M+ Online Technical Focus - 7 Jul 2017

MalaccaSecurities

Publish date: Fri, 07 Jul 2017, 09:42 AM

Despite hovering mostly in the negative territory, the FBM KLCI edged higher yesterday, closing at 1,770.53 pts on last minute gains in selective index heavyweights. The MACD Histogram has extended another green bar, while the RSI is still below 50. Resistance will be pegged around the 1,780-1,800 levels. Support will be set around the 1,750 level.

ENGTEX has formed a bullish engulfing candle and subsequently retesting the RM1.37 level accompanied by improved volumes. The MACD Line has issued a BUY Signal, while the RSI is re-testing 50. Monitor for a breakout above RM1.37 targeting the RM1.45 and RM1.52 levels. Support will be anchored around the RM1.32 level.

HSSEB has formed a flag-formation breakout above the RM0.905 level with improved volumes. The MACD Histogram has turned green, while the RSI remains above 50. Price target will be envisaged around the RM0.97-RM1.02 levels. Support will be pegged around the RM0.885 level.

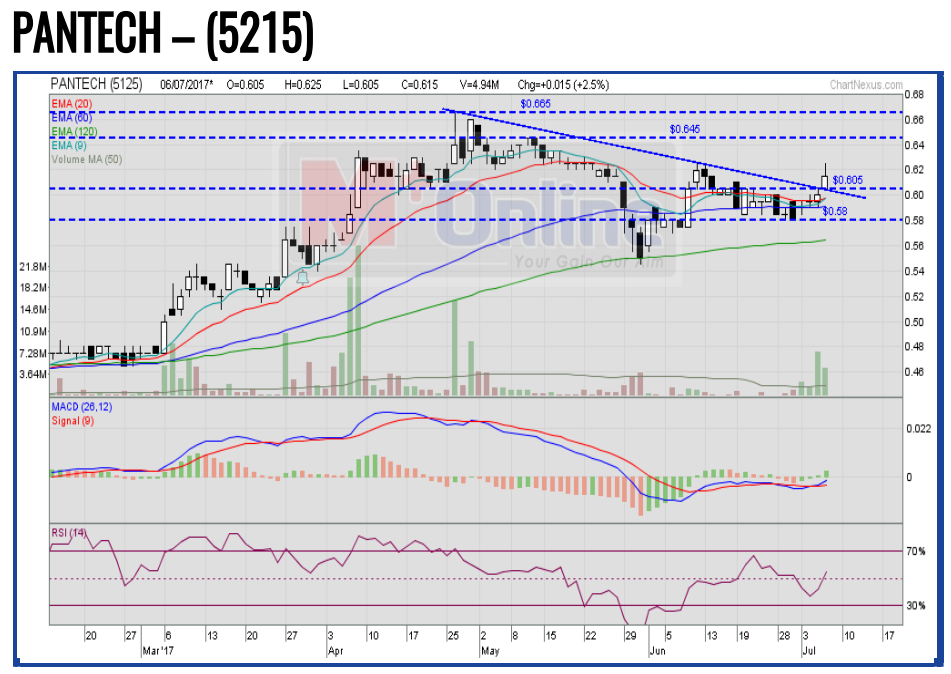

PANTECH has experienced a trendline breakout above the RM0.605 level. The MACD Histogram has extended another green bar, while the RSI has hooked up above 50. Price may rally, targeting the RM0.645-RM0.665 target levels. Support will be set around the RM0.58 level.

Source: Mplus Research - 7 Jul 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024