Mplus Market Pulse - 22 Oct 2024

MalaccaSecurities

Publish date: Tue, 22 Oct 2024, 09:38 AM

Export-Driven Stocks May Shine Amid Weak RM

Market Review

Malaysia: Following the tabling of Budget 2025 last Friday, the FBM KLCI (-0.02%) closed mildly lower as YTL-related counter dragged down the sentiment on the local front. Meanwhile, the Healthcare (+0.87%) sector gained momentum, as sentiment improved amid the government's aim to improve healthcare infrastructure.

Global markets: Wall Street ended on a mixed note as investors reduced their exposure ahead of corporate earnings results set to be released this week, driving Treasury bonds prices higher. Moreover, both the European and Asian markets also closed mixed, despite the 25bps prime rate cut in China.

The Day Ahead

The Bursa exchange ended mildly lower on the first trading day after the Budget 2025 being tabled last Friday. Meanwhile, the Dow and S&P 500 retreated from their record-high closings as investors await more US earnings releases. Looking ahead, we expect the market to remain cautious as major companies like Tesla, Coca-Cola, T-Mobile US, and GE Aerospace will be releasing their results this week. Also, traders will closely monitor key economic data, including (i) US unemployment claims, (ii) flash manufacturing and services PMI, (iii) durable goods orders, and (iv) consumer sentiment. Besides, the BRICS summit will take place over the next three days. In the commodities market, Brent crude oil rebounded after a 7-day losing streak, driven by China's rate cut, which may boost demand.

Sector Focus: Given the mixed trading environment in the US, we expect funds to remain on the sidelines in the near term. However, attention may shift to sectors set to benefit from Budget 2025 policies, including Construction, Property, Technology, and Renewable Energy. The recent weakness in the ringgit could provide opportunities to accumulate export-related stocks. Lastly, stocks tied to Johor, Sabah, and Sarawak could see potential gains, as these regions are key areas of growth under Budget 2025.

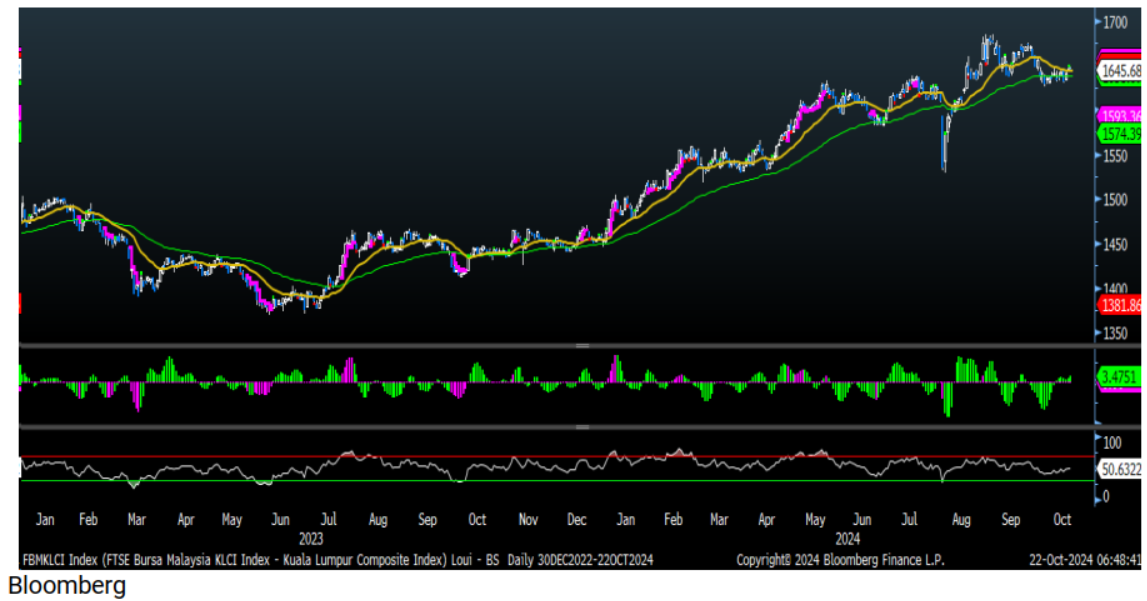

FBMKLCI Technical Outlook

The FBM KLCI index rebounded towards the 1,645 level. Meanwhile, the technical readings on the key index are improving, with the MACD histogram extended another positive histogram, and the RSI has hooked above 50. The resistance is envisaged around 1,660-1,665, and the support is set at 1,625-1,630.

Company Brief

Dagang NeXchange Bhd (DNEX) has appointed Faizal Sham Abu Mansor as its group chief executive officer effective Nov 1, succeeding executive chairman Tan Sri Syed Zainal Abidin Syed Mohamed Tahir Jamalullail in leading the company's management team. Faizal, 53, had previously served as executive director and group chief financial officer (CFO) at Vantage Energy Group, CFO of Malaysia Airports Holdings Bhd (AIRPORT) as well as CEO of Astro Productions and Astro Awani. Meanwhile, Syed Zainal Abidin, 62, will continue to lead the management team until Dec 31, after which he will be redesignated as non-executive chairman. (The Edge)

PTT Synergy Group Bhd (PTT) had signed a 10-year build and lease agreement to provide a fully automated warehouse for RM399.7m. The agreement was signed between PTT Synergy’s wholly-owned subsidiary, Projek Tetap Teguh Sdn Bhd, and a multinational corporation semiconductor maker based in Penang. The company said it is not naming the MNC because of a non-disclosure agreement. The purpose- built warehouse has a gross built-up area of 416,572.18 sq ft and PTT Synergy is required to provide an automated storage and retrieval system with a capacity of 47,320 pallets. (The Edge)

MyEG Services Bhd (MYEG) and HeiTech Padu Bhd (HTPADU) said they have commenced a partnership for current and future e-government projects in Malaysia in which either one party is involved. The partnership is consequent to a teaming agreement signed in April, the two companies said in a joint statement. The announcement of the partnership commencement comes days after Heitech announced last Friday (Oct 18) that it had won the National Integrated Immigration System project from the Immigration Department, valued at RM892.2m. (The Edge)

Facilities and waste management services company AWC Bhd (AWC) has secured a RM30.51m contract to undertake housekeeping services for the JB Sentral building in Johor Bahru. The contract, awarded by KCJ Engineering Sdn Bhd, is valid for four years and six months. With this latest contract, AWC’s order book stands at over RM700m, while its tender book has exceeded RM1bn across all business divisions. (The Edge)

Candy maker Khee San Bhd (KHEESAN) said its shareholders have approved the company's regularisation plan to exit Practice Note 17 (PN17) status. All eight resolutions relating to the regularisation plan were passed at an extraordinary general meeting on Monday. The regularisation plan includes a proposed rights issue with warrants, a scheme of arrangement with creditors, a share capital reduction and the establishment of an employee share scheme of up to 15% of its share base for eligible directors and employees. With the rights shares priced at 10 sen each, the exercise is expected to raise between RM65m on a minimum subscription basis and RM96.1m under a maximum scenario. From the amount raised, RM51.2m will be allocated to settling amounts owed to scheme creditors. In addition, Khee San will also undertake a RM137.52m capital reduction to its share capital. (The Edge)

KIP Real Estate Investment Trust (KIPREIT) reported a 3% decrease in its net profit to RM10m for the first quarter ended Sept 30, 2024 (1QFY2025), from RM10.39m, dragged by higher operating expenses, as well as higher manager's management fee and borrowing cost. For 1QFY2025, the REIT declared a distribution of 1.52 sen per unit, slightly lower than the 1.55 sen per unit declared a year ago. The distribution will be payable Nov 26, 2024. For the reporting period, KIP REIT’s quarterly revenue grew 19.2% to RM26.7m from RM22.4m a year ago, underpinned by higher revenue in its retail segment, specifically the contribution from KIPMall Kota Warisan that was acquired in February 2024. (The Edge)

CIMB Thai Bank PCL, in which CIMB Group Holdings Bhd (CIMB) owns a 94.83% stake, saw its net profit for the third quarter ended Sept 30, 2024 surge by 62.1% to 595.67m baht (RM76.77m) from 367.42m baht (RM47.33m) in the same quarter a year ago, thanks to gains on financial instruments and higher operating income. Gains on financial instruments came in at 514.64m baht versus a loss of 64.06m baht last year, while gains on investments dropped 67.9% to 62.22m baht compared to 193.88m baht. Total operating income rose 18.4% to 3.75bn baht from 3.17bn baht. CIMB Thai’s expected credit losses rose to 708.10m baht as compared to 502.48m baht a year earlier. (The Edge)

Alpha IVF Group Bhd (ALPHA) reported a 2.7% quarter-on-quarter increase in its first quarter net profit to RM14.38m from RM14m, as lower administrative expenses more than offset impact from decline in revenue. For the first quarter ended Aug 31, 2024, the fertility care specialist's revenue fell 8% to RM43m, from RM46.75m in the preceding quarter. There are no YoY comparative figures as the company was newly listed in March 2024. Alpha IVF has declared a third interim dividend of 0.45 sen per share, bringing total dividend year-to-date to 1.15 sen per share. (The Edge)

Source: Mplus Research - 22 Oct 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-21

AIRPORT2025-01-21

AIRPORT2025-01-21

DNEX2025-01-20

AIRPORT2025-01-20

ALPHA2025-01-20

ALPHA2025-01-20

ALPHA2025-01-20

CIMB2025-01-20

CIMB2025-01-20

CIMB2025-01-20

CIMB2025-01-20

CIMB2025-01-20

CIMB2025-01-20

CIMB2025-01-20

HTPADU2025-01-20

HTPADU2025-01-20

HTPADU2025-01-20

HTPADU2025-01-20

MYEG2025-01-19

CIMB2025-01-17

CIMB2025-01-17

CIMB2025-01-17

CIMB2025-01-17

CIMB2025-01-16

AIRPORT2025-01-16

AIRPORT2025-01-16

AIRPORT2025-01-16

AIRPORT2025-01-16

AIRPORT2025-01-16

CIMB2025-01-16

MYEG2025-01-15

AIRPORT2025-01-15

AIRPORT2025-01-15

CIMB2025-01-15

CIMB2025-01-15

MYEG2025-01-13

CIMB2025-01-13

CIMB2025-01-10

AWC2025-01-10

AWC2025-01-10

AWC2025-01-10

AWC2025-01-10

AWC2025-01-10

CIMBMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Jan 08, 2025

Created by MalaccaSecurities | Jan 08, 2025