Mplus Market Pulse - 25 Apr 2022

MalaccaSecurities

Publish date: Mon, 25 Apr 2022, 09:02 AM

Re-capturing 1,600 once more

Market Review

Malaysia:. The FBM KLCI (+0.2%) edge mildly higher to close above the 1,600 level after recovering all its intraday losses, lifted by gains in selected banking and Petronas-related heavyweights on last Friday. The lower liners, however, retreated, while the broader market ended mixed.

Global markets:. Wall Street took another beating as the Dow (-2.8%) sank on disappointing corporate earnings from Verizon Communications and American Express, coupled with the prospects of more aggressive interest rate hikes. The European stock markets also turned downbeat, while Asia stock markets finished mostly negative.

The Day Ahead

The FBM KLCI registered its third-session gains on Friday as the optimism in banking heavyweights overshadowed the concerns over weakness across regional markets. However, we expect the overnight tumble on Wall Street may weigh on the local sentiment, especially within the technology sector as the Nasdaq fell below the key 13,000 level. Meanwhile, we expect the Indonesia banning the export of palm oil to ease domestic shortages of cooking oil may boost the sentiment for FCPO; the FCPO traded above RM6,300 last Friday. On the Brent crude oil it is hovering above the psychological level of USD105.

Sector focus:. The technology sector may remain under pressure following the overnight plunge in Nasdaq. On the other hand, investors may put recovery-themed stocks on radar prior to the earning season, in anticipation of improving earnings capability amid smooth economic recovery. Also, we expect the plantation sector to perform positively with the Indonesia export ban.

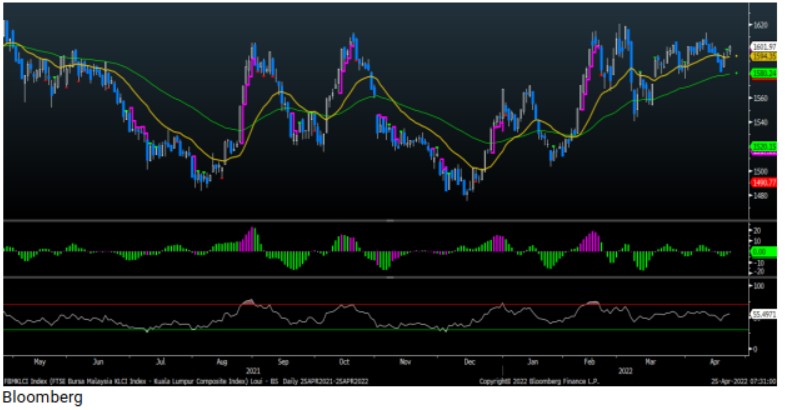

FBMKLCI Technical Outlook

The FBM KLCI marked its third-session gains as the key index climbed back above the 1,600 level. Technical indicators, however, remained mixed as MACD Histogram was below zero, while the RSI hovered above 50. Next resistance is pegged around 1,620, while 1,600 has turned support, followed by 1,580

Company Brief

GIIB Holdings Bhd has engaged independent consulting firm PKF Covenant Sdn Bhd to help GIIB's investigative committee in its probe into GIIB's suspended executive director Wong Weng Yew's management and handling of the group's glove business and accounts. PKF will examine the relevant evidence and information pertaining to the charges against Wong. (The Edge)

Sunsuria Bhd is buying a 60.8-ac piece of land in Ijok, Selangor from Superjet Revenue Sdn Bhd for RM74.2m as part of its plan to accumulate strategic industrial land for property investment and/or development. The land is currently an agricultural plot but zoned for industrial use. (The Edge)

Petronas Dagangan Bhd’s (PetDag) share price jumped on last Friday to its highest since November 2020, as its foreign shareholding rebounded from its lowest on record. The share price, which hit a high of RM22.20, later pared some gains to settle at RM21.92. (The Edge)

CTOS Digital Bhd’s 1QFY22 net profit grew 62.3% YoY to RM12.5m, as it recorded stronger revenue on improved performance across all business segments and an increase in share of profits of associates. Revenue for the quarter rose 12.4% YoY to RM42.7m. A first interim dividend of 0.325 sen per share, payable on 10th June 2022 was declared. (The Edge)

Urusharta Jamaah Sdn Bhd (UJSB) has ceased to be a substantial shareholder in Practice Note 17 (PN17) company Brahim’s Holdings Bhd, after selling 44.6m shares equivalent to a 19.3% stake in the loss-making in-flight caterer on 8th April 2022. (The Edge)

Fitters Diversified Bhd is selling its entire 72.3% stake in Molecor (SEA) Sdn Bhd, which manufactures PVC-O pipes, to Spain-based Molecor Tecnologia SI. Molecor Tecnologia currently owns 2.7% in Molecor SEA; the remaining 25.0% stake is held by Sanlens Sdn Bhd. At the same time, Fitters is selling a 369,824 sqf piece of land and an industrial premise in Gebeng II, Kuantan, Pahang to United Sapphire Sdn Bhd. Molecor Tecnologia and United Sapphire have collectively offered a purchase consideration of RM30.0m in aggregate for the proposed transactions. (The Edge)

Can-One Bhd is partnering with WorldKlang Group Property Development Sdn Bhd (WKGPD) to build factories and a hostel on 2 freehold plots of land it owns via a subsidiary in Mukim Kapar, Klang, Selangor, that will have an estimated gross development value of RM478.8m. Under the deal, TGSB is entitled to an estimated share of profit of over RM120.0m over the five-year development period, subject to completion of the development and the sale of developed units. (The Edge)

Source: Mplus Research - 25 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-15

CTOS2024-11-15

CTOS2024-11-15

PETDAG2024-11-15

PETDAG2024-11-15

PETDAG2024-11-14

PETDAG2024-11-14

PETDAG2024-11-13

CTOS2024-11-13

CTOS2024-11-13

CTOS2024-11-13

PETDAG2024-11-13

PETDAG2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

PETDAG2024-11-12

PETDAG2024-11-11

CTOS2024-11-11

CTOS2024-11-11

PETDAG2024-11-11

PETDAG2024-11-08

CTOS2024-11-08

PETDAG2024-11-07

CTOS2024-11-07

CTOS2024-11-07

CTOS2024-11-07

CTOS2024-11-07

PETDAG2024-11-07

PETDAG2024-11-06

CTOS2024-11-06

CTOS2024-11-06

CTOS2024-11-06

CTOS2024-11-06

PETDAG2024-11-06

PETDAG2024-11-05

PETDAGMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024