Multiple EGM Agenda Ahead, What is G3 Planning ...?

plantationtp

Publish date: Wed, 30 Mar 2022, 10:29 AM

Multiple EGM Agenda Ahead, What is G3 Planning ...?

“Who is G3 Global?”

This might be the very first question that appeared in investors’ mind when we mention about the company. To sum it up and simplify the learning process, G3 is a penny stock, but not just a regular one.

Investors could clearly see an undeniable landslide in share price. For an ease of understanding, I’ve plotted some important incident(s) that happened since 2020.

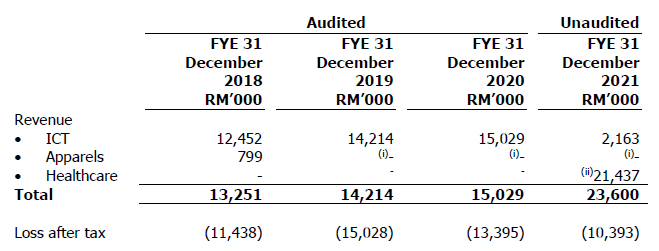

Despite a strong share price movement in 2019, the company had actually been making losses since FYE 31 December 2018 to FYE 31 December 2019.

The management however, had decided to dispose its loss-making apparel business fully by 2019, and focus on its ICT business, this could be a driver for the share price.

That does not seem to be the game changer for the company.

The famous-infamous investor, Mr. CC Puan had then joined the company as a major shareholder back in 2020. Once again, this droves the share price of G3 up again in a stock market mania as shown on the chart.

Things doesn’t seem to work well for him.

I’ve plotted a straight-line path to indicate the margin call and sell down action of Mr. CC Puan and his person acting in concert, and that kind of screw up the whole company.

At the very least, most investors had lost conviction of the company due to the share price downturn.

But back in September 2021, a new shareholder had emerged as a white knight to “inject” 51% equity interest of Bestinet Healthcare to turnaround the company.

In the same financial year, the company’s revenue had increased from RM15.02 million to RM23.60 million on a year-on-year basis.

The loss for FYE 31 December 2021 had narrowed significantly.

Judging from the reduction in revenue for their ICT business, it seems like G3 will be focusing more on their healthcare solution business moving forward.

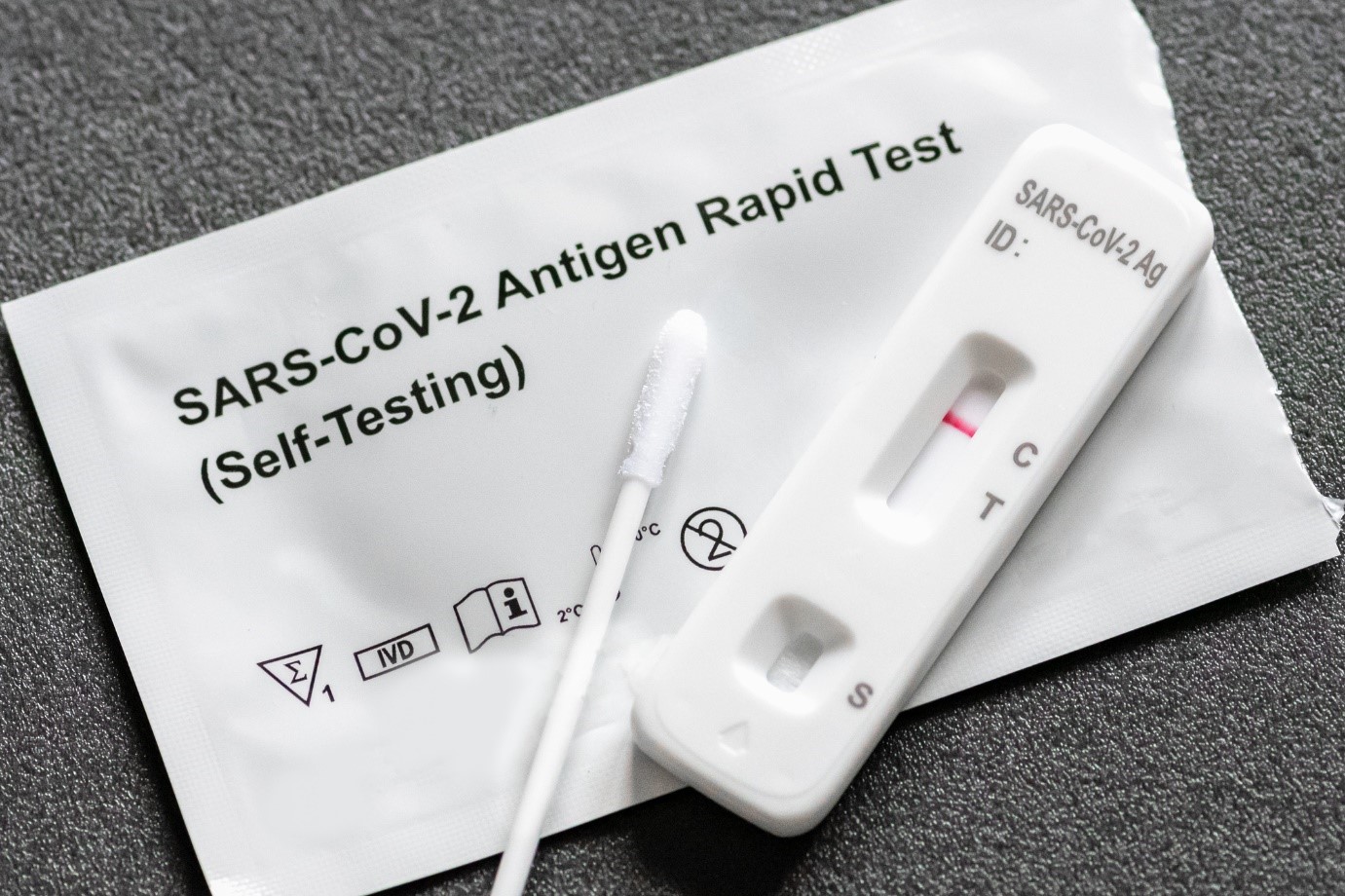

To-date, the company had secured a RM32.0 million contract value directly from the government to supply 2.0 million units of COVID-19 Test Kits.

Unlike masks which are likely to see a steep reduction in demand, COVID-19 Test Kits demand are more likely to persist as Protégé projected the demand to grow from 1.1 million in 2020, 21.5 million in 2021 and up to 25.0 million in 2022.

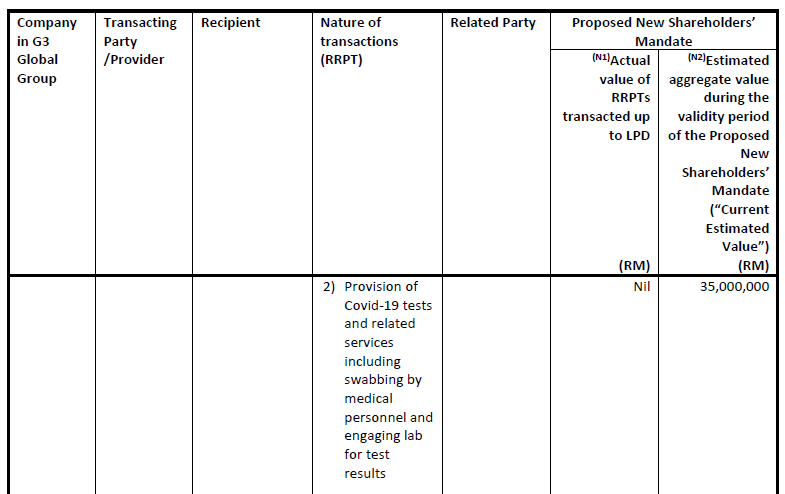

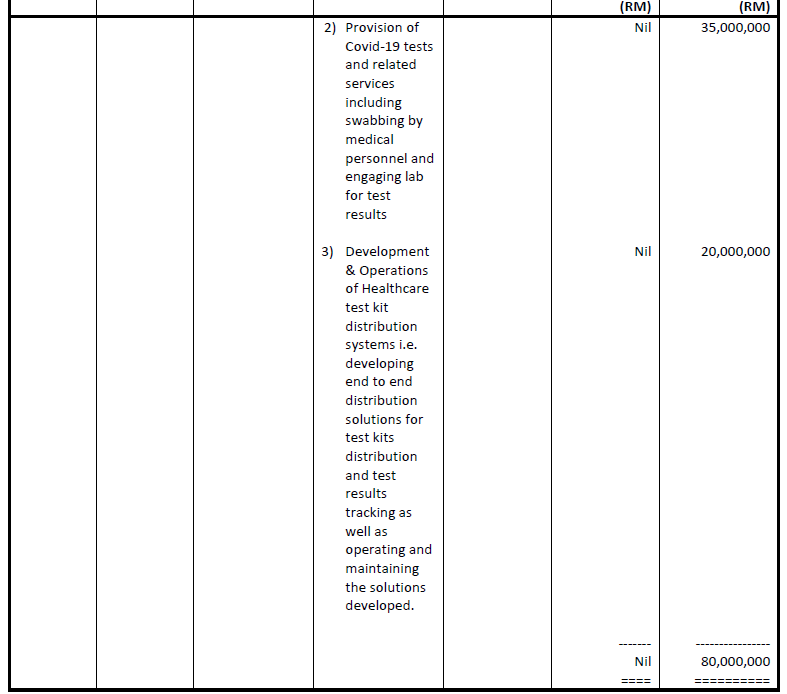

Since the management had expected an exponential growth in revenue generated from the COVID-19 Test Kits business, they are mandated to submit a proposal of business diversification.

I don’t think any sound investor would vote against a turnaround proposal for the company.

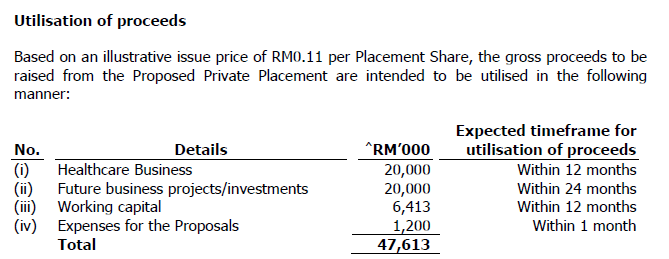

To cater for the COVID-19 Test Kits Business, the management had also decided issue up to 20% new shares for a total sum of RM47.61 million based on indicative issuance price of RM0.110.

In this case, item (i), (iii) and (iv) is compulsory for the company. As the share price had dipped, the management may choose to reduce allocation on item (ii) or issue up to 30% shares.

To protect investors’ interest, the management chose not to dilute more by issuing up to 30% shares. Which is a good sign to me.

That concludes the EGM 1 and EGM 2 for the company.

EGM 3 would be a total game changer for the company.

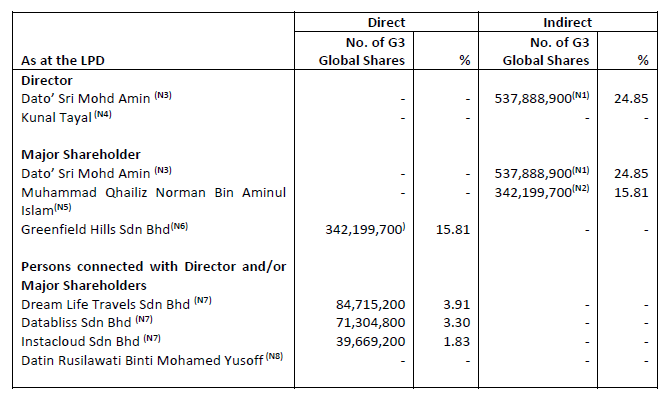

So far, we talked about how the company could raise funds and turnaround with their new healthcare solution business. One question investor may ask is – “how much skin does the new management have in the game?”

The short answer is RM80.0 million.

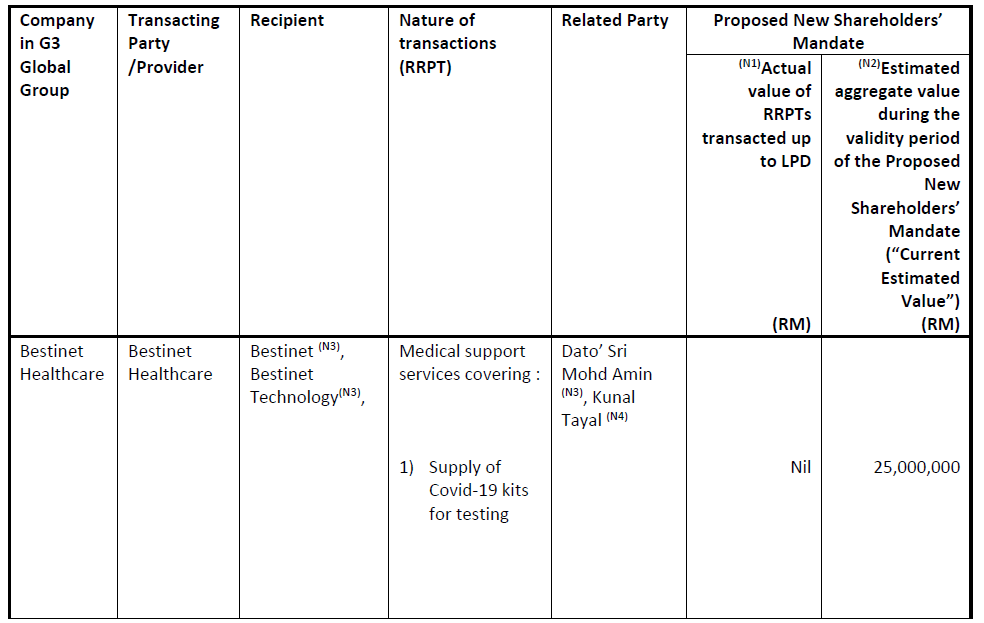

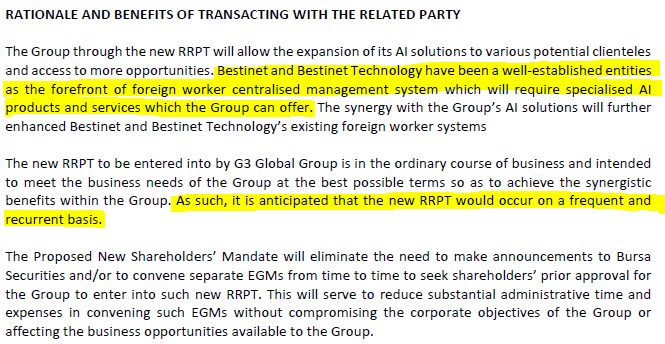

Some of you may have already noticed that brand Bestinet.

And yes, the new management and major shareholder(s) are strongly committed towards G3, and they are willing to utilize resources from Bestinet to rebuild the company.

Apart from the RM25.0 million contract secured from the government, I would like to highlight the reopening of border would encourage admission of foreign labour, where we are seeing up to 313,014 applications as of 16 March 2022.

This is how the numbers mentioned above come about.

But if you are too lazy to read the circular, you are missing out something really big.

In layman terms, the owners of the company will be injected more business into the company in order to turn in around.

If you are concerned over the 1,000 shares you are holding, just imagine how committed the major shareholders are judging from their shareholding level.

Ultimately, I believe the intention of the new management and major shareholder are good. The worse is over for the company as Mr. CC Puan together with the PACs had left the company for good. With a depressed share price of RM0.075, don’t you think your risks are extremely limited?

I rest my case.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

kfcmailman

Wow... i've started to look into this counter

2022-03-30 12:29