S P SETIA BERHAD (Stock Code: 8664 SPSETIA)

Nathan92

Publish date: Fri, 11 Nov 2022, 01:51 PM

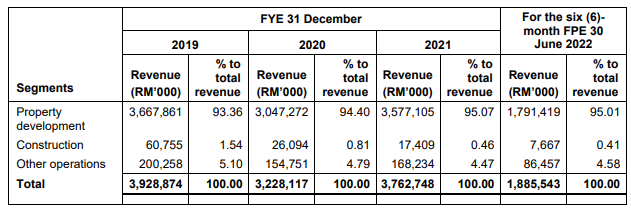

Company Background

Well Known Developer and Financially Strong : S P Setia Berhad is a well known property developer in Malaysia. The operations of the Group are primarily organised into three (3) main segments, namely property development, construction and other operations which comprise manufacturing, trading and operation of investment properties. It is also important to note that the Group is financially strong due to its long presence in the industry and is backed by PNB, one of the key investment arm of the Malaysia Government.

Investment Merits

1. Focusing on Unlocking Value: Management will placed their focus on unlocking the group’s value. One of the near term target will be a potential listing of REITs to unlock value of its commercial assets with recurring income.

2. Refinancing RCPS to Save Cost: S P Setia is in the midst of refinancing its existing RCPS-i B by issuing RCPS-i C. The proceeds from issuing RCPS-i C will be utilised to redeem the higher dividend yield RCPS-i B and retired higher cost borrowing. The whole exercise will resulting an interest savings of up to RM20 mil.

3. Reopening Beneficiary: The Group is on track to meet its RM4 bil topline target in FY22 due to pent up demand from pandemic. The Group’s overseas projects in UK, Singapore and Australia are on track to deliver and is expected to contribute cash flow to the Group in FY23.

Moreover, the company also benefiting from the reopening of Singapore Borders due to its industrial landbank in Johor. The 192 acres industrial landbank in Taman Industry Jaya, Johor will be the immediate beneficiary of Singapore’s Financial Hub development. More importantly, Singapore benefited from China’s Zero Covid Policy, MNCs in Hong Kong are moving away to set up their HQ in Singapore due to stable country policy. We believe this will be a structural change for Singapore.

4. Huge Landbank to Be Developed: Besides continuing its Residential projects, the Group will diversified its product range by offering the high demand Industrial and Commercial development. The great potential from its KL Setia Alam (399 acres) land bank will be able to generate a GDV of RM3 bil in the near future as the management is planning to launch the project in the mid of next year.

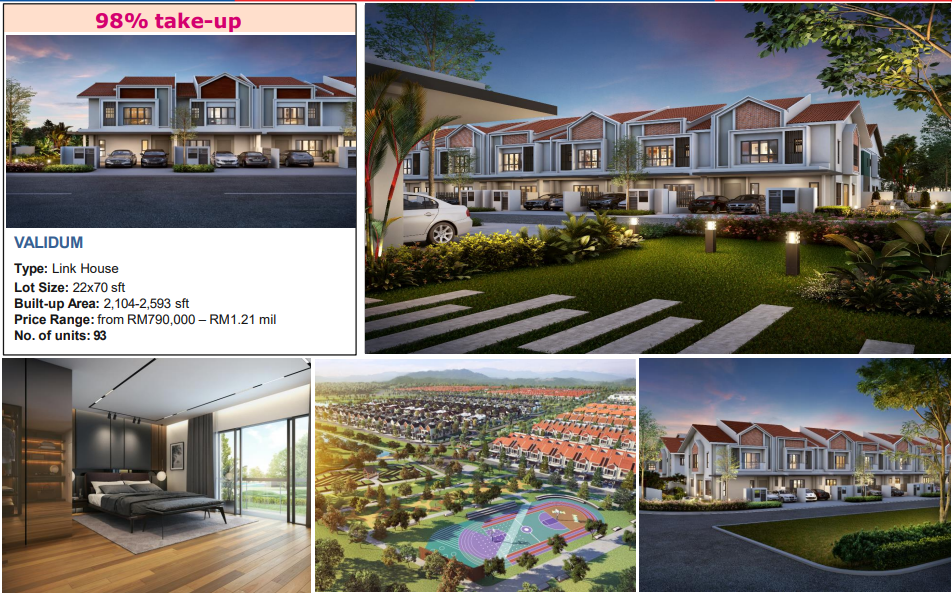

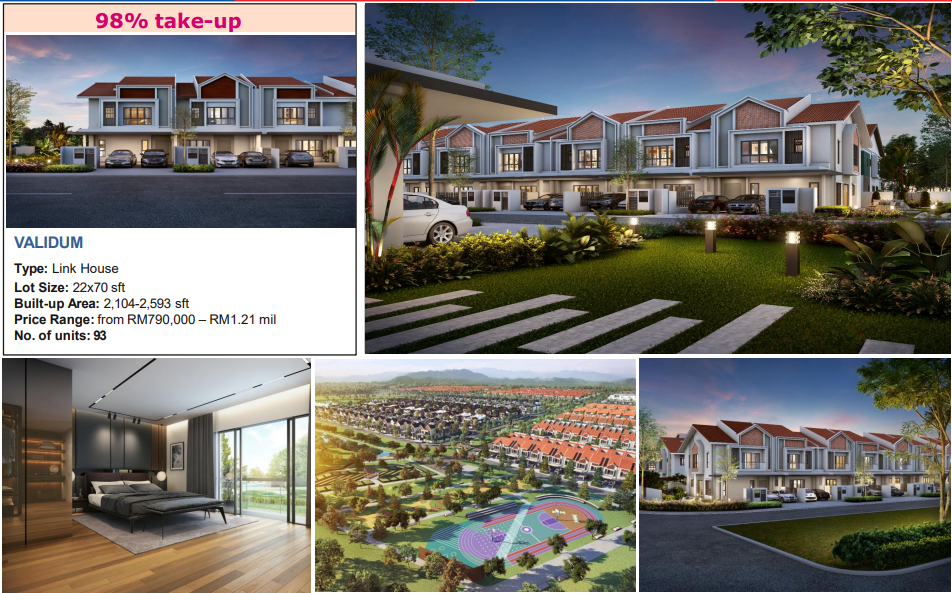

On top of that, its existing 47 on-going projects and 7,042 acres of landbank with an estimated GDV of RM120 bil will continue to support the group’s earnings. The Group’s vast experience in Township development will be benefited from the demand of Township projects post COVID19 as buyer prefers to stay in their own house or a bigger house to have better privacy.

(Figure 1: One of the key projects of S P Setia Bhd)

(Figure 2: S P Setia Bhd’s UK Project, Batttersea)

Our View

Best Proxy for the Property Sector. We think S P Setia is one the best proxies to the property sector in Malaysia. The Group is one of the largest developers in Malaysia with huge landbank and well-managed. S P Setia share is trading at a P/B ratio of around 0.15x, we deemed the share’s valuation is undemanding, in fact it’s a steal at current level.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on NTH1A

Created by Nathan92 | Dec 27, 2022