M+ Online Technical Focus - 20 Feb 2019

MalaccaSecurities

Publish date: Wed, 20 Feb 2019, 03:23 PM

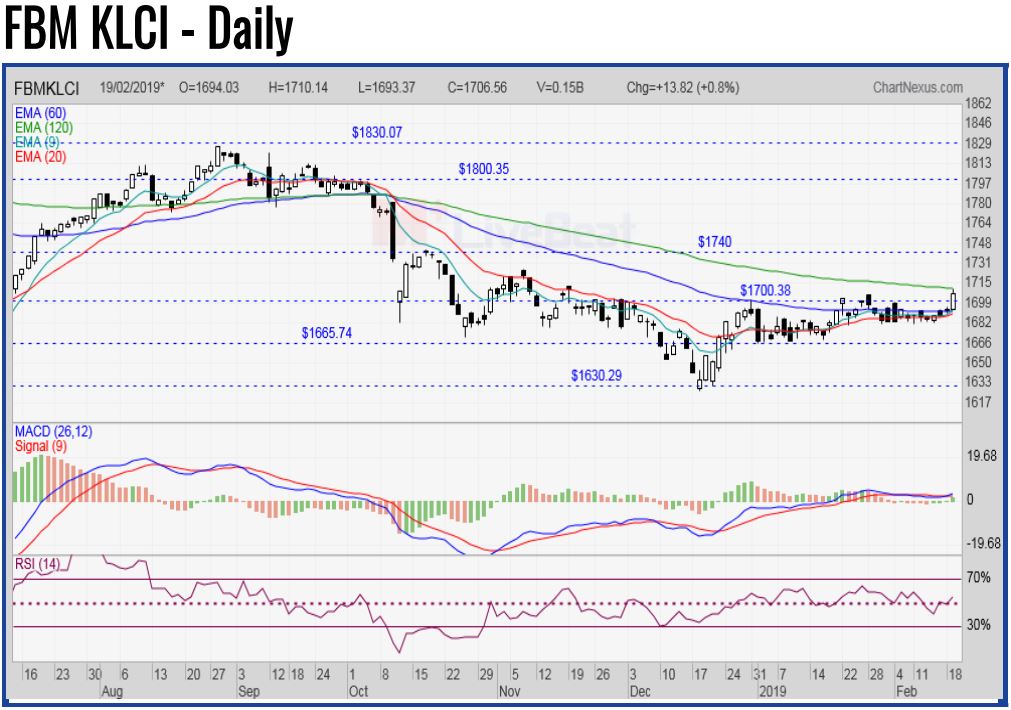

The FBM KLCI recorded its biggest daily gain year-to-date after breaching above the 1,700 psychological level as the key index closed at around the 1,706.56 level yesterday. The MACD Indicator has issued a BUY Signal, while the RSI has risen above 50. Resistances will be pegged around the 1,720-1,730 levels. Support will be set around the 1,690 level.

JHM has experienced a breakout above the RM1.08 level with high volumes. The MACD Line has expanded positively above the zero level, but the RSI is overbought. Price may stage a mild pullback, before targeting the RM1.20 and RM1.28 levels. Support will be set around the RM1.00 level.

EWINT has experienced a breakout above the RM0.795 level with improved volumes. The MACD Histogram has turned green, while the RSI remains above 50. Price may advance towards the RM0.85- RM0.895 levels. Support will be anchored around the RM0.74 level.

TGUAN has gapped-up to close above the EMA20 level with high volumes. The MACD Histogram has turned green, but the RSI remains below 50. Monitor for a trendline breakout above the RM2.38 level, targeting the RM2.60-RM2.71 levels. Support will be pegged around the RM2.27 level.

Source: Mplus Research - 20 Feb 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024