M+ Online Technical Focus - 2 May 2018

MalaccaSecurities

Publish date: Wed, 02 May 2018, 09:55 AM

The FBM KLCI started off on a weak manner at the opening bell before trending higher at the second half of the trading session as the key index formed a bullish engulfing candle to close at 1,870.37 pts on Monday. The MACD Histogram has turned green, while the RSI remains above 50. Resistance will be pegged around the 1,880-1,890 levels. Support will be set around the 1,850 level.

MBSB has closed above the EMA60 level with some improved volumes. The MACD Line has issued a BUY Signal, but the RSI has tripped below 50. Monitor for a trendline breakout above the RM1.16 level, targeting the RM1.26 and RM1.31 levels. Support will be set around the RM1.09 level.

SUNCON has formed the breakout-pullback-continuation pattern above the RM2.07 level. The MACD Histogram has turned green, while the RSI remains above 50. Price may rally, targeting the RM2.34- RM2.48 levels. Support will be anchored around the RM2.07 level.

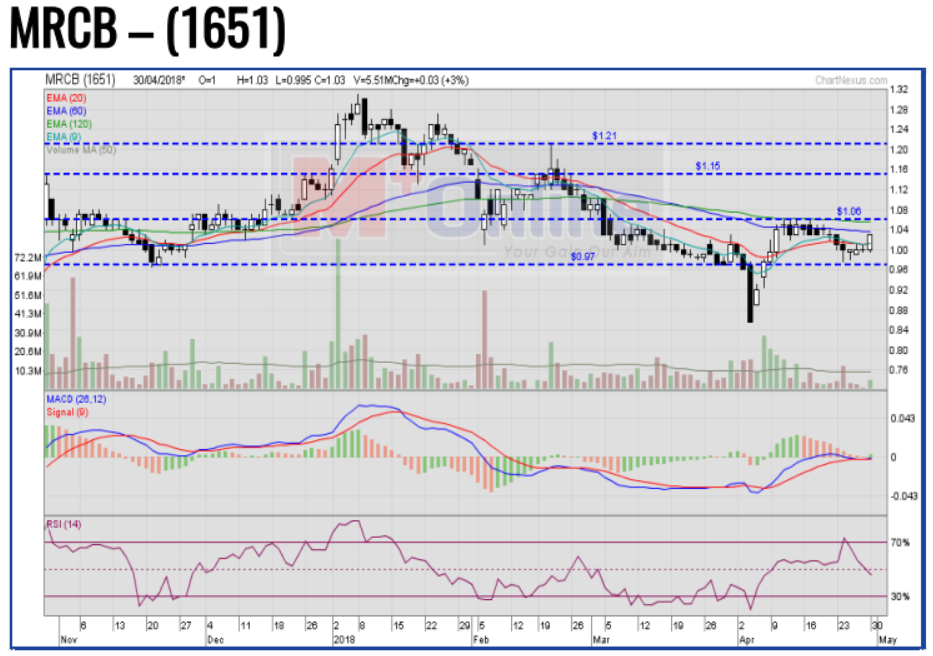

MRCB has advanced above the EMA20 level with some improved volumes. The MACD Histogram has turned green, but the RSI has tripped below 50. Monitor for a consolidation breakout above the RM1.06 level, targeting the RM1.15-RM1.21 levels. Support will be pegged around the RM0.97 level.

Source: Mplus Research - 2 May 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-18

MRCB2024-11-15

SUNCON2024-11-15

SUNCON2024-11-14

SUNCON2024-11-14

SUNCON2024-11-13

SUNCON2024-11-13

SUNCON2024-11-12

MRCB2024-11-12

SUNCON2024-11-12

SUNCON2024-11-12

SUNCON2024-11-11

SUNCON2024-11-08

MBSB2024-11-08

SUNCON2024-11-08

SUNCON2024-11-08

SUNCON2024-11-07

MBSB2024-11-07

SUNCON2024-11-07

SUNCON2024-11-07

SUNCON2024-11-06

SUNCON2024-11-05

SUNCON2024-11-05

SUNCON2024-11-05

SUNCONMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024