Mplus Market Pulse - 9 Oct 2020

MalaccaSecurities

Publish date: Fri, 09 Oct 2020, 10:04 AM

Boosted by eleventh hour buying

Market Review

Malaysia: The FBM KLCI (+2.0%) registered its biggest daily gain since 4th June 2020, boosted by the eleventh hour spike from institutional buying support as well as increased crude palm oil prices. The lower liners, however, finished mixed, while the broader market closed in the green with the exception of the technology sector (-0.03%).

Global markets: US stockmarkets extended its gain as the Dow climbed 0.4% on revived hopes on the near term fiscal stimulus and supported by the weekly decline in jobless claims. European stockmarkets pared gains, while Asia stockmarkets closed mixed.

The Day Ahead

The eleventh hour buying support that sent the FBM KLCI sharply higher yesterday may warrant a consolidation as investors would opt to digest their gains ahead of the meeting of the opposition leader, Datuk Seri Anwar Ibrahim will have a meeting with Yang di-Pertuan Agong. Meanwhile, we continue to see rotational play amongst the lower liners owing to the vibrant trading activities.

Sector focus: With profit taking setting into technology sector, the construction sector has returned to the limelight as investors continue to eye on developments surrounding the status of mega infrastructure projects ahead of the tabling of Budget 2021. We also favour the plantation sector with in CPO prices extended their gains towards near the RM2,900/MT.

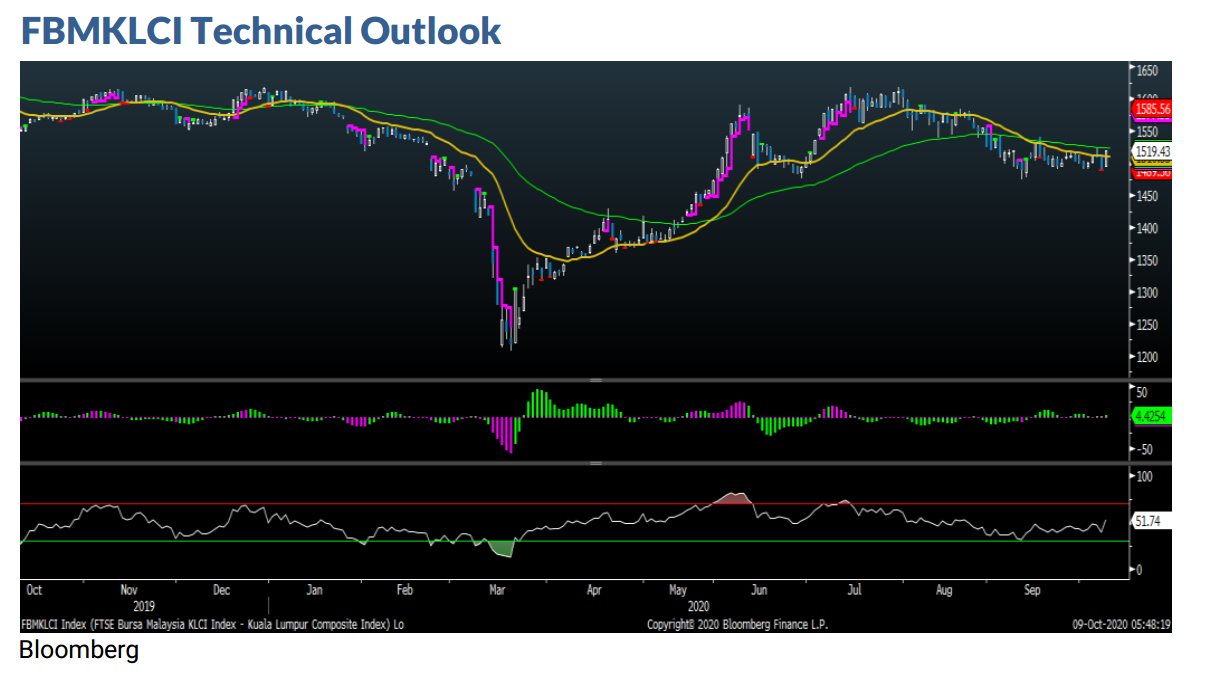

The FBM KLCI has gapped up, forming a bullish candle as the key index rose above the daily EMA120 level. The recovery signal suggests that near term upsides are still in the cards with the immediate resistance at 1,540, followed by 1,555. On the flipside, the immediate support, remained pegged at 1,480 followed by 1,450. Indicators have turned positive as the MACD Histogram has turned green, while the RSI has risen above 50.

Company Brief

UMW Holdings Bhd has named Datuk Ahmad Fuaad Mohd Kenali as its new president and group chief executive officer (CEO) effective 1st November 2020. Fuaad, 50, is leaving his post as CEO at Malakoff Corp Bhd on 31st October 2020. (The Star)

Top Glove Corp Bhd has earmarked RM10.0bn for capital expenditure over the next five financial years in a move which will see the company raising its annual production capacity to surpass 100.0bn pieces of gloves as early as FY21 as the Covid-19 pandemic generates demand for gloves.

Meanwhile, Top Glove clarified that its board has not decided on a special dividend payout in reply to theedgemarkets.com reported yesterday that a special dividend is possible as Top Glove moves away from its existing semi-annual payout scheme. (The Edge)

AirAsia Group Bhd is looking to slash dozens of planes from its fleet by returning aircraft to lessors. The group currently has 245 aircraft. (The Edge)

Brite-Tech Bhd is buying two pieces of land in Kapar, Klang for RM10.3m. The two plots are situated in a prime location, where all necessary infrastructures are readily available with positive industrial development potential. (The Edge)

Censof Holdings Bhd has bagged an RM7.8m contract from the Inland Revenue Board for the maintenance of application, hardware and licence renewal for the latter's revenue accounting system, or eRAS. (The Edge)

My EG Services Bhd has received a letter of acceptance from the Ministry of Health to undertake the provision of an online payment system for inbound travellers to pay for Covid-19 screening tests and quarantine charges, prior to their arrival in the country. The project has tenure of two years effective 1st November 2020, with no fixed value, as it is dependent on the number of transactions and the service options selected by users. (The Edge)

Euro Holdings Bhd has proposed a bonus share to reward its shareholders, on the basis of two shares for every one existing share held at an entitlement date to be fixed. (The Edge)

Pestech International Bhd’s executive director Lim Pay Chuan has been redesignated as managing director. The 50-year-old remains as the group’s CEO. He is a substantial shareholder of Pestech with a direct shareholding of 21.3% and indirect shareholding of 0.2% as of 9th September 2020. Separately, Pestech said it has declared a special dividend of 0.5 sen per share. (The Edge)

Mi Technovation Bhd has entered into a Memorandum of Understanding with Accurus Scientific Co Ltd and its shareholders for the purpose of due diligence and negotiations related to the group's proposed acquisition of all or part of the equity interest in Accurus. Accurus is involved in the manufacturing of solder spheres which are widely used in advanced packaging, such as ball grid array and wafer level packaging in the semiconductor industry. (The Edge)

Source: Mplus Research - 9 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-18

TOPGLOV2024-11-17

CAPITALA2024-11-17

MYEG2024-11-15

MALAKOF2024-11-14

CAPITALA2024-11-14

TOPGLOV2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

MALAKOF2024-11-13

TOPGLOV2024-11-12

MALAKOF2024-11-11

CAPITALA2024-11-11

CAPITALA2024-11-11

TOPGLOV2024-11-11

TOPGLOV2024-11-08

MALAKOF2024-11-08

TOPGLOV2024-11-08

TOPGLOV2024-11-07

TOPGLOV2024-11-07

TOPGLOV2024-11-07

TOPGLOV2024-11-07

TOPGLOV2024-11-06

MALAKOF2024-11-06

TOPGLOV2024-11-06

TOPGLOV2024-11-05

MALAKOF2024-11-05

MALAKOFMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024