Mplus Market Pulse - 17 May 2022

MalaccaSecurities

Publish date: Tue, 17 May 2022, 09:16 AM

Bargain hunting took precedence

Market Review

Malaysia:. The FBM KLCI (+0.4%) rebounded from the previous session’s slump on the back of bargain hunting activities ahead of the long weekend break, but on WoW, the key index registered -1.3% decline. The lower liners also recovered, while the broader market closed mostly positive, led by the technology sector (+3.7%).

Global markets:. Wall Street ended the wobbly session mixed as downbeat Chinese data sparked fear on global economic slowdown; the Dow (+0.1%) edged higher, but the S&P and Nasdaq declined -0.4% and -1.2% respectively. The European stock markets finished mixed, while the Asia stock markets finished mostly higher.

The Day Ahead

The FBM KLCI ended slightly higher despite the mixed sentiment on Wall Street. Given the persistent inflation worries, we believe the recent rebound could be short lived and we may anticipate selling pressure to emerge in the near term once the Fed’s quantitative tightening take place in June and this may affect the sentiment on the technology stocks. Back on the local front, we expect bargain hunting activities to emerge within the recovery-themed and plantation sectors ahead of the reporting season. On the commodities, the crude oil is trading above the USD110 as market could be looking forward on the reopening in China.

Sector focus:. We reckon the economy improvement should spurred further buying interest in the recovery-themed sectors such as consumers and banking. Meanwhile, the higher crude oil price may boost the energy sector. Also, we expect traders to look forward to plantation earnings this month, which could boost the share price over the near term.

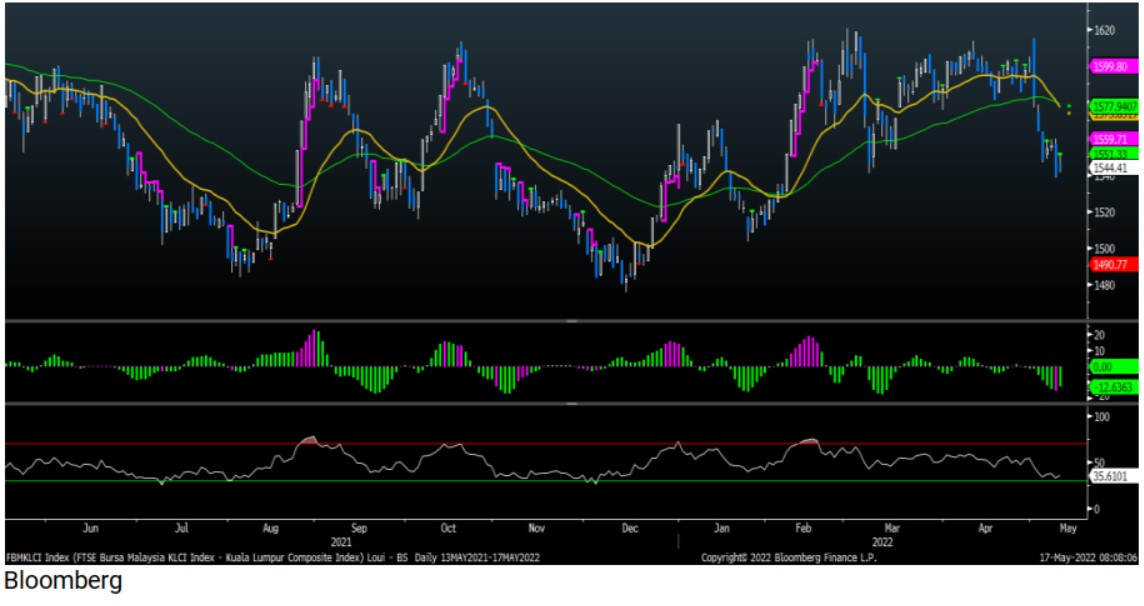

FBMKLCI Technical Outlook

The FBM KLCI settled higher but still trading below its 200-day moving average. Technical indicators remained negative as the MACD Histogram extended a negative bar, while the RSI is hovering below the 50 level. Support is pegged around 1,500-,1,510, while the resistance is set at 1,570-1,580.

Company Brief

Inari Amertron Bhd’s 3QFY22 net profit rose 10.4% YoY to RM90.5m, mainly due to higher revenue growth. Revenue for the quarter improved 5.1% YoY to RM360.3m. A third single-tier interim dividend of 2.2 sen per share, payable on 18th July 2022 was declared. (The Star)

MR D.I.Y. Group (M) Bhd’s 1QFY22 net profit fell 19.5% YoY to RM100.5m, due to higher expenses that are in line with higher store openings. Revenue for the quarter, however, improved 4.0% YoY to RM905.2m. An interim single-tier dividend of 0.7 sen per share, payable on 24th June 2022 was declared. (The Star)

After paying the RM16.0m total in compounds issued by the Securities Commission Malaysia (SC) earlier this week, Serba Dinamik Holdings Bhd and its four top executives were given a discharge and acquittal. Separately, Serba Dinamik’s co-founder Datuk Awang Daud Awang Putera has disposed his entire stake in the company on 13th May 2022. He disposed of 9.9m shares, or a 0.3% stake, at 10 sen each in the open market. (The Edge)

Fitters Diversified Bhd is launching another cash call this year, this time to raise up to RM149.0m via a renounceable rights issue with free warrant, which will be used for working capital requirements for palm oil mill operation, repayment of borrowings as well as funding its fire services projects. It had recently completed a private placement involving 30.0% of its issued shares that it had proposed in December 2021. The latest cash call will be undertaken on the basis of 3 rights shares with 2 free warrants for every 1 existing Fitters Diversified shares held at an entitlement date to be fixed. The exercise will involve up to 1.86bn rights shares with 1.24bn free detachable warrants. (The Edge)

AwanBiru Technology Bhd’s wholly-owned subsidiary Awantec Systems Sdn Bhd (ASSB) has entered into a cloud framework agreement with the government, which was represented by the Malaysian Administrative Modernisation and Management Planning Unit (MAMPU), and Google Cloud Malaysia Sdn Bhd (the cloud service provider or CSP). (The Edge)

Businessmen Datuk Chin Yoke Kan and Datuk Goh Cheng Huat, both of whom surfaced as substantial shareholders of Malaysian Bulk Carriers Bhd (Maybulk), have been appointed as executive directors of the shipping firm effective immediately. Goh and Chin bought 160.0m shares each from Pacific Carriers Ltd, an entity controlled by tycoon Robert Kuok in April 2022. The 320.0m shares in total is equivalent to a 32.0% stake. (The Edge)

Public Gold Group founder Datuk Wira Louis Ng Chun Hau has resigned as the executive chairman of Caely Holdings Bhd. The 54-year-old resigned to pursue other personal opportunities. Despite his exit from the board, Ng still owns a 17.0% stake (43.8m shares), and a 7.0% indirect stake (18.2m shares). (The Edge)

Iskandar Waterfront City Bhd (IWCity) announced it is disposing of 2 parcels of vacant unconverted developed land in Tanjung Danga, Johor to construction and property developer Knusford Bhd for an indicative disposal consideration ranging from RM90.0-95.0m. Knusford explained in a separate filing that the proposed acquisition is intended to increase the group's landbank in Johor Bahru which could potentially be utilised for future development in view of the upcoming RTS project. (The Edge)

Source: Mplus Research - 17 May 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

MRDIY2024-11-16

IWCITY2024-11-16

MRDIY2024-11-15

INARI2024-11-15

MAYBULK2024-11-15

MAYBULK2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-14

AWANTEC2024-11-14

AWANTEC2024-11-14

AWANTEC2024-11-14

INARI2024-11-14

INARI2024-11-14

INARI2024-11-14

INARI2024-11-14

MAYBULK2024-11-14

MRDIY2024-11-14

MRDIY2024-11-14

MRDIY2024-11-14

MRDIY2024-11-13

MAYBULK2024-11-13

MRDIY2024-11-13

MRDIY2024-11-12

INARI2024-11-12

INARI2024-11-12

INARI2024-11-12

MAYBULK2024-11-12

MRDIY2024-11-12

MRDIY2024-11-12

MRDIY2024-11-12

MRDIY2024-11-11

AWANTEC2024-11-11

AWANTEC2024-11-11

INARI2024-11-11

INARI2024-11-11

MAYBULK2024-11-11

MRDIY2024-11-08

INARI2024-11-08

INARI2024-11-08

INARI2024-11-08

MAYBULK2024-11-08

MRDIY2024-11-07

AWANTEC2024-11-07

AWANTEC2024-11-07

AWANTEC2024-11-07

MAYBULK2024-11-07

MRDIY2024-11-07

MRDIY2024-11-06

INARI2024-11-06

INARI2024-11-06

MAYBULK2024-11-06

MRDIY2024-11-06

MRDIY2024-11-05

INARI2024-11-05

INARI2024-11-05

INARIMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024