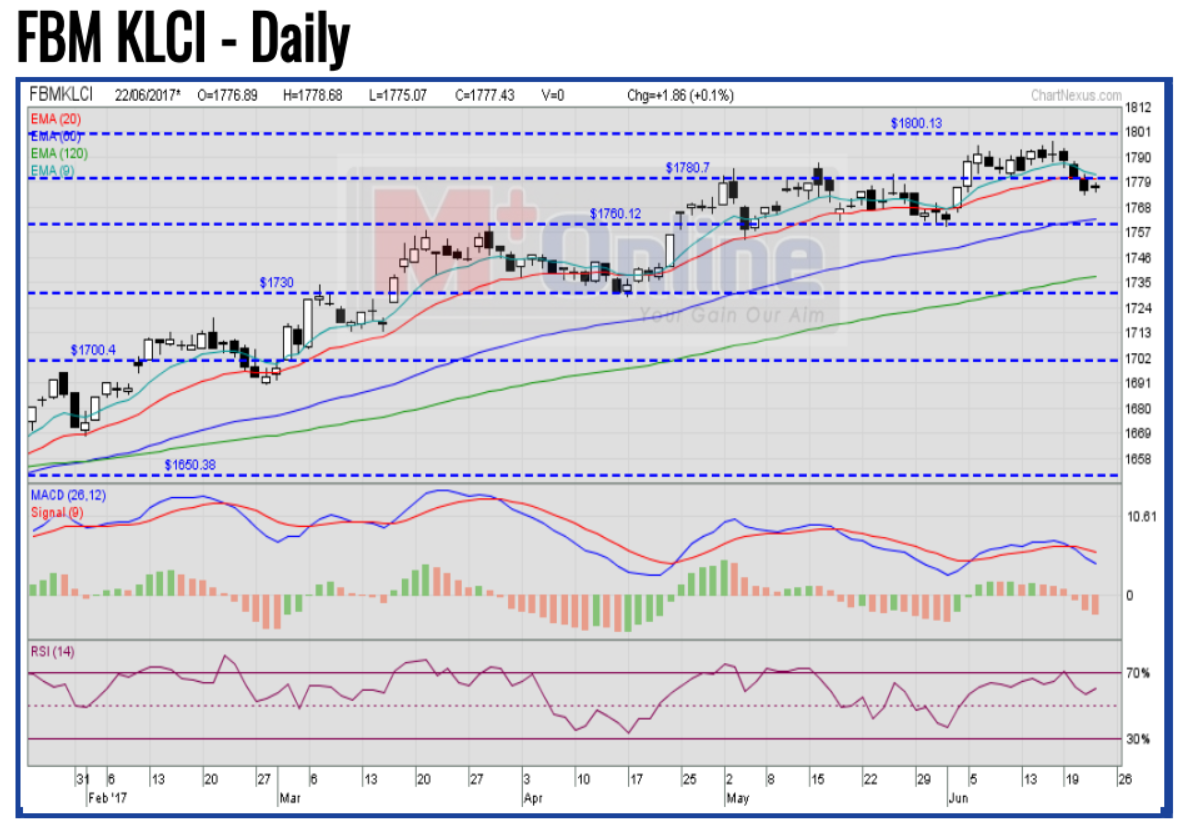

After three consecutive sessions of profit taking, the FBM KLCI staged a mild rebound after lingering mostly in the positive territory to close at 1,777.43 yesterday. The MACD Histogram has extended another red bar, while the RSI continues to trend above 50. Resistance will be pegged around the 1,800- 1,820 levels. Support will be set around the 1,760 level.

PWF has formed a breakout-pullback-continuation formation above the EMA20 level. The MACD Histogram has extended another red bar, while the RSI remains above 50. Price target will be envisaged around the RM1.17-RM1.20 levels. Support will be pegged around the RM1.00 level.

HSSEB has closed above the EMA20 level after experiencing a trendline breakout above the RM0.85 level with improved volumes. The MACD Line has issued a BUY signal, while the RSI has risen above 50. Price could rally, targeting the RM0.97 and RM1.02 levels. Support will be anchored around the RM0.785 level.

LSTEEL has experienced a breakout-pullback-continuation formation above the EMA20 level with some improved volumes. The MACD Histogram has turned green, but the RSI is slightly overbought. Price could trend towards the RM0.665 and RM0.70 levels. Support will be set around the RM0.565 level.

Source: Mplus Research - 23 Jun 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024