Mplus Market Pulse - 16 Oct 2020

MalaccaSecurities

Publish date: Fri, 16 Oct 2020, 10:07 AM

Downward bias consolidation

Market Review

Malaysia: The FBM KLCI (-0.6%) extended its losses in line with the weakness across regional peers as investors weighed on the global resurgence of Covid-19 cases, coupled with dimming hopes for pre-election fiscal stimulus in the US. The lower liners and the broader market both finished mostly lower.

Global markets: US stockmarkets closed lower as the Dow (-0.1%) fell overnight for a third straight session, weighed down by the latest jobless claims which jumped to its highest level since late August; jobless claims stood at 898k vs. estimate of 830k. Meanwhile, European stockmarkets also retreated on the tightening Covid-19 lockdown in Europe after France declares state of emergency

The Day Ahead

The extended consolidation on the local bourse is likely to continue in view of lacking of fresh leads, coupled with the uncertainties surrounding the political and Covid-19 situations. The negative sentiment across global markets may also weigh on Bursa Malaysia, but we believe bargain hunting activities could emerge at later stage. Despite there were signs of quick profit taking activities, rotational play amongst the lower liners are keep trading activities at a vibrant level as investors continue to seek for higher yield investments.

Sector focus: Following the renewed volatility, we reckon that the utilities sector that is defensive in nature will provide some portfolio stability. We also think that the construction sector may continue minor steps to recovery ahead of the tabling of Budget 2021.

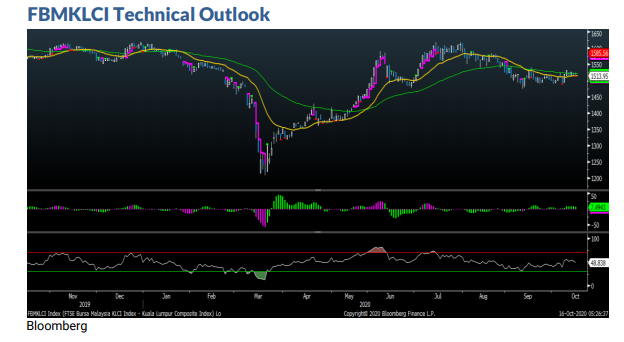

The FBM KLCI has extended its losses as the key index formed a bearish candle to close below the daily EMA20 level. The downward bias consolidation suggests that further weakness will come by with the immediate support located at 1,490, followed by 1,480. Resistances are at 1,530, followed by 1,540. Indicators remained mixed as the MACD Histogram has extended another red bar, while the RSI remains above 50.

Company Brief

LPI Capital Bhd’s 3QFY20 net profit dipped 1.9% YoY to RM86.2m, amid the Covid19 pandemic. Revenue for the quarter declined 6.6% YoY to RM395.8m. (The Star)

FGV Holdings Bhd has received an expression of interest from Perspective Land (M) Sdn Bhd (PLSB), which is wholly-owned by Tan Sri Syed Mokhtar Albukhary’s privately-held Restu Jernih Sdn Bhd. PLSB intends to participate in FGV via an injection of plantation assets in exchange for shares. PLSB owns the Tradewinds group of companies, which include Tradewinds Plantation Bhd and Central Sugars Refinery Sdn Bhd, which are in the same businesses FGV is involved in. (The Edge)

Mah Sing Group Bhd has proposed a diversification into the manufacturing and trading of gloves and related healthcare products, which will in turn provide the group access to the global market, thus reducing over-reliance on the domestic market for its property business. The property developer, which also makes plastic products, is also considering listing its manufacturing division to unlock the segment’s value. (The Edge)

EcoFirst Consolidated Bhd has proposed to expand its footprint in the Klang Valley by acquiring a 4.8-ac. piece of land in Cahaya SPK, Shah Alam for RM42.0m. A mixed development with a gross development value of RM311.0m has been planned on the leasehold land that is to be purchased from Modern Peak Sdn Bhd. (The Edge)

LYC Healthcare Bhd’s wholly-owned subsidiary is planning to issue up to 45.0m new redeemable preference shares (RPS) to Kenanga Investors Bhd (KIB) at RM1.00 each. The RPS to be issued by LYC Medicare Sdn Bhd, whose proceeds of up to RM45.0m will be used mainly to acquire shares in two Singapore medical firms T&T Medical Group Pte Ltd and HC Orthopaedic Surgery Pte Ltd, will have a five-year tenure. (The Edge)

Homeritz Corp Bhd has proposed a bonus issue with free warrants on the basis of one bonus share for every four existing shares held and one free warrant for every four existing shares held by shareholders on an entitlement date to be announced later to reward its shareholders and provide greater equity participation. The exercise price of the warrants is fixed at 75 sen, but will be adjusted to 60 sen upon implementation of the bonus issue. (The Edge)

TA Global Bhd’s subsidiary Menara TA Sdn Bhd has been sued by Tien Entertainment Sdn Bhd over the alleged wrongful termination of tenancy as the latter claims that the notice of termination dated 28th February 2018 served by Menara TA was unlawful. (The Edge)

Powerwell Holdings Bhd’s unit Kejuruteraan Powerwell Sdn Bhd has accepted two letters of intent from Sunway Group for contracts totalling RM9.1m, bringing its outstanding order book to RM80.0m. The two contracts involve the design, supply and installation of low voltage switchboards for six elevated Light Rail Transit Line 3 (LRT3) stations worth RM3.0m, and the design, supply and installation of low voltage switchboards for a mixed development project along Jalan Ampang, Kuala Lumpur, worth RM6.1m. (The Edge)

Source: Mplus Research - 16 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-13

ECOFIRS2024-11-13

ECOFIRS2024-11-12

FGV2024-11-12

MAHSING2024-11-11

ECOFIRS2024-11-11

ECOFIRS2024-11-11

PWRWELL2024-11-11

PWRWELL2024-11-11

PWRWELL2024-11-11

PWRWELL2024-11-11

PWRWELL2024-11-11

PWRWELL2024-11-11

PWRWELL2024-11-08

FGV2024-11-08

FGV2024-11-08

FGV2024-11-08

MAHSING2024-11-08

MAHSING2024-11-08

MAHSING2024-11-08

MAHSING2024-11-08

MAHSING2024-11-08

MAHSING2024-11-08

MAHSING2024-11-08

MAHSING2024-11-08

PWRWELL2024-11-08

PWRWELL2024-11-08

PWRWELL2024-11-08

PWRWELL2024-11-08

PWRWELL2024-11-08

PWRWELL2024-11-08

PWRWELL2024-11-08

PWRWELL2024-11-08

PWRWELL2024-11-07

FGV2024-11-07

MAHSING2024-11-07

MAHSING2024-11-07

MAHSING2024-11-07

MAHSING2024-11-07

MAHSING2024-11-07

MAHSINGMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024